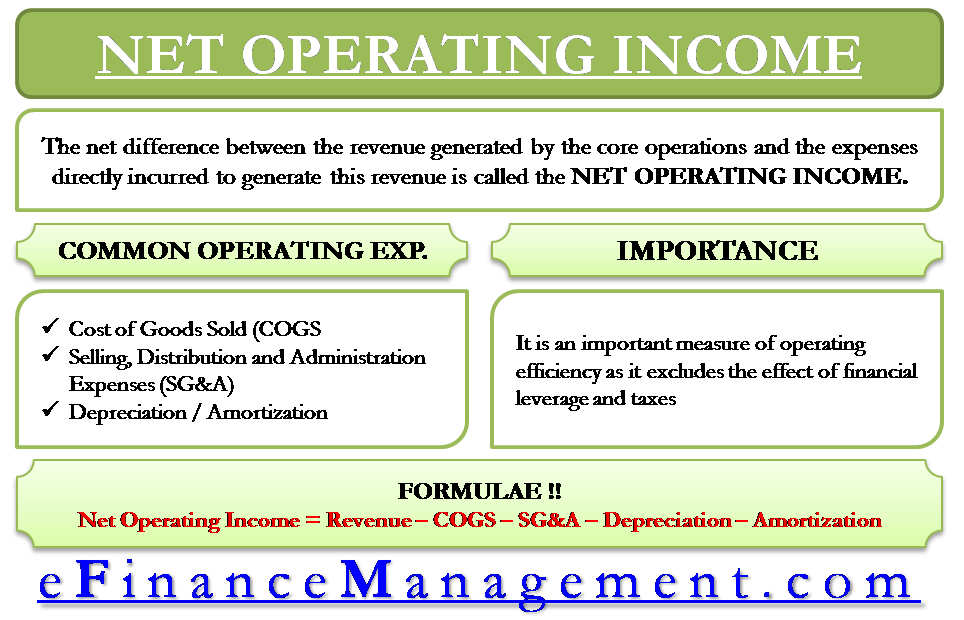

What Is Net Operating Profit Net operating profit refers to the amount of money that a company has earned after the cost of goods sold and operating expenses have been deducted This is used to see whether a company is making more than it spends or is operating at a loss

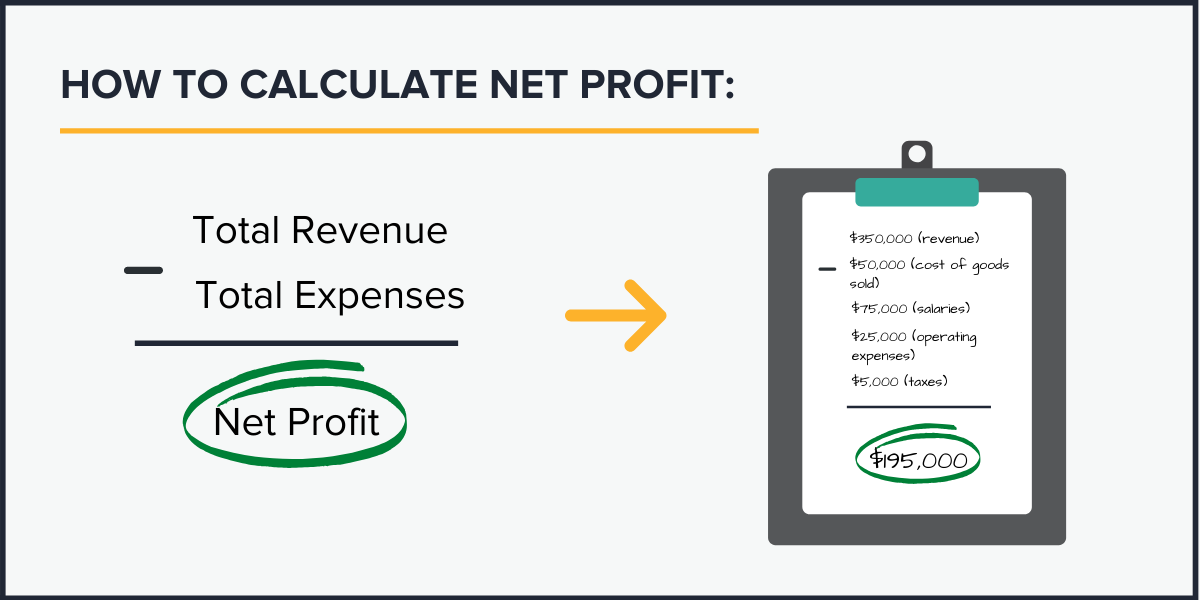

Net Operating Income NOI is a measure of profitability that represents the amount the company has earned from its core operations and is calculated by deducting operating expenses from operating revenue It excludes non operating expenses such as loss on the sale of a capital asset interest tax expenses etc Net Profit Total Revenue Total Expense for Operations Interest and tax Net profit in terms of operating profit is operating profit minus interest minus tax and it can be written as Net Profit Operating Profit Interest Tax Financial Modeling Valuation Courses Bundle 25 Hours Video Series

What Is Net Operating Profit

What Is Net Operating Profit

https://www.xero.com/content/dam/xero/pilot-images/glossary/gross-profit-vs-net-profit.png

How To Calculate Net Profit Margin In Accounting Haiper

https://www.patriotsoftware.com/wp-content/uploads/2019/12/gross-profit-vs.-net-profit-formulas-visual.jpg

Net Operating Income Formula Example Advantages EFM

https://efinancemanagement.com/wp-content/uploads/2016/04/Net-Operating-Income.png

In a nutshell net operating income is a company s direct profit from its core operations Boosting this metric is all about running your chosen business more efficiently generating The operating profit and net profit of a company are two common measures of profitability in practice with key differences Operating Profit The operating profit metric contrary to net profit is unaffected by the capitalization of the company Hence the operating profit metric is frequently used as part of performing profitability

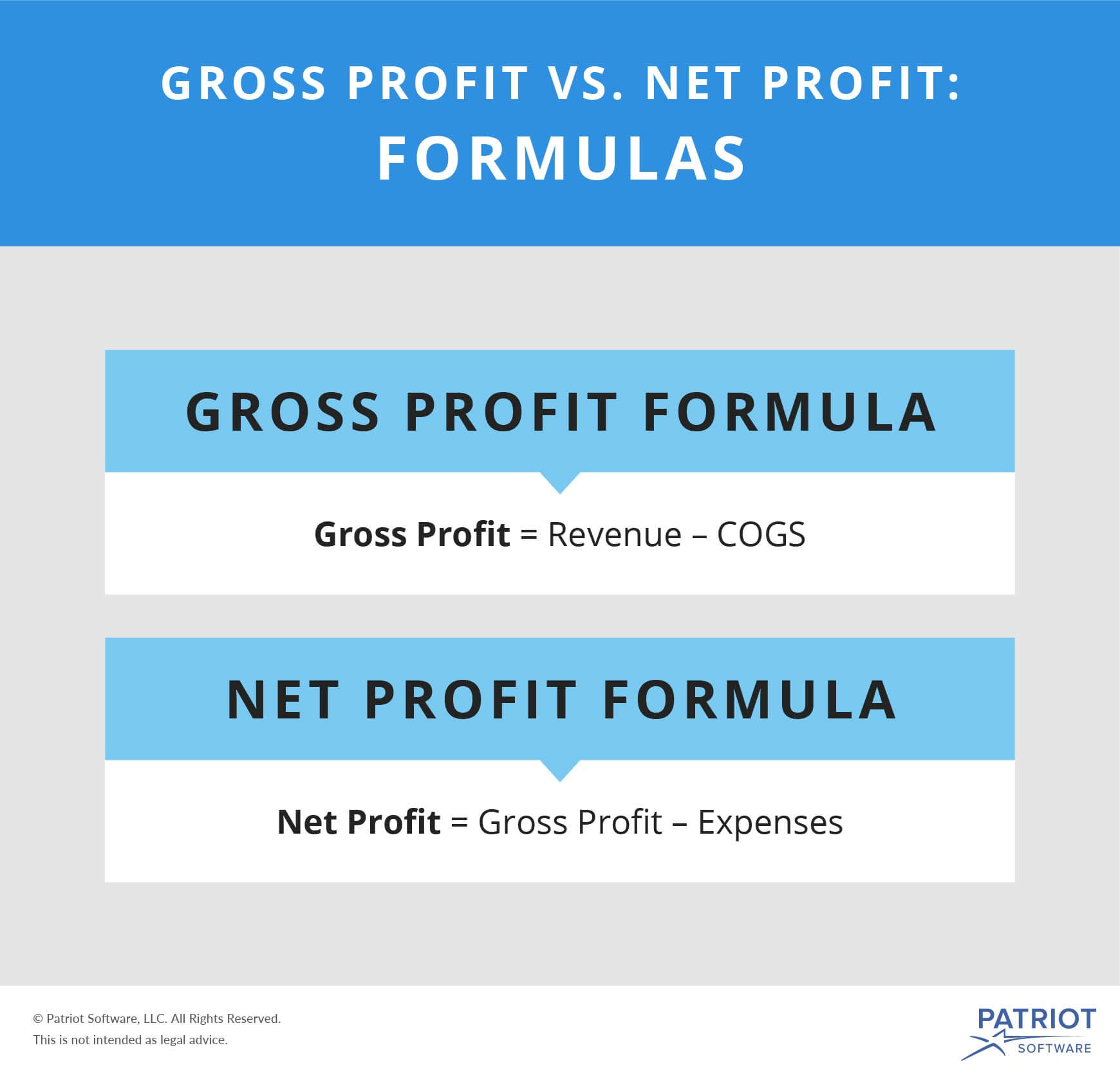

Net Profit The word Net means after all deductions Accordingly the profit earned after all deductions is called Net Profit It is also called Net Income or Net Earnings It is the difference between total revenue earned and total cost incurred What is Operating Profit Operating profit is a company s earnings after deducting operating expenses and Cost of Goods Sold COGS It s also known as EBIT earnings before interest and taxes It s important to note that many companies track both operating profit and gross profit

More picture related to What Is Net Operating Profit

:max_bytes(150000):strip_icc()/Apple12-29-2018incomestatement-5c537a8fc9e77c0001cff2a8.jpg)

How To Calculate Net Income Example Haiper

https://www.investopedia.com/thmb/YensjMD8yWu66ZKmA4J0LzGvFGA=/910x826/filters:no_upscale():max_bytes(150000):strip_icc()/Apple12-29-2018incomestatement-5c537a8fc9e77c0001cff2a8.jpg

How To Calculate Net Profit Margin Ratio Formula Haiper

https://www.wallstreetmojo.com/wp-content/uploads/2018/02/Operating-Profit-Margin-Formula.jpg

How To Calculate Net Income Gross Profit Haiper

https://learn.financestrategists.com/wp-content/uploads/2020/09/Net-Income-Formula-SIMPLE-1024x512.jpg

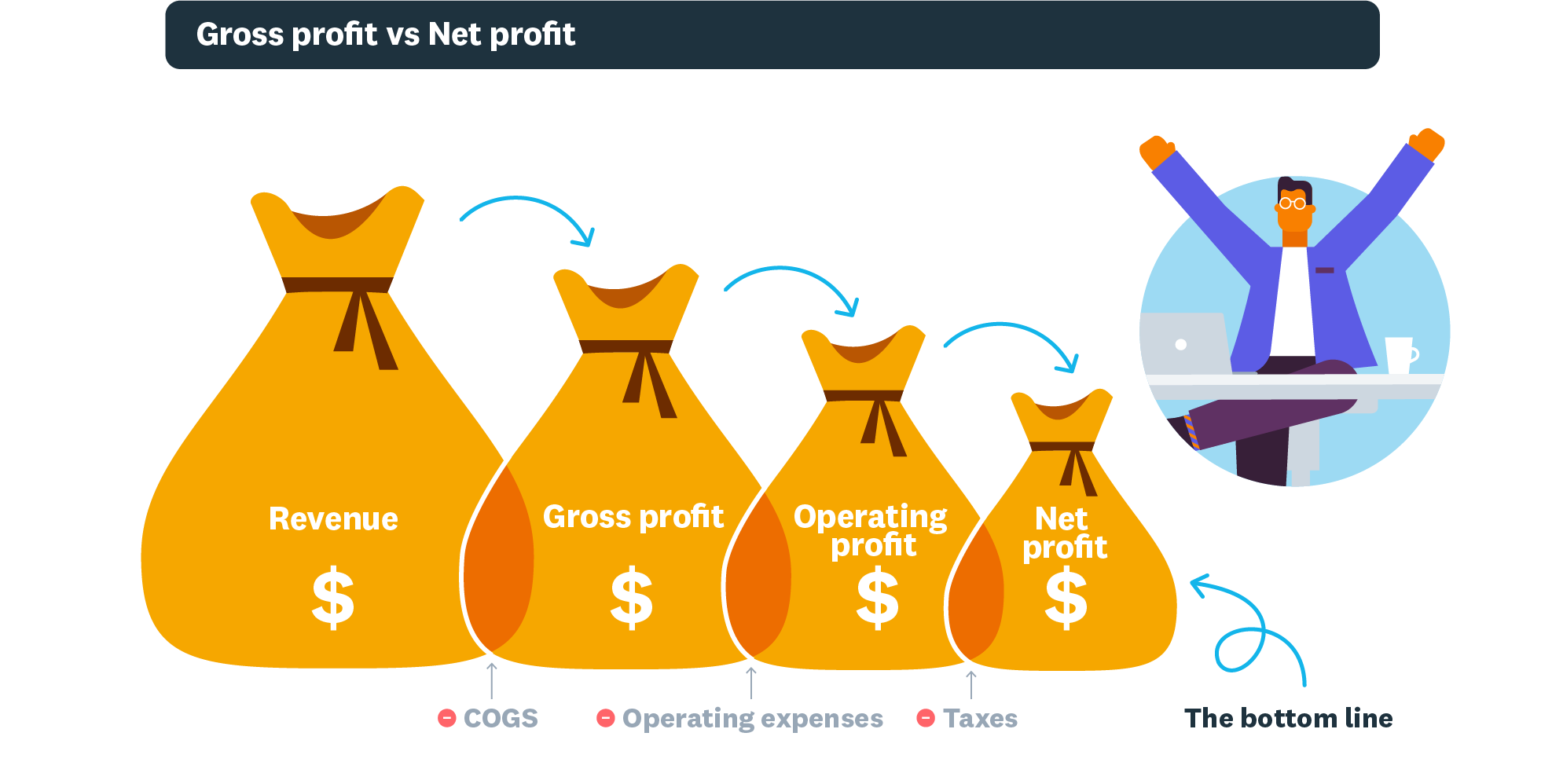

NOPAT is an abbreviation that stands for Net Operating Profit After Tax and is a measure of profit that assumes that the company did NOT receive tax benefits from holding debt Among industry practitioners as well as in academia the metric is frequently used interchangeably with terms such as Tax Effected EBIT Key takeaways Gross profit is the amount a business has earned minus the direct costs of manufacturing or the cost of goods sold Operating profit is the amount of the gross profit minus operational costs Net profit is the total amount left over after the business has accounted for all deductions including interest and taxes

Simply put net operating profit after tax measures a company s financial performance without considering the tax savings of debt since it looks at operating profits exclusive of interest The goal of using NOPAT is to compare multiple companies in the same industry based solely on their earnings regardless of differences in leverage Net Operating Profit After Tax NOPAT shows a firm s after tax profits from day to day business operations and provides key insights allowing business owners to capitalize on lucrative opportunities Keep reading to learn what NOPAT is and how the calculation differs from net income EBIT and other balances

What Is Net Profit Net Profit Formula updated 2023

https://fastloans.ph/wp-content/uploads/2020/11/Created-by-2-copy.png

Net Operating Income Formula Astonishingceiyrs

https://wsp-blog-images.s3.amazonaws.com/uploads/2020/10/01133418/noi-reconciliation.jpg

What Is Net Operating Profit - NOPAT Net Operating Profit After Taxes is a crucial metric in assessing a company s profitability considering tax implications and adjusting for interest expenses It serves as a foundation for unlevered cash flow and aids in evaluating cash generation potential Calculated as EBIT 1 Tax Rate NOPAT involves Earnings Before Interest