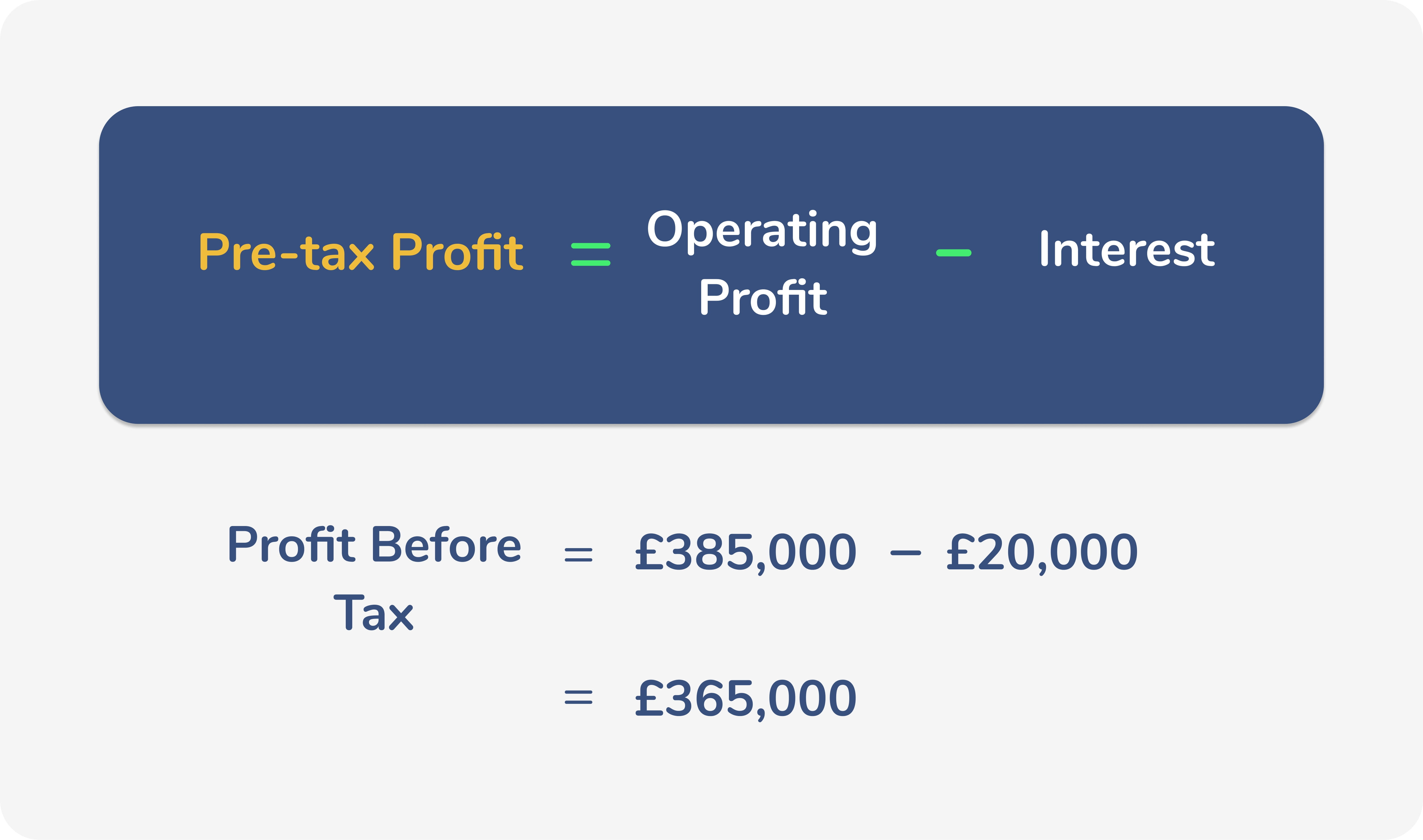

How To Calculate Pretax Cost Of Debt In Excel Post tax cost of debt Pre tax cost of debt 1 tax rate For example if the pre tax cost of debt is 8 and tax is charged at 30 then the post tax cost of debt will be 8 1 30 5 6 That s pretty straightforward We can then calculate the blended rate known as the weighted average cost of capital WACC

The pre tax cost of debt for BankOnIt would be 1 000 000 10 000 000 x 1 0 30 7 These examples demonstrate how to calculate pre tax cost of debt in different industries and scenarios highlighting the importance of understanding this concept in making informed business decisions In this video I walk you through an example in Excel that shows how you can calculate the weighted average cost of capital using data on bonds equity and o

How To Calculate Pretax Cost Of Debt In Excel

How To Calculate Pretax Cost Of Debt In Excel

https://i.ytimg.com/vi/0pW4D5q235o/maxresdefault.jpg

Cost Of Debt How To Calculate Cost Of Debt Nav

https://www.nav.com/wp-content/uploads/2020/09/cost-of-debt-formula.jpg

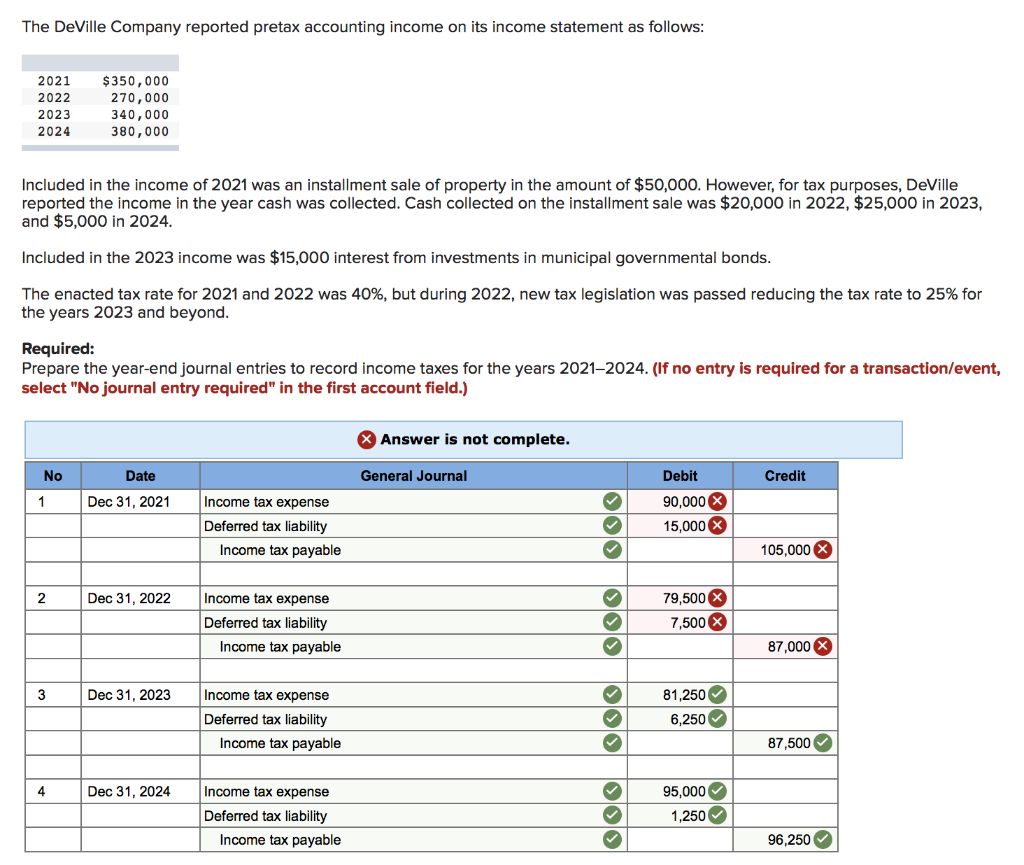

Solved The DeVille Company Reported Pretax Accounting Income Chegg

https://media.cheggcdn.com/media/0f0/0f0be171-26ca-4913-9ba6-fa418712ecae/php5maQjZ

The formula for determining the Pre tax Kd is as follows Cost of Debt Pre tax Formula Total Interest Cost Incurred Total Debt 100 Solving for the above formula using a financial calculator or excel we get r 3 64 So Kd Before tax is r 2 since r is calculated for semi annual coupon payments 7 3 Pre tax cost of debt x 1 tax rate x proportion of debt post tax cost of equity x 1 proportion of debt The resulting percentage is your post tax weighted average cost of capital WACC the rate your company is expected to pay on average to all security holders in order to finance your assets 3 Work out your DCFs

Here s how to calculate the Cost of Debt Cost of Debt is essentially the interest expense you pay on your business loans Here s how to calculate the Cost of Debt Examples Calculate Cost of Debt in Excel or Google Sheets For this example I will calculate Company A s cost of debt Company A s debt consists of two loans the Cost of debt is what it costs a company to maintain debt The amount of debt is normally calculated as the after tax cost of debt because interest on debt is normally tax deductible The general formula for after tax cost of debt then is pretax cost of debt x 100 percent tax rate

More picture related to How To Calculate Pretax Cost Of Debt In Excel

Pretax Income How To Calculate Pretax Income With Examples

https://cdn.educba.com/academy/wp-content/uploads/2021/06/Pretax-Income.jpg

R36 Cost Of Capital Q Bank LO Calculate And Interpret The Weighted

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/1aa8abf4664c0e4f1e58fd20ef01c614/thumb_1200_1553.png

Pretax Margin Formula SayemaEvonna

https://wise.com/imaginary/251e126aeedb4b6609f03c68975428c2.jpg

Now let s see a practical example to calculate the cost of debt formula Cost of Debt Formula Example 4 A company named S M Pvt Ltd has taken a loan of 50 000 from a financial institution for five years at a rate of interest of 8 the tax rate applicable is 30 Now we will see amortization to calculate the cost of debt Excel s versatility makes it an invaluable tool for calculating the cost of debt By leveraging its functions users can streamline complex financial computations The process begins with gathering the necessary data such as the total amount of debt the interest rate and the repayment period

[desc-10] [desc-11]

How To Calculate Pretax Income

https://media.licdn.com/dms/image/D5612AQH6x7bk3Qding/article-cover_image-shrink_600_2000/0/1659130691303?e=2147483647&v=beta&t=zulIF3-Z7cnfgJt_e8NfE0c4NmW_Zx_Wm_pC0toeJXI

Lecture 60 How To Calculate The Cost Of Redeemable Debt Example 2

https://i.ytimg.com/vi/eKvTTXK6_34/maxresdefault.jpg

How To Calculate Pretax Cost Of Debt In Excel - Cost of debt is what it costs a company to maintain debt The amount of debt is normally calculated as the after tax cost of debt because interest on debt is normally tax deductible The general formula for after tax cost of debt then is pretax cost of debt x 100 percent tax rate