Difference Between Net Income And Net Operating Income Approach Of Capital Structure Net Operating Income Approach NOI Approach This approach was put forth by Durand and totally differs from the Net Income Approach Also famous as the traditional approach Net Operating Income Approach suggests that the change in debt of the firm company or the change in leverage fails to affect the total value of the firm company

This article throws light upon the top four theories of capital structure The theories are 1 Net Income Approach 2 Net Operating Income Approach 3 Traditional Approach 4 Modigliani Miller Approach Theory 1 Net Income NI Approach David Durand suggested the two famous capital structure theories viz Net Income Approach and the Operating Income Approach According to NI approach a Total revenue was 23 9 billion It includes net sales and other revenue Operating income was 382 million and included all the expenses associated with operating for the year including cost of

Difference Between Net Income And Net Operating Income Approach Of Capital Structure

Difference Between Net Income And Net Operating Income Approach Of Capital Structure

https://efinancemanagement.com/wp-content/uploads/2014/07/Net-income-approach-NI-and-Net-Operating-income-approach-NOI.png

Net Income Approach Capital Structure With Assumptions Examples

https://i.ytimg.com/vi/kZFnooRhtMA/maxresdefault.jpg

3 NI Net Income Approach NOI Net Operating Income Approach

https://i.ytimg.com/vi/k5czSqzwdnA/maxresdefault.jpg

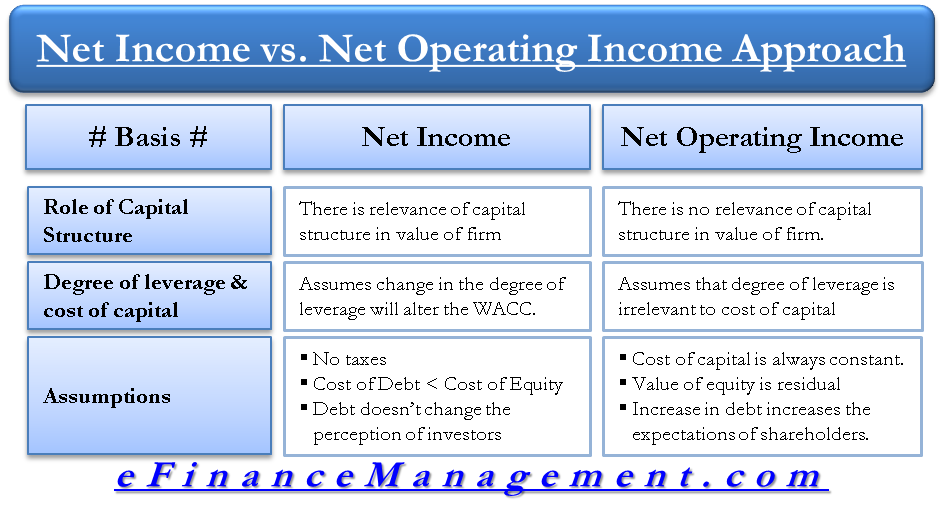

Net income approach and net operating income approach were proposed by David Durand According to NI approach there exists positive relationship between capital structure and valuation of firm and change in the pattern of capitalisation brings about corresponding change in the overall cost of capital and total value of the firm Thus with an increase According to Net Income Approach a change in the financial leverage of a firm will lead to a corresponding change in the Weighted Average Cost of Capital WACC and the company s value The Net Income Approach suggests that with the increase in leverage proportion of debt the WACC decreases and the firm s value increases

Write the difference between Net operating income and net income The major differences between net operating income and net income are as follows Net operating incomeNo relevance in capital structure Degree of leverage is irrelevant to cost of capital assumes It has constant cost of capital Equity value is residual Changes perception of investor with increas Here operating income has been calculated by deducting the cost and expenses from the total sales However to calculate net income total expenses are deducted from total income and then tax is levied Also as illustrated net income is the bottom line and the final number on the income statement as one follows the top down approach

More picture related to Difference Between Net Income And Net Operating Income Approach Of Capital Structure

How To Calculate Net Income Formula Examples

https://www.profitwell.com/hubfs/Net Income-01.jpg#keepProtocol

Gross Profit Vs Operating Income YouTube

https://i.ytimg.com/vi/kXwAHQtstf0/maxresdefault.jpg

Differences Between Net Sales And Net Income YouTube

https://i.ytimg.com/vi/qIgH0_ZoSLc/maxresdefault.jpg

The document discusses several capital structure theories including the net income theory and net operating income theory The net income theory states that a firm can increase its value and lower its overall cost of capital by increasing the proportion of debt in its capital structure up to a maximum level as debt is a cheaper source of financing than equity In short the net income of a firm is defined as the profit after all the expenses get deducted from the revenues The expenses include general and administrative costs interest on loans income taxes and other operating expenses such as utilities rent and payroll Difference between Operating Income and Net Income

[desc-10] [desc-11]

Net Income Vs Net Revenue Differences And Similarities Financial Falconet

https://www.financialfalconet.com/wp-content/uploads/2022/11/Net-income-vs-net-revenue-1024x576.png

Financial Management Net Operating Income Approach NOI Approach Theory

https://i.ytimg.com/vi/SOmN638-iiI/maxresdefault.jpg

Difference Between Net Income And Net Operating Income Approach Of Capital Structure - [desc-13]