How To Calculate Tax On Total Income Formula This calculator computes federal income taxes state income taxes social security taxes medicare taxes self employment tax capital gains tax and the net investment tax The provided information does not constitute financial tax or legal advice We strive to make the calculator perfectly accurate

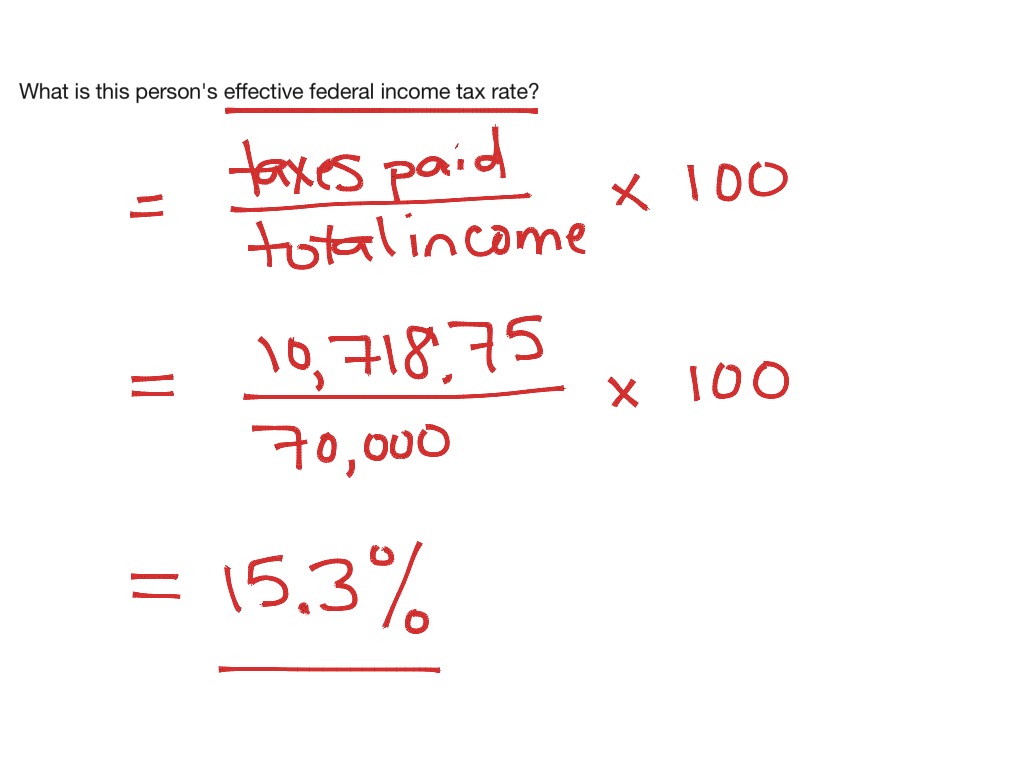

Calculating the Federal Income Tax Rate The United States has a progressive income tax system This means there are higher tax rates for higher income levels These are called marginal tax rates meaning they do not apply to total income but only to the income within a specific range These ranges are referred to as brackets The taxable income formula for an individual can be derived by using the following four steps Firstly determine the total gross income of the individual Gross total income includes all sources of income like wage salary rental income from property capital gains from the asset sale income from other business interests etc

How To Calculate Tax On Total Income Formula

How To Calculate Tax On Total Income Formula

https://exceljet.net/sites/default/files/styles/original_with_watermark/public/images/formulas/income tax bracket calculation_0.png

Income Tax Formula Math Marginal Tax Rate Bogleheads If You Claim

https://showme0-9071.kxcdn.com/files/1000093366/pictures/thumbs/2302829/last_thumb1456332448.jpg

How To Calculate Cannabis Taxes At Your Dispensary

https://flowhub.imgix.net/Education/normal-tax-calculation.jpg

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return It is mainly intended for residents of the U S and is based on the tax brackets of 2024 and 2025 Non refundable credits can reduce the total tax liability to 0 but not beyond 0 Any unused non refundable tax credits will expire and cannot Calculate Social Security tax Social Security tax is 6 2 on 147 000 of earned income The maximum Social Security tax for employees is 9 114 per year To calculate your Social Security tax amount simply multiply paycheck gross pay 062 For example if a paycheck s gross pay is 1 000 1000 062 62 00

If you had 50 000 of taxable income in 2021 as a single filer you re going to pay 10 on that first 9 950 and 12 on the chunk of income between 9 951 and 40 525 and so on this is how Below are the most common tax forms that you will need in order to calculate your gross income Form W 2 shows the income you earned through services performed as an employee

More picture related to How To Calculate Tax On Total Income Formula

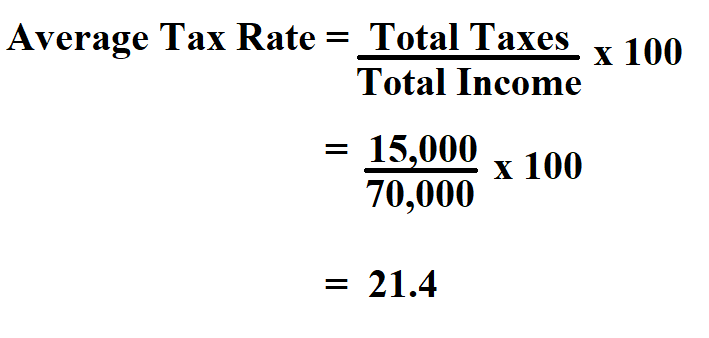

How To Calculate Average Tax Rate

https://www.learntocalculate.com/wp-content/uploads/2020/06/Average-Tax-Rate-2.png

How To Calculate Accounts Payable Formula Modeladvisor

https://imgmidel.modeladvisor.com/how_to_calculate_accounts_payable_from_income_statement.png

Total Revenue Intelligent Economist

https://intelligenteconomist.com/wp-content/uploads/2020/02/Total-Revenue-Formula.png

For help figuring this out use our easy to use income tax calculator Step 3 Calculate Deductions and Taxable Income Your Adjusted Gross Income AGI is then calculated by subtracting the adjustments from your total income Your AGI is the next step in figuring out your taxable income You then subtract certain deductions from your AGI Remember that a tax deduction reduces your taxable income cutting your tax bill indirectly by reducing the income that s subject to a marginal tax rate A tax credit is a dollar for dollar discount on your tax bill So if you owe 1 000 but qualify for a 500 tax credit your tax bill goes down to 500

[desc-10] [desc-11]

How To Calculate Income Tax On Monthly Salary In India Tax Walls

https://www.bankbazaar.com/images/india/infographic/how-calculate-income-tax-on-salary-with-example.png

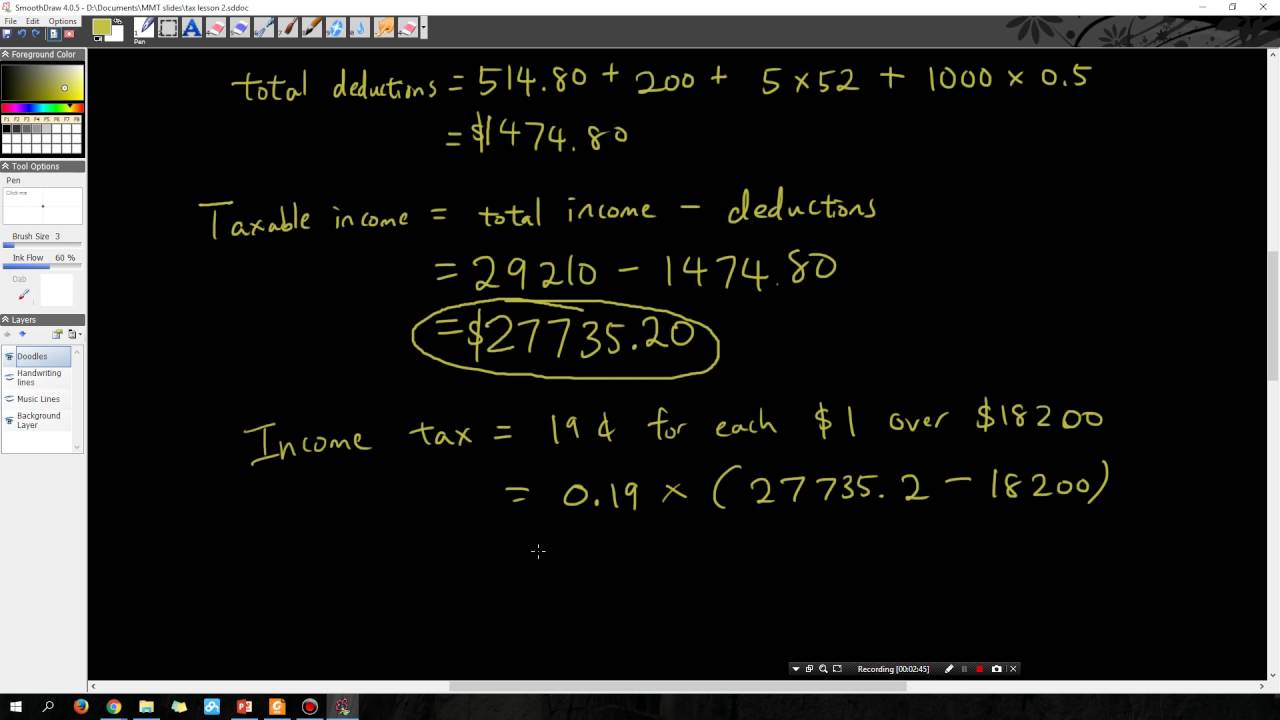

Maths A Tax Lesson 3 Calculate Income Tax YouTube

https://i.ytimg.com/vi/RZCDhA02fTc/maxresdefault.jpg

How To Calculate Tax On Total Income Formula - If you had 50 000 of taxable income in 2021 as a single filer you re going to pay 10 on that first 9 950 and 12 on the chunk of income between 9 951 and 40 525 and so on this is how