Salary Employee Overtime Law Michigan Under the Fair Labor Standards Act FLSA non exempt employees are entitled to receive overtime pay at a rate of 1 5 times their regular hourly pay for any hours worked over 40 in a week This applies when employees work more than eight hours a day or more than five days a week

Bureau of Employment Relations Wage and Hour Minimum Wage Overtime Minimum Wage Overtime Michigan s Minimum Wage Rate Effective January 1 2024 the minimum wage rate is 10 33 per hour Acts and Rules Michigan s Minimum Wage and Overtime law Improved Workforce Opportunity Wage Act Public Act 337 of 2018 On March 24 2023 Governor Whitmer signed into law a bill reinstituting Michigan s Prevailing Wage Act the Act that will take effect in February of 2024 The new Act will require every contractor and subcontractor in Michigan to pay the prevailing wage and benefit rates to employees working on most state funded construction projects

Salary Employee Overtime Law Michigan

Salary Employee Overtime Law Michigan

https://www.navigantlaw.com/wp-content/uploads/2021/09/Untitled-design-32.jpg

How The New U S Overtime Law Will Affect Your Business Workly

https://workly.io/wp-content/uploads/2016/08/56.jpg

![]()

Save Money On Overtime Payments With The Fluctuating Work Week

https://2.bp.blogspot.com/-TOhGgJrGL2I/Wpfxz25369I/AAAAAAAAjps/8BNHisbLXX4bagJCswc7VIDc1MI_g818wCLcBGAs/s1600/rawpixel-com-552391-unsplash.jpg

Currently the minimum wage in Michigan is 10 10 The WOWA also has overtime rules Employees who work more than 40 hours in a single workweek must be paid overtime The WOWA overtime rate is at least one and one half 1 times their regular pay rate That means the minimum overtime pay in Michigan is 15 15 per overtime hour Tipped Employees Michigan s overtime law requires all non exempt employees to be paid 1 5 times their regular rate of pay for all hours worked after the first 40 in a week This means if you usually make 10 an hour you must be paid 15 an hour for any time worked beyond the 40 hour threshold

Example A non exempt employee is paid 10 per hour and receives a 50 bonus for the week The employee worked 43 hours during the week Employee has 3 hours of overtime over the 40 hour work week The calculation for the regular rate would be 10 per hr x 43 hrs 430 total weekly compensation for straight time The Improved Workforce Opportunity Wage Act Public Act 337 of 2018 as amended allows the accrual and use of compensatory time in lieu of payment of overtime wages under certain conditions Employees may agree to receive time off instead of overtime pay Employees should then receive 1 5 hours of time off for each hour of overtime

More picture related to Salary Employee Overtime Law Michigan

Even Illegal Businesses Must Adhere To Overtime And Wage Laws

https://paycheckcollector.com/wp-content/uploads/bfi_thumb/all-businesses-adhere-to-overtime-and-wage-laws-oxhn4br4zo8ir1oukhd1fy8qu0yuzxglduo4ryowo0.jpg

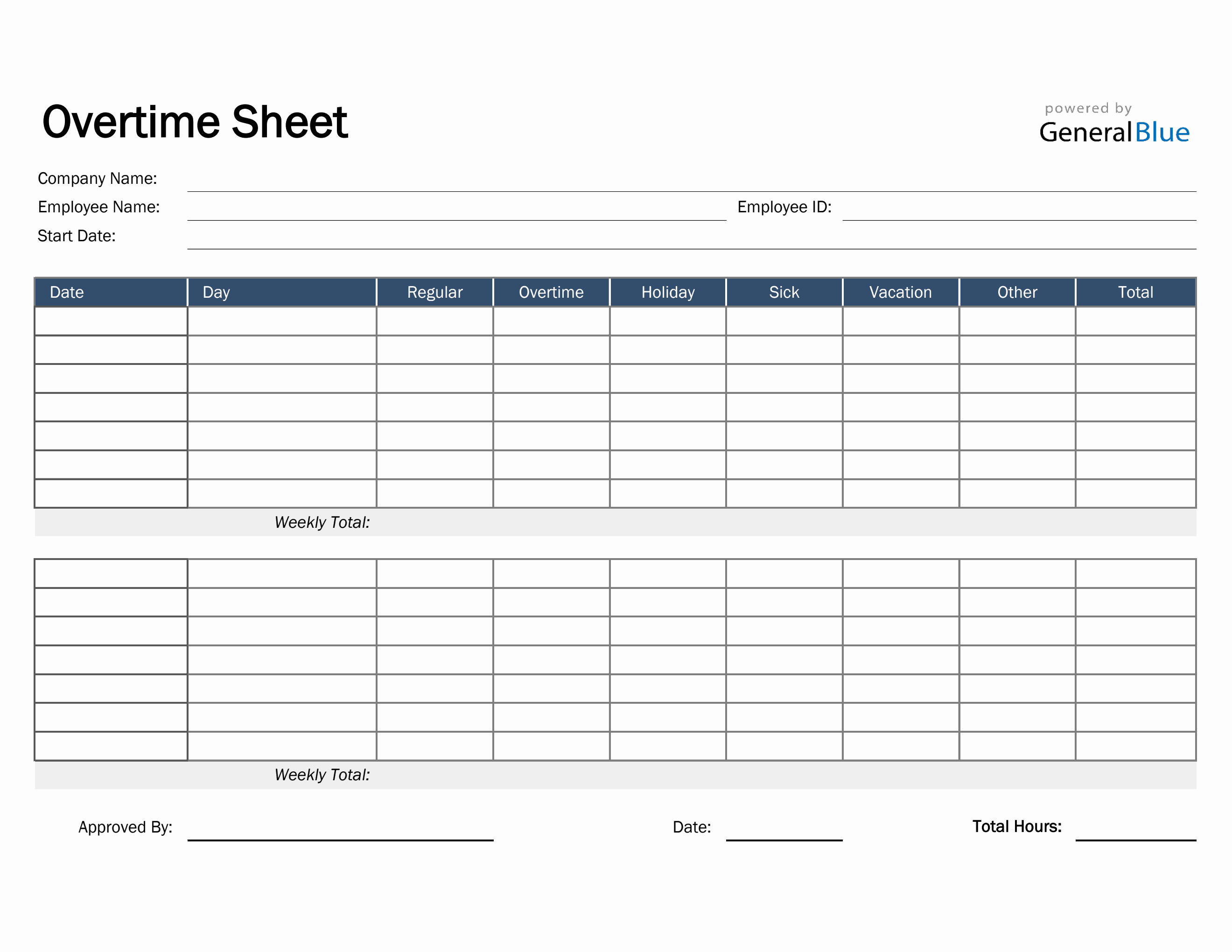

Overtime Sheet In Excel Basic

https://www.generalblue.com/overtime-sheet/p/t7rg541fg/f/basic-overtime-sheet-in-excel-lg.png?v=6400ff4cffb01b18c29965ce34bdf016

Exempt V Non Exempt California Overtime Wages Law Simplified

http://sacemploymentlawyer.com/wp-content/uploads/2016/11/overtime-law.jpg

The overtime wages are calculated by dividing the weekly salary by 40 or a bi monthly salary by 80 to get the regular hourly rate and then multiplying that by 1 5 to get the overtime rate Another difference between the Michigan law and Federal Law is the statute of limitations U S Labor Laws Michigan Labor Laws A Complete Guide to Wages Breaks Overtime and More 2024 In this article we ll dive deep into Michigan s labor laws with details on all the important aspects of the state s regulations on your employees 10 min read Cedric Jackson December 10 2023 2 Citations U S Labor Laws Tennessee Labor Laws

Michigan s current regular minimum wage is 9 87 All non exempt workers who are not tip workers are eligible to receive the minimum wage Michigan Workforce Opportunity Wage Act On the first of each calendar year beginning in 2023 the minimum wage in Michigan will increase The WOWA has exemptions to overtime rules for executive administrative or professional employees who make at least 684 per week 35 578 annually Farmworkers are also not covered Neither federal nor Michigan wage and hour laws require employers to pay you higher wages to work on weekends or holidays They also do not require employers

University Employee Overtime Authorization Form How To Create An

https://i.pinimg.com/originals/1c/8f/86/1c8f8638d5ab41af0465a4f818c9cdd6.png

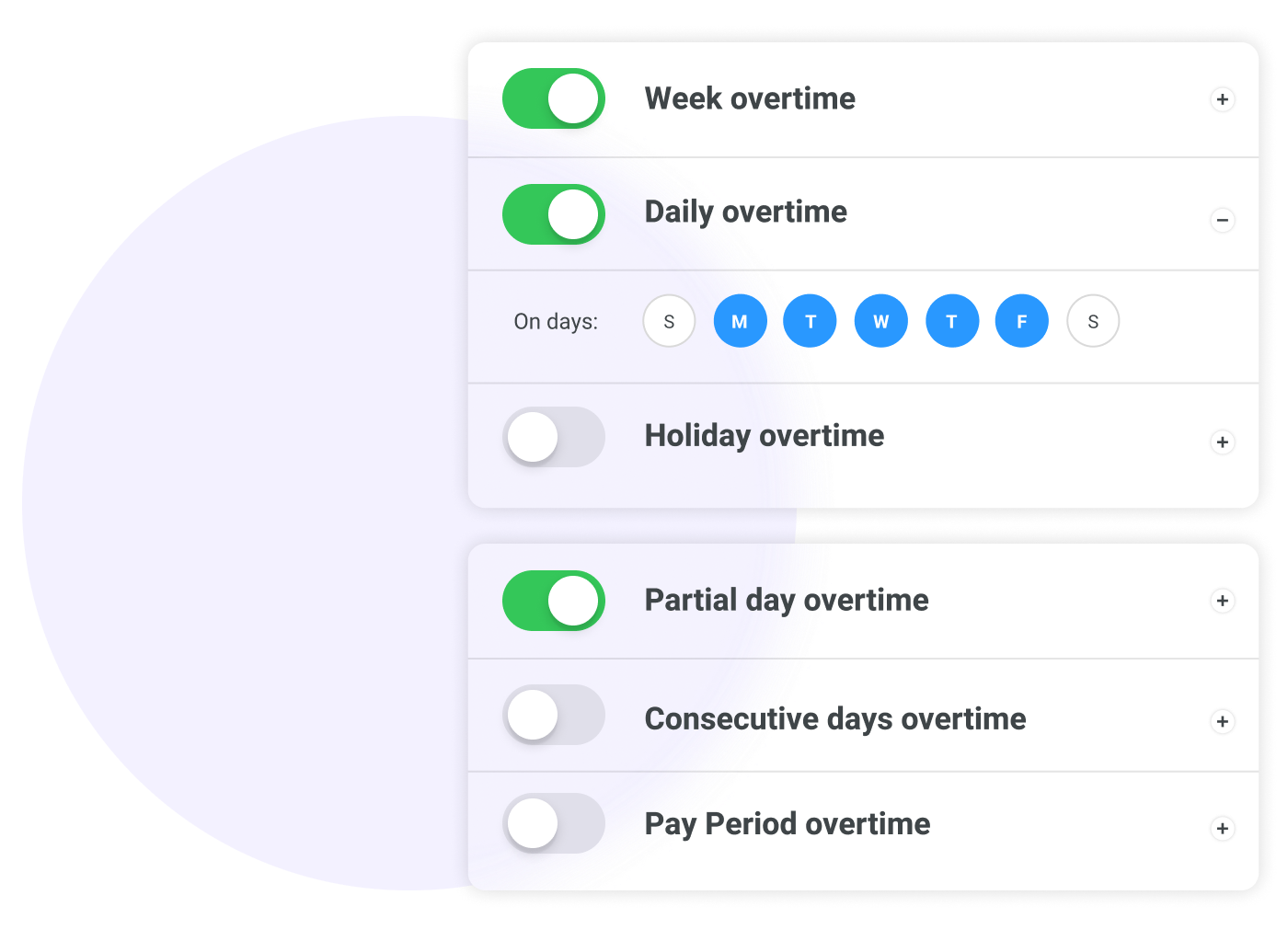

Stay On Top Of Employee Overtime Connecteam

https://connecteam.com/wp-content/uploads/2022/07/[email protected]

Salary Employee Overtime Law Michigan - Example A non exempt employee is paid 10 per hour and receives a 50 bonus for the week The employee worked 43 hours during the week Employee has 3 hours of overtime over the 40 hour work week The calculation for the regular rate would be 10 per hr x 43 hrs 430 total weekly compensation for straight time