How Much Is Your Paycheck If You Make 80000 Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

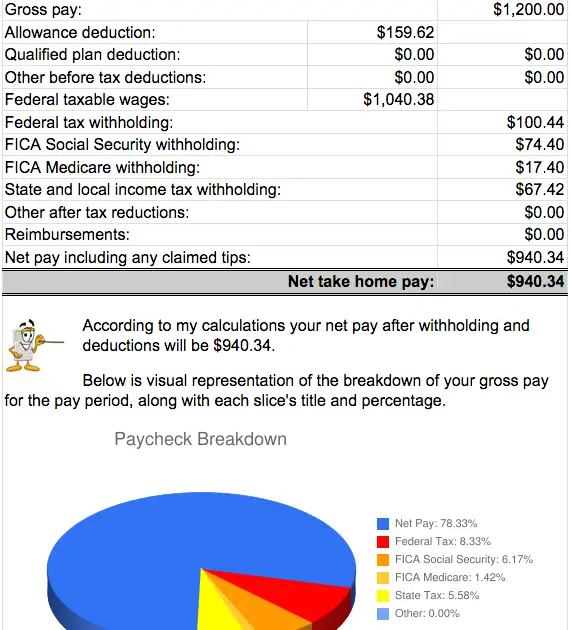

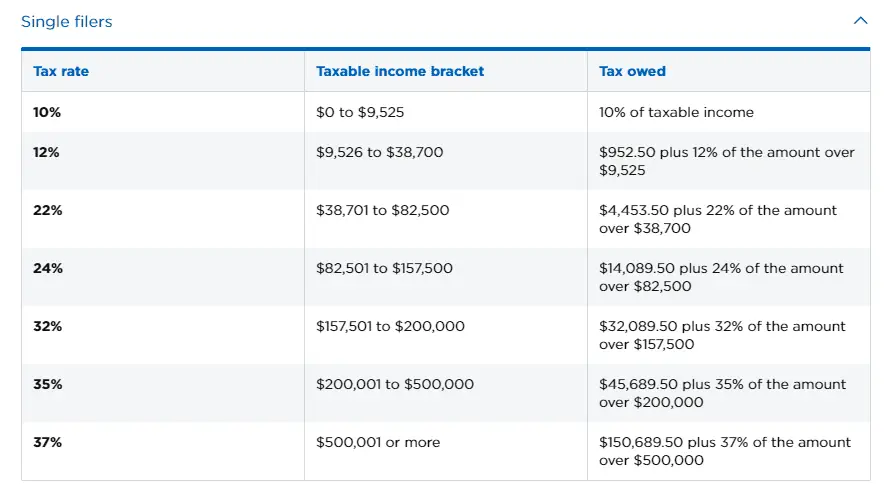

If you earn over 200 000 you can expect an extra tax of 9 of your wages known as the additional Medicare tax Your federal income tax withholdings are based on your income and filing status The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator

How Much Is Your Paycheck If You Make 80000

How Much Is Your Paycheck If You Make 80000

https://www.uhren2000.de/media/image/0f/a6/41/32430385006001-4.jpg

How To Save Money Living Paycheck To Paycheck Life And A Budget

https://lifeandabudget.com/wp-content/uploads/2016/07/yay-5749022-digital.jpg

How Much Taxes Get Taken Out Of Paycheck TaxesTalk

https://www.taxestalk.net/wp-content/uploads/how-much-are-taxes-taken-out-of-paycheck-tax-walls.png

Ask your employer if they use an automated system to submit Form W 4 Submit or give Form W 4 to your employer To keep your same tax withholding amount You don t need to do anything at this time Check your withholding again when needed and each year with the Estimator This helps you make sure the amount withheld works for your circumstance Estimate your 2023 2024 federal taxes with our free income tax calculator and refund estimator Input your income deductions and credits to determine your potential bill or refund Taxable

How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 The gross pay method refers to whether the gross pay is an annual amount or a per period amount The annual amount is your gross pay for the whole year Per period amount is your gross pay every payday For example if your annual salary were 52 000 and you are paid weekly your annual amount is 52 000 and your per period amount is 1 000

More picture related to How Much Is Your Paycheck If You Make 80000

Taxes

https://loginportal.funnyjunk.com/pictures/Taxes_2e06bc_6752130.jpg

Where Does All Your Money Go Your Paycheck Explained

https://www.gannett-cdn.com/-mm-/1f66555fb4d7f329693b5f08f4e67628057c309f/c=0-26-2118-1223/local/-/media/2016/10/31/USATODAY/USATODAY/636135136112978940-paycheck.jpg?width=3200&height=1680&fit=crop

How Much Taxes Do They Take Off Your Paycheck TaxesTalk

https://www.taxestalk.net/wp-content/uploads/how-much-tax-is-taken-out-of-my-paycheck-indiana-tax-walls.png

Unlimited companies employees and payroll runs for 1 low price All 50 states including local taxes and multi state calculations Federal forms W 2 940 and 941 Use PaycheckCity s free paycheck calculators withholding calculators and tax calculators for all your paycheck and payroll needs If your monthly salary is 6 500 your hourly pay is 37 5 h on average To find this result Find the number of hours you worked in a month In an average 8 hours per day job you work 8 5 52 12 173 34 hours monthly Divide your monthly salary by the number of hours you worked in a month 6 500 173 34 h 37 5 h 3 This is your

So benefit estimates made by the Quick Calculator are rough Although the Quick Calculator makes an initial assumption about your past earnings you will have the opportunity to change the assumed earnings click on See the earnings we used after you complete and submit the form below You must be at least age 22 to use the form at right Take Home Pay for 2024 61 259 00 We hope you found this salary example useful and now feel your can work out taxes on 80k salary if you did it would be great if you could share it and let others know about iCalculator We depend on word of mouth to help us grow and keep the US Tax Calculator free to use

How To Calculate Your Biweekly Paycheck If You Make 13 An Hour

https://insidethewebb.com/wp-content/uploads/2022/08/how-to-calculate-your-biweekly-paycheck-if-you-make-13-an-hour-1024x1024.png

I Make 80 000 A Year How Much House Can I Afford Bundle

https://bundleloan.com/blog/wp-content/uploads/2020/06/80000.png

How Much Is Your Paycheck If You Make 80000 - The gross pay method refers to whether the gross pay is an annual amount or a per period amount The annual amount is your gross pay for the whole year Per period amount is your gross pay every payday For example if your annual salary were 52 000 and you are paid weekly your annual amount is 52 000 and your per period amount is 1 000