What Is The Difference Between Gross Pay And Net Pay Quizlet What is the difference between gross pay and net pay a Net pay describes your pay after deductions gross pay is before b Gross pay describes your pay after deductions net pay is before c Gross and net pay are the same d None of the above

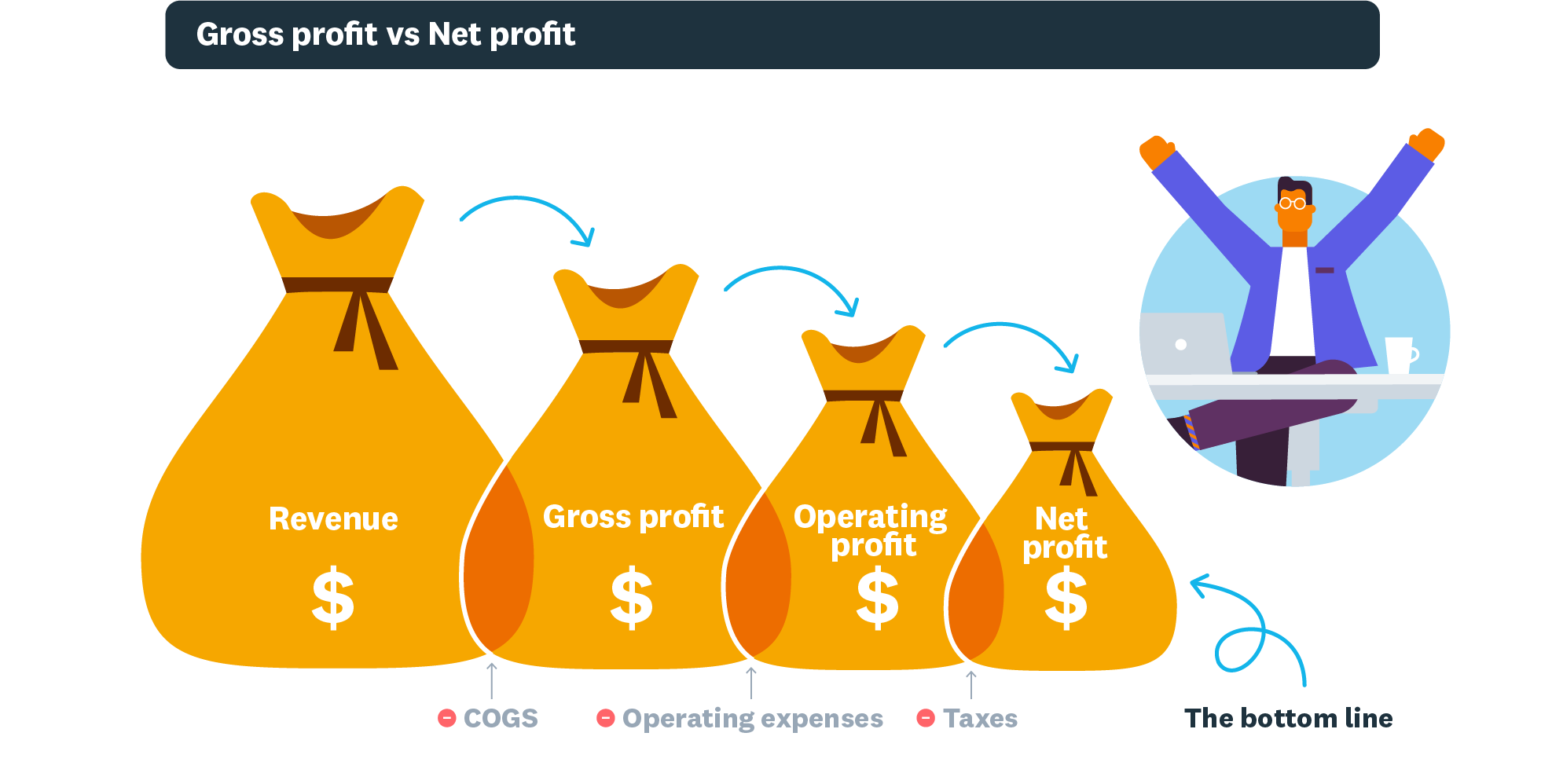

In this guide we ll explain everything you need to know to understand the differences between gross pay and net pay calculate each and answer any questions your employees have about The net pay formula is Gross pay deductions Net pay Some common deductions include income taxes Social Security taxes health insurance and retirement contributions Calculating the difference between gross pay and net pay is crucial for employers and employees Here s a quick guide to doing so

What Is The Difference Between Gross Pay And Net Pay Quizlet

What Is The Difference Between Gross Pay And Net Pay Quizlet

https://s.thestreet.com/files/tsc/v2008/photos/contrib/uploads/a7febeae-8f6c-11e8-9c19-5150dbb86951.png

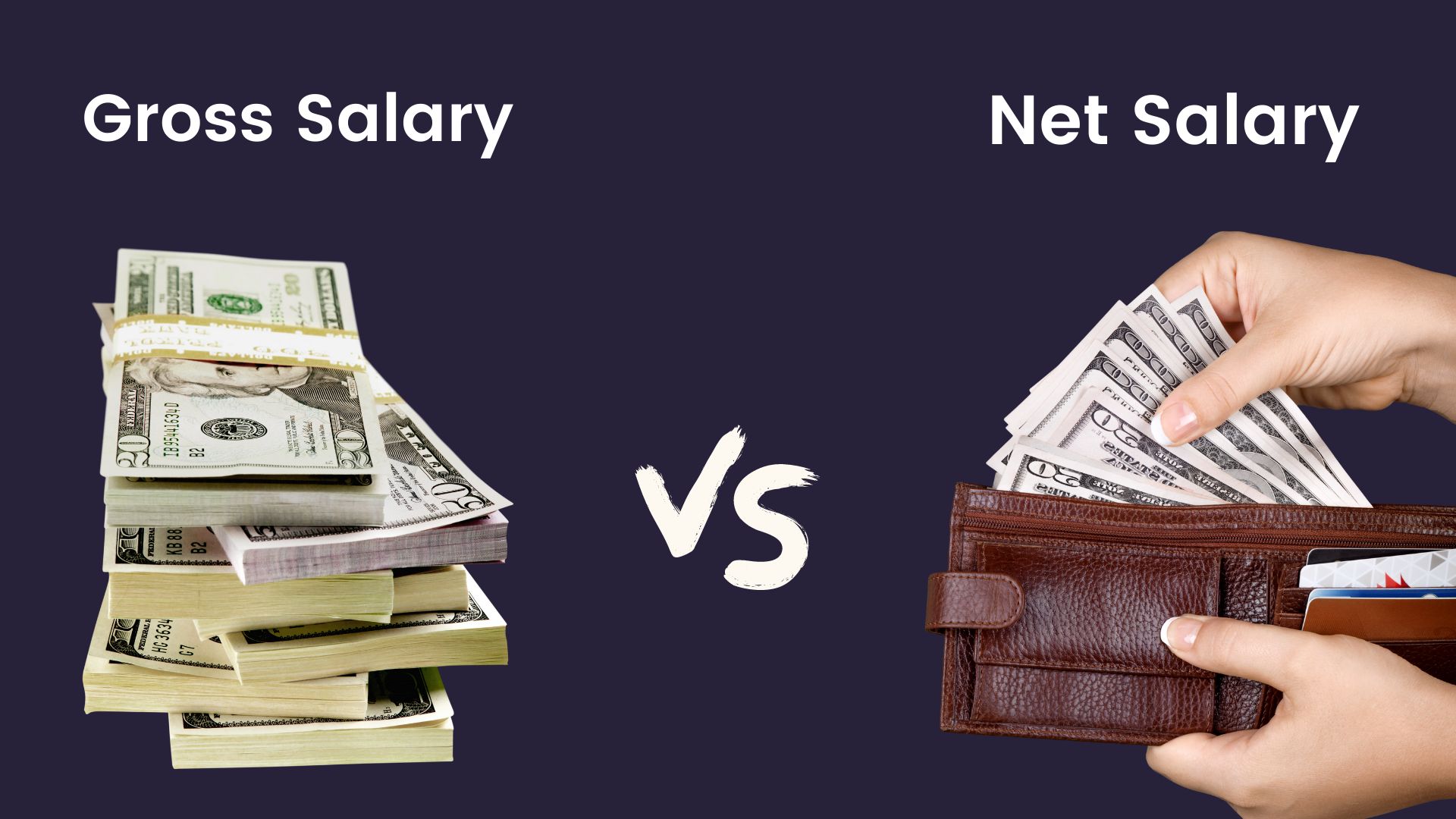

What Is The Difference Between Gross Salary And Net Salary

https://cdn.autonomous.ai/static/upload/images/new_post/what-is-the-difference-between-gross-salary-and-net-salary-2691-1629997722841.jpg

Gross Pay Vs Net Pay Definitions And Examples Indeed

https://images.ctfassets.net/pdf29us7flmy/1mWYaSiqsKhd8iV2E5UhXD/bb8f71b867741ce5d170c0c00f09781e/what-is-gross-pay-FINAL-JULY-02.png

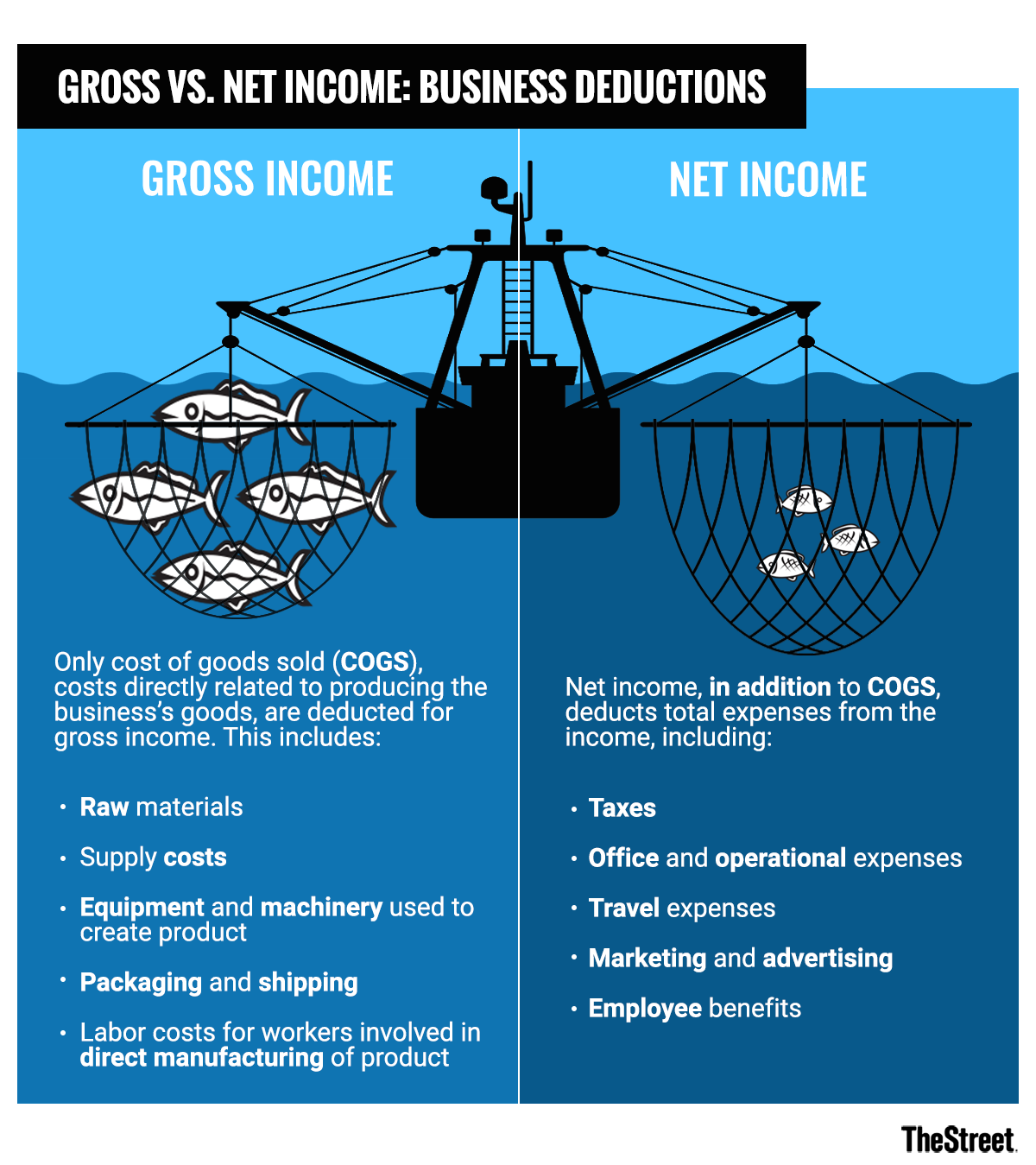

What is the difference between gross and net pay Gross pay is before taxes are subtracted but net pay is after taxes are taken out The amount of money you re paid after all taxes and deductions are taken out of your paycheck is called For salaried employees gross pay is equal to their annual salary divided by the number of pay periods in a year see chart below So if someone makes 48 000 per year and is paid monthly the gross pay will be 4 000 To calculate gross pay for hourly workers multiply the hourly rate by the hours worked during a pay period

Taxes that employees pay are subtracted out of an employee s gross pay which lowers the net pay for that paycheck Here s a quick refresher on the difference between gross pay and net pay Payroll taxes paid by the employer however do not affect an employee s paycheck Here s a summary of the payroll taxes that employers and What is gross pay Gross pay is the total amount of money an employee receives before taxes and deductions are taken out For example when an employer pays you an annual salary of 40 000 per year this means you have earned 40 000 in gross pay

More picture related to What Is The Difference Between Gross Pay And Net Pay Quizlet

Gross Salary Vs Net Salary Key Differences Components And Calculation

https://uploads-ssl.webflow.com/60ae205a9765a905fb4d243c/626aefc44f197c209ab27fe9_Gross vs net salary c.jpg

Gross Profit Vs Net Profit Definitions Xero NZ

https://www.xero.com/content/dam/xero/pilot-images/glossary/gross-profit-vs-net-profit.png

How To Calculate Net Take Home Salary Haiper

https://www.patriotsoftware.com/wp-content/uploads/2019/12/gross-vs.-net-pay-visual.jpg

Gross pay also known as gross salary is the amount of compensation a company or organization pays an employee before any required or voluntary deductions take effect per payment period Gross pay is the total sum of money an employee makes before any deductions or taxes are removed from their income For example if you sign a contract to make 45 000 a year this means you ll be making 45 000 in gross pay on an annual basis

Divide annual salary by pay periods Now take an employee s annual salary and divide it by the number of pay periods in a year So if an employee makes 70 000 per year and the company has 26 pay periods in a year the calculation would be 70 000 26 2 692 30 That means that every pay period the employee s gross pay would be 2 692 30 Study with Quizlet and memorize flashcards containing terms like The Internal Revenue Service IRS is the federal government agency responsible for a Keeping the unemployment rate low b Writing tax laws c Filling out your tax forms d Tax collection and tax law enforcement What is the difference between gross pay and net pay a Net pay describes your pay after deductions gross pay is

Gross Pay Vs Net Pay What Is The Difference Between Them

https://www.ncesc.com/wp-content/uploads/2021/12/the-gross-pay-vs-net-pay-768x1152.png

What s The Difference Between Gross Pay And Net Pay Integra Credit

https://www.integracredit.com/files/resource/42/medium_What_s_The_Difference_Between_Gross_Pay_and_Net_Pay.jpg

What Is The Difference Between Gross Pay And Net Pay Quizlet - Taxable Income vs Gross Income An Overview Gross income includes all income you receive that isn t explicitly exempt from taxation under the Internal Revenue Code IRC Taxable income is the