How To Calculate Apr On A Loan In Excel To get the monthly payment amount for a loan with four percent interest 48 payments and an amount of 20 000 you would use this formula PMT B2 12 B3 B4 As you see here the interest rate is in cell B2 and we divide that by 12 to obtain the monthly interest Then the number of payments is in cell B3 and loan amount in cell B4

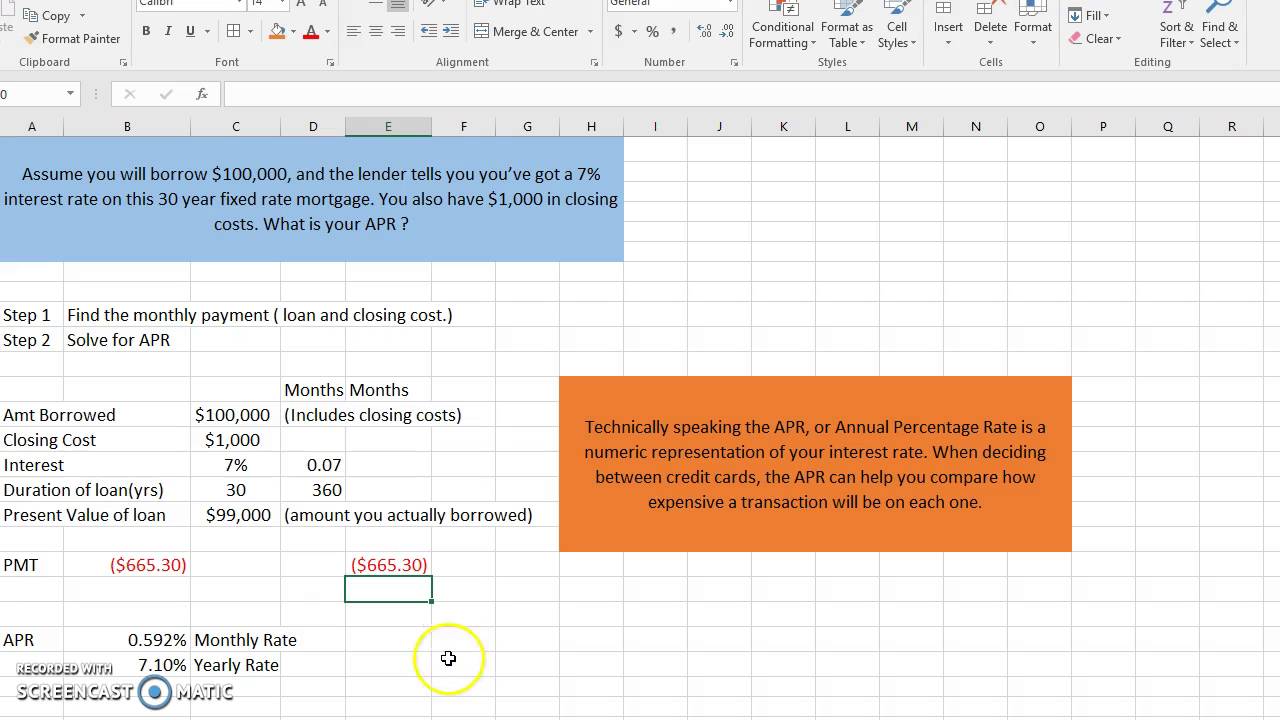

PMT 0 04 12 120 200000 0 Instead of entering in the interest rate to the decimal point I ve left it is a fraction so that the calculation is more precise The present value is entered as a negative since the 200 000 is what is currently owed while the future value 0 is what it will be when the loan is paid off To calculate APR in Microsoft Excel use the RATE function and insert the required values to get the result The process is straightforward if you know your monthly payment amount and some other key facts about the loan but you can work it out based on some basic information What Is APR

How To Calculate Apr On A Loan In Excel

How To Calculate Apr On A Loan In Excel

https://www.lexingtonlaw.com/content/dam/lexington-law/assets/images/seo-articles/content-image/what-is-apr/how-to-calculate-apr.png

How To Calculate Interest Percentage Haiper

https://i.ytimg.com/vi/QEo2m1d9xbw/maxresdefault.jpg

APR Vs Interest Rate Know The Difference When Choosing A Personal Loan

https://www.upgrade.com/img/apr-vs-interest-rate.png

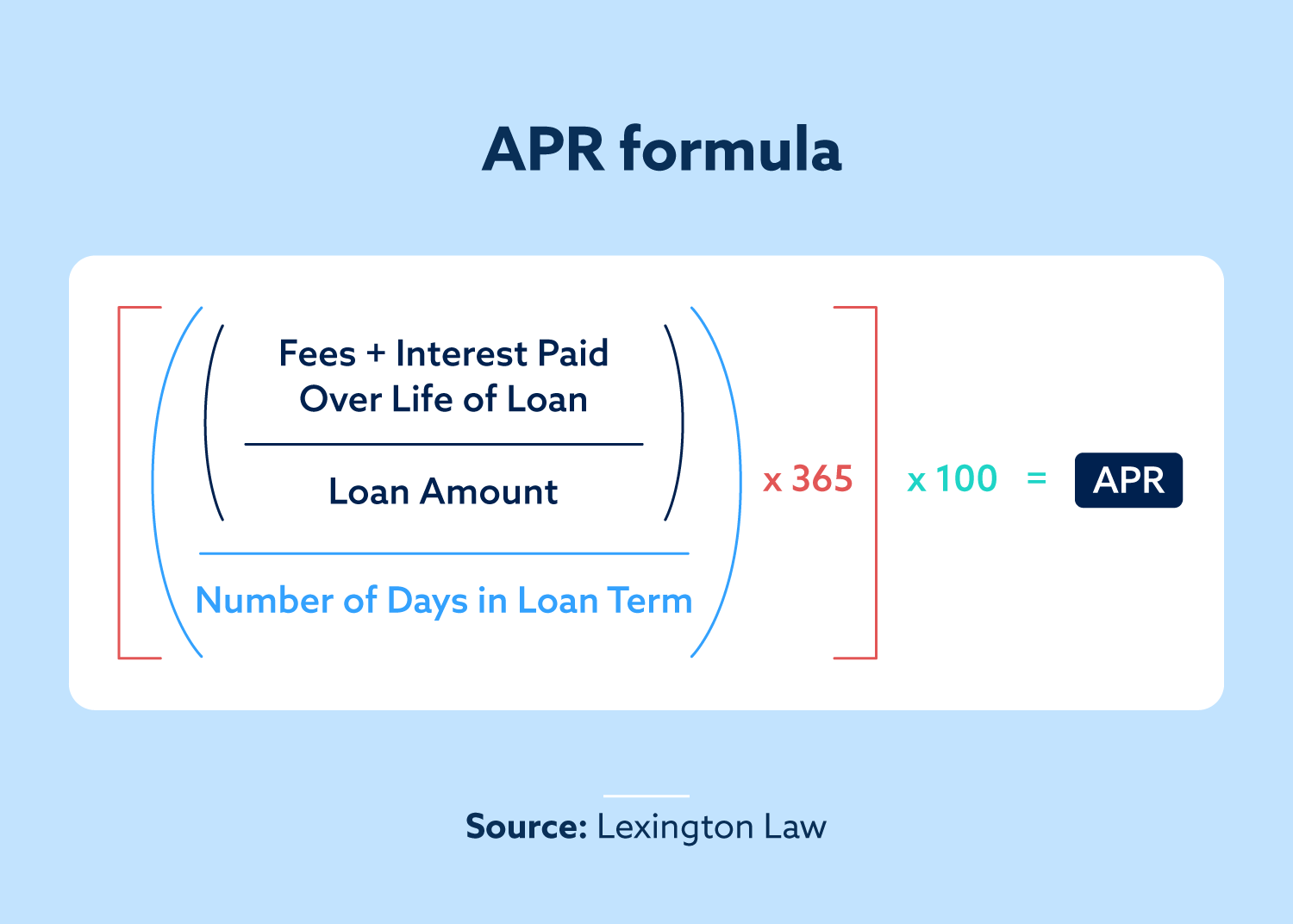

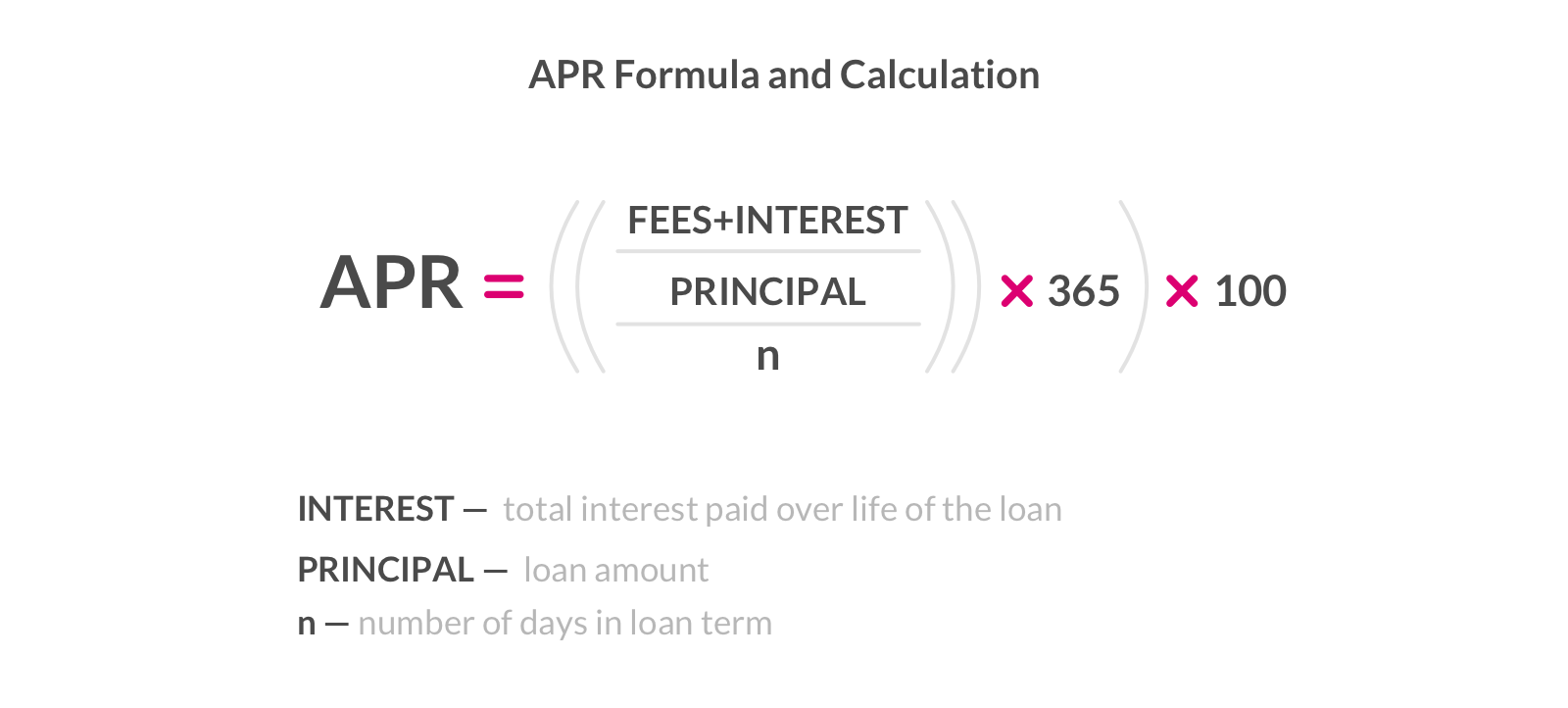

Annual Percentage Rate APR Periodic Interest Rate x 365 Days x 100 Where Periodic Interest Rate Interest Expense Total Fees Loan Principal Number of Days in Loan Term To express the APR as a percentage the amount must be multiplied by 100 What is the Conceptual Meaning of APR Follow these steps to effectively set up your Excel document for calculating APR A Open a new Excel document Begin by opening a new Excel document on your computer This will serve as the foundation for your APR calculation B Labeling the necessary columns and cells

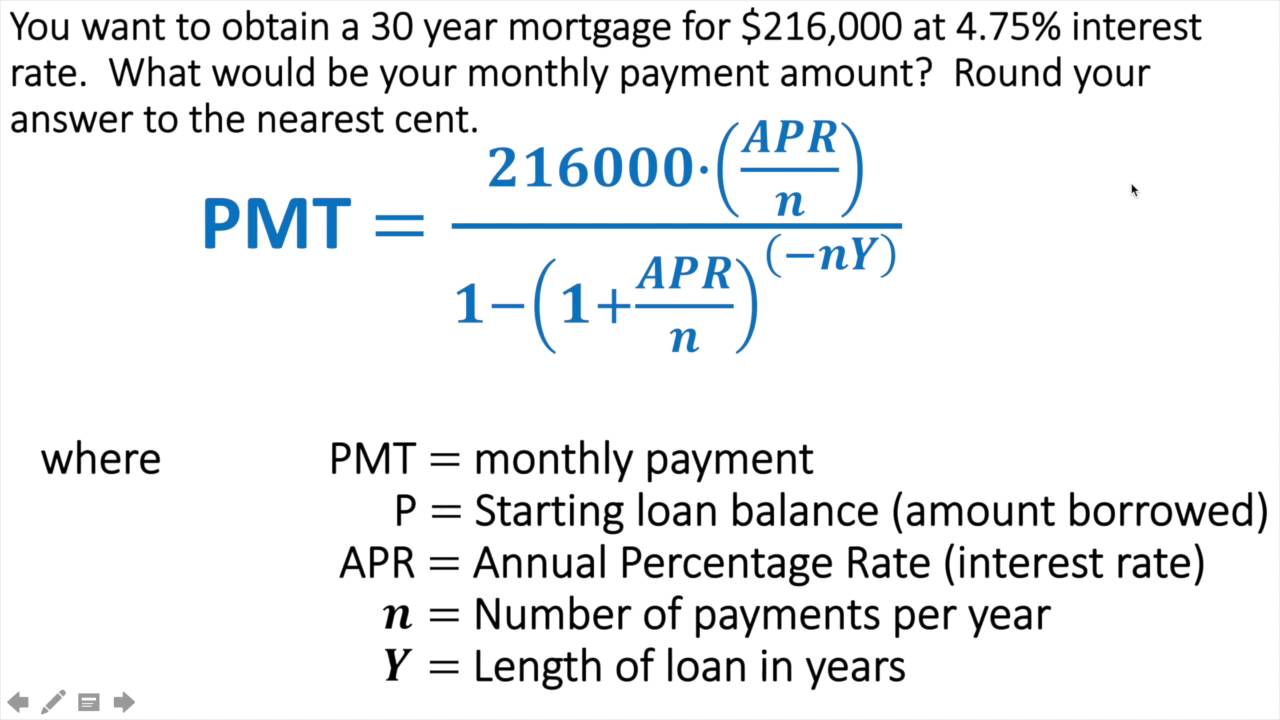

The basic formula for calculating monthly payment with APR is Monthly Payment P r 1 1 r n Where P principal loan amount r monthly interest rate n number of payments loan term in months B Importance of understanding the formula before using Excel In a new cell use the formula for calculating the total amount paid over the loan term 2 Enter the formula syntax PMT interest rate 12 loan term loan amount loan term 3 Press Enter to calculate the total amount paid over the loan term By following these steps you can easily calculate the APR for a loan using Excel

More picture related to How To Calculate Apr On A Loan In Excel

Calculate Payment For A Loan Excel Formula Exceljet

https://exceljet.net/sites/default/files/styles/og_image/public/images/formulas/calculate payment for a loan.png

What Is A Personal Loan APR How It Works Examples

https://cdn.wallethub.com/wallethub/posts/68136/personal-loan-apr.jpg

How To Calculate APR Using Excel YouTube

https://i.ytimg.com/vi/RcoYMTxgKLg/maxresdefault.jpg

In this example we want to calculate the annual interest rate for 5 year 5000 loan and with monthly payments of 93 22 The RATE function is used like this RATE C7 C6 C5 C8 The function arguments are configured as follows nper The number of periods is 60 5 12 and comes from cell C7 The following two calculators help reveal the true costs of loans through real APR General APR Calculator Real APR 6 563 74 24 2 Principal Interest Fees View Amortization Table Mortgage APR Calculator Use the calculator below for mortgage loans in the United States Real APR 6 367 45 54 1 Principal Interest Fees Related

To save 8 500 in three years would require a savings of 230 99 each month for three years The rate argument is 1 5 divided by 12 the number of months in a year The NPER argument is 3 12 for twelve monthly payments over three years The PV present value is 0 because the account is starting from zero The FV future value that you want Step 2 Enter the Data into Excel Once you have all the necessary information you can enter it into Excel Start by entering the loan amount in cell A1 Then enter the interest rate in cell A2 Next enter the number of payments in cell A3 Finally enter any additional fees in cell A4 Step 3 Calculate the APR

What Is An APR Lemonade Homeowners Insurance

https://www.lemonade.com/content-hub/homeowners/wp-content/uploads/2022/01/APR-formula-Calculation.png

Calculating Loan Payments For A Mortgage YouTube

https://i.ytimg.com/vi/Ryfn1L1mjXw/maxresdefault.jpg

How To Calculate Apr On A Loan In Excel - Follow these steps to effectively set up your Excel document for calculating APR A Open a new Excel document Begin by opening a new Excel document on your computer This will serve as the foundation for your APR calculation B Labeling the necessary columns and cells