How To Calculate Before Tax Cost Of Debt In Excel What is Pre Tax Cost of Debt and Why Does it Matter The pre tax cost of debt is a crucial financial metric that represents the actual cost of borrowing before considering tax implications It is essential in capital budgeting decisions as it directly affects a company s profitability and cash flow In simple terms pre tax cost of debt is the rate of return a company must earn on its

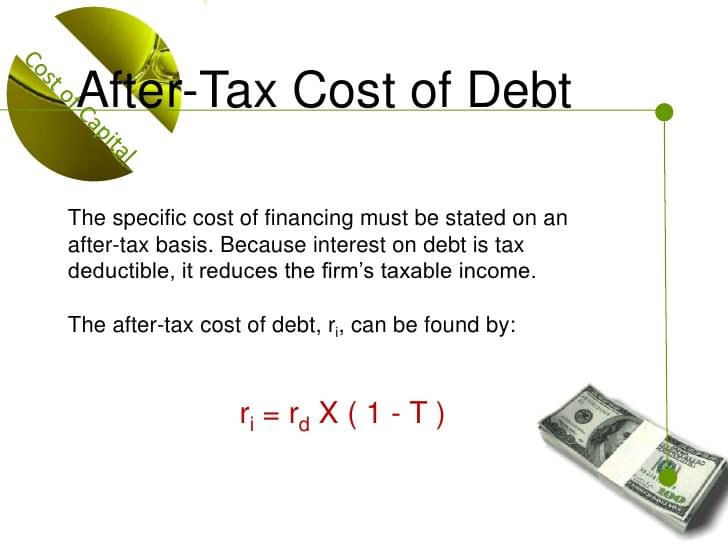

The cost of debt may be determined before tax or after tax Solving for the above formula using a financial calculator or excel we get r 3 64 So Kd Before tax is r 2 since r is calculated for semi annual coupon payments 7 3 Kd Post tax is determined as Post tax cost of debt Pre tax cost of debt 1 tax rate For example if the pre tax cost of debt is 8 and tax is charged at 30 then the post tax cost of debt will be 8 1 30 5 6 That s pretty straightforward We can then calculate the blended rate known as the weighted average cost of capital WACC

How To Calculate Before Tax Cost Of Debt In Excel

How To Calculate Before Tax Cost Of Debt In Excel

https://accountingcoaching.online/wp-content/uploads/2020/12/image-i4Y0mKofW3F82SLP.png

PDF The Cost Of Debt In Unlisted Companies

https://i1.rgstatic.net/publication/355558813_The_Cost_of_Debt_in_Unlisted_Companies/links/6176da15a767a03c14b0f1bd/largepreview.png

How To Calculate Before Tax Cost Of Debt Pocket Sense

https://img-aws.ehowcdn.com/877x500p/s3-us-west-1.amazonaws.com/contentlab.studiod/getty/13ec0c3d4ddd4751a00f41f696c9d7d4.jpg

Divide by Total Debt Amount To estimate the before tax cost of debt divide the total annual cost interest fees by the total debt amount Example If the total cost is 15 000 and your debt is 200 000 the before tax cost of debt is 7 5 Stealth Agents tools handle this calculation for you offering fast and precise results 6 Learn how to calculate the cost of debt with our simple formula and calculator Estimate your interest payments accurately to manage business finances better To calculate it you ll need to know the before tax figure from above and your company s marginal corporate tax rate After tax Cost of Debt Pre tax Cost of Debt 1

You must identify the after tax cost of debt and the income tax rate for the company in question to accurately calculate the before tax cost Before Tax Debt vs After Tax Debt In this example if the company s after tax cost of debt equals 830 000 you ll then divide 830 000 by 0 71 to find a before tax cost of debt of 1 169 014 08 When the cost of debt is mentioned without qualification it usually refers to the before tax cost of debt though it depends on context This value can then be used to calculate the after tax cost of debt which also considers the tax rate Examples Calculate Cost of Debt in Excel or Google Sheets For this example I will calculate

More picture related to How To Calculate Before Tax Cost Of Debt In Excel

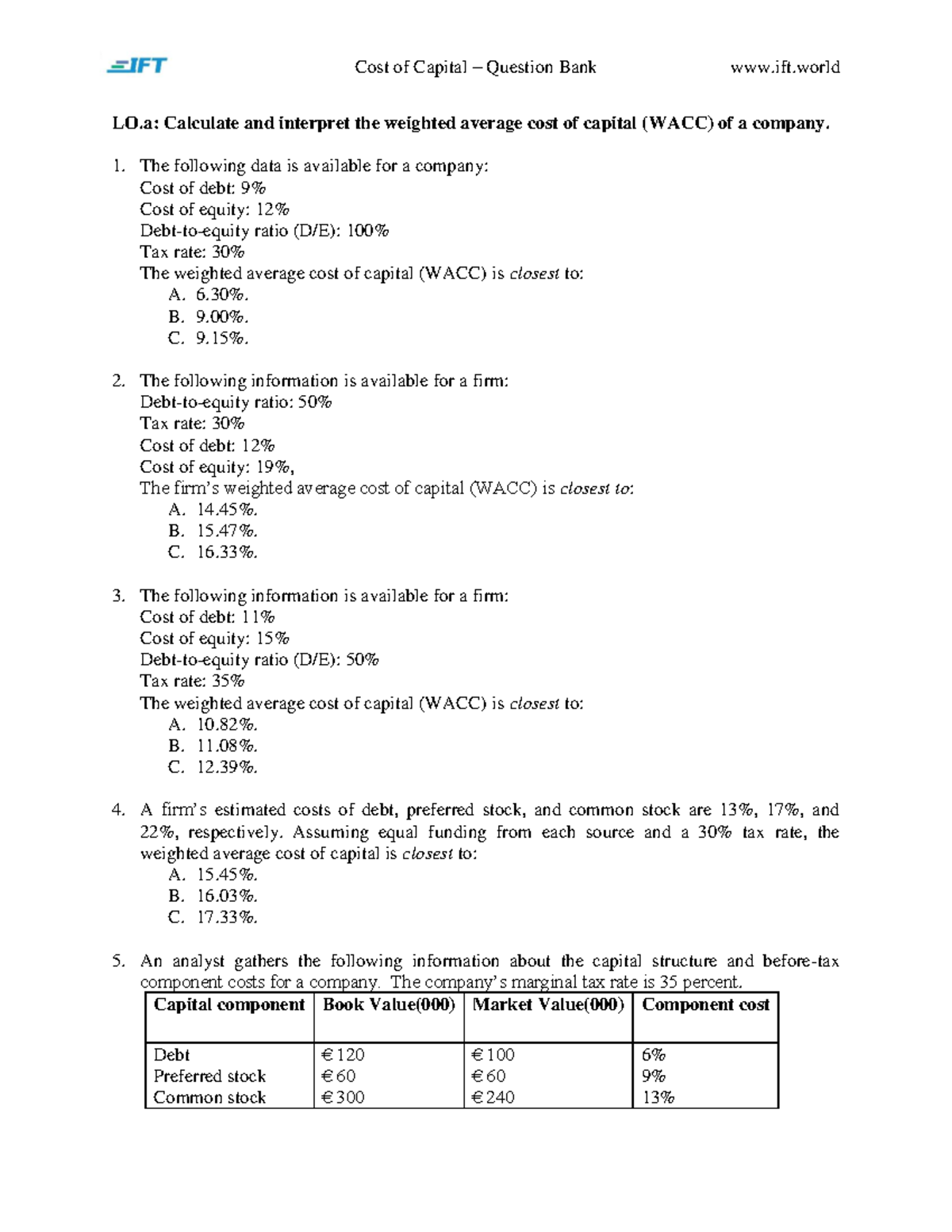

R36 Cost Of Capital Q Bank LO Calculate And Interpret The Weighted

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/1aa8abf4664c0e4f1e58fd20ef01c614/thumb_1200_1553.png

Cost Of Debt Formula How To Calculate With Examples

https://www.educba.com/academy/wp-content/uploads/2019/01/Cost-of-Debt-Formula.jpg

How Much Did Jane Earn Before Taxes New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

How to Calculate the Pre Tax Cost of Debt A Step by Step Approach The pre tax cost of debt formula is a fundamental concept in corporate finance enabling companies to evaluate the true cost of debt financing The formula is calculated as follows pre tax cost of debt interest expense total debt x 1 tax rate How to calculate cost of debt First determine the interest expense For this example we will say the interest expense is 100 000 00 Next determine the tax rate This should be the effective tax rate on the debt For this example the tax rate is 5 Finally calculate the cost of debt

[desc-10] [desc-11]

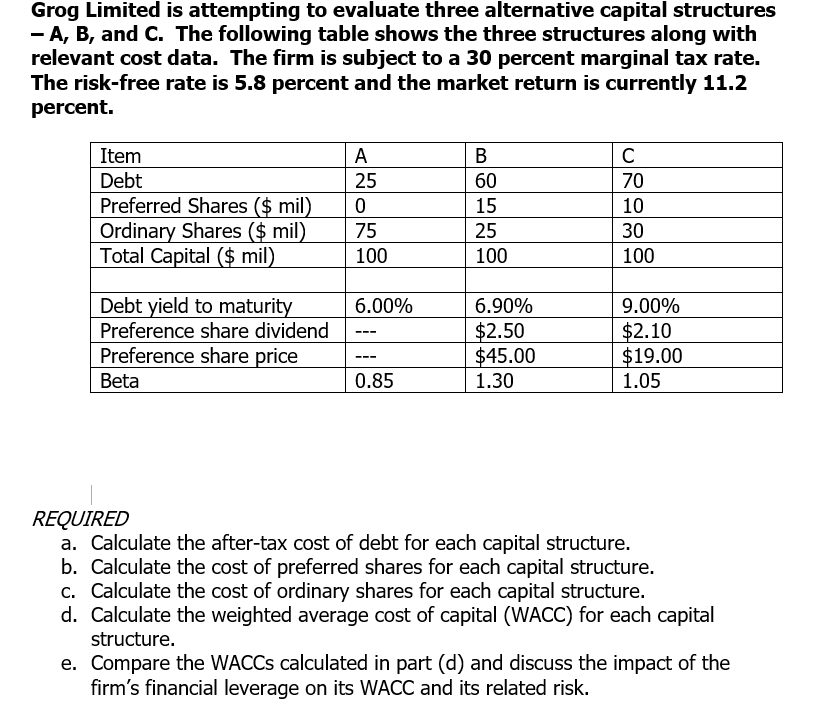

REQUIRED A Calculate The After tax Cost Of Debt For Chegg

https://media.cheggcdn.com/media/61f/61fcb67c-2d0b-4520-ada2-73df5cd0324a/php8dsWQk

WACC Formula Rask Education

https://education.rask.com.au/wp-content/uploads/sites/4/2020/01/WACC-Formula.png

How To Calculate Before Tax Cost Of Debt In Excel - You must identify the after tax cost of debt and the income tax rate for the company in question to accurately calculate the before tax cost Before Tax Debt vs After Tax Debt In this example if the company s after tax cost of debt equals 830 000 you ll then divide 830 000 by 0 71 to find a before tax cost of debt of 1 169 014 08