How Do You Calculate Gross Salary From Net Pay In South Africa PAYE Calculator South Africa Gross to Nett PAYE Calculator 2023 2024 South African PAYE UIF Calculator Tax Year 2023 2024 Monthly Gross Income R Younger than 65 years Between 65 and 75 years Older than 75 years Clear Simple calculator for calculating South African PAYE for 2023 2024

29 March 2022 at 13 13 How do I calculate gross salary if given a net salary The gross salary should include the UIF and PAYE per month For example if someone s net salary that is the amount that goes into the bank account is R50000 00 what is their gross considering only two deductions that is UIF and PAYE TaxTim says To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck

How Do You Calculate Gross Salary From Net Pay In South Africa

How Do You Calculate Gross Salary From Net Pay In South Africa

https://zaviad.s3.eu-west-2.amazonaws.com/wp-content/uploads/2022/04/26224638/What-Is-Gross-Salary.png

What Is Gross Salary And The Formula To Calculate Gross Salary

https://99employee.com/wp-content/uploads/2021/01/gross-salary-employee.jpg

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or

https://i.ytimg.com/vi/ev3JQIvAaPY/maxresdefault.jpg

Gross pay and net pay both appear on employee paychecks Gross pay is an employee s earned wages before deductions By contrast net pay is the amount an employee takes home after deductions The following steps show how to calculate gross pay for hourly wages Determine the actual number of hours worked Multiply the number of hours worked by the hourly wage If there is overtime multiply the number of overtime hours worked by the overtime pay rate Add regular pay and overtime pay together to find the gross pay for that pay period

Net pay is the amount of money employees earn after payroll deductions are taken away from gross pay These includes taxes benefits wage garnishments and other deductions In simple terms net 1 minus 2965 0 7035 Then we ll divide the net pay 700 by the rate 0 7035 700 divided by 0 7035 is 995 00 this number totals the gross payment 995 x 2965 is 295 00 this number equals the total tax withheld 995 295 700 this is the net bonus the employee should receive So the gross up or extra pay the employer

More picture related to How Do You Calculate Gross Salary From Net Pay In South Africa

C Program To Calculate Gross Salary Of An Employee Tuts Make

https://www.tutsmake.com/wp-content/uploads/2021/12/C-Program-to-Calculate-Gross-Salary-of-an-Employee.jpg

Gross Pay VS Net Pay Definition Examples How To Calculate Right

https://www.bookstime.com/wp-content/uploads/2020/09/shutterstock_328330016.jpg

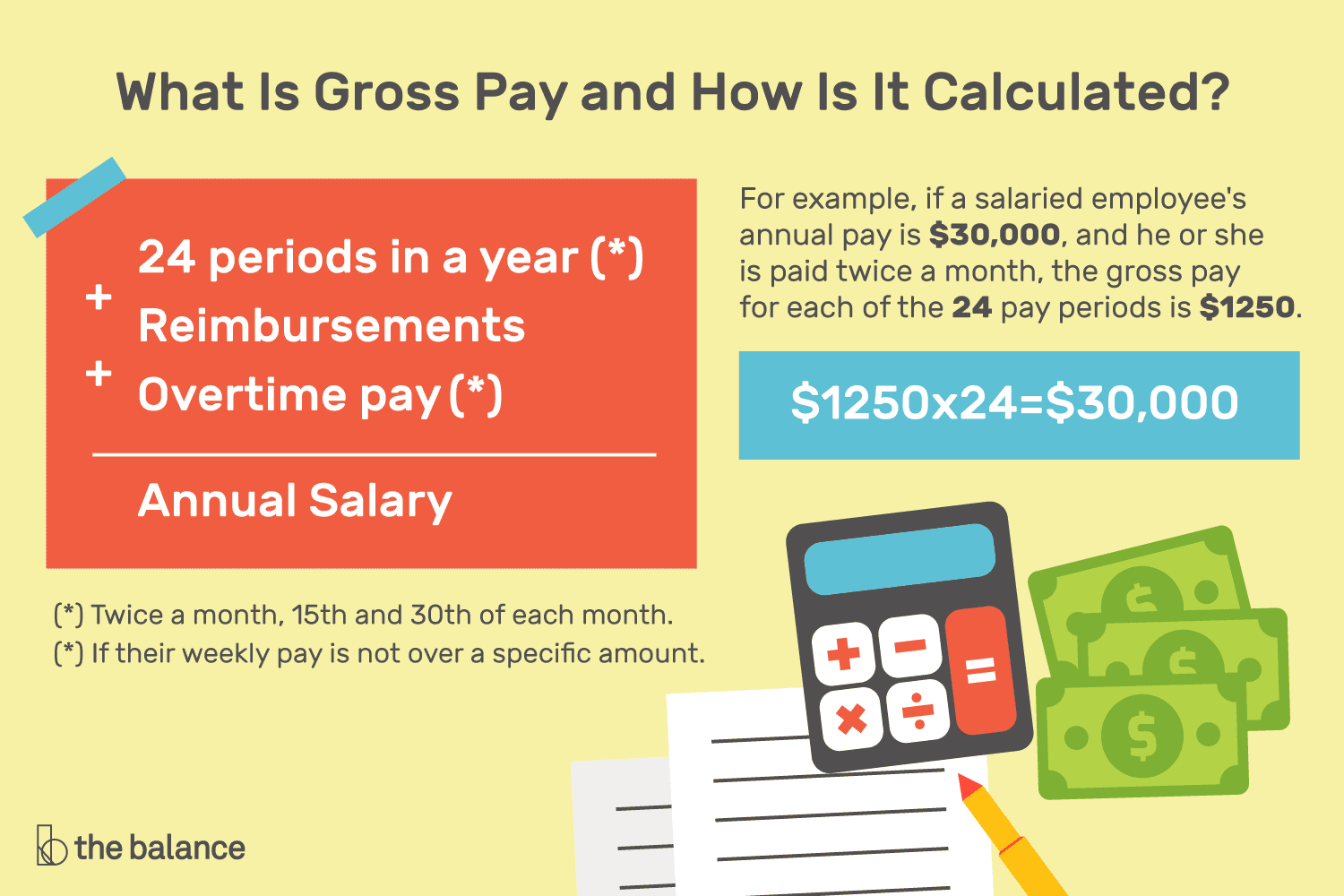

What Is Gross Pay And How Is It Calculated Db excel

https://db-excel.com/wp-content/uploads/2019/09/what-is-gross-pay-and-how-is-it-calculated.png

Follow these steps to calculate gross pay per pay period for a salaried employee 1 Divide the annual gross pay by the number of pay periods in the year For example if an employee has an annual salary of 35 000 and you pay them biweekly this would be the calculation 2 Add bonuses and commissions if applicable Gross pay calculator Plug in the amount of money you d like to take home each pay period and this calculator will tell you what your before tax earnings need to be Important Note on Calculator The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates

Our updated and free online salary tax calculator incorporates the changes announced in the Budget Speech View what your tax saving or liability will be in the 2023 2024 tax year Divide your employee s annual salary by the number of pay periods If you have a salaried employee making 60 000 per year here s how gross pay would look divided by each type of pay period Weekly 60 000 52 1 153 85 per pay period Every two weeks 60 000 26 2 307 69 per pay period

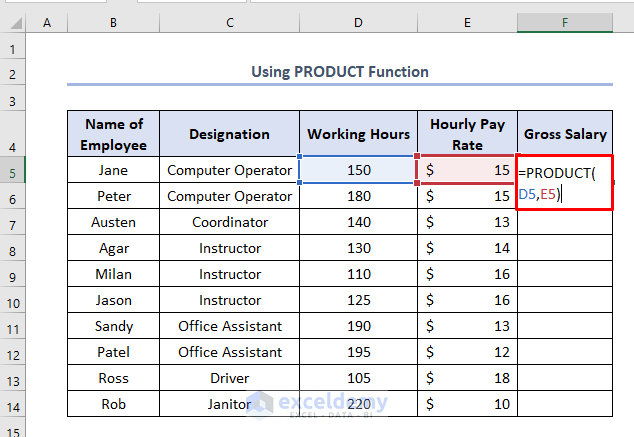

How To Calculate Gross Salary In Excel 3 Useful Methods ExcelDemy

https://www.exceldemy.com/wp-content/uploads/2022/06/how-to-calculate-gross-salary-2.png

P11 Program To Calculate Gross Salary With HRA DA And TA From Basic

https://i.ytimg.com/vi/PzQ6pD9oE-g/maxresdefault.jpg

How Do You Calculate Gross Salary From Net Pay In South Africa - Gross Pay Calculator Straight Time ST Hours Rate Hr hourly rate of pay Overtime OT OT Hours OT Rate OT rate multiplier 1 5 is time and a half ST Double Time DT DT Hours DT Rate DT rate multiplier 2 is double time ST Round hours to Answer Gross Pay Rate Hr Hours Amount ST OT DT Total How could this calculator be better