What Is The Difference In Gross Income And Net Income Gross income is the money you earn from your hourly wages salary commissions and bonuses Net income is the money you re left with after taxes are paid and any deductions for health

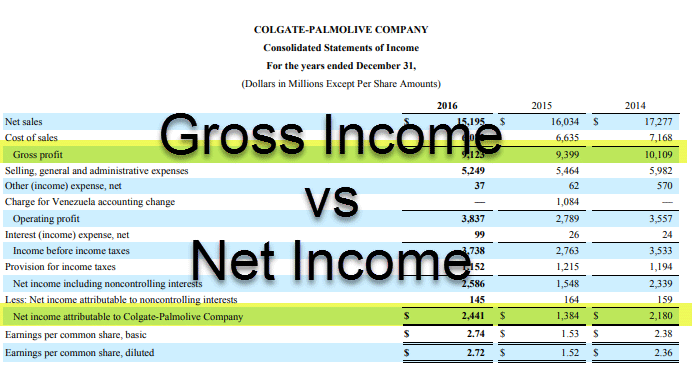

In a Nutshell Gross income for an individual is all the money you earn before any deductions or taxes are taken out For a business gross income is the total amount earned from sales after subtracting the cost of producing the goods sold For both individuals and businesses net income is the amount that remains after deductions and taxes Your adjusted gross income AGI is a number that the IRS uses to help calculate your taxable income after certain tax deductions and credits Tax deductions that reduce your taxable income include student loan interest payments and certain retirement account contributions

What Is The Difference In Gross Income And Net Income

What Is The Difference In Gross Income And Net Income

https://keydifferences.com/wp-content/uploads/2015/01/gross-income-vs-net-income-thumbnail.jpg

What s The Difference Between Gross Vs Net Income TheStreet

http://s.thestreet.com/files/tsc/v2008/photos/contrib/uploads/d997efb7-8e93-11e8-9c19-bfa299d23271.jpg

Difference Between Profit And Margin RuarieNadine

https://i.pinimg.com/736x/fb/9a/ec/fb9aeccfe3e43129f54fb9c0c8b9c5d4.jpg

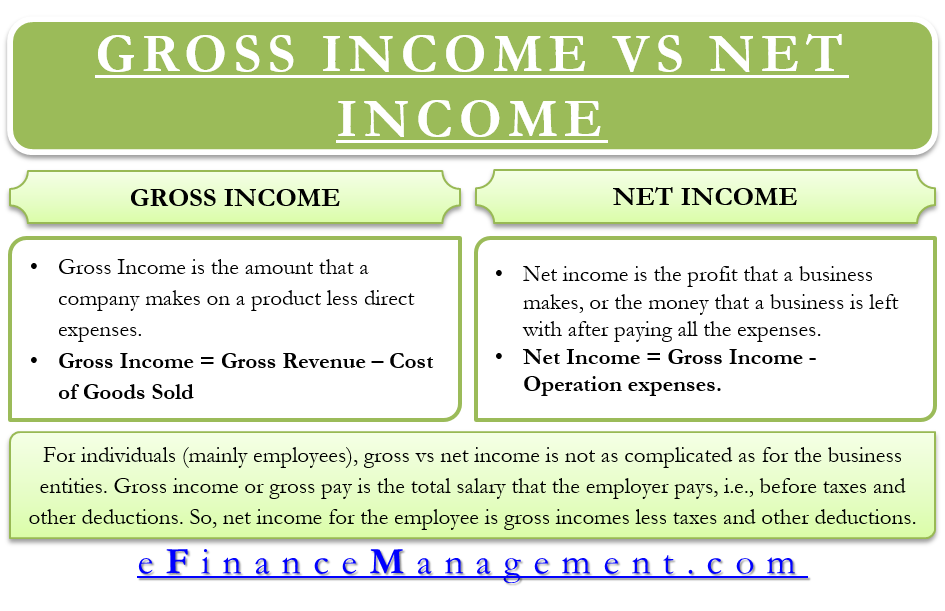

Gross income is the total income of a business often just income from its operations and net income is gross income minus expenses But gross income is also the result after deducting some expenses directly related to the core products or services of the business Here s the formula to calculate it If you are an hourly employee then your gross income will depend on the total number of hours you work and your hourly wage If you work 80 hours during a pay period and have an hourly wage of 15 hour your gross income will be 1 200 80 times 15 In either case any tips bonuses or one time additions may also be added to your total gross

For individuals gross income is the total pay you earn from employers or clients before taxes and other deductions This is not limited to income received as cash as it can also include property or services received On the other hand refers to your income after taxes and deductions are taken into account Finance Operations Insights Stories Understanding the difference between gross and net income is crucial for any small business owner Learn these differences so you can improve your business

More picture related to What Is The Difference In Gross Income And Net Income

How To Calculate Net Take Home Salary Haiper

https://www.patriotsoftware.com/wp-content/uploads/2019/12/gross-vs.-net-pay-visual.jpg

Difference Between Gross Income Vs Net Income Definition Importance

https://efinancemanagement.com/wp-content/uploads/2019/05/Gross-Income-Vs-Net-Income.png

Gross Vs Net Differences Between Net Vs Gross You Must Know 7ESL

https://i.pinimg.com/originals/68/bc/ed/68bced9b18c3739ce27d4c48d42ea97f.jpg

Fact checked by Yarilet Perez Gross Profit vs Net Income An Overview Two critical profitability metrics for any company include gross profit and net income Gross profit represents Gross income is considered total income for the purpose of tax preparation and filing It is used to further determine your total tax liability Gross income is the starting point for

A business s net income is its total profit over a period of time while gross income is simply its total sales over the same period The difference between a company s net and gross income is Net pay is the amount of money employees earn after payroll deductions are taken away from gross pay These includes taxes benefits wage garnishments and other deductions In simple terms net

Gross Income Vs Net Income What Are The Top 6 Differences

https://www.wallstreetmojo.com/wp-content/uploads/2018/05/Gross-Income-vs-Net-Income-1.png

The Difference Between Gross And Net Pay Economics Help

https://www.economicshelp.org/wp-content/uploads/2010/08/gross-net-pay.png

What Is The Difference In Gross Income And Net Income - If you are an hourly employee then your gross income will depend on the total number of hours you work and your hourly wage If you work 80 hours during a pay period and have an hourly wage of 15 hour your gross income will be 1 200 80 times 15 In either case any tips bonuses or one time additions may also be added to your total gross