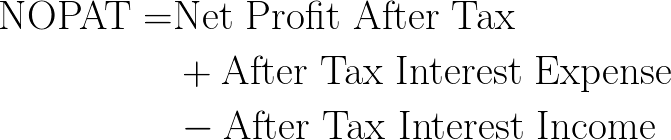

How To Calculate Net Operating Profit After Taxes Some simple explanation of the main terms in the above table Revenue The total value of business generated from the regular activities of a company Operating expense The cost incurred by the company to generate Revenue Operating profit The money remaining with the company after paying for its operating activities Interest Interest repayment for any borrowings similar to the

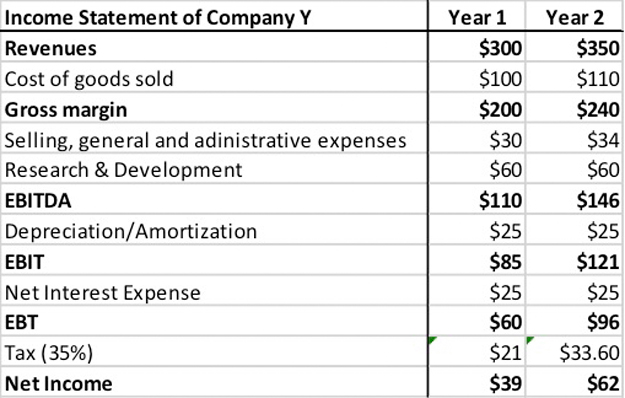

The net operating profit after tax calculator calculates the after tax profit from the operations of a company To clarify net operating profit is net earnings generated from the core business operations of the company And it is a difference between the revenues from operations and expenses which are directly attributable to such core In theory the metric should represent the core operating income EBIT of a company taxed after removing the impact of non operating gains losses debt financing e g tax shield and taxes paid Thus the net operating profit after tax is a company s potential cash earnings if its capitalization were unleveraged that is

How To Calculate Net Operating Profit After Taxes

How To Calculate Net Operating Profit After Taxes

https://snorable.org/wp-content/uploads/2022/06/How-To-Calculate-NOPAT-Net-Operating-Profit-After-Tax-Calculation.jpg

Net Operating Profit After Tax NOPAT

http://www.wikicalculator.com/en/formula_image/net-operating-profit-after-tax-NOPAT-31.png

NOPAT P1P

https://p1p.com.br/blog/wp-content/uploads/2015/10/NOPAT.jpg

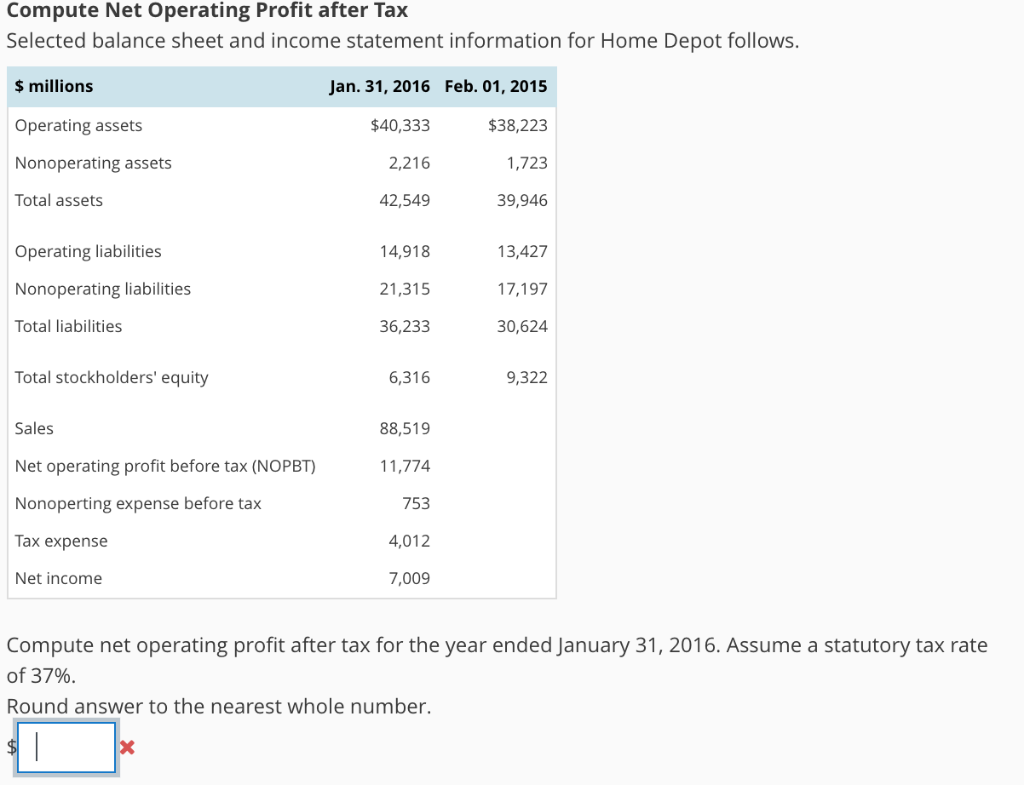

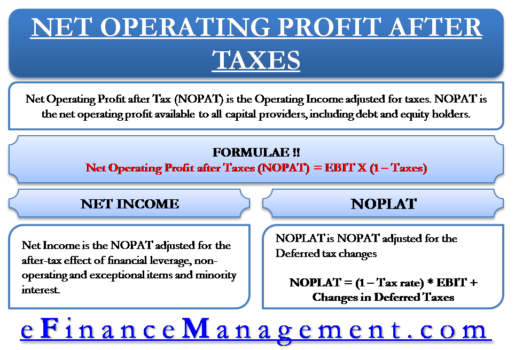

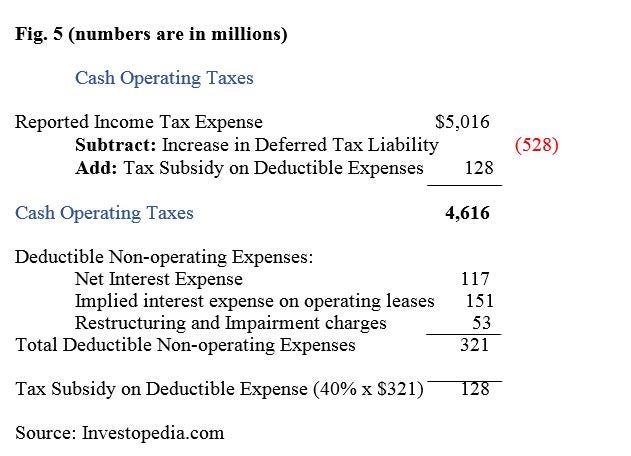

The Net Operating Profit After Tax NOPAT is a financial measure of profitability that provides an unbiased look at the income from a company s operations if it had no debt or leverage There are two ways to calculate the Operating Income operating income gross profit operating expense where gross profit total revenue cost Net profit margin after tax is a financial ratio that measures a company s profitability relative to its revenue It shows you how much profit a company generates for every dollar of sales The formula for calculating net profit margin after tax is Net profit margin Net income net sales 100 Net income Total revenue expenses taxes

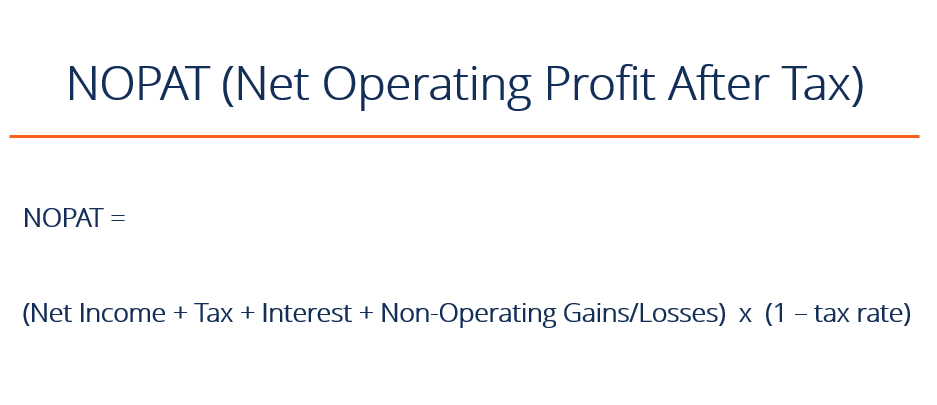

Next the interest expense is calculated You get this value by subtracting profit before tax from net profit The tax expense is calculated by multiplying profit before tax and the tax rate NOPAT examples Let us say you have an operating income of 200 000 and a tax rate of 40 The companies executives can subtract those costs from the company s revenue which results in 40 000 in total net profit Related Operating Income Net Income and Net Operating Income Definitions 2 Find any nonoperating losses or gains Nonoperating losses and gains are the costs and profits that don t come from the focus of a business

More picture related to How To Calculate Net Operating Profit After Taxes

What Is Net Operating Profit After Taxes NOPAT Definition

http://www.myaccountingcourse.com/accounting-dictionary/images/net-operating-profit-after-taxes.jpg

How Much Will I Net After Taxes Tax Walls

https://cdn.corporatefinanceinstitute.com/assets/nopat.png

Solved Compute Net Operating Profit After Tax Selected Chegg

https://media.cheggcdn.com/media/93c/93ce7ca2-0acd-4b35-90ab-f0c55a617d6d/php14bN2M.png

The simple formula to calculate NOPAT is NOPAT Operating Profit 1 Tax Rate Here operating profit is gross profit minus the operating expenses of a business The term 1 Tax Rate calculates the net profit after paying taxes Therefore the formula calculates profits net of tax savings made on interest payments How to Calculate Net Operating Profit After Tax The formula for net operating profit after tax is to multiply an organization s operating income by the difference between 1 and the applicable tax rate The formula is as follows Operating income x 1 tax rate NOPAT Example of Net Operating Profit After Tax If a company earns 100 000

[desc-10] [desc-11]

Net Operating Profit After Tax EFinanceManagement

https://efinancemanagement.com/wp-content/uploads/2016/05/Net-Operating-Profit-after-taxes-NOPAT-515x350.png

How To Calculate Net Operating Profit After Taxes NOPAT

https://i.investopedia.com/image/jpeg/1516208323006/nopat_5.jpg

How To Calculate Net Operating Profit After Taxes - Next the interest expense is calculated You get this value by subtracting profit before tax from net profit The tax expense is calculated by multiplying profit before tax and the tax rate NOPAT examples Let us say you have an operating income of 200 000 and a tax rate of 40