How To Work Out After Tax Pay The more someone makes the more their income will be taxed as a percentage In 2025 the federal income tax rate tops out at 37 Only the highest earners are subject to this percentage Federal income tax is usually the largest tax deduction from gross pay on a paycheck

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck Discover the latest Today at Work insights from ADP Research How to Calculate Hourly Pay Estimate the after tax pay for hourly employees by entering the following information into a hourly paycheck calculator Divide this number by the gross pay to determine the percentage of taxes taken out of a paycheck

How To Work Out After Tax Pay

How To Work Out After Tax Pay

https://phantom-marca.unidadeditorial.es/b749857ef5858cbb72271d40412aff3b/crop/142x0/2048x1072/resize/1200/f/jpg/assets/multimedia/imagenes/2022/02/20/16453693975805.jpg

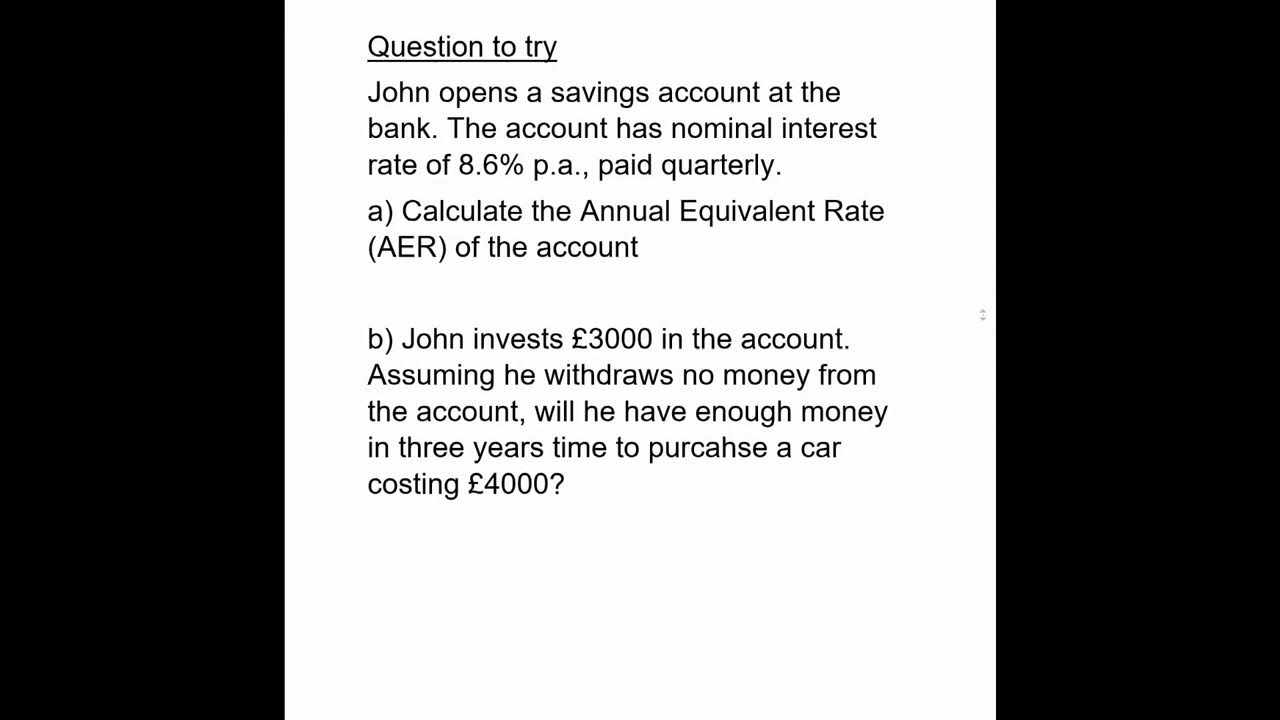

How To Work Out Annual Equivalent Rate YouTube

https://i.ytimg.com/vi/_grU0A7yBpc/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGwgbChsMA8=&rs=AOn4CLCg794NBKueMR-JNMlsRdlzjdjCBg

How To Work Out Percentages Mentally Percentage Tricks YouTube

https://i.ytimg.com/vi/0c1Onp87Y1c/maxresdefault.jpg

Like federal tax liability there are a few substeps to work out your state tax liability Step 3 1 State taxable income You can use the federal AGI you calculated earlier Step 5 Your net pay After calculating your total tax liability subtract deductions pre and post tax and any withholdings if applicable See how your withholding affects your refund take home pay or tax due How it works Use this tool to Estimate your federal income tax withholding See how your refund take home pay or tax due are affected by withholding amount New job or other paid work Major income change Marriage Child birth or adoption Home purchase

The Hourly Wage Tax Calculator uses tax information from the tax year 2023 to show you take home pay See where that hard earned money goes Federal Income Tax Social Security and other deductions More information about the calculations performed is available on the about page Tax Year 2025 2026 If you live in California and earn a gross annual salary of 72 280 or 6 023 per month your monthly take home pay will be 4 715 This results in an effective tax rate of 22 as estimated by our US salary calculator

More picture related to How To Work Out After Tax Pay

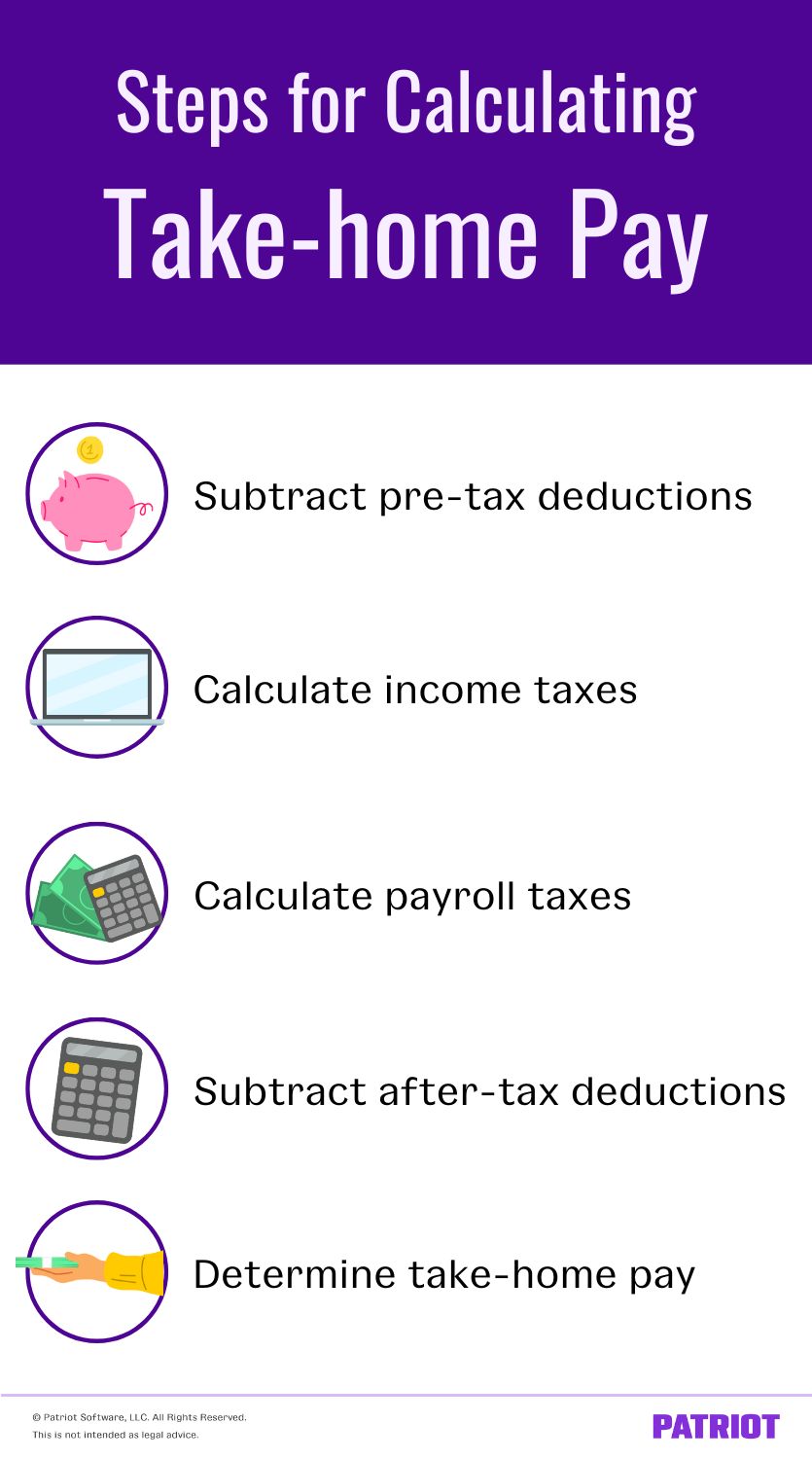

Take home Pay Definition Steps To Calculate Extra Partner For

https://www.patriotsoftware.com/wp-content/uploads/2022/09/take-home-pay.jpg

How To Work Out Increase In Pension 17 5 Percent IP 2023 Detailed

https://i.ytimg.com/vi/oXy94bZlh14/maxresdefault.jpg

How To Work Out Every Day POPSUGAR Fitness

https://media1.popsugar-assets.com/files/thumbor/8I_Buh3dACOGNCsLgEZGZTpiWNs/fit-in/2048xorig/filters:format_auto-!!-:strip_icc-!!-/2015/05/01/721/n/1922398/b08d6b12_20-ways.jpg

Use these free paycheck calculators to quickly determine your net pay after taxes deductions and withholding Calculate accurate payroll estimates for federal state and local taxes with Paycheck City s suite of tools Calculate paycheck deductions based on your state and filing status Compare salary vs hourly wages to see earnings There are many rules regarding the definition of post tax reimbursements in IRS Publication 15 but these will typically be business and travel expenses that you pay out of your personal account

[desc-10] [desc-11]

Work Out Percentage Clever Pie Chart Workout Girl Work Out Exercises

https://i.pinimg.com/originals/e1/5b/cc/e15bcc2f21e25113bfbf04ed22597ac3.png

AskNow Articles Health Wellness How To Workout At Home

https://cn.asknow.com/static/get/1pd6326m9x_how_to_work_out_at_home-5A0C2060D2E03BD0437CEE7664F85121.png

How To Work Out After Tax Pay - See how your withholding affects your refund take home pay or tax due How it works Use this tool to Estimate your federal income tax withholding See how your refund take home pay or tax due are affected by withholding amount New job or other paid work Major income change Marriage Child birth or adoption Home purchase