How To Calculate Net Income After Taxes Canada If you make 52 000 a year living in the region of Ontario Canada you will be taxed 14 043 That means that your net pay will be 37 957 per year or 3 163 per month Your average tax rate is 27 0 and your marginal tax rate is 35 3 This marginal tax rate means that your immediate additional income will be taxed at this rate

Your net income is used to calculate your federal and provincial or territorial non refundable tax credits The CRA also uses your net income and your spouse s or common law partner s net income to calculate amounts such as the Canada child benefit GST HST credit social benefits repayment and certain other credits Enter your spouse s or common law partner s net income on page 1 of your Canada Salary Calculator How to Calculate Salary After Tax and Net Income The personal income tax system in Canada is a progressive system This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates Federal tax rates range from 15 to 33 Canada

How To Calculate Net Income After Taxes Canada

How To Calculate Net Income After Taxes Canada

https://www.annuity.org/wp-content/uploads/net-income-formula-2-640x0-c-default.jpg

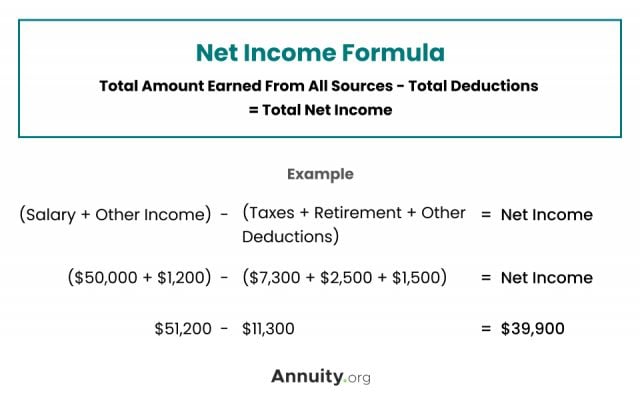

How To Calculate Net Income How To Tutorial

https://tnhrce.org/wp-content/uploads/2021/05/a-1024x683.jpg?v=1621174249

How To Calculate Net Income In Two Minutes Net Income Income Net

https://i.pinimg.com/originals/b5/3f/a7/b53fa7e1d7d46cc468c3e046b7281fe4.png

Calculate your after tax salary for the 2025 tax season on CareerBeacon Use our free tool to explore federal and provincial tax brackets and rates 2025 Canada Income Tax Calculator Total Income Total Deductions Net Pay Avg Tax Rate Comp Deduction Rate Nunavut 50 000 00 9 082 66 40 917 34 10 99 18 17 In Canada each province and territory has its own provincial income tax rates besides federal tax rates Below there is simple income tax calculator for every Canadian province and territory Or you can choose income tax calculator for particular province or territory depending on your residence

These calculations are approximate and include the following non refundable tax credits the basic personal tax amount CPP QPP QPIP and EI premiums and the Canada employment amount After tax income is your total income net of federal tax provincial tax and payroll tax Rates are current as of July 30 2024 Use our Canada take home pay calculator and find out your annual biweekly weekly and daily salary after taxes deductions English Fran ais 4 8 637 reviews English taxes CPP EI are applied Net Salary is the amount you take home after all deductions have been subtracted from your gross salary

More picture related to How To Calculate Net Income After Taxes Canada

Cheque Jud as Verdes Corta Vida Calculate Your Net Salary Saludar

https://images.contentful.com/ifu905unnj2g/66K2AdsLlvARouig6tdw8D/9fb05a7c0c4b54eca5f4d7bb8c04ce1c/Net_income_formula.jpg

How To Calculate Net Income Loss News At How To Www joeposnanski

https://i.pinimg.com/736x/c9/79/5d/c9795db2abeff9fa85883f753c070feb.jpg

Profit Before Tax Formula Examples How To Calculate PBT

https://www.wallstreetmojo.com/wp-content/uploads/2019/07/Profit-Before-Tax-PBT-1.jpg

The Salary Calculators on this page are for Canada Federal Tax and Social Security deductions only for a salary calculation encompassing both Federal and Provincial taxes please select the appropriate province from the options listed below alternatively continue reading to calculate using Federal taxation rules only or use the Canada Tax Subtract the total deductions from your gross earnings to arrive at your net income Use a Salary Calculator A salary calculator can simplify the process Enter your gross pay along with the specific deductions to obtain a clear estimate of your take home pay This tool can account for various benefits that may impact your final amount

[desc-10] [desc-11]

How To Calculate Net Income After Taxes TaxesTalk

https://www.taxestalk.net/wp-content/uploads/solved-calculate-the-net-income-after-tax-to-the-net-sa.png

How To Determine Income Tax TaxesTalk

https://www.taxestalk.net/wp-content/uploads/solved-calculate-the-net-income-after-tax-to-the-net-sa-chegg-com.png

How To Calculate Net Income After Taxes Canada - Use our Canada take home pay calculator and find out your annual biweekly weekly and daily salary after taxes deductions English Fran ais 4 8 637 reviews English taxes CPP EI are applied Net Salary is the amount you take home after all deductions have been subtracted from your gross salary