How To Work Out Weekly Pay After Tax Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck Paycheck Calculator Advertiser Disclosure Paycheck Calculator For Salary And Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your paycheck Use our

How To Work Out Weekly Pay After Tax

How To Work Out Weekly Pay After Tax

https://i.pinimg.com/originals/47/75/bd/4775bdc4cb1069a72950bfef5eadcba2.jpg

Taxes Pay Less Keep More With After Tax Planning Farrow Financial

https://static.twentyoverten.com/5bc771c281fa3256bc62d9ac/lZyN1WP4LJh/Taxes-pay-less-keep-more.jpg

Take Home Salary Get Ready To Take A Hit From Next Fiscal Year

https://cdn.dnaindia.com/sites/default/files/styles/full/public/2020/12/09/942245-salary.jpg

Hourly wage Hourly wage Hours worked per day Days worked per week Weeks worked per year Your weekly paycheck Step 2 Federal income tax liability There are four substeps to take to work out your total federal taxes Step 2 1 Gross income adjusted The formula is Gross income Pre tax deductions Gross income adjusted You need to follow these steps Determine the number of hours you work per week the standard value is 40 Then multiply the number from Step 1 by your hourly wage The result is your weekly income If you struggle with calculations try using Omni s weekly income calculator

To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left hand table above In the Weekly hours field enter the number of hours you do each week excluding any overtime If you do any overtime enter the number of hours you do each month and the rate you get How do I calculate hourly rate First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52 Next divide this number from the annual salary For example if an employee has a salary of 50 000 and works 40 hours per week the hourly rate is 50 000 2 080 40 x 52 24 04

More picture related to How To Work Out Weekly Pay After Tax

How To Calculate Taxes Taken Out Of Paycheck In Illinois Willene Morrell

https://i.insider.com/59cabefea66b5127008b4640?width=1000&format=jpeg&auto=webp

How Do I Calculate My W2 From Hourly Rate QATAX

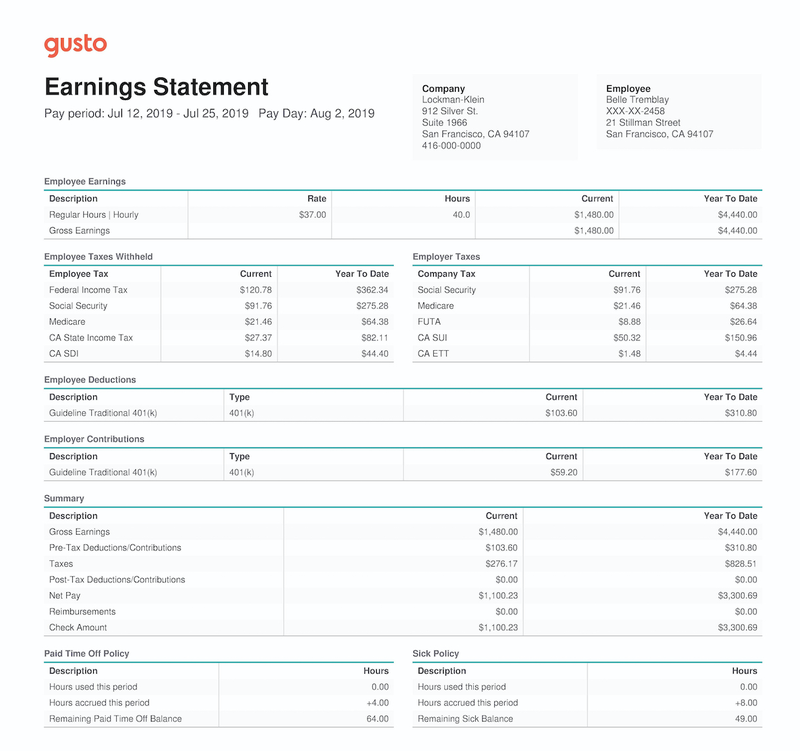

https://m.foolcdn.com/media/the-blueprint/images/Paystubs-01-Gusto_earning_report_TmvHKqZ.width-800.png

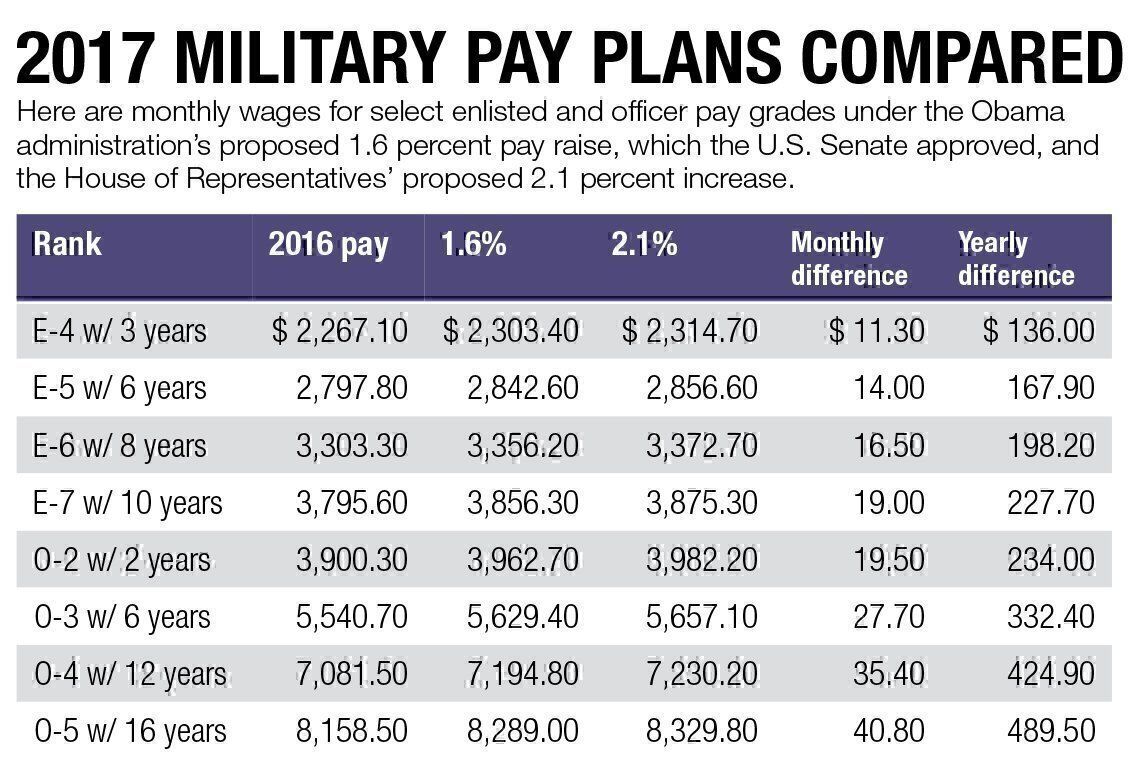

Army Spouse Separation Pay Chart Army Military

http://militaryspouse.com/wp-content/uploads/2016/11/2017-military-pay-plans-compared.jpg

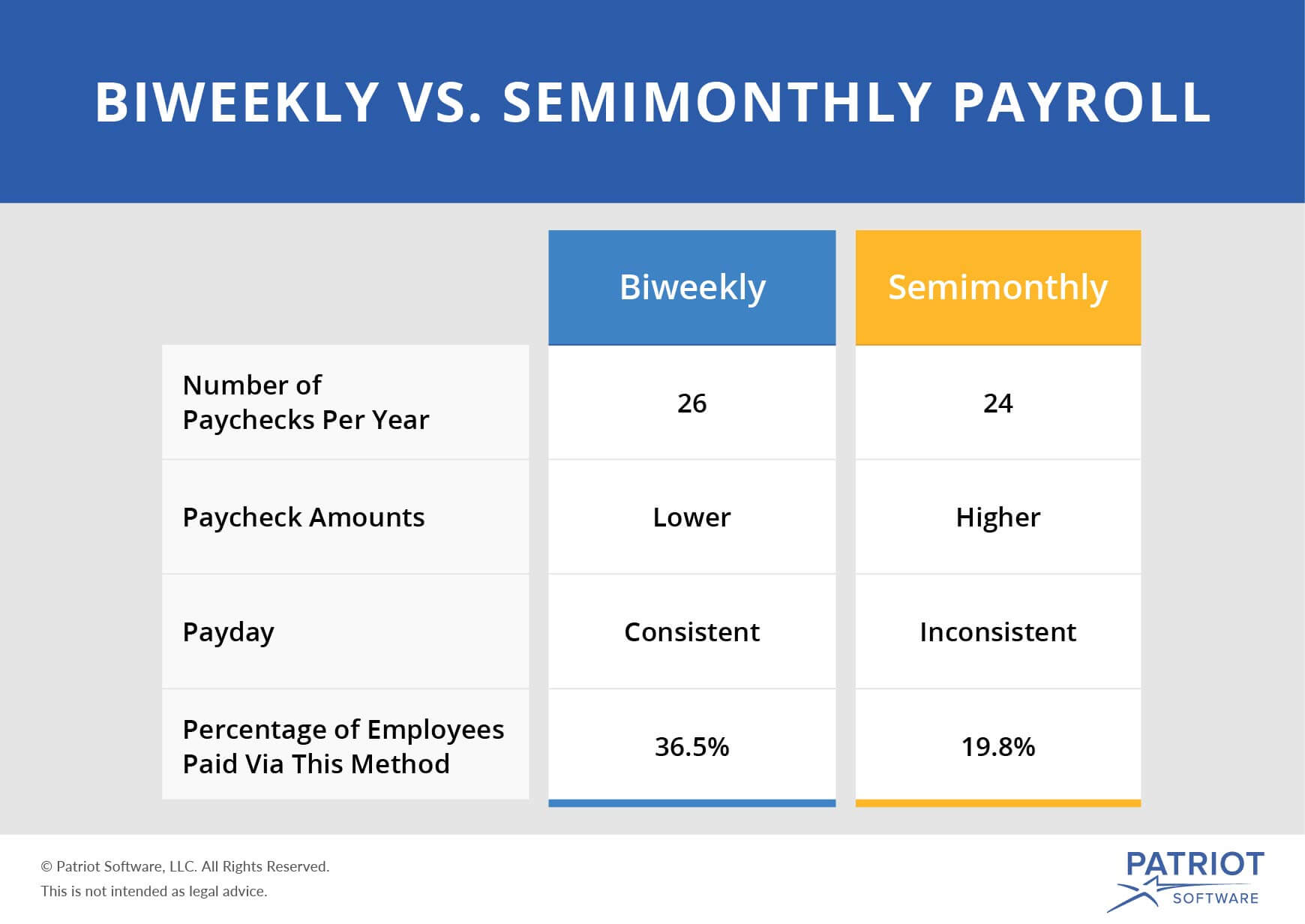

Bi Weekly Pays every two weeks which comes out to 26 times a year for most years Semi Monthly Pays twice each month usually on the 15th and the last day of the month Although common it will result in inconsistent pay dates due to differences in dates from month to month Monthly Pays once per month This means that your net income or salary after tax will be 55 578 per year 4 632 per month or 1 069 per week To ensure our US take home pay calculator is as easy to use as possible we have to make a few assumptions about your personal circumstances such as that you have no dependents and are not married

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator Helps you work out how much Australian income tax you should be paying what your take home salary will be when tax and the Medicare levy are removed your marginal tax rate This calculator can also be used as an Australian tax return calculator Note that it does not take into account any tax rebates or tax offsets you may be entitled to

Pin On Money Saving Plan

https://i.pinimg.com/736x/2c/f6/74/2cf674081f7466498bbb98ebbd4a59b2.jpg

Bimonthly Paycheck Calculator JilliePatrik

https://www.patriotsoftware.com/wp-content/uploads/2019/12/biweekly-vs.-semimonthly-payroll-visual.jpg

How To Work Out Weekly Pay After Tax - Hourly Paycheck Calculator Use this calculator to help you determine your paycheck for hourly wages First enter your current payroll information and deductions Then enter the hours you expect