How To Calculate Reducing Interest Rate On A Loan In Excel If the Payment Frequency is Monthly then at first we have to calculate the Rate for a month Annual Percentage Rate 12 9 50 12 0 792 0 00792 The next thing is we have to calculate the monthly PMT for the loan using Excel s PMT function PMT rate nper loan Here rate 0 00792

To get the monthly payment amount for a loan with four percent interest 48 payments and an amount of 20 000 you would use this formula PMT B2 12 B3 B4 As you see here the interest rate is in cell B2 and we divide that by 12 to obtain the monthly interest Then the number of payments is in cell B3 and loan amount in cell B4 1 Set up the amortization table For starters define the input cells where you will enter the known components of a loan C2 annual interest rate C3 loan term in years C4 number of payments per year C5 loan amount

How To Calculate Reducing Interest Rate On A Loan In Excel

How To Calculate Reducing Interest Rate On A Loan In Excel

https://www.wikihow.com/images/6/6d/Calculate-Mortgage-Interest-Step-14.jpg

How To Calculate Fixed Rate Loan Haiper

https://lh5.googleusercontent.com/proxy/D37vhAQY8dKmWDB2DapW9FSyTw8sJb7P5ljCDlLjzPORcETwGt0aGh8rDQb3QP4GFap4sKpRZMk_SVt5A7MBtyn3QYmj3a-zTeTJXx95OpES_sFqY7vXi0hy=w1200-h630-p-k-no-nu

Wendy Jimenez Where Will Mortgage Rates Be Headed In 2015

http://www.keepingcurrentmatters.com/wp-content/uploads/2015/01/Interest-Rates-2015.jpg

In the chart above we assumed a 20 down payment on a 500 000 home making a total loan amount of 400 000 with a 30 year fixed term comparing a 6 7 and 8 rate Getting a home loan at a 6 Reducing the interest rate is by far the most popular reason to refinance a mortgage If you can qualify for a lower rate than your existing mortgage interest rate refinancing can reduce your monthly mortgage payments or potentially save thousands in interest over the life of your loan

Shorter term loans can also help you get a lower interest rate both on ARMs and on fixed rate loans For example the current rate on 30 year fixed rate loans last week was 6 90 according The PMT function syntax has the following arguments Rate Required The interest rate for the loan Nper Required The total number of payments for the loan Pv Required The present value or the total amount that a series of future payments is worth now also known as the principal Fv Optional

More picture related to How To Calculate Reducing Interest Rate On A Loan In Excel

How To Calculate Simple Interest On Reducing Balance In Excel

https://www.exceldemy.com/wp-content/uploads/2022/06/How-to-Calculate-Simple-Interest-on-Reducing-Balance-in-Excel-1-1-767x829.png

Loan Repayment Formula EmmalineShane

https://i.pinimg.com/originals/6d/81/2a/6d812add1a01581d4bbd053e394f856f.jpg

A Simple Explanation Of How Student Loan Interest Is Calculated

https://www.fundingcloudnine.com/wp-content/uploads/2017/02/student-loan-interest-equation-example.jpg

To calculate the interest rate using the PV and FV functions in Excel you will first need to input the necessary data into the spreadsheet This includes the present value PV future value FV and the number of periods N for the loan or investment Present Value PV Input the initial amount of the loan or investment Calculate mortgage rates Modify the interest rate to evaluate the impact of seemingly minor rate changes Knowing that rates can change daily consider the impact of waiting to improve your credit score in exchange for possibly qualifying for a lower interest rate

The loan calculations will be as below Things to note in the above calculation Interest Payable The total interest payable calculation is simple But on downside this simplicity makes the fixed interest loans expensive for the borrowers Calculation Rs 1 00 000 x 8 5 x 1 year Rs 8 500 Where Rate required the constant interest rate per period You can supply it as a percentage or decimal number For example if you make annual payments on a loan with an annual interest rate of 6 percent use 6 or 0 06 for rate If you make weekly monthly or quarterly payments divide the annual rate by the number of payment periods per year as shown in this example

How To Calculate Your Monthly Mortgage Payment Given The Principal

https://i.ytimg.com/vi/6bLg_Ex0A-4/maxresdefault.jpg

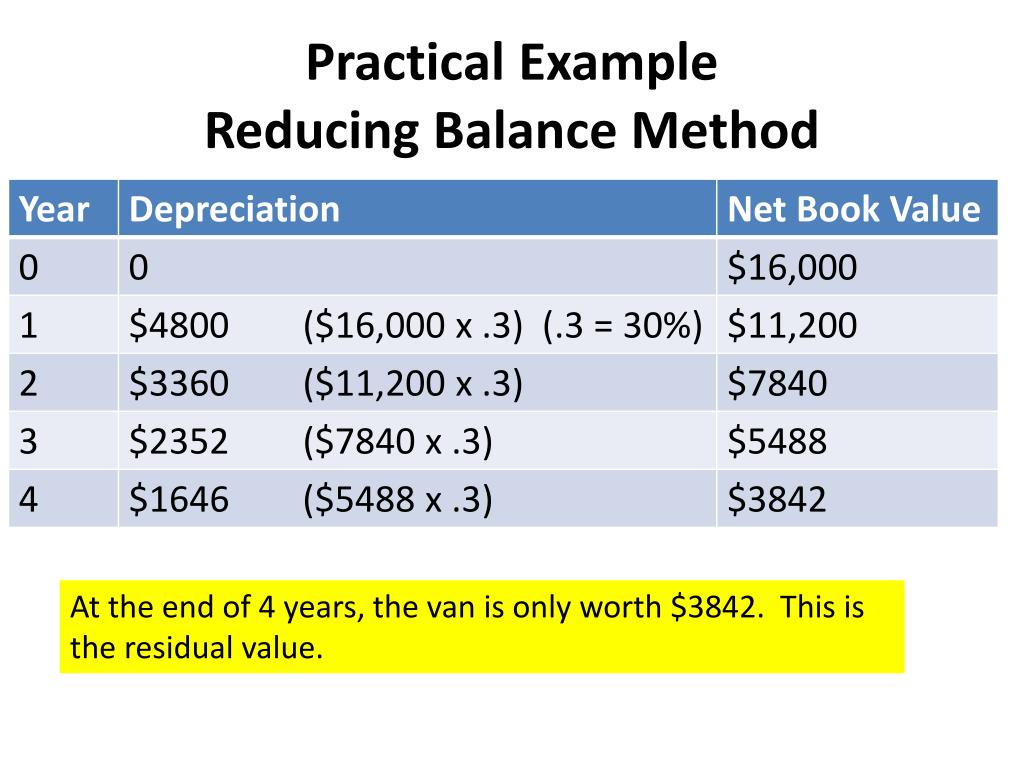

How To Calculate Depreciation By Reducing Balance Method Haiper

https://image1.slideserve.com/2515132/practical-example-reducing-balance-method1-l.jpg

How To Calculate Reducing Interest Rate On A Loan In Excel - Reducing the interest rate is by far the most popular reason to refinance a mortgage If you can qualify for a lower rate than your existing mortgage interest rate refinancing can reduce your monthly mortgage payments or potentially save thousands in interest over the life of your loan