How To Calculate Apr On A Loan APR Calculator Loan Amount Interest Rate Compounding Number of Payments Payment Frequency Additional Fees Non Financing Fees Added to the loan 0 Financing Fees Added to the loan 1 Prepaid Financing Fees Prepaid separately 2 Answer Annual Percentage Rate APR Total Financial Charges Amount Financed Total Payments

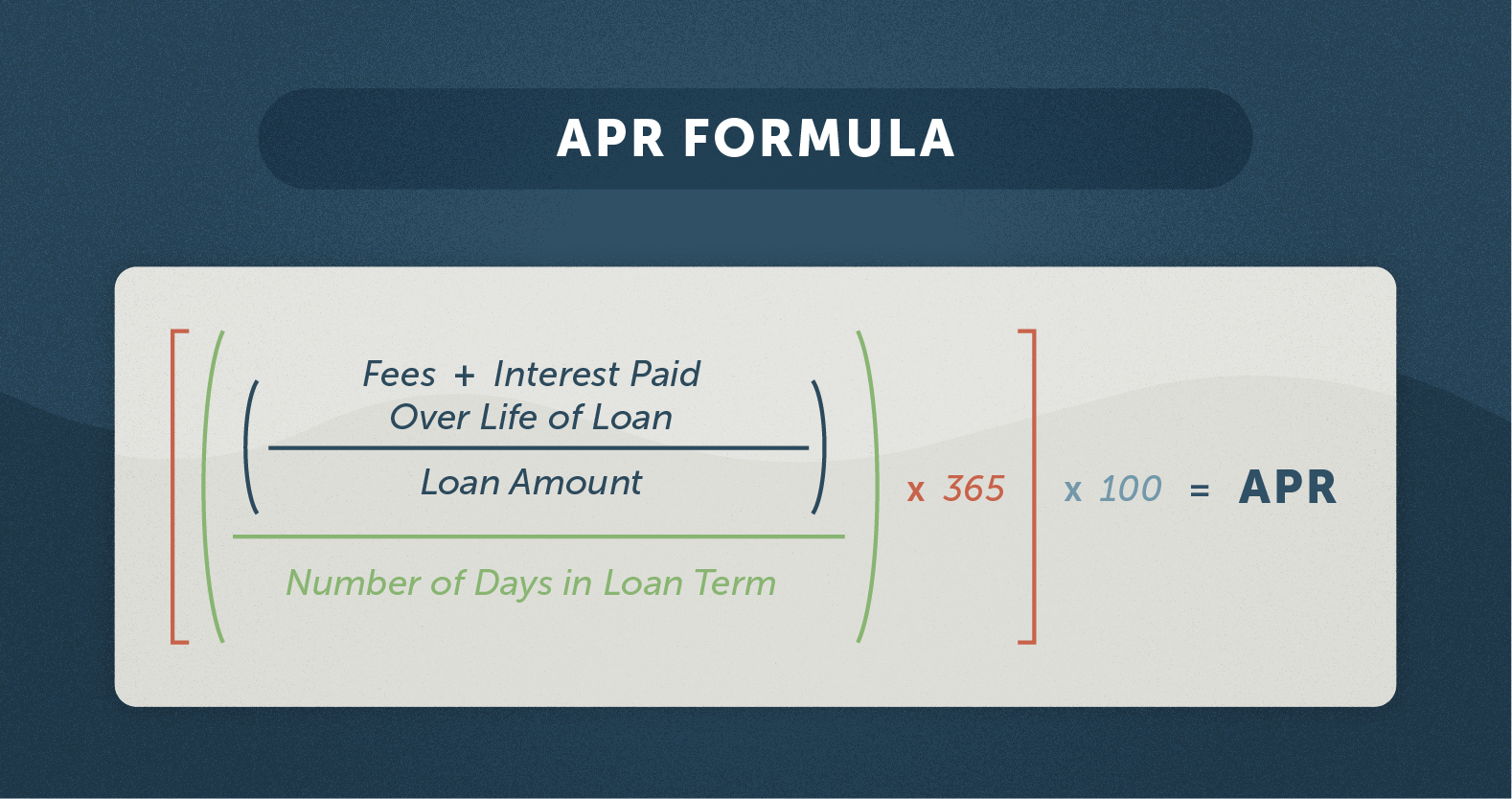

APR Interest Fees Loan amount Number of days in loan term x 365 x 100 What is the difference between APR and interest rate A loan s APR tends to be higher than its APR is calculated in three steps Add the fees to the loan amount At the loan s interest rate figure what the monthly payment would be if you include fees in the loan amount rather than

How To Calculate Apr On A Loan

How To Calculate Apr On A Loan

https://goldenfs.org/wp-content/uploads/2019/12/what-is-apr_2-apr-formula.png

How To Calculate Interest Rate Loan Haiper

https://usercontent2.hubstatic.com/13347425.jpg

What Is APR Mortgage APR MLS Mortgage

https://www.mlsmortgage.com/wp-content/uploads/How-to-Calculate-APR-on-a-Mortgage-Calculate-APR-Annual-Percentage-Rate-Calculation-1024x768.png

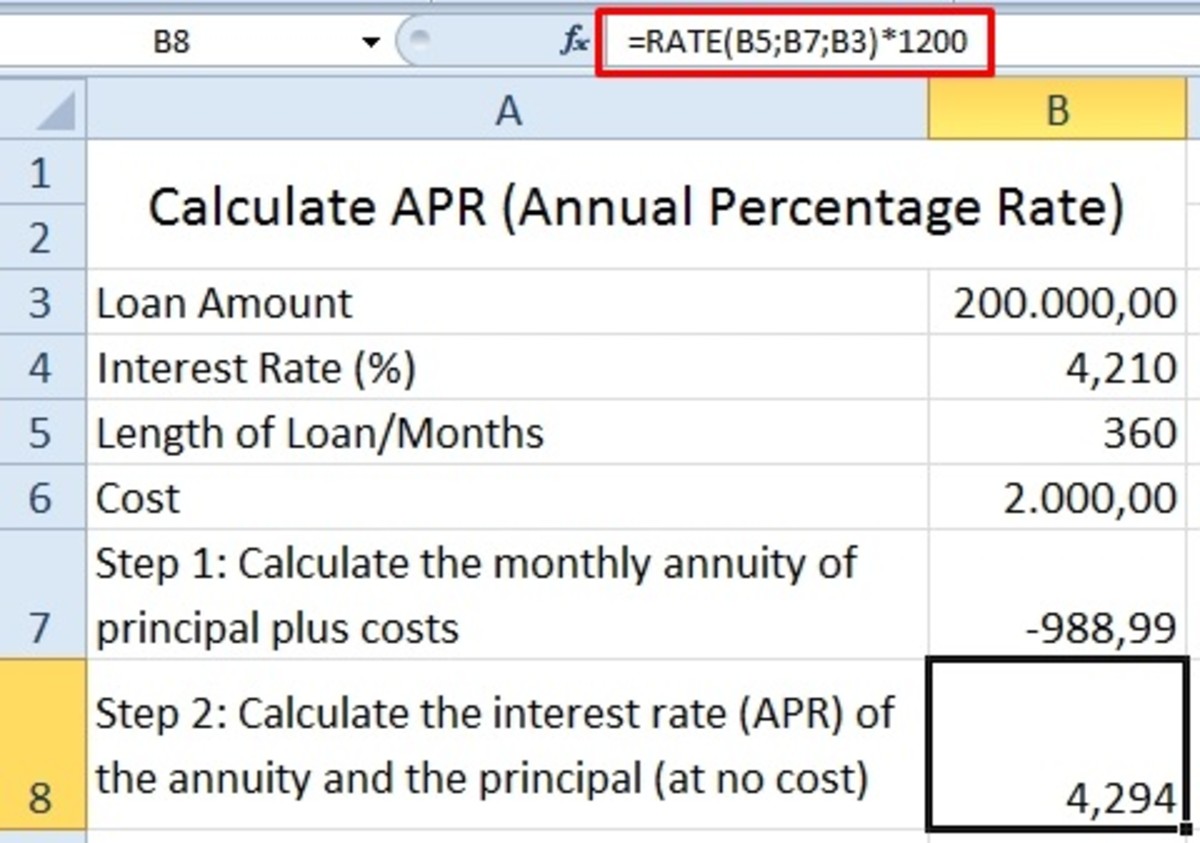

APR Calculator is an advanced device that helps you to compute the Annual Percentage Rate APR that is the annual rate charged for the credit APR then represents the total cost of the borrowed money By computing the APR rate you can easily compare different loan offers so that you can have a better understanding of the real cost of borrowing This basic APR Calculator finds the effective annual percentage rate APR for a loan such as a mortgage car loan or any fixed rate loan The APR is the stated interest rate of the loan averaged over 12 months

The APR calculator determines a loan s APR based on its interest rate fees and terms You can use it as you compare offers by entering the following details Loan amount How much you plan to borrow Finance charges Required fees from the lender such as an origination fee or mortgage broker fee How Is APR Calculated APR is calculated by multiplying the periodic interest rate by the number of periods in a year in which it was applied It does not indicate how many times the rate is

More picture related to How To Calculate Apr On A Loan

What Is APR Mortgage APR MLS Mortgage

https://www.mlsmortgage.com/wp-content/uploads/Formula-to-Calculate-APR-rate-Formula-for-Calculating-APR-1024x768.png

Bad Credit Loan Companies In Maryland March 2017

https://www.mlsmortgage.com/wp-content/uploads/Calculate-APR-Mortgage-How-is-Mortgage-APR-Calculated-APR-Fees-Mortgage-Rate-APR-Difference-1024x768.png

How To Calculate Interest Using Apr Haiper

https://www.wikihow.com/images/6/6d/Calculate-Mortgage-Interest-Step-14.jpg

Our calculator shows you the total cost of a loan expressed as the annual percentage rate or APR Enter the loan amount term and interest rate in the fields below and click calculate to see What Is APR APR provides the best measure of how much borrowers pay for mortgage loans each year It s an even more effective way of measuring your loan s annual cost than its interest rate Why Because your APR does not just include how much you ll pay in interest for your mortgage

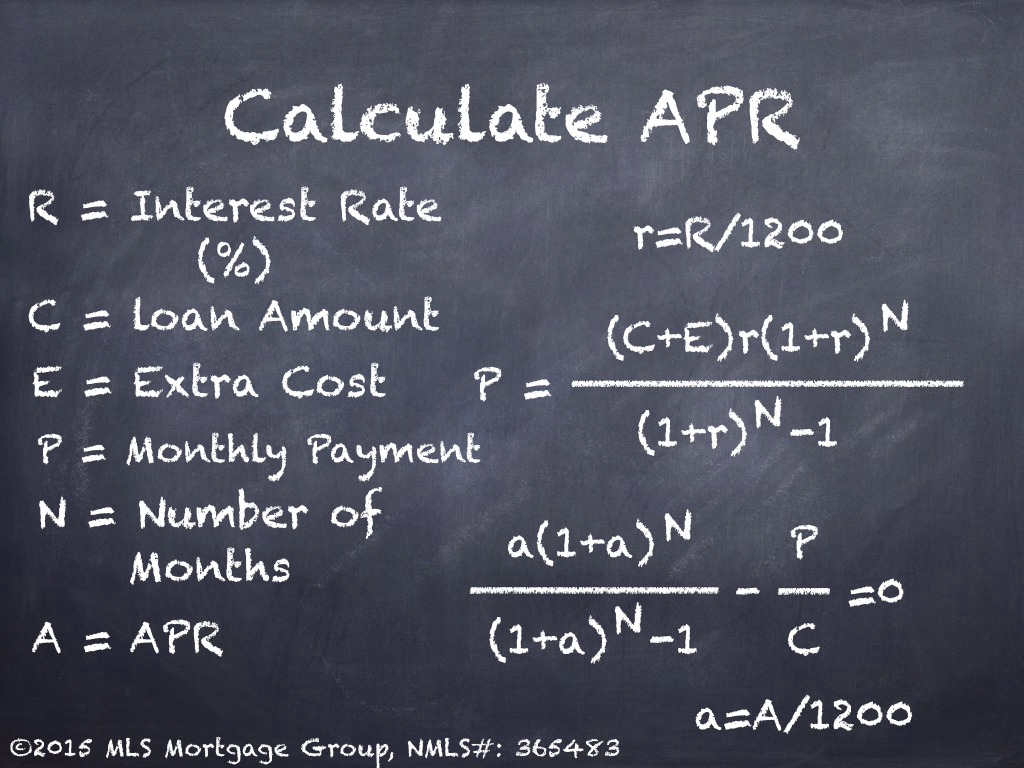

Here s the formula for calculating APR APR Interest charges fees Principal n x 365 x 100 APR Calculation Example Here s an example of using the formula to calculate APR For simplicity s sake we ll use smaller numbers as APR is part of any loan not just a mortgage Use this annual percentage rate calculator to determine the annual percentage rate or APR for your mortgage Press the View Report button for a full amortization schedule either by year or

What Is A Personal Loan APR How It Works Examples

https://cdn.wallethub.com/wallethub/posts/68136/personal-loan-apr.jpg

How To Calculate A Mortgage Payment Amount Mortgage Payments

https://i.ytimg.com/vi/Wzcn2I_6OCs/maxresdefault.jpg

How To Calculate Apr On A Loan - The APR calculator determines a loan s APR based on its interest rate fees and terms You can use it as you compare offers by entering the following details Loan amount How much you plan to borrow Finance charges Required fees from the lender such as an origination fee or mortgage broker fee