What Happens If You Let A Put Option Expire In The Money In the money options can pose a significant risk to traders going into expiration This is unlike out of the money options which expire worthless post expiration and require no action It is almost always best to trade out of in the money options before the closing bell on the expiration day If no action is taken both long options and short

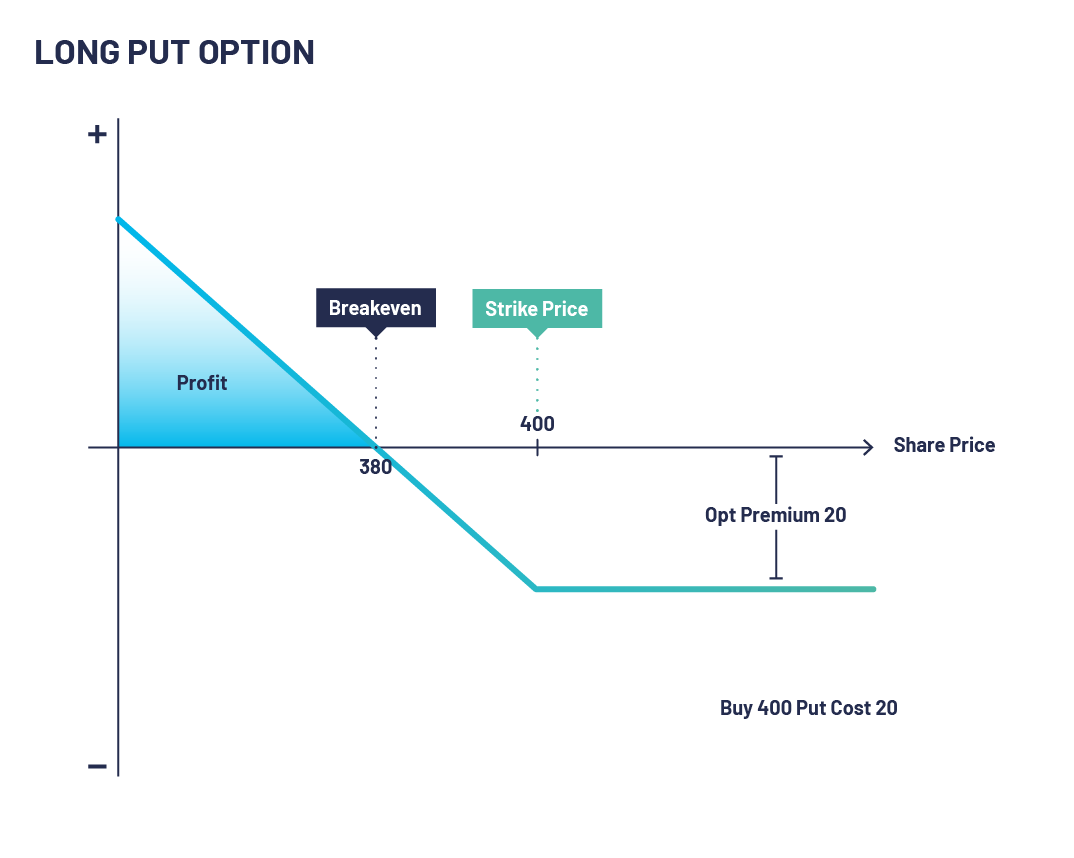

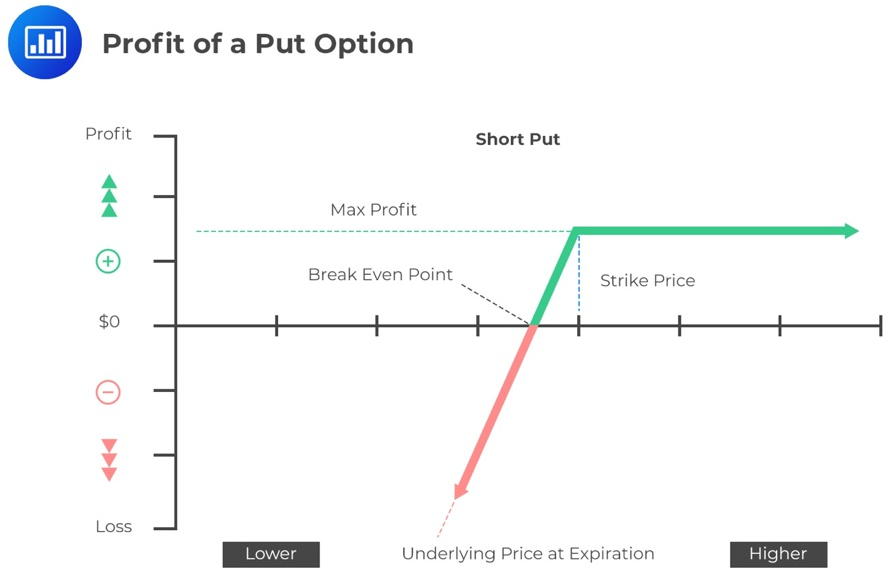

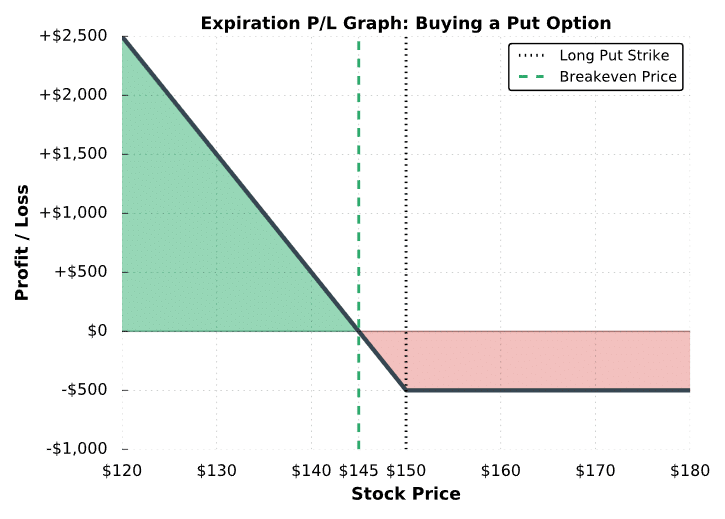

If you bought a put option there are two possible scenarios you will face as the expiration date approaches First the share price is higher than the put option strike price That means the option is out of the money or OTM and it expires worthless Your loss is limited to 100 percent of the premium you paid for the option The buyer owner of an option has the right but not the obligation to exercise the option on or before expiration A call option 5 gives the owner the right to buy the underlying security a put option 6 gives the owner the right to sell the underlying security Conversely when you sell an option you may be assigned at any time regardless of the ITM amount if the option owner

What Happens If You Let A Put Option Expire In The Money

What Happens If You Let A Put Option Expire In The Money

https://optionsdesk.com/wp-content/uploads/2021/08/Put-Option.png

Moneyness Of An Option Explained What You Need To Know

https://www.projectfinance.com/wp-content/uploads/2021/08/Copy-of-Short-Call.jpg

The Impact Of Paying Only The Minimum Amount Due On Your Credit Card

https://cardinsider.com/wp-content/uploads/2022/01/what-happens-if-you-only-pay-the-minimum-due-amount.jpg

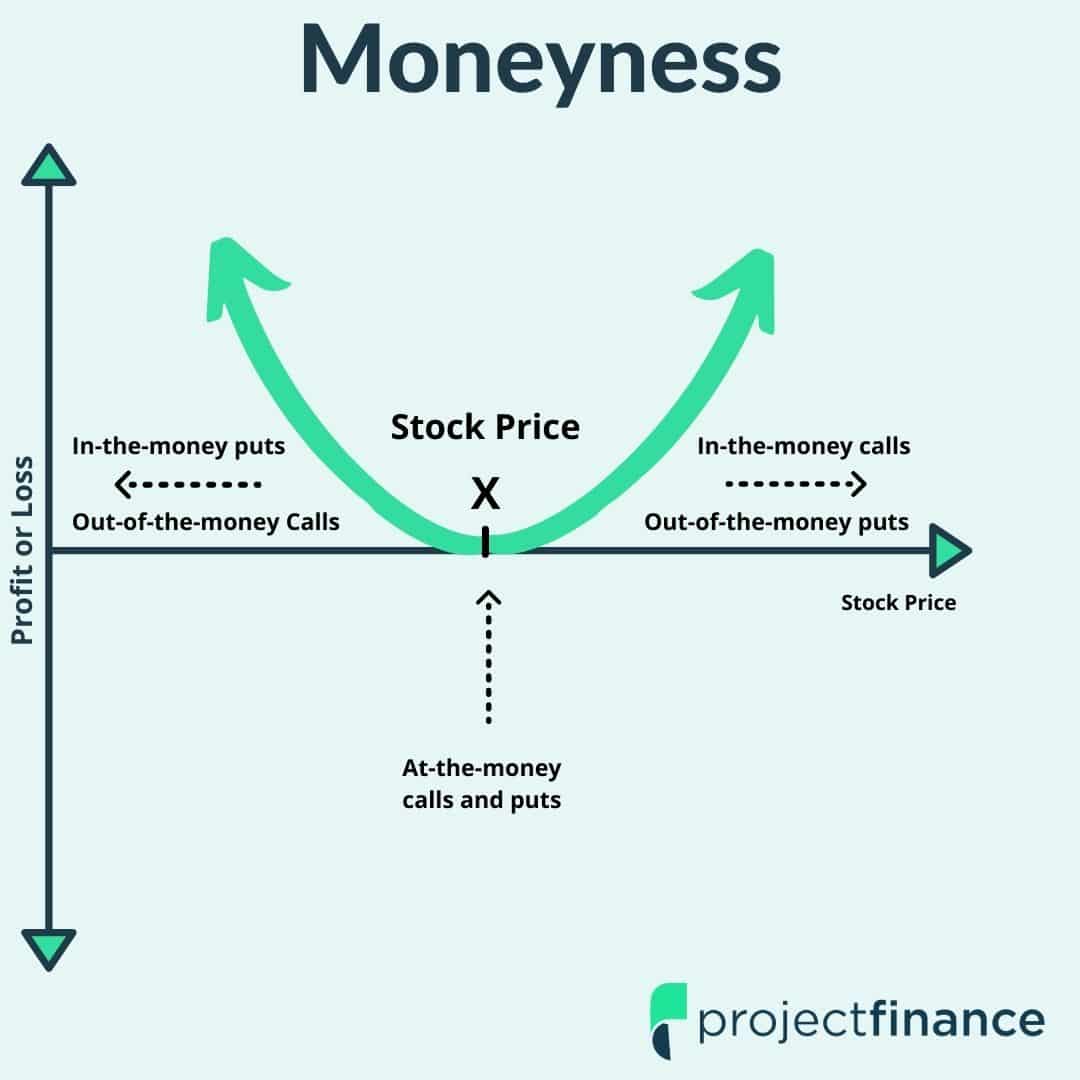

The value of a call option or the value of a put option on its expiration date is its intrinsic value For example if you have a call option with a 50 strike and the stock closed at expiration at 55 then the option contract is worth exactly 5 which is the difference between the strike price and where the stock closed 14 Each option has an expiration date which is when the contract expires and ceases to exist Strike price Each option also has a strike price and if the contract is exercised the underlying security is bought and sold at the strike price of the option Moneyness Options can either be in the money ITM at the money ATM or out of the

A put option is said to be in the money when the strike price is higher than the underlying security s market price Investors commonly use put options as downside protection which cuts or Assessment If TQE stayed at 54 75 the 55 call options or the short side of the spread will not be in the money This means that if TQE was above 50 but below 55 at expiration there would be a purchase of 5 000 shares and there would not be an offsetting sell of 5 000 shares of TQE The buying power to cover the purchase of TQE would

More picture related to What Happens If You Let A Put Option Expire In The Money

What Happens If You Cash In Your Savings JustMoney

https://www.justmoney.co.za/uploads/4b38b18c-f7f0-48d8-b75d-a3a6a9853b1c.webp

Learn How To Trade Options A Step By Step Guide To Get Started

https://media.realvision.com/wp/20210910160929/Put-vs-Call-Chart.jpg

Options Trading 101 Pt 2 Buying And Selling Calls And Puts Market

https://www.markettradersdaily.com/wp-content/uploads/2020/06/Options-Trading-101-Pt.-2-Buying-And-Selling-Calls-And-Puts22-1536x1140.jpg

One of the key factors in any options contract is an expiration date The expiration date helps determine the value of the contract itself You set a strike price either a call or put that you Expiration Date Derivatives An expiration date in derivatives is the last day that an options or futures contract is valid When investors buy options the contracts gives them the right but

Close options if the effect of the exercise assignment would be to place the account in margin deficit You do not want the broker involved in these decisions If the broker prohibits the exercise you ll lose 3k of intrinsic value You have the ability to sell your call any time before expiration avoiding these complications After a week the stock drops in value down to 19 share Your contract is in the money and you can exercise the option to sell that stock at a premium of 1 share Obviously this is the ideal outcome And it s something you can enjoy at a high rate of consistency when you leverage the VectorVest system more on that later

Determining The Value At Expiration And Profit From A Long Or A Short

https://analystprep.com/cfa-level-1-exam/wp-content/uploads/2022/12/Lower.png

What Is A Long Put Option Ultimate Guide With Visuals Projectfinance

https://www.projectfinance.com/wp-content/uploads/2022/01/long-put-chart.png

What Happens If You Let A Put Option Expire In The Money - Stock options that are in the money at the time of expiration will be automatically exercised For puts your options are considered in the money if the stock price is trading below the strike price Conversely call options are considered in the money when the stock price is trading above the strike price For example if you own a call option