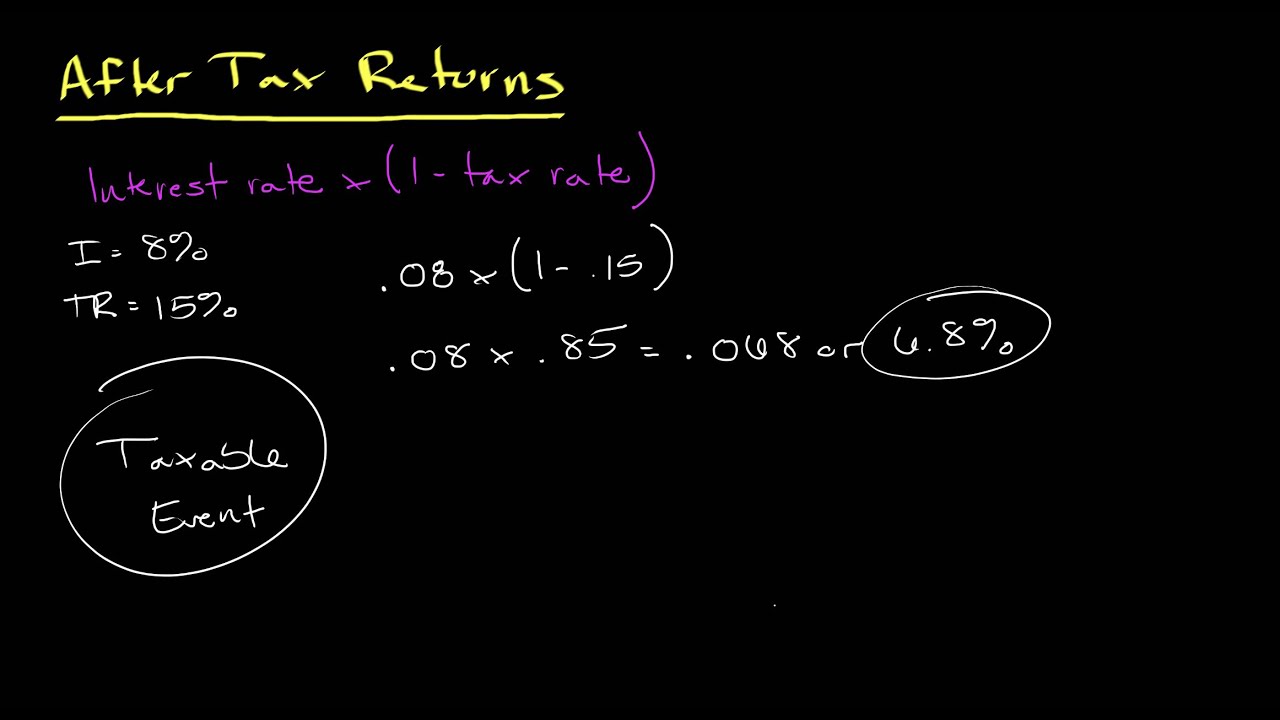

How To Calculate After Tax Cost Of Debt In Excel Before tax cost of debt x 100 incremental tax rate After tax cost of debt The after tax cost of debt can vary depending on the incremental tax rate of a business If profits are quite low an entity will be subject to a much lower tax rate which means that the after tax cost of debt will increase

Further the pre tax cost of the debt can be calculated simply by obtaining an interest rate in the debt instrument 4 Calculate after tax cost of debt You have a pre tax cost of interest an effective interest rate and all the debt balances at this stage These all the costs need to be entered in the following formula In other words the after tax cost of debt is the required rate of return of the project if the project is funded 100 by debt To earn a return from the project the project s rate of return has to be more than the required rate of return which is the after tax cost of debt After tax cost of debt helps us to assess the riskiness of a company

How To Calculate After Tax Cost Of Debt In Excel

How To Calculate After Tax Cost Of Debt In Excel

https://i1.rgstatic.net/publication/355558813_The_Cost_of_Debt_in_Unlisted_Companies/links/6176da15a767a03c14b0f1bd/largepreview.png

Cost Of Debt Formula How To Calculate With Examples

https://www.educba.com/academy/wp-content/uploads/2019/01/Cost-of-Debt-Formula.jpg

Calculating After Tax Returns Personal Finance Series YouTube

https://i.ytimg.com/vi/eY1YM5lxJW4/maxresdefault.jpg

The company s tax rate is 30 which means its after tax cost of debt is 3 62 To calculate this we use the following formula 0 0517 Examples Calculate Cost of Debt in Excel or Google Sheets For this example I will calculate Company A s cost of debt Company A s debt consists of two loans the first is for 500 000 with a 4 interest rate and the second is for 100 000 with a 6 interest rate If you also want to calculate the after tax cost of debt you will

After tax cost of debt 28 000 1 30 After Tax Cost of Debt 28 000 0 70 After Tax Cost of Debt 19 600 Now we got an after tax cost of debt which is 19 600 The after tax cost of debt is high as income tax paid by the company will be low as the company has a loan on it and the interesting part paid by the company will be The formula for determining the Pre tax Kd is as follows Cost of Debt Pre tax Formula Total Interest Cost Incurred Total Debt 100 The formula for determining the Post tax cost of debt is as follows Cost of DebtPost tax Formula 100 To calculate the cost of debt of a firm the following components are to be determined

More picture related to How To Calculate After Tax Cost Of Debt In Excel

How To Calculate Before Tax Cost Of Debt Pocket Sense

https://img-aws.ehowcdn.com/877x500p/s3-us-west-1.amazonaws.com/contentlab.studiod/getty/13ec0c3d4ddd4751a00f41f696c9d7d4.jpg

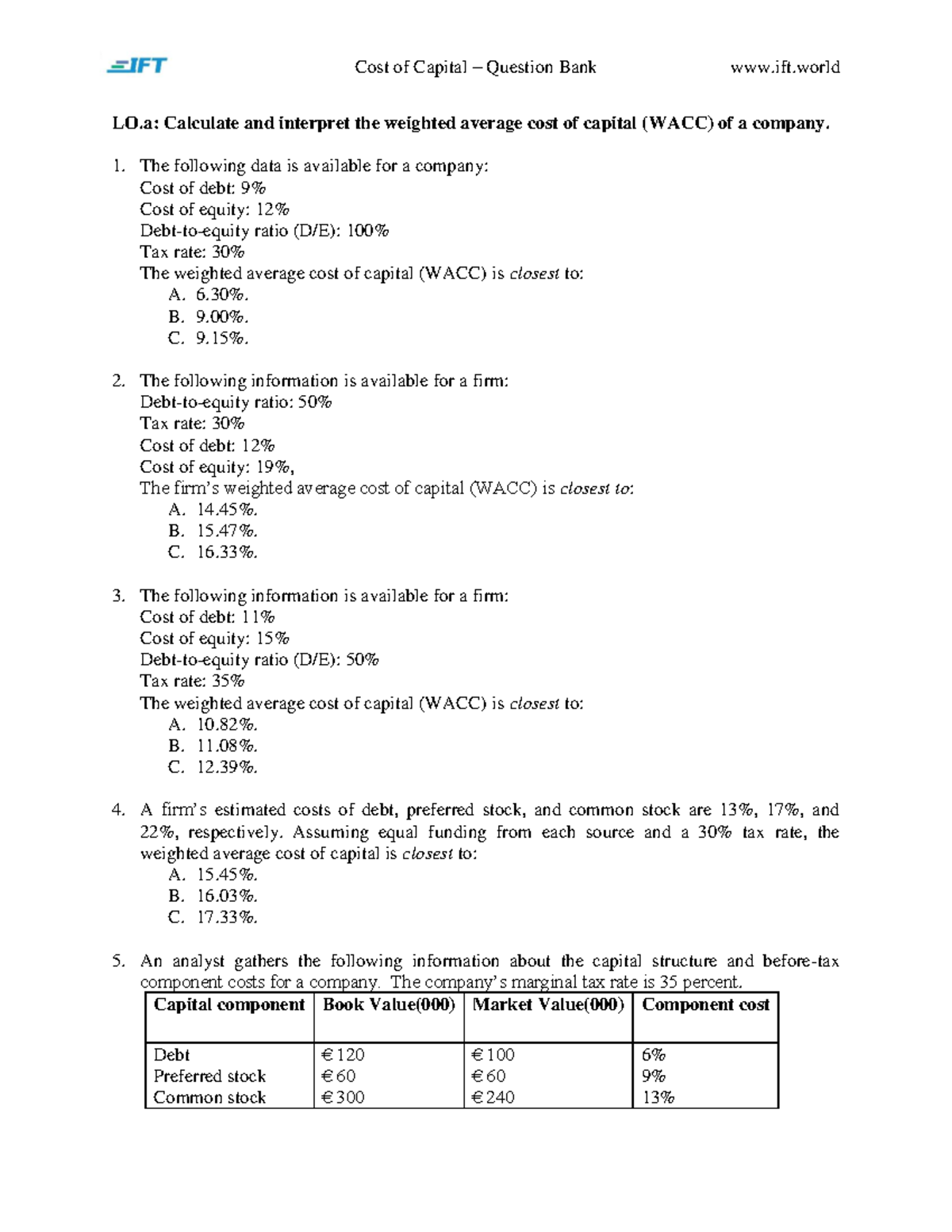

R36 Cost Of Capital Q Bank LO Calculate And Interpret The Weighted

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/1aa8abf4664c0e4f1e58fd20ef01c614/thumb_1200_1553.png

How To Calculate After tax Cost Of Debt

https://www.bizmanualz.com/wp-content/uploads/2023/09/Calculate-After-tax-Cost-of-Debt.jpg

The formula for the after tax cost of debt is After Tax Cost of Debt Pre Tax Cost of Debt x 1 Tax Rate This calculation shows the real cost of debt after considering tax savings For example if your pre tax cost of debt is 6 and your effective tax rate is 30 your after tax cost of debt would be 6 1 0 30 4 2 Step 3 Calculate the after tax cost of debt Now that we ve done all that leg work we can plug our values into the after tax cost of debt formula after tax cost of debt before tax cost of debt 1 marginal corporate tax rate 5 5 6 9 1 20 Let s look at the same equation but use decimals 0 055 0 069 1 0 2

[desc-10] [desc-11]

Learn How To Calculate After Tax Cost Of Debt And Stop Losing Money

https://demodirt.com/wp-admin/admin-ajax.php?action=rank_math_overlay_thumb&id=11028&type=gif&hash=383ae521882aa44f4e3ce9eabdbe1bbb

How To Calculate Cost Of Debt With Examples Layer Blog

https://blog.golayer.io/uploads/images/builder/image-blocks/_w1832h1030/How-to-Calculate-Cost-of-Debt-After-Tax-Cost-of-Debt-Value.png

How To Calculate After Tax Cost Of Debt In Excel - [desc-13]