Noi Approach Of Capital Structure Net Operating Income Approach The net operating income approach suggested by David Durand states the irrelevance of capital structure in calculating the firm s value The cost of capital for the firm will always be the same No matter what the degree of leverage is the firm s total value will remain constant

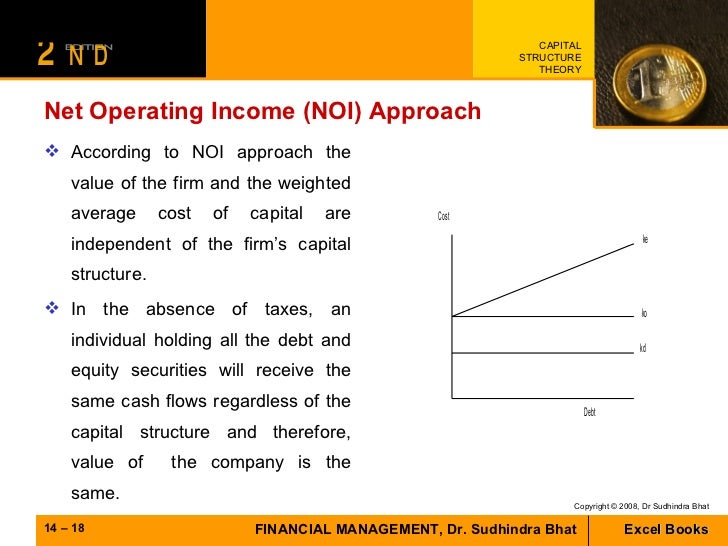

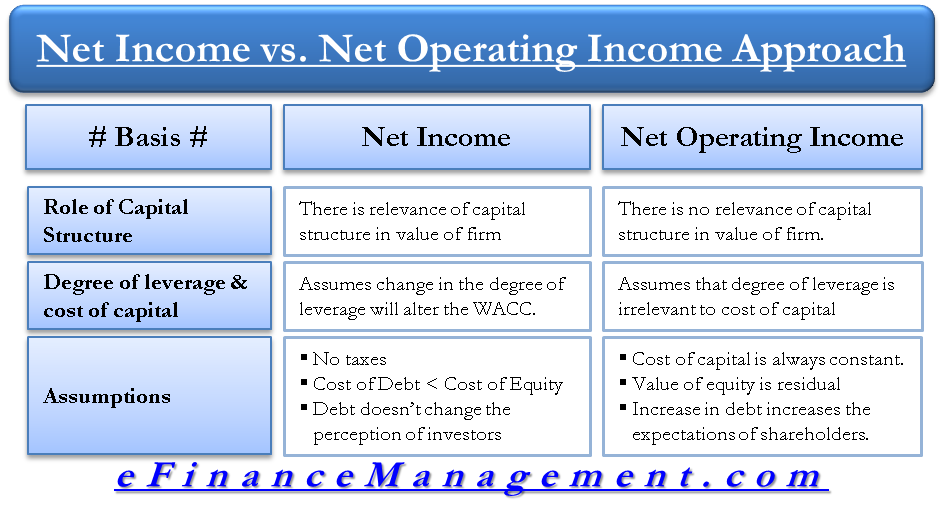

5 Net Operating Income Approach NOI According to this approach capital structure decisions of the firm are irrelevant Any change in the leverage will not lead to any change in the total value of the firm and the market price of shares as the overall cost of capital is independent of the degree of leverage As per NOI Approach Net income approach and net operating income approach were proposed by David Durand According to NI approach there exists positive relationship between capital structure and valuation of firm and change in the pattern of capitalisation brings about corresponding change in the overall cost of capital and total value of the firm Thus with an increase

Noi Approach Of Capital Structure

Noi Approach Of Capital Structure

https://i.ytimg.com/vi/nqyLDGSZmGk/maxresdefault.jpg

Theories Of Capital Structure NI NOI MM Approach Financial

https://i.ytimg.com/vi/267Mtx2MXPk/maxresdefault.jpg

FM Capital Structure NOI Approach YouTube

https://i.ytimg.com/vi/FDuAYQ1yNnE/maxresdefault.jpg

The NOI Approach can be illustrated with the help of the following diagram Hence optimum capital structure in this case is considered as Equity Capital Rs 1 00 000 and Debt Capital Rs 1 00 000 which bring the lowest overall cost of capital followed by the highest value of the firm According to the NOI approach the market value of the firm depends upon the net operating profit or EBIT and the over cost of capital WACC The financing mix or the capital structure is irrelevant and does not affect the value of the firm Assumptions of NOI Approach Overall cost of capital K 0 remains constant Cost of Debt K d is constant

Explain Net operating income theory of capital structure Capital structure of a company depends on mix or ratio of debt and equity in their mode of their financing Depending on what company prefer some may have more debt or more equity in financing their asset but final goal is to maximize their market value and their profits Net operating income NOI Capital structure is also referred to as financial leverage which strictly means the proportion of debt or borrowed funds in the financing mix of a company vs Net Operating Income NOI Approach Capital Structure and its Theories Capital Structure Analysis Capital Structure Decisions Importance Factors Tips and More Factors

More picture related to Noi Approach Of Capital Structure

FINANCIAL MANAGEMENT CAPITAL STRUCTURE THEORIES NOI APPROACH YouTube

https://i.ytimg.com/vi/1JwphXBrKFM/maxresdefault.jpg

3 NI Net Income Approach NOI Net Operating Income Approach

https://i.ytimg.com/vi/k5czSqzwdnA/maxresdefault.jpg

Capital Structure Theory

https://image.slidesharecdn.com/capitalstructuretheory-090408162048-phpapp02/95/capital-structure-theory-18-728.jpg?cb=1239207846

2 Net Operating Income Approach NOI This approach is also suggested by Durand according to it the market value of the firm is not affected by the capital structure changes The market value of the firm is ascertained by capitalising the net operating income at the overall cost of capital which is constant 2 Net Operating Income Approach NOI Approach This theory is just opposite to NI approach NI approach is relevant to capital structure decision It means decision of debt equity mix does affect the WACC and value of the firm As per NOI approach the capital structure decision is irrelevant and the degree of financial leverage does not affect

[desc-10] [desc-11]

NOI Approach Theory Of Capital Structure The Financing Decision YouTube

https://i.ytimg.com/vi/cgXJzW_SuZc/maxresdefault.jpg

Difference Between Net Income Vs Net Operating Income Approach

https://efinancemanagement.com/wp-content/uploads/2014/07/Net-income-approach-NI-and-Net-Operating-income-approach-NOI.png

Noi Approach Of Capital Structure - [desc-12]