How To Calculate Net Income After Taxes Federal Income Tax The federal income tax is a progressive tax meaning it increases in accordance with the taxable amount The more someone makes the more their income will be taxed as a percentage In 2025 the federal income tax rate tops out at 37 Only the highest earners are subject to this percentage

The result is net income How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck The average annual salary in the United States is 72 280 translating to approximately 4 715 per month after taxes and contributions though the exact amount depends on where you live Since salaries can vary significantly across states we have compiled the average annual salary for each state in the table below along with the monthly take home pay estimated by our calculator

How To Calculate Net Income After Taxes

How To Calculate Net Income After Taxes

https://www.taxestalk.net/wp-content/uploads/how-to-calculate-net-profit-newyork-city-voices.png

How To Calculate Net Income 12 Steps with Pictures WikiHow

https://www.wikihow.com/images/7/74/Calculate-Net-Income-Step-12-Version-2.jpg

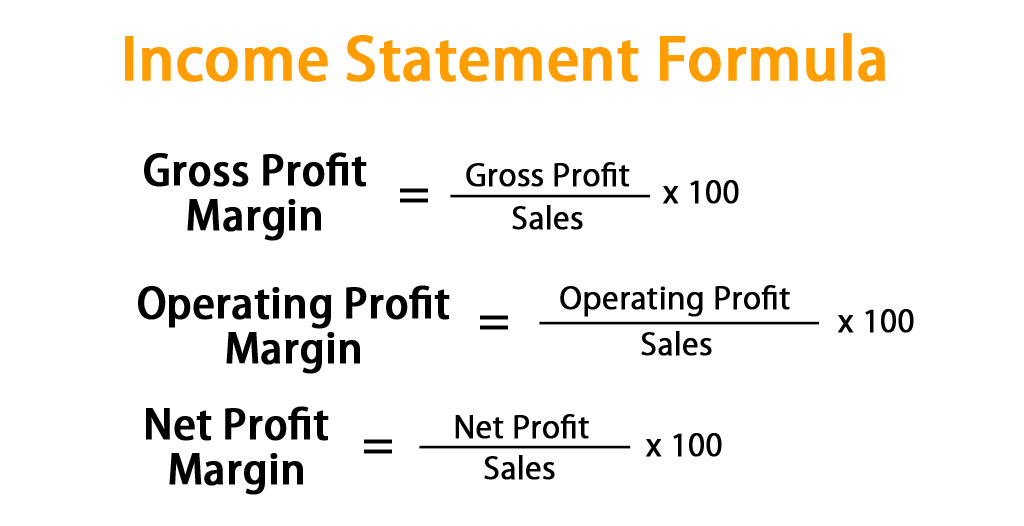

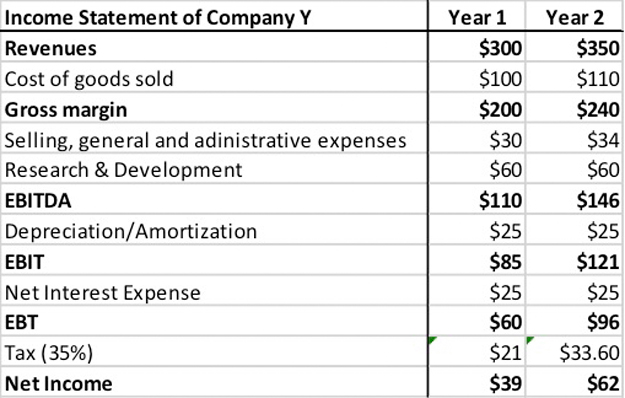

Income Statement Formula Calculate Income Statement Excel Template

https://www.educba.com/academy/wp-content/uploads/2019/04/Income-Statement-Formula.jpg

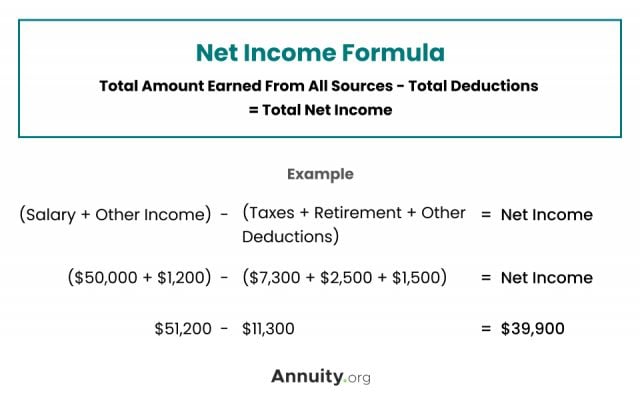

Gross income or State taxable income Local income tax rate Local income tax liability Step 5 Your net pay After calculating your total tax liability subtract deductions pre and post tax and any withholdings if applicable The formula is To effectively use the Net Income After Tax US Calculator follow these steps Field Explanation Input your total gross income in the first field In the second field enter the tax rate percentage applicable to your income Result Interpretation The result displayed is your net income after tax deduction For example if your gross

Discover Talent s income tax calculator tool and find out what your paycheck tax deductions will be in USA for the 2025 tax year Income tax calculator USA Find out how much your salary is after tax Enter your gross income hence your net pay will only increase by 63 99 Bonus Example A 1 000 bonus will generate an extra 640 A salary calculator lets you enter your annual income gross pay and calculate your net pay paycheck amount after taxes You will see what federal and state taxes were deducted based on the information entered You can use this tool to see how changing your paycheck affects your tax results

More picture related to How To Calculate Net Income After Taxes

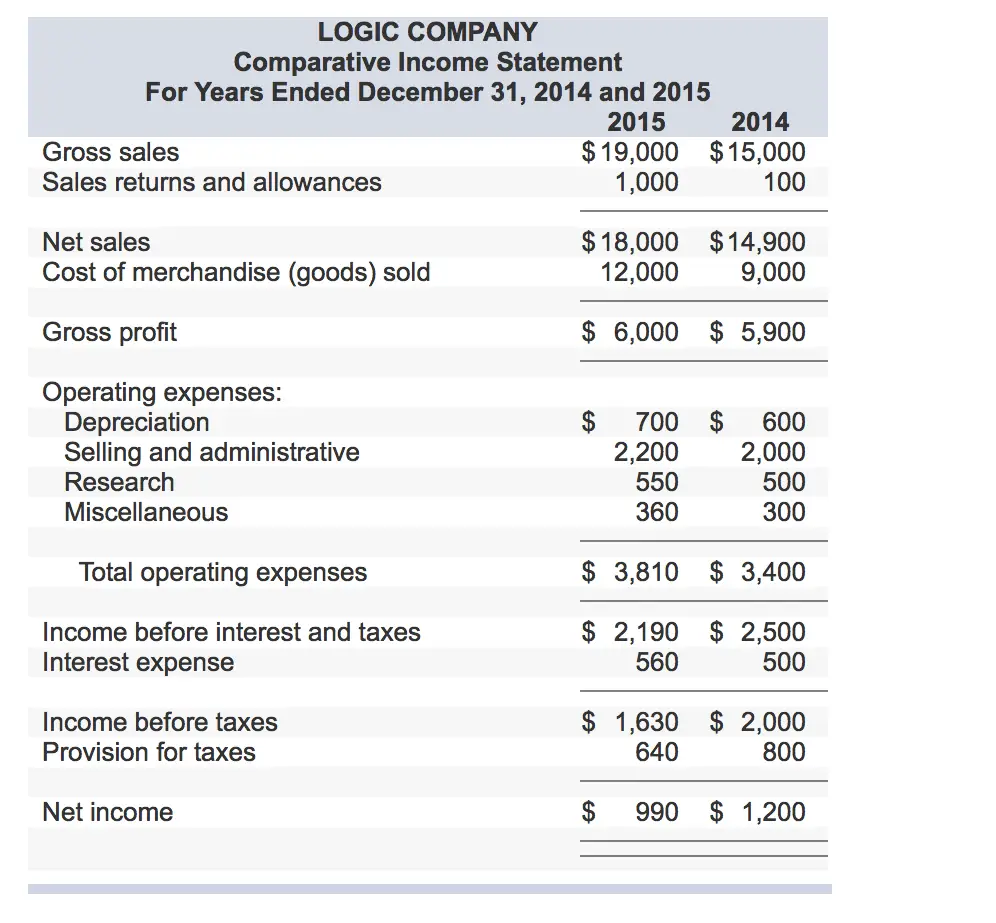

How To Calculate Net Income After Taxes TaxesTalk

https://www.taxestalk.net/wp-content/uploads/solved-calculate-the-net-income-after-tax-to-the-net-sa.png

How To Calculate Net Income After Taxes TaxesTalk

https://www.taxestalk.net/wp-content/uploads/net-income-after-taxes-niat.jpeg

How To Calculate Net Income After Taxes Intuit payroll

https://intuit-payroll.org/wp-content/uploads/2021/03/image-3woBkcV21AQxj9fO.png

Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules Find your total tax as a percentage of your taxable income Calculate net income after taxes Compare your net pay between filing jointly and separately Use our free paycheck calculators net to gross and bonus calculators Form W 4 and state withholding forms 401k savings and retirement calculator and other specialty payroll calculators for all your paycheck and payroll needs

[desc-10] [desc-11]

Annual Net Income Formula RanaldBraiden

https://www.annuity.org/wp-content/uploads/net-income-formula-2-640x0-c-default.jpg

What Is Net Operating Profit After Taxes NOPAT Definition

https://www.myaccountingcourse.com/accounting-dictionary/images/net-operating-profit-after-taxes.jpg

How To Calculate Net Income After Taxes - To effectively use the Net Income After Tax US Calculator follow these steps Field Explanation Input your total gross income in the first field In the second field enter the tax rate percentage applicable to your income Result Interpretation The result displayed is your net income after tax deduction For example if your gross