How To Work Out Pay After Tax Nz Employers and employees can use this calculator to work out how much PAYE should be withheld from wages It s useful for weekly fortnightly four weekly or monthly pays but it will not allow for extra pays like redundancy or special bonuses employees with tailored tax codes or a student loan special deduction rate schedular payments

Income Tax Pay in New Zealand is taxed at a progressive rate starting at 10 5 for incomes under 15 600 and capping at 39 for incomes over 180 000 Accident Compensation Corporation ACC ACC levies are a form of insurance that entitles you to healthcare and rehabilitation if you re hurt outside of work Important the calculator below uses the 1 April 2025 rates which is what you need to understand your tax obligations Wondering how much difference that pay rise or a new job would make Our PAYE calculator shows you in seconds To use the PAYE calculator enter your annual salary or the one you would like in the Insert Income box below The tool below will automatically display your

How To Work Out Pay After Tax Nz

How To Work Out Pay After Tax Nz

https://i.ytimg.com/vi/_grU0A7yBpc/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGwgbChsMA8=&rs=AOn4CLCg794NBKueMR-JNMlsRdlzjdjCBg

How Is Corporation Tax Calculated Year 2020 21 Tapoly

https://blog.tapoly.com/wp-content/uploads/2021/09/businessman-calculating-his-monthly-expenses-ESX84ZV.jpg

What Is Corporation Tax

https://static.wixstatic.com/media/cee7ec_5b0daf27cc7e48c09f173d2bec1448b8~mv2.png/v1/fit/w_1000%2Ch_1000%2Cal_c/file.png

Use this calculator to work out your basic yearly tax for any year from 2011 to the current year It will not include any tax credits you may be entitled to for example the independent earner tax credit IETC It also will not include any tax you ve already paid through your salary or wages or any ACC earners levy you may need to pay This calculator has been updated with the tax changes If you make 50 000 a year living in New Zealand you will be taxed 8 715 That means that your net pay will be 41 285 per year or 3 440 per month Your average tax rate is 17 4 and your marginal tax rate is 31 4 This marginal tax rate means that your immediate additional income will be taxed at this rate

How to use the New Zealand Income Tax Calculator Thank you for this made it so much easier to work out how much starting kiwisaver would effect my weekly income great site I was trying to find out my net pay after tax for 70000 00 Even I visit IRD two times but the way they were explaining in far complicated Now I can see the 2 67 of the gross salary goes to the first tier tax 10 82 of the gross salary goes to the second tier of tax 3 82 of the gross salary goes to the third tier of tax In this example the person paid 9 520 00 in PAYE tax on a 55 000 00 gross salary so the effective tax rate across the whole salary was 17 31

More picture related to How To Work Out Pay After Tax Nz

How To Work Out Every Day POPSUGAR Fitness

https://media1.popsugar-assets.com/files/thumbor/8I_Buh3dACOGNCsLgEZGZTpiWNs/fit-in/2048xorig/filters:format_auto-!!-:strip_icc-!!-/2015/05/01/721/n/1922398/b08d6b12_20-ways.jpg

How To Work Out Increase In Pension 17 5 Percent IP 2023 Detailed

https://i.ytimg.com/vi/oXy94bZlh14/maxresdefault.jpg

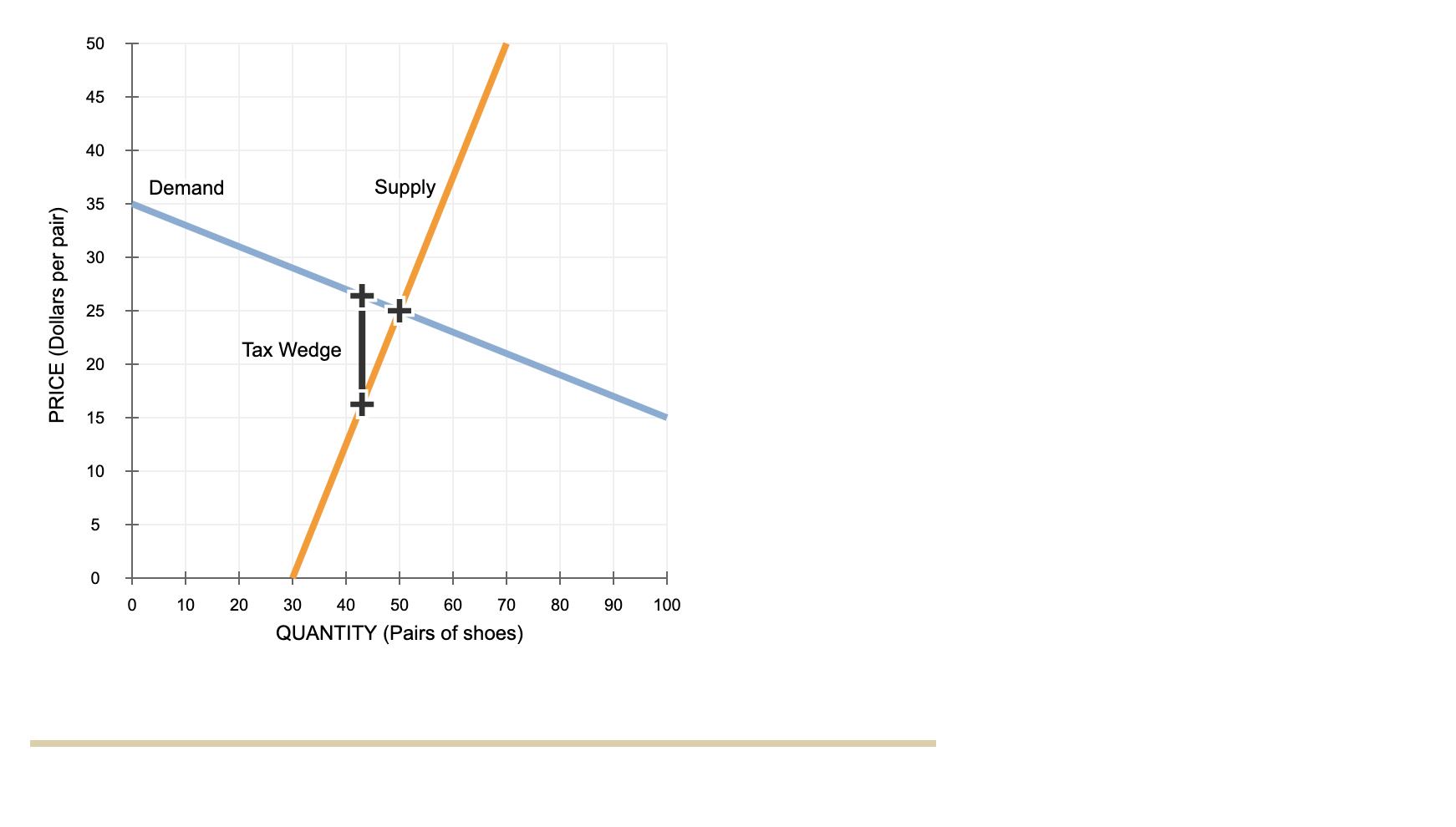

Solved 7 Effect Of A Tax On Buyers And Sellers The Chegg

https://media.cheggcdn.com/media/c1c/c1cd340c-640c-42c8-a162-25b4f435788f/phpJxdL3y.png

How to calculate your salary after tax in New Zealand Follow these simple steps to calculate your salary after tax in New Zealand using the New Zealand Salary Calculator 2025 which is updated with the 2025 tax tables Resident Status The Resident status in New Zealand here refers to your tax status not necessarily your visa type or domicile The New Zealand income after Tax calculator is a helpful tool for anyone who wants to know how much they ll take home from their paycheck after tax and other deductions have been taken into account You can read the full length in depth Tax Rates in the New Zealand article to learn more about New Zealand income tax

[desc-10] [desc-11]

The NZ Tax System Explained FLiP

https://freelifephysio.com/wp-content/uploads/2021/08/Screen-Shot-2021-08-28-at-11.31.00-am.png

How To Work Out Which Loan Product Is Right For You Refinance Mortgage

https://i.pinimg.com/originals/09/da/03/09da03d03713f6c7704d17118f9acfb8.gif

How To Work Out Pay After Tax Nz - 2 67 of the gross salary goes to the first tier tax 10 82 of the gross salary goes to the second tier of tax 3 82 of the gross salary goes to the third tier of tax In this example the person paid 9 520 00 in PAYE tax on a 55 000 00 gross salary so the effective tax rate across the whole salary was 17 31