How Much Per Paycheck Is 80000 Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

Step 6 Your paycheck For the final step divide your net pay by your pay frequency The following is the formula for each pay frequency Daily Your net pay Days worked per week Weeks worked per year Your daily paycheck Weekly Your net pay 52 Your weekly paycheck The gross pay method refers to whether the gross pay is an annual amount or a per period amount The annual amount is your gross pay for the whole year Per period amount is your gross pay every payday For example if your annual salary were 52 000 and you are paid weekly your annual amount is 52 000 and your per period amount is 1 000

How Much Per Paycheck Is 80000

How Much Per Paycheck Is 80000

https://www.savingadvice.com/wp-content/uploads/2022/08/How-Much-Money-Is-80000-Pennies-scaled-467x700.jpg

80 000 A Year Is How Much An Hour Saving Budgeting Guidelines

https://www.moneyforthemamas.com/wp-content/uploads/2022/07/saving-recommendations-on-80000-salary-512x1024.jpg

How Much Per Paycheck Is A 10k Raise Lauracaldwell

https://lauracnsd.lauracaldwell.com/how-much-per-paycheck-is-a-10k-raise-.jpg

An individual who receives 60 384 07 net salary after taxes is paid 80 000 00 salary per year after deducting State Tax Federal Tax Medicare and Social Security Let s look at how to calculate the payroll deductions in the US How much Federal Tax should I pay on 80 000 00 You will pay 9 441 00 in Federal Tax on a 80 000 00 In 2022 your employer will withhold 6 2 of your wages up to 147 000 for Social Security Additionally you must pay 1 45 of all of your wages for Medicare without any limitations If you

How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator

More picture related to How Much Per Paycheck Is 80000

How Much Is 80000 Pennies In Dollars Go World Win

https://goworldwin.com/wp-content/uploads/2021/12/How-Much-Is-80000-Pennies-1024x572.png

80 000 A Year Is How Much An Hour Saving Budgeting Guidelines

https://www.moneyforthemamas.com/wp-content/uploads/2022/07/50-30-20-budget-for-80000-pay-512x1024.jpg

80 000 A Year Is How Much An Hour Is This A Good Salary Frugal Mom

https://frugalmomboss.com/wp-content/uploads/2022/12/80k-a-year-is-how-much-per-hour.jpg

The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336 The Tax Withholding Estimator doesn t ask for personal information such as your name social security number address or bank account numbers We don t save or record the information you enter in the estimator For details on how to protect yourself from scams see Tax Scams Consumer Alerts Check your W 4 tax withholding with the IRS Tax

Factors that Influence Salary and Wage in the U S Most Statistics are from the U S Bureau of Labor in 2023 In the third quarter of 2023 the average salary of a full time employee in the U S is 1 118 per week which comes out to 58 136 per year While this is an average keep in mind that it will vary according to many different factors In the year 2024 in the United States 80 000 a year gross salary after tax is 63 512 annual 4 783 monthly 1 100 weekly 219 99 daily and 27 5 hourly gross based on the information provided in the calculator above Check the table below for a breakdown of 80 000 a year after tax in the United States Yearly Monthly Weekly Daily

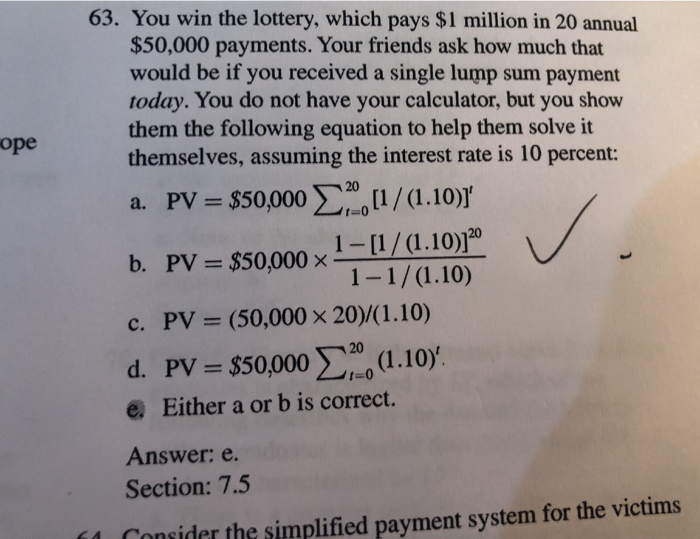

Solved 63 You Win The Lottery Which Pays 1 Million In 20 Chegg

https://media.cheggcdn.com/study/c4f/c4f53971-2802-4a87-82dc-6b5d83257202/image.png

80 000 A Year Is How Much An Hour Saving Budgeting Guidelines

https://www.moneyforthemamas.com/wp-content/uploads/2022/07/80000-a-year-is-how-much-an-hour.jpg

How Much Per Paycheck Is 80000 - In 2022 your employer will withhold 6 2 of your wages up to 147 000 for Social Security Additionally you must pay 1 45 of all of your wages for Medicare without any limitations If you