How Much Per Paycheck Is 90000 Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

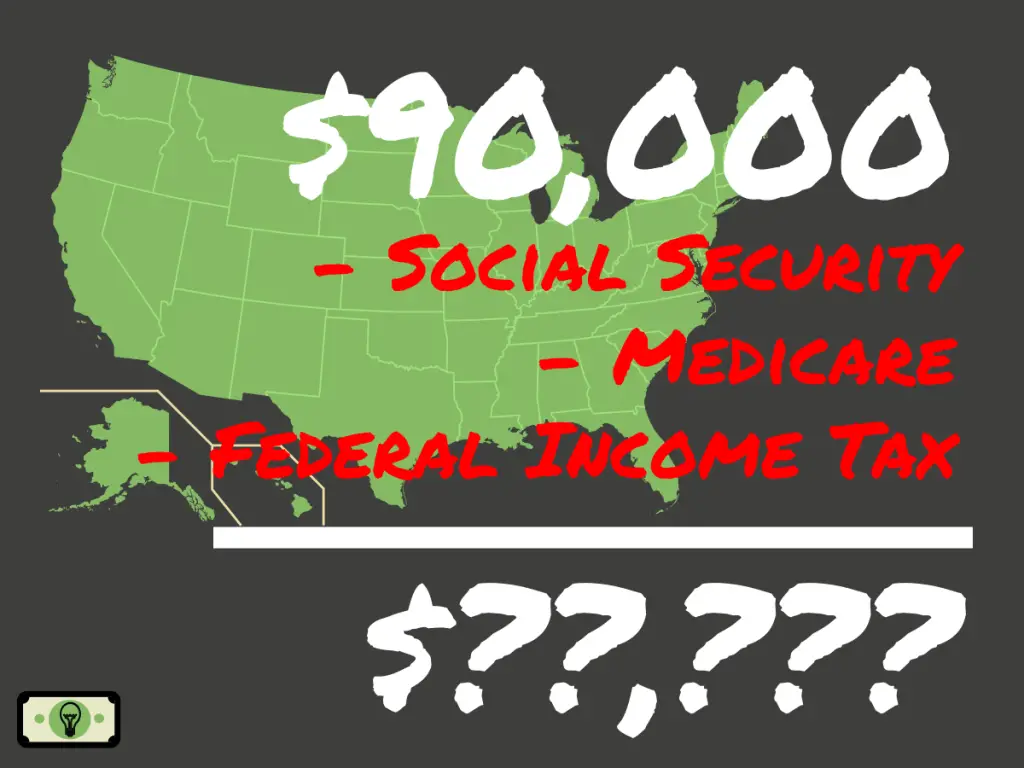

Step 6 Your paycheck For the final step divide your net pay by your pay frequency The following is the formula for each pay frequency Daily Your net pay Days worked per week Weeks worked per year Your daily paycheck Weekly Your net pay 52 Your weekly paycheck An individual who receives 67 116 50 net salary after taxes is paid 90 000 00 salary per year after deducting State Tax Federal Tax Medicare and Social Security Let s look at how to calculate the payroll deductions in the US How much Federal Tax should I pay on 90 000 00 You will pay 11 641 00 in Federal Tax on a 90 000 00

How Much Per Paycheck Is 90000

How Much Per Paycheck Is 90000

https://www.insideedition.com/sites/default/files/styles/video_1920x1080/public/images/2021-04/040221_pennies_web.jpg?h=d1cb525d&width=1280&height=720

Federal Taxes Withheld From Paycheck FederalProTalk

https://www.federalprotalk.com/wp-content/uploads/texas-tax-withholding-federal-witholding-tables-2021.png

90 000 A Year Is How Much An Hour Monthly Budget Breakout

https://www.moneyforthemamas.com/wp-content/uploads/2022/07/fi-90000-a-year-is-how-much-an-hour.jpg

In 2022 your employer will withhold 6 2 of your wages up to 147 000 for Social Security Additionally you must pay 1 45 of all of your wages for Medicare without any limitations If you The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator Use this tool to Estimate your federal income tax withholding See how your refund take home pay or tax due are affected by withholding amount Choose an estimated withholding amount that works for you Results are as accurate as the information you enter

More picture related to How Much Per Paycheck Is 90000

How Much Should I Save Per Paycheck Monorail

https://assets-global.website-files.com/6166b489cfba8272a0a24114/6259103afccbda2cf731727b_how-much-should-i-save-per-paycheck-calculator.jpg

How Much Per Paycheck Will Go Toward Your Retirement

https://rs.aig.com/content/dam/valic/america-canada/us-corporate/images/nextgen-images/hero-landing/hero-image-1030964930-1600x450.jpg

90000 A Year Is How Much An Hour Good Salary Money Bliss

https://moneybliss.org/wp-content/uploads/2021/11/90000-a-year-long.jpg

An hourly calculator lets you enter the hours you worked and amount earned per hour and calculate your net pay paycheck amount after taxes You will see what federal and state taxes were deducted based on the information entered You can use this tool to see how changing your paycheck affects your tax results This calculator helps you determine the gross paycheck needed to provide a required net amount First enter the net paycheck you require Then enter your current payroll information and deductions

37 609 351 or more 731 201 or more 365 601 or more 690 351 or more Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary Federal tax state tax Medicare as well as Social Security tax allowances are all taken into account and are kept up to date with 2024 25 rates Factors that Influence Salary and Wage in the U S Most Statistics are from the U S Bureau of Labor in 2023 In the third quarter of 2023 the average salary of a full time employee in the U S is 1 118 per week which comes out to 58 136 per year While this is an average keep in mind that it will vary according to many different factors

How Do I Amend My Tax Return TaxesTalk

https://www.taxestalk.net/wp-content/uploads/how-do-i-amend-my-tax-return-______-get-answers-to-all.jpeg

How Much Is 90 000 A Year After Taxes filing Single 2023 Smart

https://smartpersonalfinance.info/wp-content/uploads/2022/08/after-tax-income-on-90000-dollars-sm-2-1024x768.png

How Much Per Paycheck Is 90000 - How much is 90 000 a Year After Tax in the United States In the year 2024 in the United States 90 000 a year gross salary after tax is 70 547 annual 5 305 monthly 1 220 weekly 244 02 daily and 30 5 hourly gross based on the information provided in the calculator above Check the table below for a breakdown of 90 000 a year