How To Add Tax Rate In Excel As the name implies sales tax is a tax added to the sale of goods For example suppose the price of a given product is 10 If the sales tax rate is 20 then the final price of the product after sales tax is added is Price with sales tax 10 1 0 20 10 1 2 12 You can use the following formulas to add or remove sales tax from prices in Excel

Step 2 Calculate Taxable Income For the first bracket due to the zero lower limit the maximum Taxable Income will be 9 315 To calculate the taxable income for the second Bracket we need to subtract the lower limit Cell D6 from the upper limit Cell E6 and then add the result with 1 Determine the taxable income for the third bracket in the same way Method 1 Getting the Sales Tax using a Subtraction The receipt shows price tax rate and total price Steps Subtract the price value from the total price to get the tax amount Go to C7 and enter the following formula

How To Add Tax Rate In Excel

How To Add Tax Rate In Excel

https://www.studiocart.co/wp-content/uploads/2021/11/sc-tax-settings-enable.gif

How To Add Tax In WooCommerce Invoice WebAppick

https://webappick.com/wp-content/uploads/2022/10/how-to-add-tax-in-woocommerce-856x350.png

How To Add Tax To A Price AccountingCoaching

https://accountingcoaching.online/wp-content/uploads/2020/12/image-MZta2DQSB54YwOup.png

Step 2 Input the tax rate Type the tax rate as a decimal in another cell e g B1 If the tax rate is 7 you ll enter it as 0 07 Remember converting percentage to a decimal is crucial for the formula to work correctly Step 3 Create the formula to calculate tax In a new cell enter the formula A1 B1 to calculate the tax amount There are two common ways of adding sales tax in Excel One way is to insert the total tax on a purchase as a separate line item and then add it to the net price Another way is to apply the tax

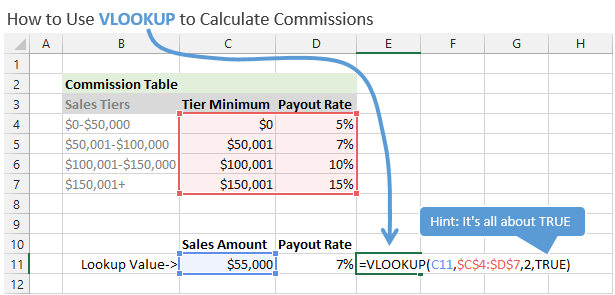

Create a new table with two columns Category and Tax Rate Fill in the categories and their respective rates In your main sheet add a Category column next to the Item Name column In the Tax Rate column use the formula VLOOKUP A2 your table range 2 FALSE to automatically pull the correct tax rate based on the item category To create a cell for entering the tax rate simply select a cell where you want to enter the tax rate and label it as Tax Rate You can then input the tax rate as a percentage for example 7 5 Formatting options for the tax rate cell It s important to format the tax rate cell to ensure it is displayed correctly

More picture related to How To Add Tax Rate In Excel

Youtube Tax Required For All Monetise Creators What Why And How To

https://i.ytimg.com/vi/XuoMgqYMfAY/maxresdefault.jpg

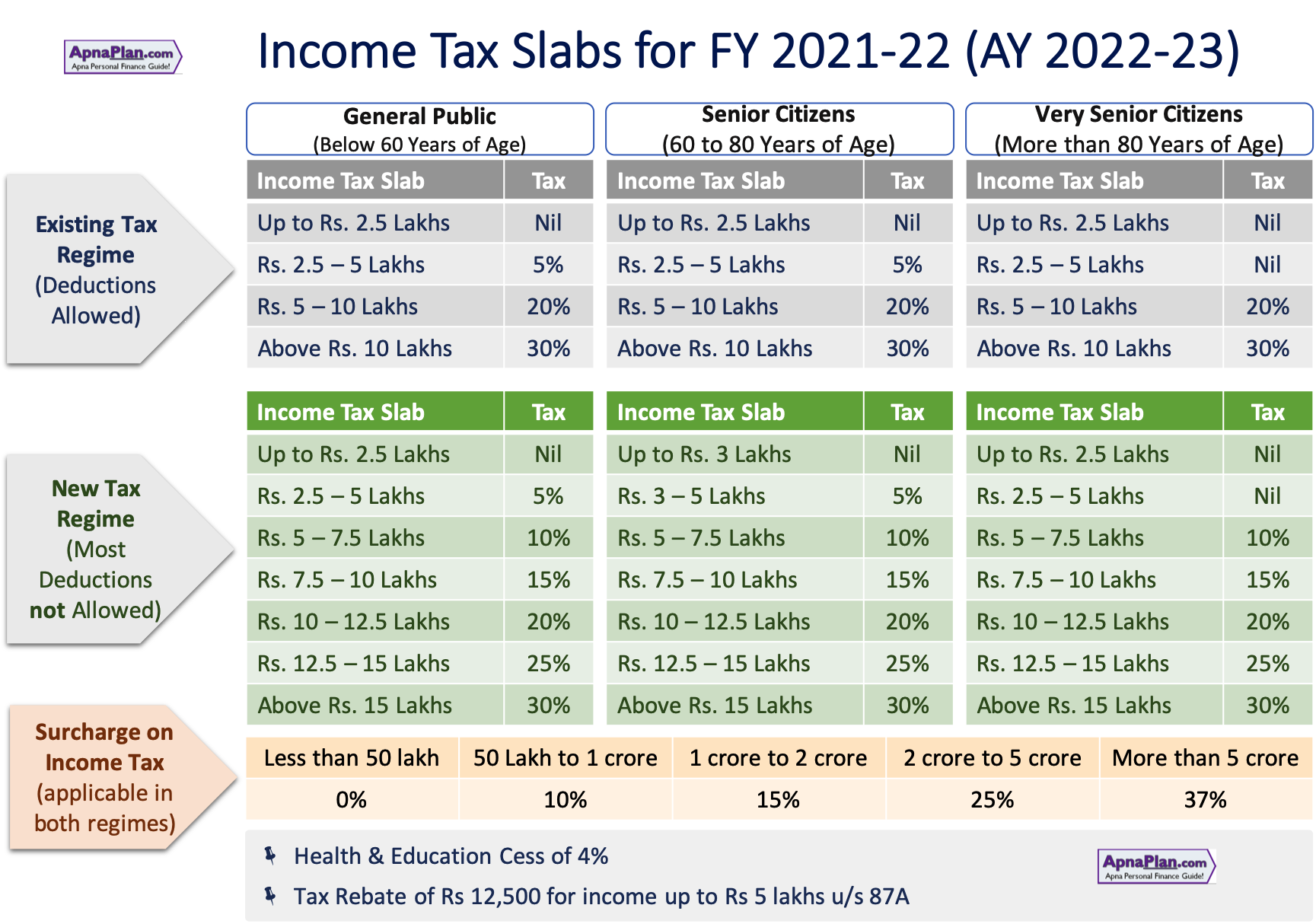

Income Tax Calculator India In Excel FY 2021 22 AY 2022 23

https://www.apnaplan.com/wp-content/uploads/2021/03/Income-Tax-Slabs-for-FY-2021-22-AY-2022-23.png

Effective Annual Interest Rate Excel Formula Exceljet

https://exceljet.net/sites/default/files/styles/original_with_watermark/public/images/formulas/effective annual interest rate.png

If it does and the income is at least 9 951 then I can multiply that by the tax rate of 10 as that would be the maximum that can be taxed at the first bracket 9 951 x 10 If the income is not at least 9 951 then I just multiply the total income by the tax rate Here is what the formula looks like using named ranges For example if the tax rate is 10 you should enter it as 0 10 This allows Excel to correctly interpret the tax rate for calculations Step 5 Calculate the Tax In the third column label it Tax Amount and use the formula A2 B2 for the first row under this column This formula multiplies the income by the tax rate to give you the tax

[desc-10] [desc-11]

How To Calculate Income Tax In Excel

https://www.extendoffice.com/images/stories/doc-excel/calculate-income-tax/doc-excel-calculate-income-tax-7.png

Chapter 1 Excel Part II How To Calculate Corporate Tax YouTube

https://i.ytimg.com/vi/nVfshf3tfrw/maxresdefault.jpg

How To Add Tax Rate In Excel - There are two common ways of adding sales tax in Excel One way is to insert the total tax on a purchase as a separate line item and then add it to the net price Another way is to apply the tax