What Happens If You Let Option Expire The Role of Theta in Options Expiration Theta also known as time decay plays a significant role in what happens when options expire As an option gets closer to its expiration date theta generally increases which means the option s value decreases This is because as time runs out there s less chance the option will become ITM if it

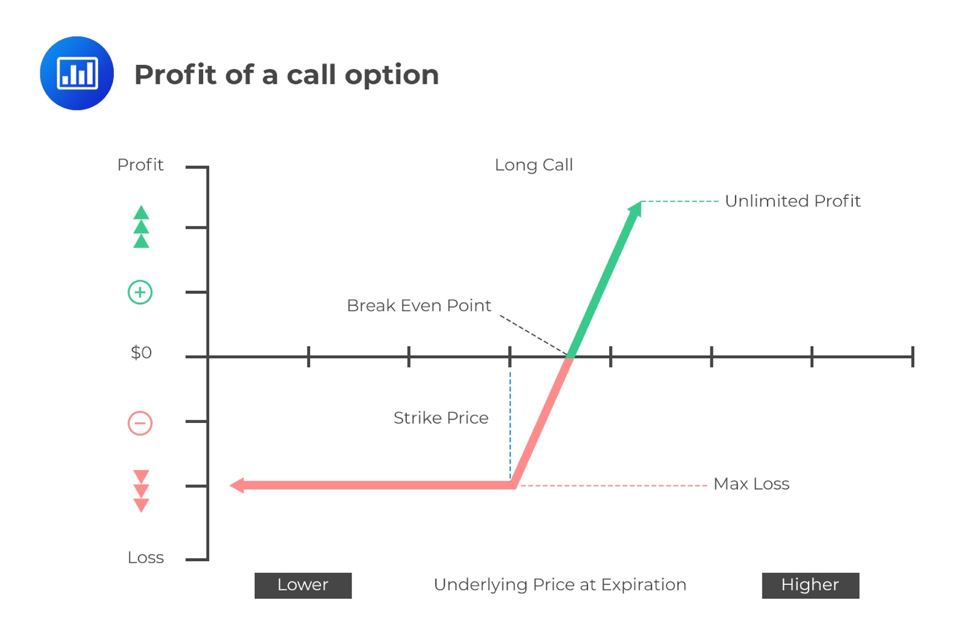

For example if an option is trading for 1 40 the price of one contract excluding fees is 140 or 1 40 x 100 multiplier 140 Expiration Each option has an expiration date which is when the contract expires and ceases to exist Strike price Each option also has a strike price and if the contract is exercised the underlying Options expiration is the date at which an option s contract expires The expiration date is usually set by a market maker who acts as a middleman between buyers and sellers of options In most cases this happens automatically when you buy or sell an option contract An option s expiration date can be different than the exercise date

What Happens If You Let Option Expire

What Happens If You Let Option Expire

https://www.projectfinance.com/wp-content/uploads/2022/03/In-The-Money-Option-at-Expiration.png

Options Expiration Explained Options Trading For Beginners YouTube

https://i.ytimg.com/vi/BDLevympTzA/maxresdefault.jpg

Determining The Value At Expiration And Profit From A Long Or A Short

https://analystprep.com/cfa-level-1-exam/wp-content/uploads/2022/12/Lower.png

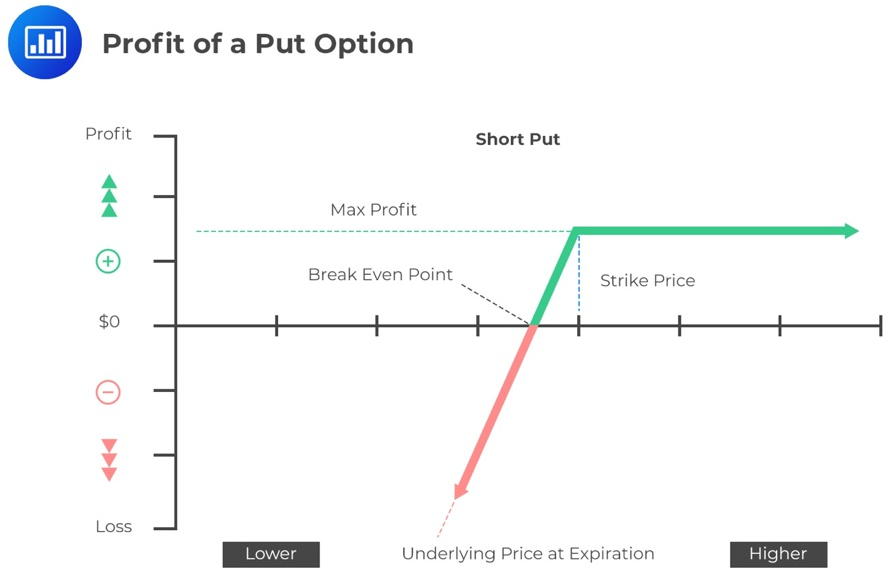

One of the key factors in any options contract is an expiration date The expiration date helps determine the value of the contract itself You set a strike price either a call or put that you At expiration one of two things happens depending on whether one s option is in the money ITM or out of the money OTM If an option has intrinsic value to the owner it is considered ITM If it does not it is considered OTM Put options below the stock price are OTM and put options above the stock price are ITM

After a week the stock drops in value down to 19 share Your contract is in the money and you can exercise the option to sell that stock at a premium of 1 share Obviously this is the ideal outcome And it s something you can enjoy at a high rate of consistency when you leverage the VectorVest system more on that later Options expiration is crucial in preventing traders from holding their positions indefinitely ensuring that a specific timeframe governs the validity of their trades Efficiency and balance are essential in options trading to ensure a fair playing field Options expiration serves as a mechanism to uphold this equilibrium simultaneously

More picture related to What Happens If You Let Option Expire

Explained What Happens When Options Expire Best Stock Strategy

https://beststockstrategy.com/wp-content/uploads/2021/04/options-expire-1024x768.jpg

:max_bytes(150000):strip_icc()/dotdash_Final_Put_Option_Jun_2020-01-ed7e626ad06e42789151abc86206a1f3.jpg)

Put Option What It Is How It Works And How To Trade Them

https://www.investopedia.com/thmb/3SNXQolr-wMMBdtJ2LJPl97Yd4M=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/dotdash_Final_Put_Option_Jun_2020-01-ed7e626ad06e42789151abc86206a1f3.jpg

:max_bytes(150000):strip_icc()/BuyingCalls-7ff771dfbc724b95b8533a77948d7194.png)

Options Trading Strategies A Guide For Beginners

https://www.investopedia.com/thmb/2Nm9sdU3TgYP6bxYrYv9MDnxsdI=/6250x0/filters:no_upscale():max_bytes(150000):strip_icc()/BuyingCalls-7ff771dfbc724b95b8533a77948d7194.png

Expiration Date Derivatives An expiration date in derivatives is the last day that an options or futures contract is valid When investors buy options the contracts gives them the right but Fair enough Solution 1 Never get down to options expiration with in the money options Be proactive with your trades Solution 2 Close out the in the money option completely This may be difficult into options expiration as the liquidity will dry up and you will be forced to take a worse price

This guide can help you navigate the dynamics of options expiration So your trading account has gotten options approval and you recently made that first trade say a long call in XYZ with a strike price of 105 Then expiration day approaches and at the time XYZ is trading at 105 30 Wait The stock s above the strike Each option contract has a set expiration date This date significantly impacts the value of the option contract because it limits the time you can buy sell or exercise the option contract Once an option contract expires it will stop trading and either be exercised or expire worthless

Call Option Profit Formula AmaynaSulav

https://analystprep.com/cfa-level-1-exam/wp-content/uploads/2019/10/56c-2.png

:max_bytes(150000):strip_icc()/BuyingPuts-d28c8f1326974c16807f23cb32854501.png)

Options Trading Strategies A Guide For Beginners

https://www.investopedia.com/thmb/l-P_XDe71tBTMIZisUCYNRmaRjE=/3274x0/filters:no_upscale():max_bytes(150000):strip_icc()/BuyingPuts-d28c8f1326974c16807f23cb32854501.png

What Happens If You Let Option Expire - After a week the stock drops in value down to 19 share Your contract is in the money and you can exercise the option to sell that stock at a premium of 1 share Obviously this is the ideal outcome And it s something you can enjoy at a high rate of consistency when you leverage the VectorVest system more on that later