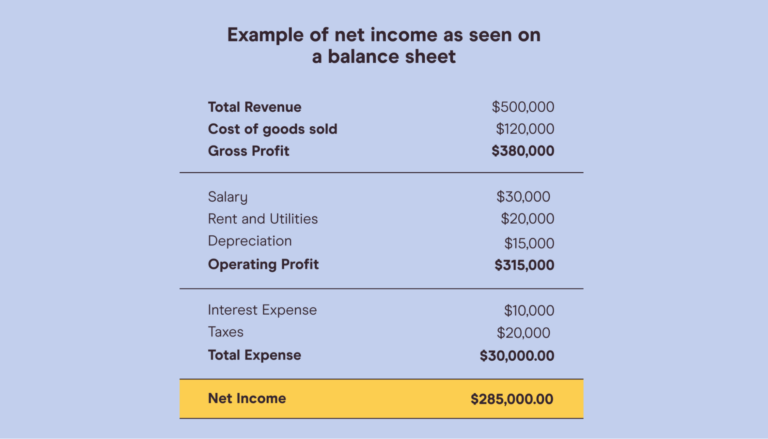

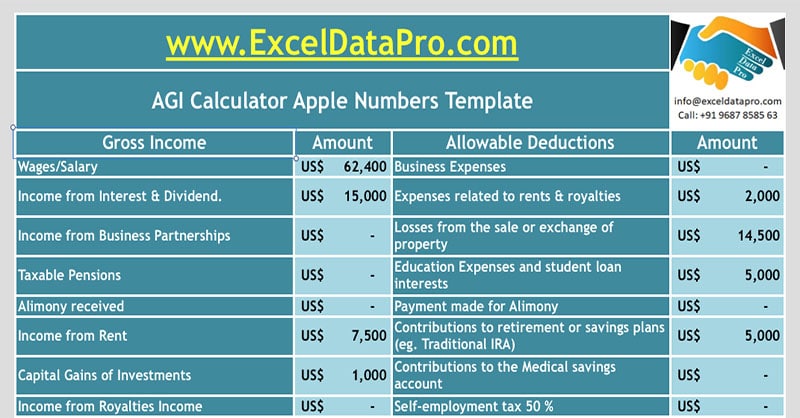

How Is Total Income Calculated Gross income the total earnings before deductions provides a broad overview of a household s earning potential and is often used in loan applications Net income the take home pay after deductions like taxes social security contributions and health insurance premiums gives a clearer picture of funds available for daily expenses and savings

The adjusted annual salary can be calculated as 30 8 260 25 56 400 Using 10 holidays and 15 paid vacation days a year subtract these non working days from the total number of working days a year All bi weekly semi monthly monthly and quarterly figures are derived from these annual calculations The basic formula to calculate annual gross income as a salaried employee is Gross pay x Number of pay periods per year Annual income If you re paid about the same amount each pay period you can calculate your annual gross income by following these steps Figure out what your gross pay is by looking at your most recent pay stub

How Is Total Income Calculated

How Is Total Income Calculated

https://www.paretolabs.com/wp-content/uploads/2021/06/Example-of-net-income-as-seen-on-a-balance-sheet-768x439.png

Feature Slide Calculating Modified Adjusted Gross Income MAGI

http://www.healthreformbeyondthebasics.org/wp-content/uploads/2014/09/Feature-Slide-MAGI.jpg

Total Income How To Calculate Total Income Tax2win

https://blog.tax2win.in/wp-content/uploads/2019/03/What-is-Total-Income-and-How-to-Calculate-It.jpg

How to Calculate Total Annual Income What is my total annual income going to be this year There are a few different ways to calculate your total annual income The most common approach is to add up all of your incomes for the year and then divide by 12 or 365 if you re counting days However there are other methods that can be used as well 3 Add all gross income Because household income is the total sum of all gross income the final step is to add all the annual income together This will give you the total annual household income Example of household income Let s say that five people are living in a home a husband and wife the husband s mother a 16 year old and a 14 year old

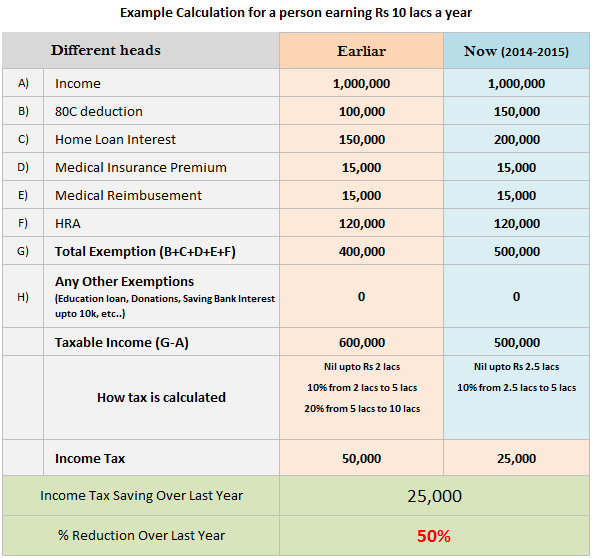

Total income is the taxpayer s income that remains after taking into account all the permissible deductions under the income tax act It is calculated by subtracting GTI deductions Taxation Tax is not calculated on gross total income However GTI acts as the starting point for tax calculation Tax is calculated directly on the Total It s a crucial element in personal finance tax calculations and financial planning This guide will delve into the intricacies of total income exploring its components calculation methods and significance in various contexts Components of Total Income Total income encompasses all earnings regardless of their source Here s a breakdown

More picture related to How Is Total Income Calculated

How To Calculate Dividends From A Balance Sheet Lietaer

https://imgtaer.lietaer.com/how_to_calculate_dividends_from_income_statement.png

How Do Net Income And Operating Cash Flow Differ

https://www.investopedia.com/thmb/MfkGyF55iCBf0hvwE0eTtBbjyDM=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/exxon_income_statement_net_income_investopedia_2017_10k-5bfd87d8c9e77c0051835749

How To Calculate Income Tax For Department Of Local Government Exam

http://punjabexamportal.com/wp-content/uploads/2015/10/example.png

Annual income hourly wage hours per week 52 taxes Or if you know the total number of hours you worked over the course of the year you can instead use the simplified formula below annual income hourly wage total hours worked taxes The formula for those that earn a fixed salary is even easier Total Annual Income For an individual or business with multiple income streams or sources of earnings their total annual income will be equal to the sum of all the income sources For example Sarah works part time at Online Co earning 32 000 per year and also works part time at Offline Co earning 21 000 per year

[desc-10] [desc-11]

Binary To Decimal Conversion Examples How To Convert Binary To

https://d138zd1ktt9iqe.cloudfront.net/media/seo_landing_files/binary-to-decimal-step-2-1622615940.png

Download AGI Calculator Apple Numbers Template ExcelDataPro

https://exceldatapro.com/wp-content/uploads/2018/02/AGI-Calculator-Apple-Numbers-Template.jpg

How Is Total Income Calculated - Total income is the taxpayer s income that remains after taking into account all the permissible deductions under the income tax act It is calculated by subtracting GTI deductions Taxation Tax is not calculated on gross total income However GTI acts as the starting point for tax calculation Tax is calculated directly on the Total