What Is The Gross Salary And Net Salary Gross Salary 50 000 10 000 5 000 3 000 2 000 4 000 74 000 per month So in this example the employee s gross salary is 74 000 per month What is Net Salary Net income is the final amount of money you have left after subtracting all your expenses from the total amount of money you earned

The result is net income How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck Indeed Editorial Team Updated June 29 2023 Image description Whether you earn an annual salary or are paid hourly wages you might notice gross pay and net pay on your paycheck Understanding what is included in gross pay vs net pay will help you understand your total take home pay

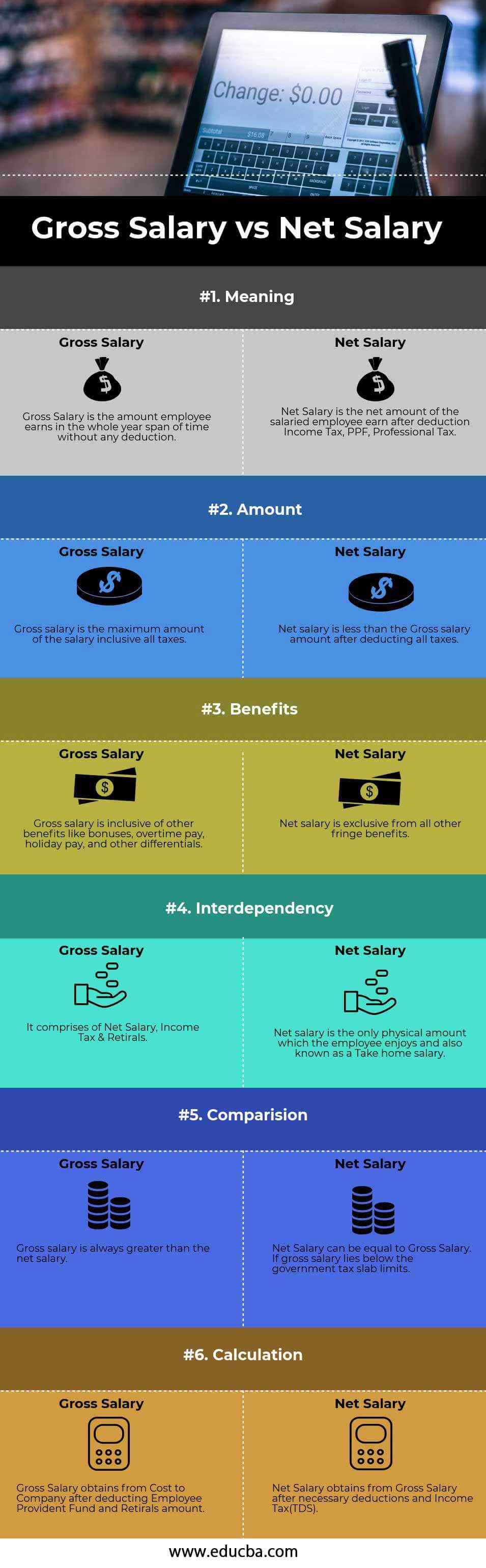

What Is The Gross Salary And Net Salary

What Is The Gross Salary And Net Salary

https://cdn.educba.com/academy/wp-content/uploads/2019/01/Gross-Salary-vs-Net-Salary-info.jpg

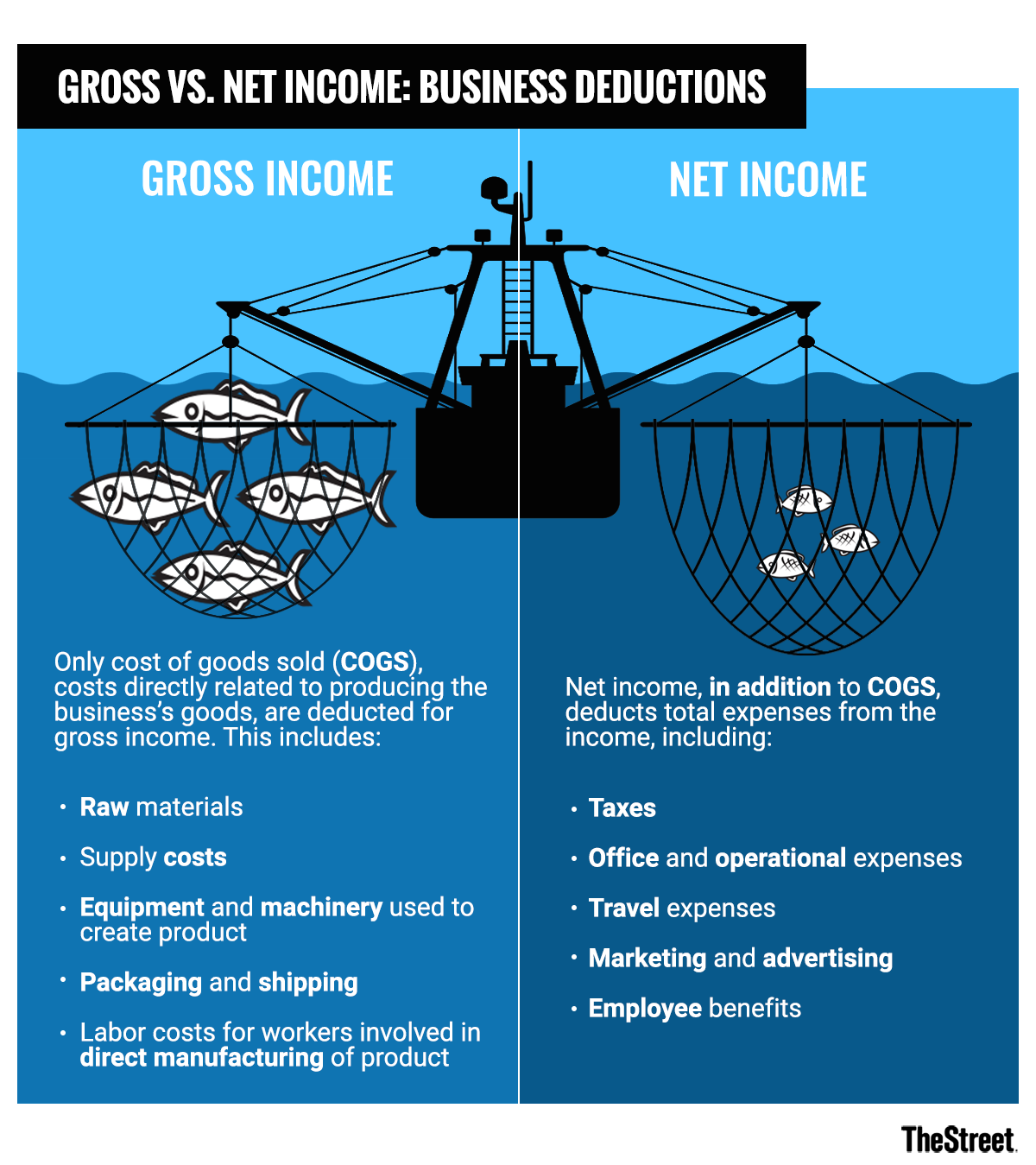

What s The Difference Between Gross Vs Net Income TheStreet

https://s.thestreet.com/files/tsc/v2008/photos/contrib/uploads/a7febeae-8f6c-11e8-9c19-5150dbb86951.png

Gross Vs Net Salary Difference And Comparison

https://askanydifference.com/wp-content/uploads/2022/10/Gross-vs-Net-Salary.jpg

For example if the employee earns 81 000 in gross pay on an annual basis and is paid monthly they would divide 81 000 by 12 to find their gross income per pay period This would equal 6 750 Example If an employee s annual salary is 95 000 year and there are 26 payroll periods the bi weekly gross pay is 3 654 Net pay How to calculate deductions from gross pay

Calculating gross pay The method for calculating gross wages largely depends on how the employee is paid For salaried employees gross pay is equal to their annual salary divided by the number of pay periods in a year see chart below So if someone makes 48 000 per year and is paid monthly the gross pay will be 4 000 Gross pay is the total sum of money an employee makes before any deductions or taxes are removed from their income For example if you sign a contract to make 45 000 a year this means you ll be making 45 000 in gross pay on an annual basis

More picture related to What Is The Gross Salary And Net Salary

Gross Salary Vs Net Salary Key Differences Components And Calculation

https://uploads-ssl.webflow.com/60ae205a9765a905fb4d243c/626aefc44f197c209ab27fe9_Gross vs net salary c.jpg

How To Calculate Net Take Home Salary Haiper

https://www.patriotsoftware.com/wp-content/uploads/2019/12/gross-vs.-net-pay-visual.jpg

Gross Compensation Worksheet Turbotax

https://decoalert.com/wp-content/uploads/2021/06/Is-base-salary-the-same-as-gross-pay-1024x576.jpg

If you re a salaried employee your gross pay is your annual salary divided by the number of pay periods per year So if you earn 60 000 annually and get paid biweekly your gross pay per paycheck would be 60 000 26 bi weekly pay periods per year 2 307 69 per paycheck To calculate gross pay for an hourly employee you will multiply For salaried employees gross pay is calculated by dividing the employee s annual salary by the number of pay periods in a year For example if an employee earns a salary of 60 000 per year and is paid monthly their gross pay for each pay period would be 5000 On the other hand calculating gross pay for hourly employees is a bit more

The net pay formula is Gross pay deductions Net pay Some common deductions include income taxes Social Security taxes health insurance and retirement contributions Calculating the difference between gross pay and net pay is crucial for employers and employees Here s a quick guide to doing so Multiply your gross monthly income amount by 12 to find out your annual gross salary Make sure you take into account any short or long term bonuses you might receive to land at your total gross number

Gross Salary Vs Net Salary Bunq

https://assets-global.website-files.com/63b43f001c7774d38d5f3a2d/64467301365d2e5c5fa66852_63b43f001c77741d115f4826_634ebe9b6cfd7f9a816e1088_62e93776631d722c8f53dcbb_christina-wocintechchat-com-tKYfcTaXsf0-unsplash.jpeg

Gross Salary Vs Net Salary Comparison Tuko co ke

https://netstorage-tuko.akamaized.net/images/0fgjhs17c608hjvn8o.jpg?imwidth=900

What Is The Gross Salary And Net Salary - Calculating gross pay The method for calculating gross wages largely depends on how the employee is paid For salaried employees gross pay is equal to their annual salary divided by the number of pay periods in a year see chart below So if someone makes 48 000 per year and is paid monthly the gross pay will be 4 000