What Is Tax Payable On Total Income Taxable income is always lower than gross income since the U S allows taxpayers to deduct certain income from their gross income to determine taxable income To calculate taxable income you begin by making certain adjustments from gross income to arrive at adjusted gross income AGI

There are seven federal income tax rates and brackets in 2023 and 2024 10 12 22 24 32 35 and 37 Your taxable income and filing status determine which rates apply to you The U S Income Age 401 k contributions IRA contributions Withheld Refine your numbers Deductions Your standard deduction 13850 Standard Deduction Itemize Deductions Tax Credits Here s a list of

What Is Tax Payable On Total Income

What Is Tax Payable On Total Income

https://imgmidel.modeladvisor.com/how_to_calculate_accounts_payable_from_income_statement.png

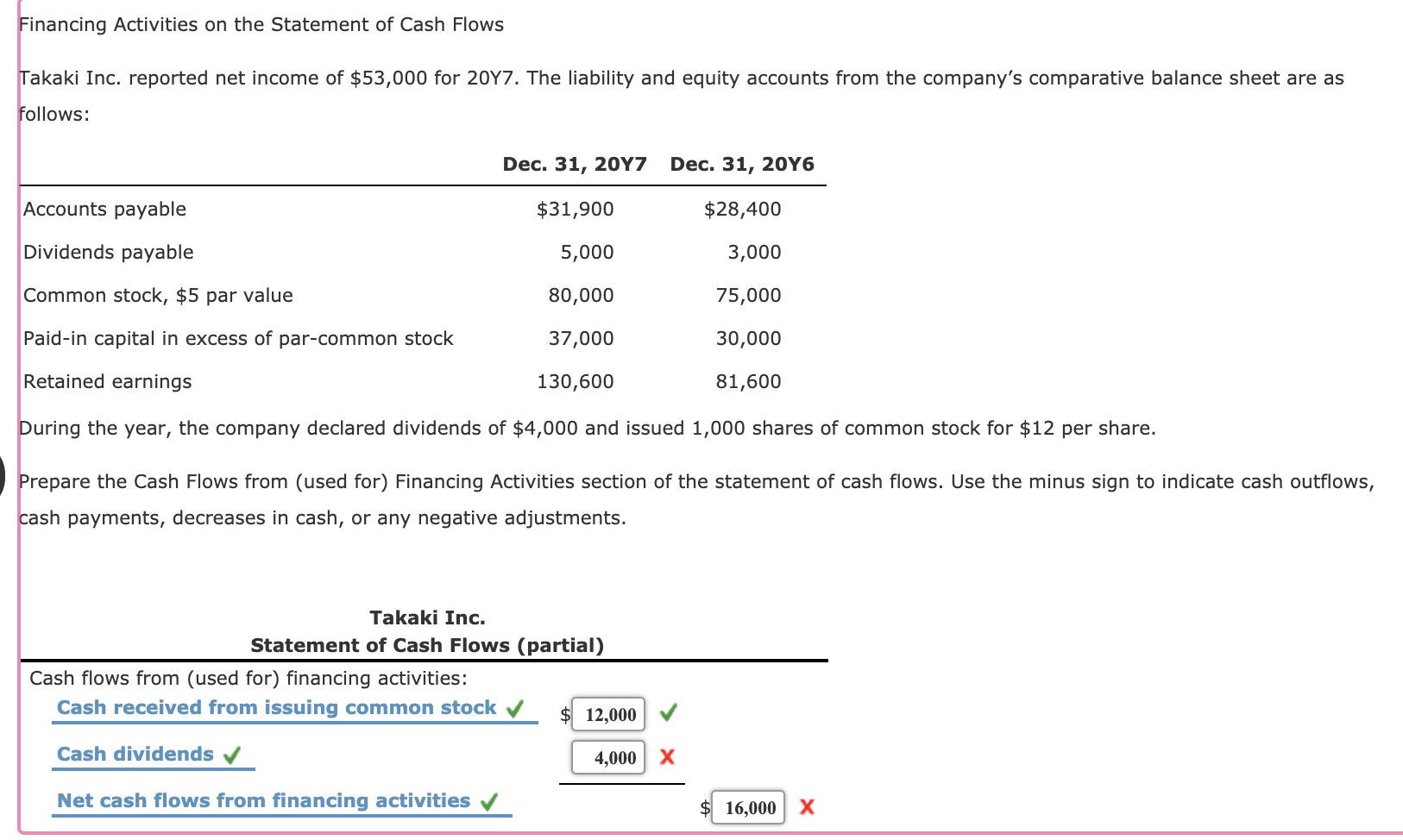

Solved Financing Activities On The Statement Of Cash Flows Chegg

https://media.cheggcdn.com/media/c30/c30250df-935e-406f-9e42-6dc6351db685/phpboCVNS.png

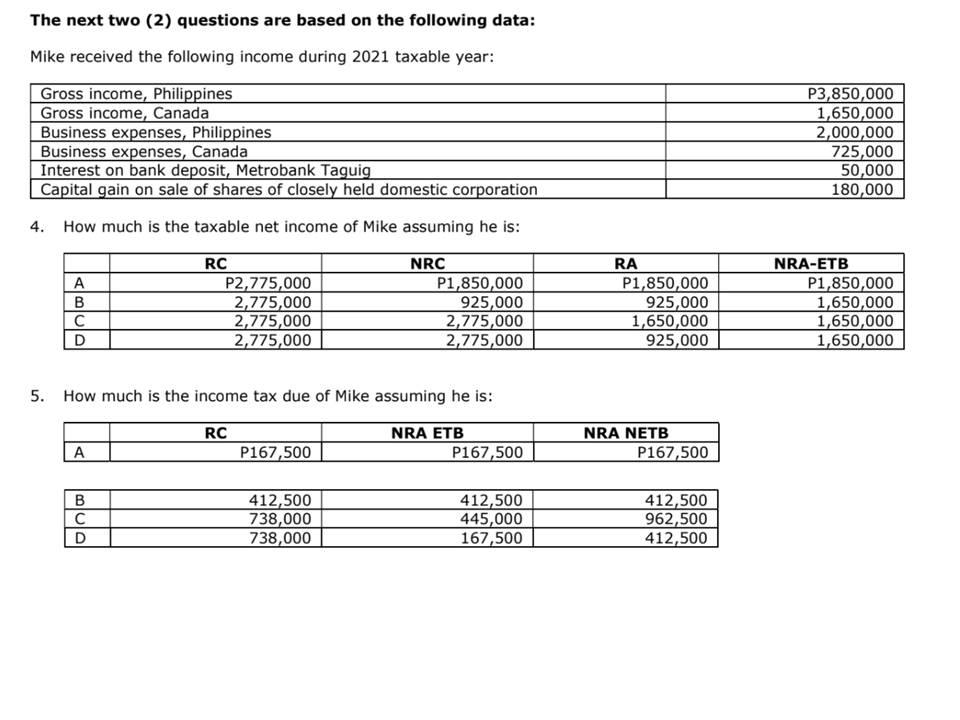

The Next Two 2 Questions Are Based On The Following Chegg

https://media.cheggcdn.com/media/e8e/e8e20a2a-f8b8-4045-b715-0e1fb20bf86c/phpZNRdFL

Benefits paid to you Retirement plan distributions pensions or annuities Unemployment benefits Social Security income Some life insurance proceeds Some survivor benefits Other types of income Tax refunds reimbursements and rebates Canceled debts Alimony payments Court awards and damages Some scholarships Gambling winnings Prizes and awards Simply enter your taxable income filing status and the state you reside in to find out how much you can expect to pay Generally if your taxable income is below the 2022 2023 standard deduction

The top 1 percent s income share rose from 20 1 percent in 2019 to 22 2 percent in 2020 and its share of federal income taxes paid rose from 38 8 percent to 42 3 percent The top 50 percent of all taxpayers paid 97 7 percent of all federal individual income taxes while the bottom 50 percent paid the remaining 2 3 percent For the tier of income between 11 001 and 44 725 you ll pay a 12 tax rate For all of your income above 44 726 you ll pay tax at a much steeper rate 22 Federal income tax bracket 2023

More picture related to What Is Tax Payable On Total Income

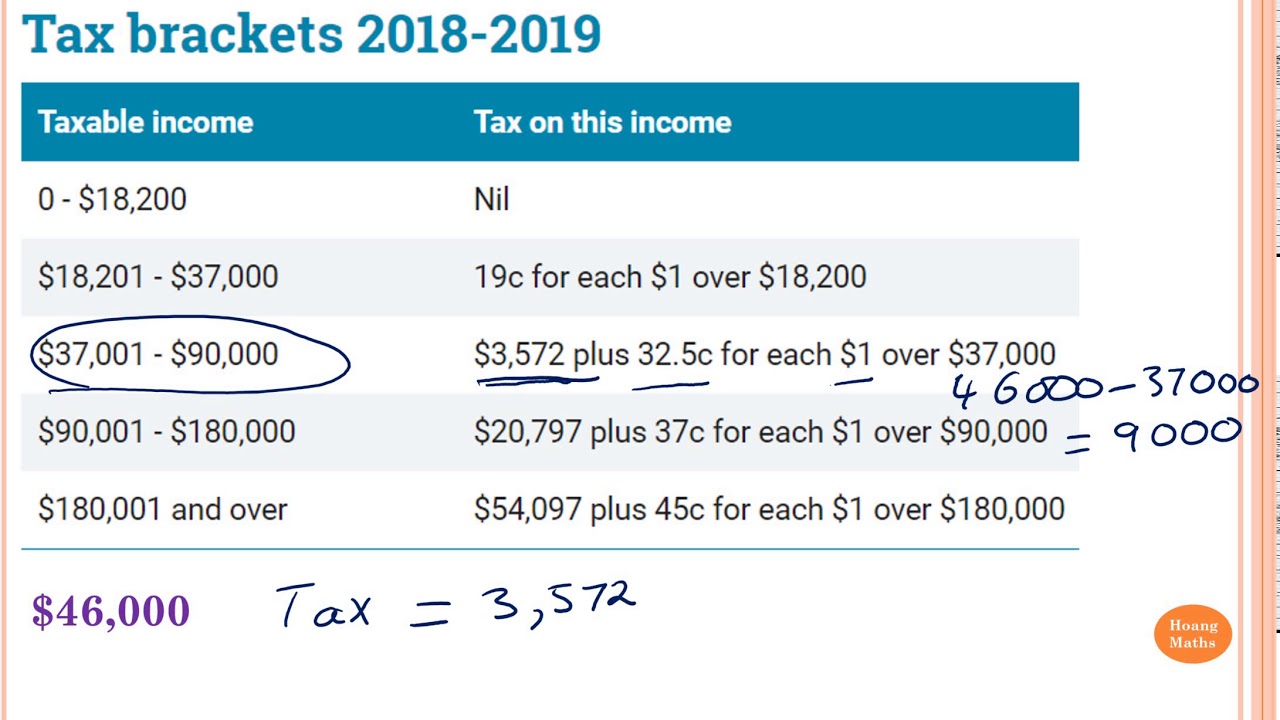

Calculating Tax Payable Part 1 YouTube

https://i.ytimg.com/vi/1lA9I61SPeU/maxresdefault.jpg

The Dentist Unused Compensation For Damaged Property Is Tax Payable

https://www.the-dentist.co.uk/media/1i3dccto/unused-compensation-for-damaged-property-is-tax-payable.png

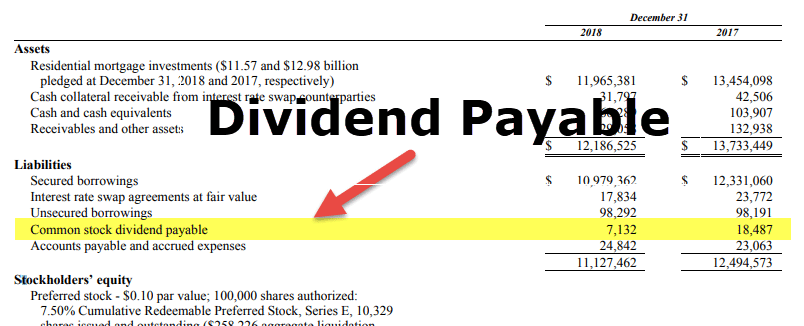

Dividend Payable Definition Examples Calculate Dividend Payables

https://www.wallstreetmojo.com/wp-content/uploads/2019/04/Dividend-Payable.png

2021 Federal Income Tax Brackets and Rates In 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1 The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 523 600 and higher for single filers and 628 300 and higher for married couples A guide to understanding your federal income tax rate F MARTIN RAMIN THE WALL STREET JOURNAL STYLING BY SHARON RYAN HALLEY RESOURCES By Ashlea Ebeling Updated Jan 9 2024 5 14 pm ET

Step 1 Determine Your Filing Status First determine your filing status If you are married your best option is usually to file jointly If you file your taxes jointly with your spouse you are required to add all of your income together to determine the total You can combine your deductions and you pay your taxes jointly 54 95 State Filing Fee 39 95 2 TaxSlayer Premium Learn More On TaxSlayer s Website Federal Filing Fee 0 State Filing Fee 0

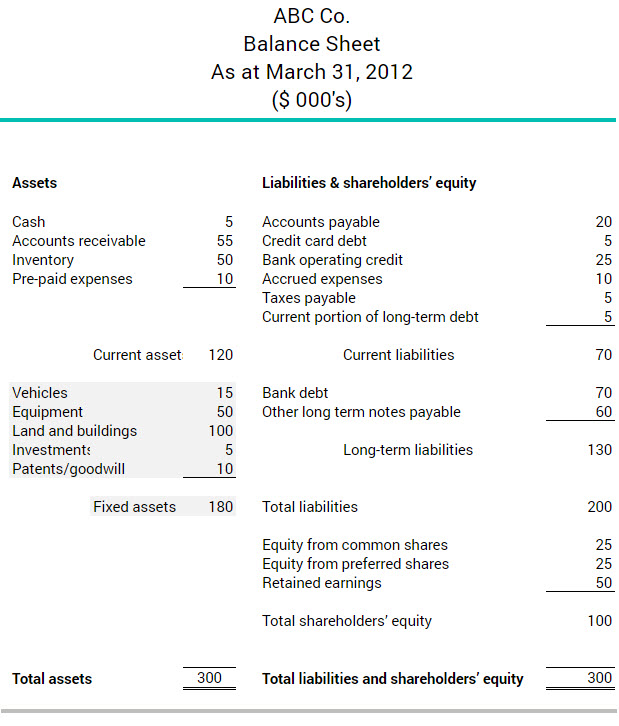

What Are Long term Assets BDC ca

https://www.bdc.ca/globalassets/digizuite/15171-long-term-assets-exemple.jpg?v=4a4b90

What Is Wages Payable Definition Meaning Example

http://www.myaccountingcourse.com/accounting-dictionary/images/wages-payable-journal-entry.jpg

What Is Tax Payable On Total Income - Arriving at Taxable Income Both individuals and corporations begin with gross income the total amount earned in a given year For individual filers calculating federal taxable income starts by taking all income minus above the line deductions and exemptions like certain retirement plan contributions higher education expenses and student loan interest and alimony payments among others