How Much Is Your Paycheck If You Make 80k A Year Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

The following is the formula for each pay frequency Daily Your net pay Days worked per week Weeks worked per year Your daily paycheck Weekly Your net pay 52 Your weekly paycheck Bi weekly Your net pay 26 Your bi weekly paycheck Semi monthly Your net pay 24 Your semi monthly paycheck Ask your employer if they use an automated system to submit Form W 4 Submit or give Form W 4 to your employer To keep your same tax withholding amount You don t need to do anything at this time Check your withholding again when needed and each year with the Estimator This helps you make sure the amount withheld works for your circumstance

How Much Is Your Paycheck If You Make 80k A Year

How Much Is Your Paycheck If You Make 80k A Year

https://i.ytimg.com/vi/IcTpUPqSJp4/maxresdefault.jpg

17 Simple Jobs To Earn Up To 80k Per Year Work From Home Jobs Money

https://i.pinimg.com/originals/31/39/76/313976323370d52c3a599265cfe5923e.png

How Much Should You Save From Your Paycheck Clever Girl Finance

https://www.clevergirlfinance.com/wp-content/uploads/2021/08/How-much-should-you-save-from-your-paycheck.jpg

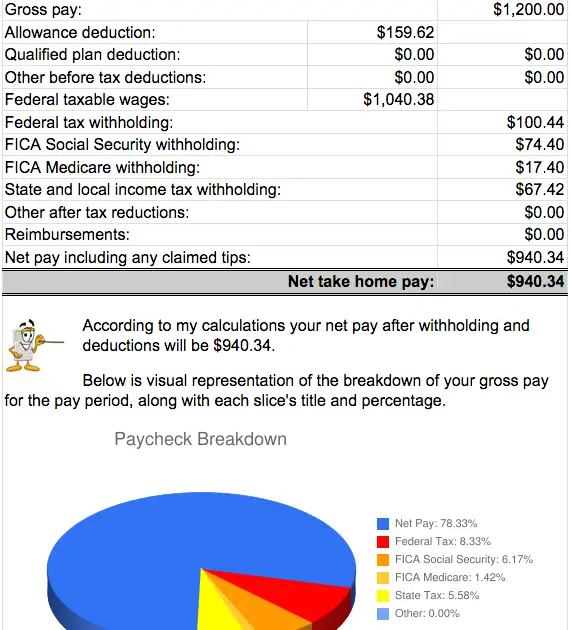

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator 2012 47 680 New York State s progressive income tax system is structured similarly to the federal income tax system There are nine tax brackets that vary based on income level and filing status Wealthier individuals pay higher tax rates than lower income individuals New York s income tax rates range from 4 to 10 9

In 2022 your employer will withhold 6 2 of your wages up to 147 000 for Social Security Additionally you must pay 1 45 of all of your wages for Medicare without any limitations If you Beginning in calendar year 2024 Missouri s top income tax rate falls to 4 8 A financial advisor in Missouri can help you understand how taxes fit into your overall financial goals SmartAsset s free tool matches you with up to three vetted financial advisors who serve your area and you can have a free introductory call with your advisor matches to decide which one you feel is right for you

More picture related to How Much Is Your Paycheck If You Make 80k A Year

Infographic Reveals Exactly How Much YOU Earn Compared To Billionaires

https://i.pinimg.com/736x/d4/51/e3/d451e318e18d6a1ac2930db8515057b8.jpg

Taxes

https://loginportal.funnyjunk.com/pictures/Taxes_2e06bc_6752130.jpg

How Much Taxes Get Taken Out Of Paycheck TaxesTalk

https://www.taxestalk.net/wp-content/uploads/how-much-are-taxes-taken-out-of-paycheck-tax-walls.png

The gross pay method refers to whether the gross pay is an annual amount or a per period amount The annual amount is your gross pay for the whole year Per period amount is your gross pay every payday For example if your annual salary were 52 000 and you are paid weekly your annual amount is 52 000 and your per period amount is 1 000 Calculate your take home pay after various taxes For United States residents Constantly updated to keep up with the tax year

37 609 351 or more 731 201 or more 365 601 or more 690 351 or more Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary Federal tax state tax Medicare as well as Social Security tax allowances are all taken into account and are kept up to date with 2024 25 rates Estimate your US federal income tax for 2023 2022 2021 2020 2019 2018 2017 2016 or 2015 using IRS formulas The calculator will calculate tax on your taxable income only Does not include income credits or additional taxes Does not include self employment tax for the self employed Also calculated is your net income the amount you

Millionaire Reacts Living On 80K A Year In Los Angeles Millennial

https://i.ytimg.com/vi/4tdECsCJgCI/maxresdefault.jpg

HE MUST MAKE 80K HONEY A YEAR BE GOOD WITH CUBS AND HAVE A 7

https://i.redd.it/hrpn075bsqq41.jpg

How Much Is Your Paycheck If You Make 80k A Year - In 2022 your employer will withhold 6 2 of your wages up to 147 000 for Social Security Additionally you must pay 1 45 of all of your wages for Medicare without any limitations If you