How Tax Payable On Total Income Is Calculated Find your total tax as a percentage of your taxable income Calculate net income after taxes Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules Since taxes are calculated in tiers the actual tax you pay as a percentage of your taxable income will always be less than your tax bracket

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return It is mainly intended for residents of the U S and is based on the tax brackets of 2024 and 2025 The 2025 tax values can be used for 1040 ES estimation planning ahead or comparison If you had 50 000 of taxable income in 2021 as a single filer you re going to pay 10 on that first 9 950 and 12 on the chunk of income between 9 951 and 40 525 and so on this is how

How Tax Payable On Total Income Is Calculated

How Tax Payable On Total Income Is Calculated

https://images.contentful.com/ifu905unnj2g/66K2AdsLlvARouig6tdw8D/9fb05a7c0c4b54eca5f4d7bb8c04ce1c/Net_income_formula.jpg

How To Calculate Accounts Payable Formula Modeladvisor

https://imgmidel.modeladvisor.com/how_to_calculate_accounts_payable_from_income_statement.png

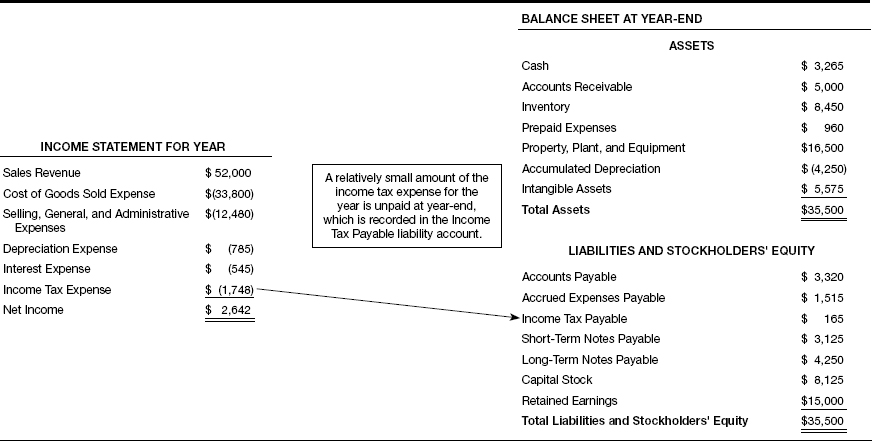

Chapter 12 Income Tax Expense And Its Liability How To Read A

https://www.oreilly.com/api/v2/epubs/9781118735589/files/images/f090-01.jpg

Below are the most common tax forms that you will need in order to calculate your gross income Form W 2 shows the income you earned through services performed as an employee Total Tax 0 00 Payments Credits Tax Owed 0 00 0 00 0 00 This calculator computes federal income taxes state income taxes social security taxes medicare taxes self employment tax capital gains tax and the net investment tax The provided information does not constitute financial tax or legal advice

Dividend tax over and above allowances and outside an ISA is charged at special rates according to the highest rate of income tax you pay The rate applied to dividend income for basic rate Calculating the Federal Income Tax Rate The United States has a progressive income tax system This means there are higher tax rates for higher income levels These are called marginal tax rates meaning they do not apply to total income but only to the income within a specific range These ranges are referred to as brackets

More picture related to How Tax Payable On Total Income Is Calculated

Ch Required Information The Following Information Applies To The

https://img.homeworklib.com/questions/a3441550-5d1f-11ea-9803-15dd3c24dd19.png?x-oss-process=image/resize,w_560

Tax Example Part 1 Tax Payable YouTube

https://i.ytimg.com/vi/ya_uCYKigJ4/maxresdefault.jpg

Sales Tax Payable Journal Entries YouTube

https://i.ytimg.com/vi/QEWU3vPuRa8/maxresdefault.jpg

A tax return consists of the documents filed with a tax authority that report your income expenses deductions credits and other relevant information used to calculate the taxes an individual When you file separately it means each of you adds up your income and you pay your taxes separately You have to divide up your deductions Both of you can t use the same expenses to calculate the amount of your separate deductions Your total gross income is determined by adding up all types of income that you have received during the

[desc-10] [desc-11]

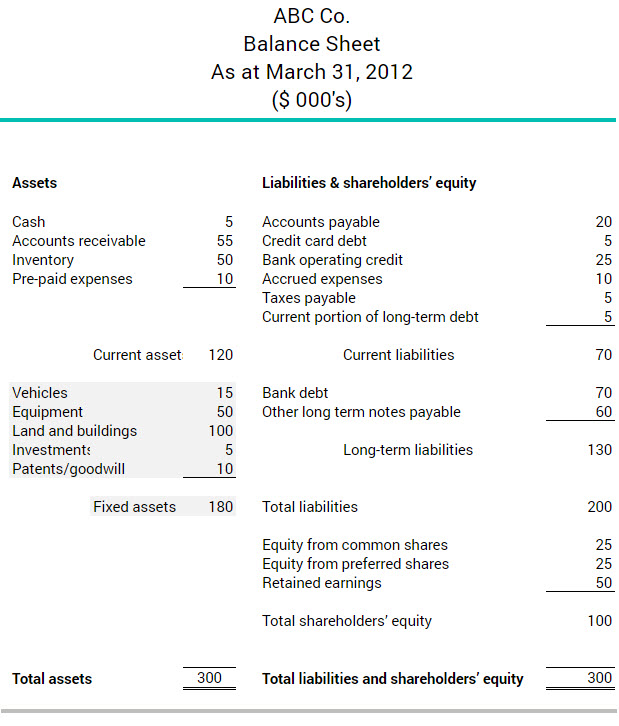

What Are Long term Assets BDC ca

https://www.bdc.ca/globalassets/digizuite/15171-long-term-assets-exemple.jpg?v=4a4b90

M A AUDITS ACADEMI What Is The Difference Between Tax Expense And

https://4.bp.blogspot.com/-6GvW7nVPB9Y/U2S77OCodOI/AAAAAAAANek/_KV-_gHK7sk/s1600/tax+payable+and+tax+expenses.PNG

How Tax Payable On Total Income Is Calculated - [desc-13]