What Happens If You Let A Call Option Expire In The Money Two long calls at 20 per contract costs you 4k That leaves you with 1k in your account If your calls are in the money at expiration and you do not close them the OCC will auto exercise them and you will have to buy 40k worth of stock If it s a cash account you re lacking 39k If it s a margin account 50 you re lacking 19k

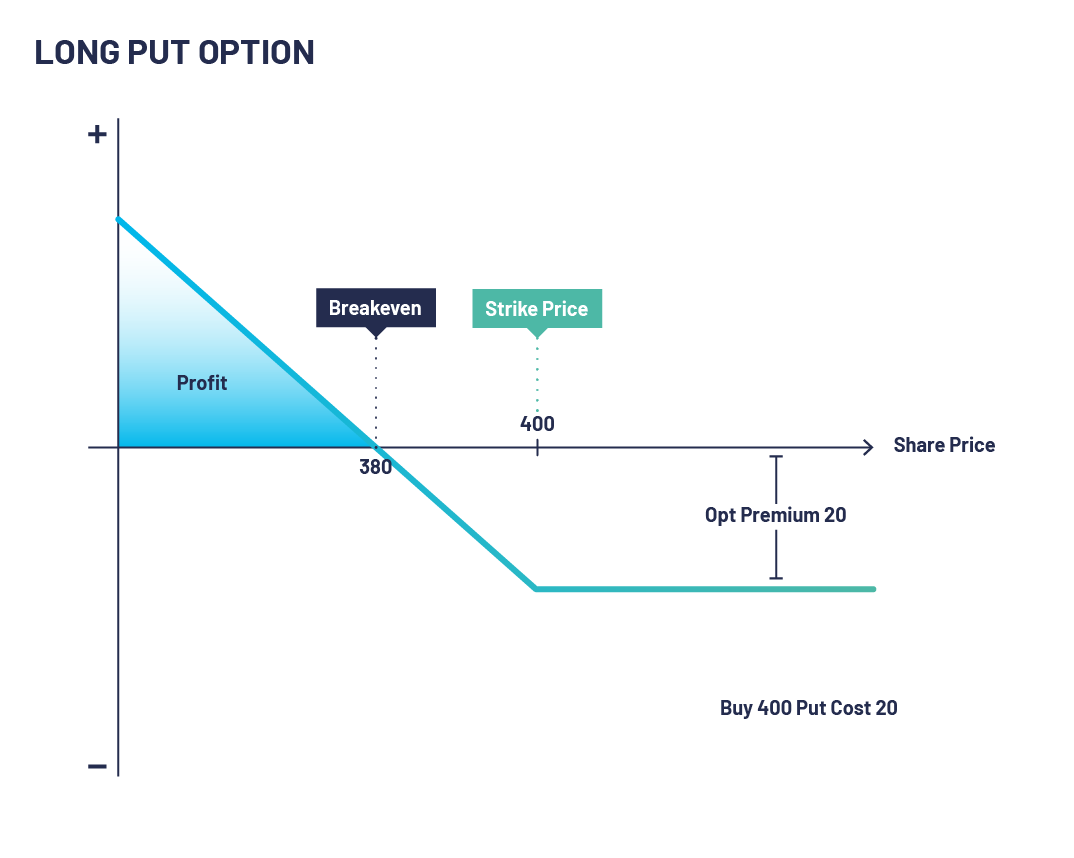

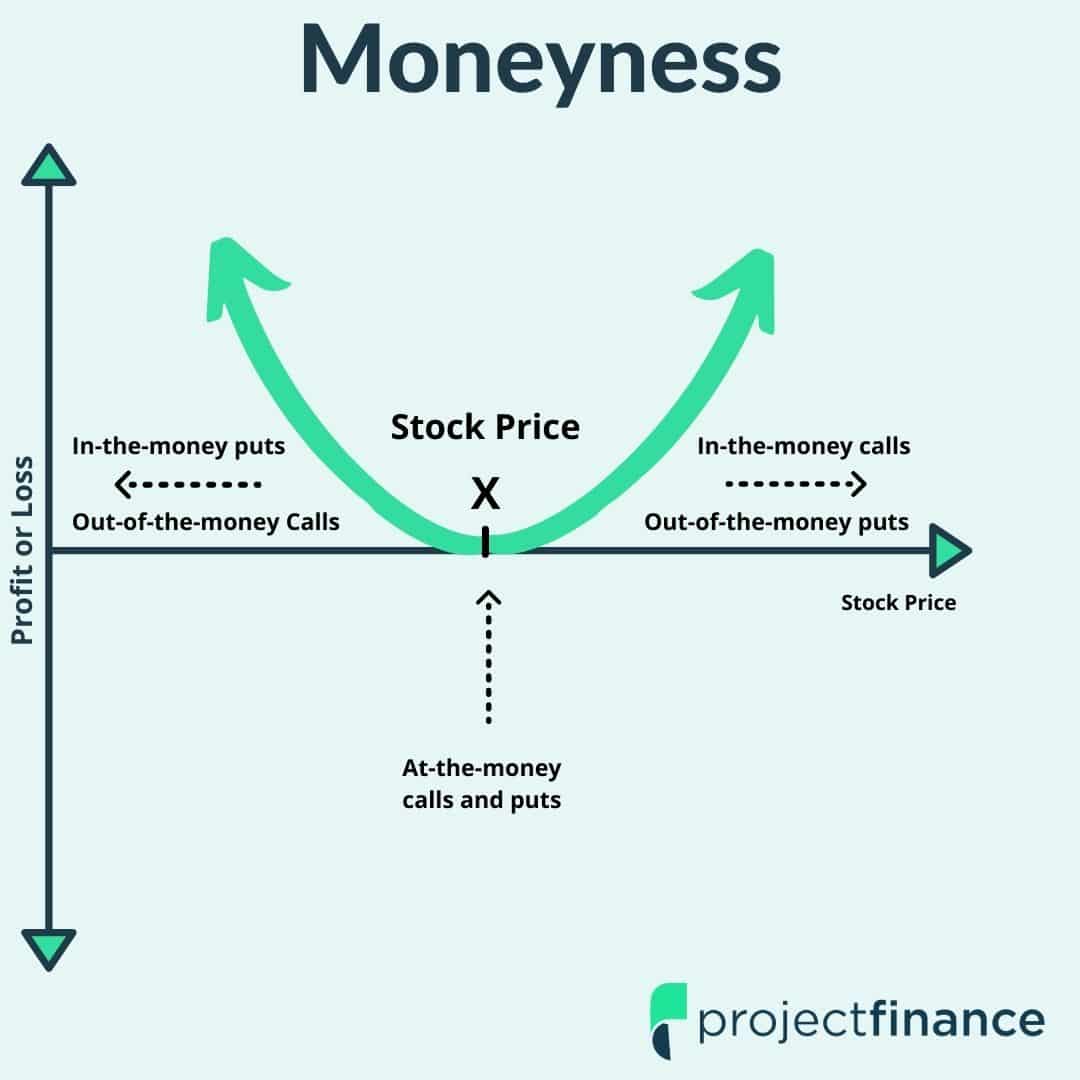

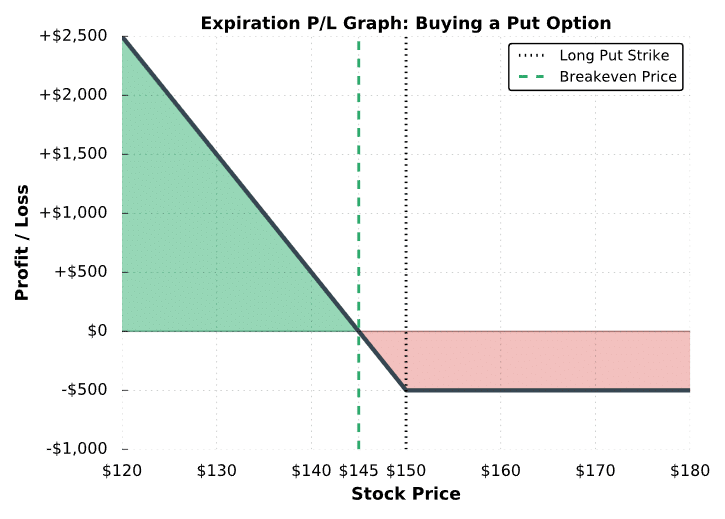

The two most common types of options are call and put options When you buy a call option you pay for a contract that gives you the right to purchase a stock or asset called the underlying security at an agreed upon price until the option expires With put options you pay for a contract that gives you the right to sell a stock or asset at an agreed upon price before the expiration date The Role of Theta in Options Expiration Theta also known as time decay plays a significant role in what happens when options expire As an option gets closer to its expiration date theta generally increases which means the option s value decreases This is because as time runs out there s less chance the option will become ITM if it

What Happens If You Let A Call Option Expire In The Money

What Happens If You Let A Call Option Expire In The Money

https://optionsdesk.com/wp-content/uploads/2021/08/Put-Option.png

Moneyness Of An Option Explained What You Need To Know

https://www.projectfinance.com/wp-content/uploads/2021/08/Copy-of-Short-Call.jpg

The Impact Of Paying Only The Minimum Amount Due On Your Credit Card

https://cardinsider.com/wp-content/uploads/2022/01/what-happens-if-you-only-pay-the-minimum-due-amount.jpg

This guide can help you navigate the dynamics of options expiration So your trading account has gotten options approval and you recently made that first trade say a long call in XYZ with a strike price of 105 Then expiration day approaches and at the time XYZ is trading at 105 30 Wait The stock s above the strike Options expiration is the date at which an option s contract expires The expiration date is usually set by a market maker who acts as a middleman between buyers and sellers of options In most cases this happens automatically when you buy or sell an option contract An option s expiration date can be different than the exercise date

Each option has an expiration date which is when the contract expires and ceases to exist Strike price Each option also has a strike price and if the contract is exercised the underlying security is bought and sold at the strike price of the option Moneyness Options can either be in the money ITM at the money ATM or out of the One of the key factors in any options contract is an expiration date The expiration date helps determine the value of the contract itself You set a strike price either a call or put that you

More picture related to What Happens If You Let A Call Option Expire In The Money

Learn How To Trade Options A Step By Step Guide To Get Started

https://media.realvision.com/wp/20210910160929/Put-vs-Call-Chart.jpg

Options Trading 101 Pt 2 Buying And Selling Calls And Puts Market

https://www.markettradersdaily.com/wp-content/uploads/2020/06/Options-Trading-101-Pt.-2-Buying-And-Selling-Calls-And-Puts22-1536x1140.jpg

What Happens If You Don t Pay A Judgment Crixeo

https://crixeo.com/wp-content/uploads/2022/08/shutterstock_2080820809.jpg

Assessment If TQE stayed at 54 75 the 55 call options or the short side of the spread will not be in the money This means that if TQE was above 50 but below 55 at expiration there would be a purchase of 5 000 shares and there would not be an offsetting sell of 5 000 shares of TQE The buying power to cover the purchase of TQE would To prevent automatic exercises please call us prior to 4 15 p m ET on the last trading day of your options contract For more information on automatic exercises or to exercise options that are not in the money please call us at 800 544 6666 800 544 6666 Chat with a representative

After hours price movements can change the in the money or out the money status of an options contract If for any reason we can t sell your contract and you don t have the necessary buying power or shares to exercise it we may attempt to submit a DNE request to the Options Clearing Corporation OCC and your contract should expire worthless Expiration Date Derivatives An expiration date in derivatives is the last day that an options or futures contract is valid When investors buy options the contracts gives them the right but

What Is A Long Put Option Ultimate Guide With Visuals Projectfinance

https://www.projectfinance.com/wp-content/uploads/2022/01/long-put-chart.png

What Happens If I Don t Pay My Verizon Bill TechCult

https://techcult.com/wp-content/uploads/2023/04/What-happens-if-I-dont-pay-my-Verizon-bill-revised.png

What Happens If You Let A Call Option Expire In The Money - This guide can help you navigate the dynamics of options expiration So your trading account has gotten options approval and you recently made that first trade say a long call in XYZ with a strike price of 105 Then expiration day approaches and at the time XYZ is trading at 105 30 Wait The stock s above the strike