Noi Approach Of Capital Structure Given By Net income approach and net operating income approach were proposed by David Durand According to NI approach there exists positive relationship between capital structure and valuation of firm and change in the pattern of capitalisation brings about corresponding change in the overall cost of capital and total value of the firm Thus with an increase

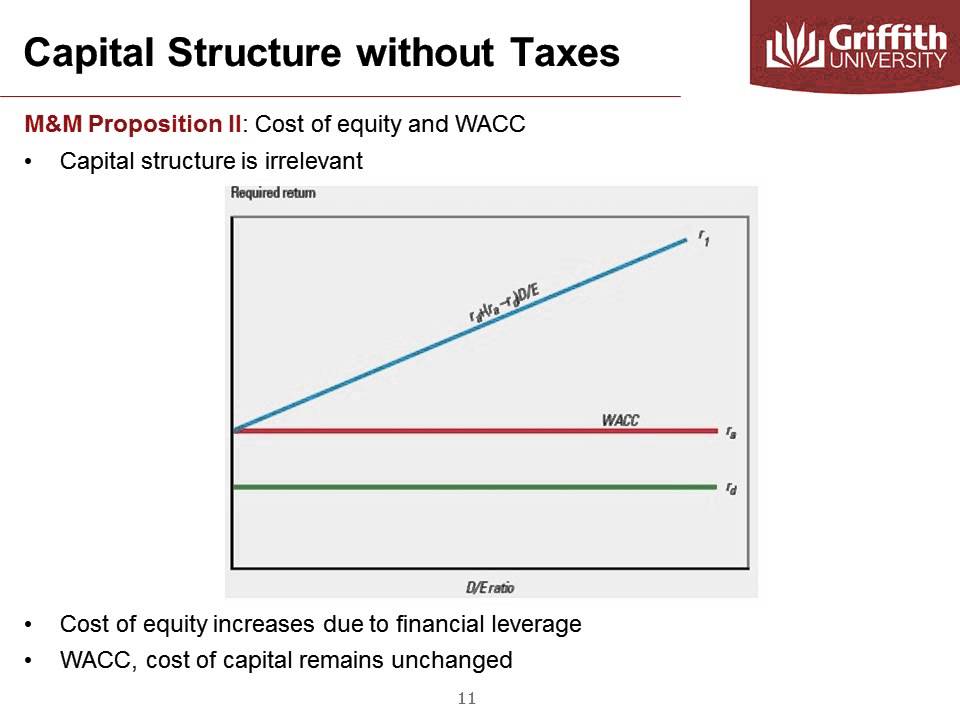

2 Net Operating Income Approach NOI Approach This theory is just opposite to NI approach NI approach is relevant to capital structure decision It means decision of debt equity mix does affect the WACC and value of the firm As per NOI approach the capital structure decision is irrelevant and the degree of financial leverage does not affect The degree of leverage is plotted along with the X axis whereas K e K w and K d on the Y axis It reveals that when the cheaper debt capital in the capital structure is proportionally increased the weighted average cost of capital K w decreases and consequently the cost of debt K d Thus it is needless to say that the optimal capital structure is the minimum cost of capital if financial

Noi Approach Of Capital Structure Given By

Noi Approach Of Capital Structure Given By

https://i.ytimg.com/vi/FDuAYQ1yNnE/maxresdefault.jpg

Net Income Approach YouTube

https://i.ytimg.com/vi/WvnonMCUGtA/maxresdefault.jpg

Module 9 Optimal Capital Structure Theory YouTube

https://i.ytimg.com/vi/ipyhMXZVIYE/maxresdefault.jpg

According to the NOI approach the market value of the firm depends upon the net operating profit or EBIT and the over cost of capital WACC The financing mix or the capital structure is irrelevant and does not affect the value of the firm Assumptions of NOI Approach Overall cost of capital K 0 remains constant Cost of Debt K d is constant Net Operating Income Approach The net operating income approach suggested by David Durand states the irrelevance of capital structure in calculating the firm s value The cost of capital for the firm will always be the same No matter what the degree of leverage is the firm s total value will remain constant

There are various theories that propagate the ideal capital mix capital structure for a firm Capital structure is the proportion of debt and equity in which a corporate finances it s business The capital structure of a company firm plays a very important role in determining the value of a firm Introduction to Capital Structure Theory 5 Net Operating Income Approach NOI According to this approach capital structure decisions of the firm are irrelevant Any change in the leverage will not lead to any change in the total value of the firm and the market price of shares as the overall cost of capital is independent of the degree of leverage As per NOI Approach

More picture related to Noi Approach Of Capital Structure Given By

NOI Approach Theory Of Capital Structure The Financing Decision YouTube

https://i.ytimg.com/vi/cgXJzW_SuZc/maxresdefault.jpg

Theory Of Capital Structure Class 2 NOI Approach Bangla Tutorial

https://i.ytimg.com/vi/kFBQGB7HpXk/maxresdefault.jpg

L11 Capital Structure NOI Approach Concepts Problems CA

https://i.ytimg.com/vi/YMDgSmiM9I4/maxresdefault.jpg

This approach is also given by David Durand This approach is just the opposite of Net Income Approach According to this approach there is no relationship between capital structure cost of capital and values of the firm The theory holds that change in proportion of debt in the capital structure does not change the overall cost of capital Hence there is no optimum capital structure or cost of capital is not a function of leverage Features of NOI approach At all degrees of leverage debt the overall capitalization rate would remain constant For a given level of Earnings before Interest and Taxes EBIT the value of a firm would be equal to EBIT overall capitalization rate

[desc-10] [desc-11]

Theories Of Capital Structure NI NOI MM Approach Financial

https://i.ytimg.com/vi/267Mtx2MXPk/maxresdefault.jpg

Which One Of The Following Is Constant For NOI Approach YouTube

https://i.ytimg.com/vi/BizZUsRWVYU/maxresdefault.jpg

Noi Approach Of Capital Structure Given By - [desc-12]