How To Calculate Net Profit After Taxes The tax rate stands at 30 Calculate profit after tax PAT for the company Solution From the above data we get the following information Revenue of ABC private limited 500 Operating Expenses 150 Non Operating Expenses 68 Net Profit after tax or the Bottom line of the company decreases leaving less amount for the shareholders

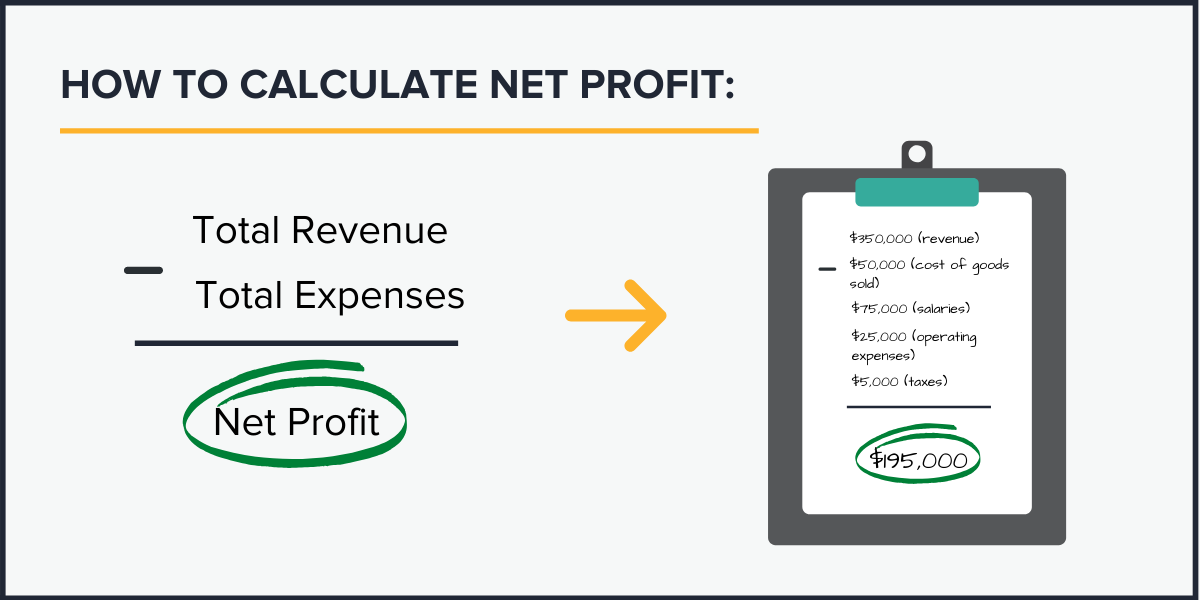

Net income after taxes represents the profit or earnings after all expense have been deducted from revenue Net income after taxes calculation can be shown as both a total dollar amount and a per The net income after taxes is obviously the net income value obtained after deduction of taxes Therefore to get the actual value of the net income you need to have actual numbers of the total revenue expenses business running costs and losses

How To Calculate Net Profit After Taxes

How To Calculate Net Profit After Taxes

https://www.taxestalk.net/wp-content/uploads/how-to-calculate-net-profit-newyork-city-voices.png

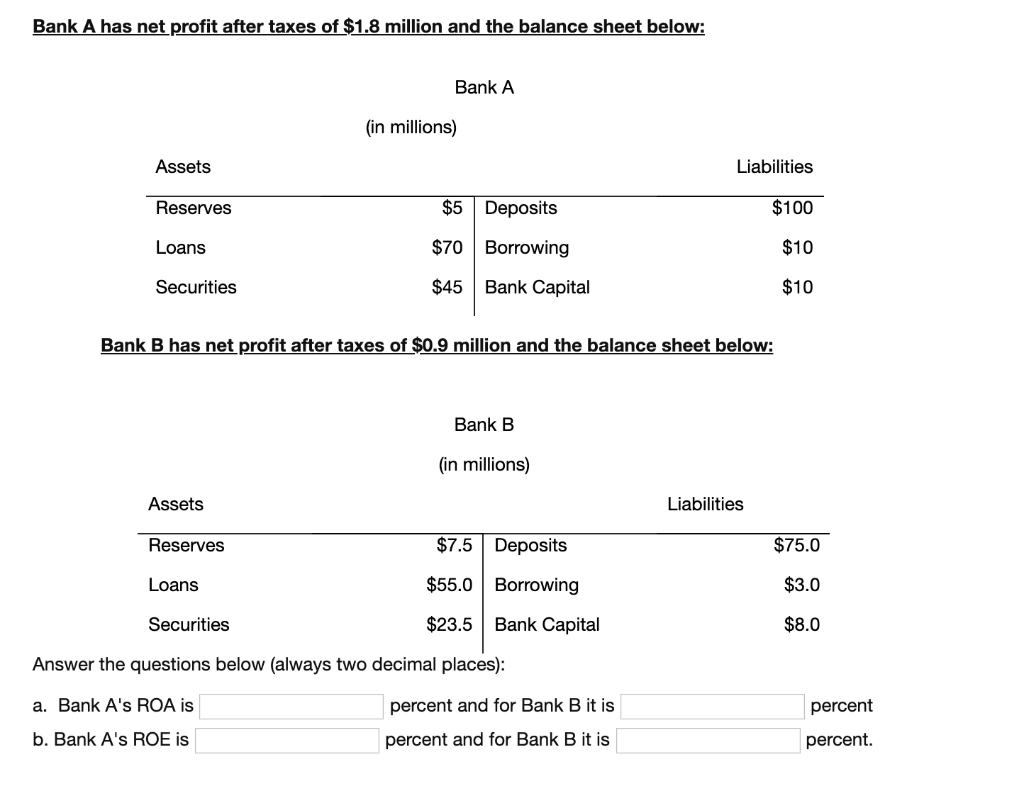

Solved Bank A Has Net Profit After Taxes Of 1 8 Million And Chegg

https://media.cheggcdn.com/media/4a7/4a7d067e-7b85-44ea-a504-fe814b7d1201/phpfyjkhk.png

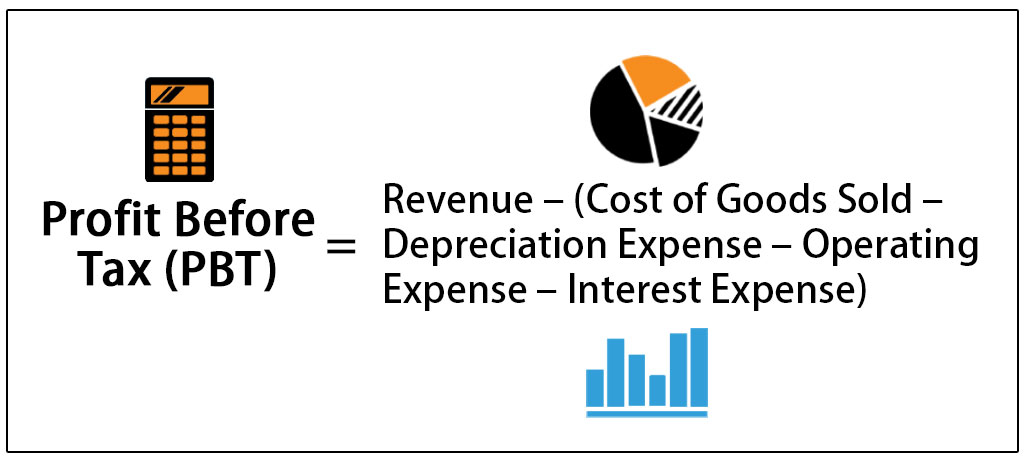

Profit Before Tax Formula Examples How To Calculate PBT

https://www.wallstreetmojo.com/wp-content/uploads/2019/07/Profit-Before-Tax-PBT-1.jpg

The net income or net profit is recorded at the bottom of the income statement and represents the after tax profit remaining upon deducting all costs and expenses The net income is calculated by subtracting revenue by operating costs such as cost of goods sold COGS and selling general and administrative SG A and non If Wyatt wants to calculate his operating net income for the first quarter of 2021 he could simply add back the interest expense to his net income 20 000 net income 1 000 of interest expense 21 000 operating net income Calculating net income and operating net income is easy if you have good bookkeeping In that case you likely

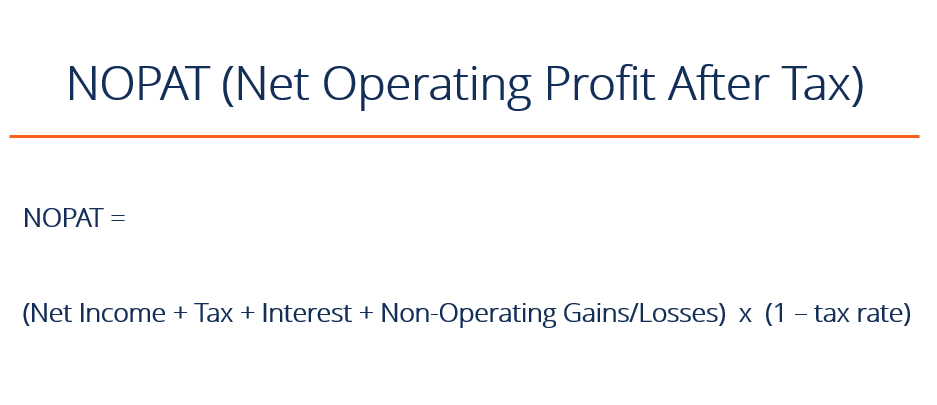

The net operating profit after tax calculator calculates the after tax profit from the operations of a company To clarify net operating profit is net earnings generated from the core business operations of the company And it is a difference between the revenues from operations and expenses which are directly attributable to such core For example if EBIT is 10 000 and the tax rate is 30 the net operating profit after tax is 0 7 which equals 7 000 calculation 10 000 x 1 0 3 This is an approximation of after tax

More picture related to How To Calculate Net Profit After Taxes

What Is Net Profit Net Profit Formula updated 2022

https://fastloans.ph/wp-content/uploads/2020/11/Created-by-2-copy.png

How Much Will I Net After Taxes Tax Walls

https://cdn.corporatefinanceinstitute.com/assets/nopat.png

How To Calculate Profit Percentage Of RETAIL SHOP How To Calculate Net

https://i.ytimg.com/vi/Cv0BgAjQDAY/maxresdefault.jpg

Calculating net income after tax involves deducting all expenses and costs from revenues in a given fiscal period The expenses and costs are the following Cost of Goods Sold COGS The cost of goods sold COGS is the carrying value of goods sold in a given period Recording the cost of goods sold is dependent on the applied inventory 4 Calculate net profit after tax Operating income and the answer to your tax rate equation are used to calculate net profit after tax The net profit after taxes is determined by multiplying the two items together As an illustration if operating income is 10 000 and the solution to the tax rate equation is 0 50 the net profit after tax

[desc-10] [desc-11]

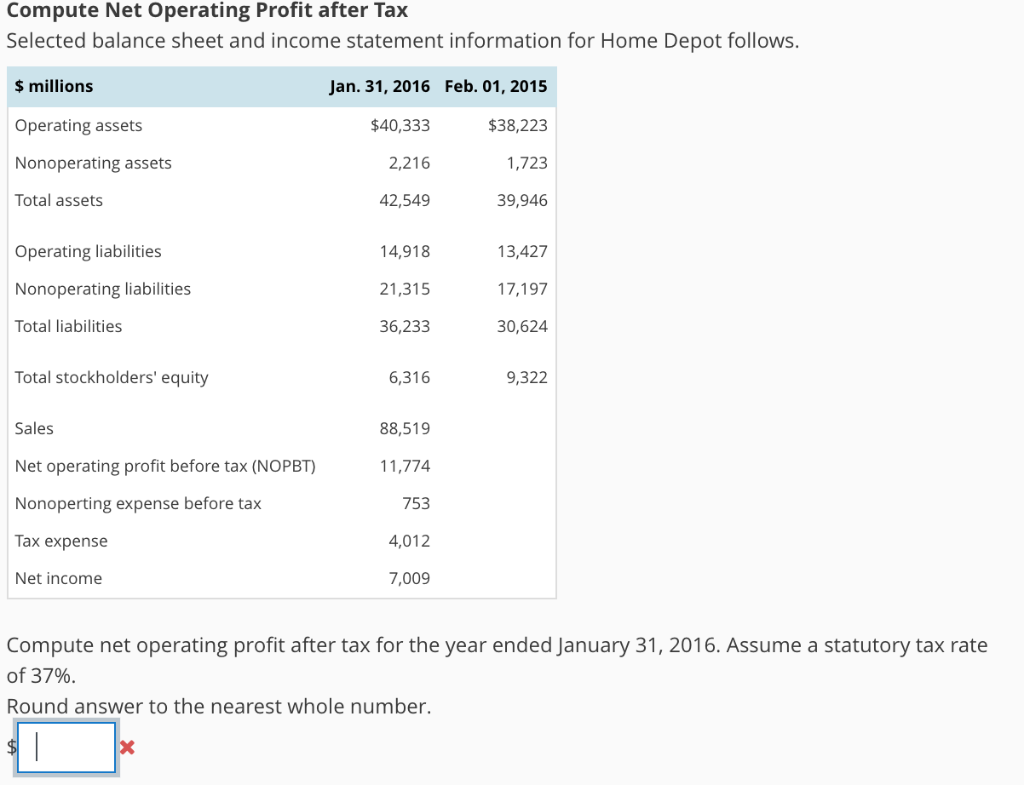

Solved Compute Net Operating Profit After Tax Selected Chegg

https://media.cheggcdn.com/media/93c/93ce7ca2-0acd-4b35-90ab-f0c55a617d6d/php14bN2M.png

How To Calculate Net Profit Rate

https://media.cheggcdn.com/study/4e8/4e821d15-2bfb-4354-a341-34ca52733186/image.jpg

How To Calculate Net Profit After Taxes - For example if EBIT is 10 000 and the tax rate is 30 the net operating profit after tax is 0 7 which equals 7 000 calculation 10 000 x 1 0 3 This is an approximation of after tax