Explain Net Operating Income Approach Of Capital Structure The Net Income Approach suggests that the value of the firm can be increased by decreasing the overall cost of capital Capital Structure Theory Net Operating Income Approach Sanjay Bulaki Borad MBA Finance CMA CS Insolvency Professional B Com Please explain the reason Reply BIJU M June 20 2020 at 6 10 pm

This article throws light upon the top four theories of capital structure The theories are 1 Net Income Approach 2 Net Operating Income Approach 3 Traditional Approach 4 Modigliani Miller Approach Theory 1 Net Income NI Approach David Durand suggested the two famous capital structure theories viz Net Income Approach and the Operating Income Approach According to NI approach a 2 Net Operating Income Approach NOI Approach This theory is just opposite to NI approach NI approach is relevant to capital structure decision It means decision of debt equity mix does affect the WACC and value of the firm As per NOI approach the capital structure decision is irrelevant and the degree of financial leverage does not affect

Explain Net Operating Income Approach Of Capital Structure

Explain Net Operating Income Approach Of Capital Structure

https://i.ytimg.com/vi/k5czSqzwdnA/maxresdefault.jpg

THEORIES OF CAPITAL STRUCTURE PART 1 NET INCOME APPROACH NET

https://i.ytimg.com/vi/xsnXRb6gIpM/maxresdefault.jpg

Financial Management Net Operating Income Approach NOI Approach Theory

https://i.ytimg.com/vi/SOmN638-iiI/maxresdefault.jpg

7 4 Net Income Approach As per Net Income Approach there is a relationship between capital structure and value of the firm and therefore firm can affect its value by increasing or decreasing the debt proportion in the overall financing mix This approach shows that capital structure has relevance in determining the value of firm The Net Explain Net operating income theory of capital structure Capital structure of a company depends on mix or ratio of debt and equity in their mode of their financing Depending on what company prefer some may have more debt or more equity in financing their asset but final goal is to maximize their market value and their profits Net operating

Net Operating Income Approach The net operating income approach suggested by David Durand states the irrelevance of capital structure in calculating the firm s value The cost of capital for the firm will always be the same No matter what the degree of leverage is the firm s total value will remain constant Net Income approach of capital structure theory assumes that the only capital can affect the value of firm and overall cost of capital According to Net income theory proposed by David Durand in 1952 Capital structure is relevant to the value and overall cost of capital EBIT Operating Income 2 00 000 2 00 000 Debt 5 00 000 0 Cost

More picture related to Explain Net Operating Income Approach Of Capital Structure

Solved Numerical Problems Of Capital Structure Approaches

https://noteslearning.com/wp-content/uploads/2020/02/CAPITAL-STRUCRURE-e1659511052249.jpg

Capital Structure Theories Net Income Approach And Net Operating

https://i.ytimg.com/vi/vyHnvZjUQLM/maxresdefault.jpg

Solved Please Answer The Table Below Shows The National Income

https://www.coursehero.com/qa/attachment/35132634/

This part introduces the Net Operating Income Approach which suggests that the cost of capital and the firm value remain unaffected by changes in capital structure It covers the theoretical underpinnings assumptions and implications of this approach contrasting it with the Net Income Approach This section explains the Net Income Approach which posits that changes in the capital structure can influence the overall cost of capital and the firm s valuation It discusses the assumptions the impact of leverage on firm value and the practical applications of this approach in financial decision making

[desc-10] [desc-11]

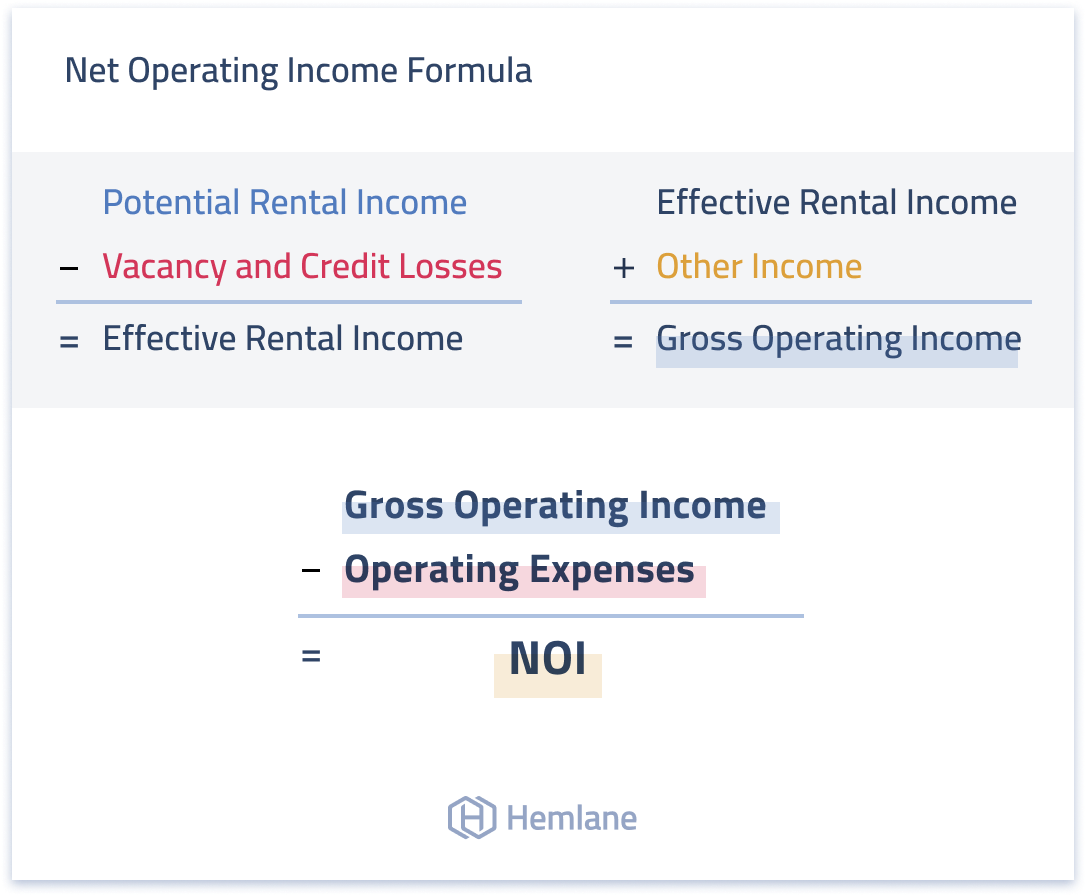

Net Operating Income Formula Astonishingceiyrs

https://resources.hemlane.com/content/images/2021/06/Net-operating-income--NOI--formula-for-real-estate-investors.png

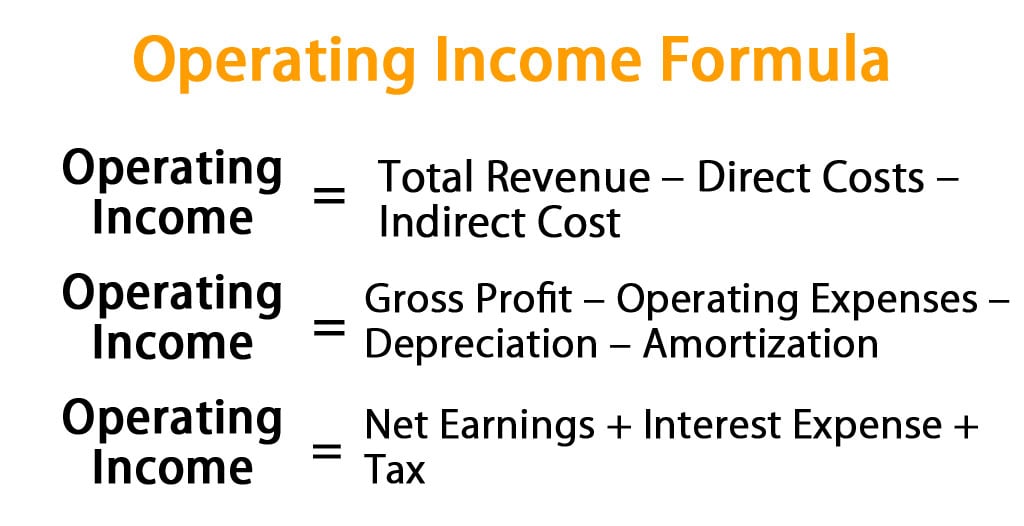

How To Calculate Operating Income Haiper

https://cdn.educba.com/academy/wp-content/uploads/2019/04/Operating-Income-Formula.jpg

Explain Net Operating Income Approach Of Capital Structure - [desc-12]