How Much Is 85000 Per Month After Taxes FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024

The 12 month period for income taxes begins on January 1st and ends on December 31st of the same calendar year The federal income tax rates differ from state income tax rates Federal taxes are progressive higher rates on higher income levels At the same time states have an advanced tax system or a flat tax rate on all income An individual who receives 64 216 50 net salary after taxes is paid 85 000 00 salary per year after deducting State Tax Federal Tax Medicare and Social Security Answer is 43 88 assuming you work roughly 40 hours per week or you may want to know how much 85k a year is per month after taxes Answer is 5 351 38 in this example

How Much Is 85000 Per Month After Taxes

How Much Is 85000 Per Month After Taxes

https://images-na.ssl-images-amazon.com/images/S/amzn-author-media-prod/7ohtsokqbg48t48s24ms6kq0qd.jpg

85 000 A Year Is How Much An Hour Before And After Taxes The Next

https://thenextgenbusiness.com/wp-content/uploads/2021/07/85000dollarsayear-1024x682.webp

How Much Is 85 000 Per Year After Tax

https://salarycalculators.org/wp-content/uploads/2023/06/85000-After-Tax-1.png

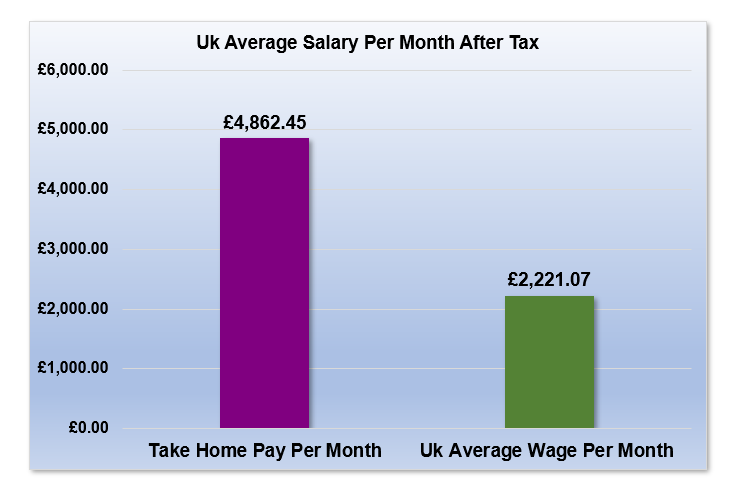

The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336 In the year 2024 in the United States 85 000 a year gross salary after tax is 67 030 annual 5 044 monthly 1 160 weekly 232 01 daily and 29 hourly gross based on the information provided in the calculator above Check the table below for a breakdown of 85 000 a year after tax in the United States Yearly

Age Enter the age you were on Jan 1 2024 Your age can have an effect on certain tax rules or deductions For example people aged 65 or older get a higher standard deduction 401 k 2015 60 413 2014 54 916 2013 53 937 On the state level you can claim allowances for Illinois state income taxes on Form IL W 4 Your employer will withhold money from each of your paychecks to go toward your Illinois state income taxes Illinois doesn t have any local income taxes

More picture related to How Much Is 85000 Per Month After Taxes

Saffron Online Store In America 2023 Price Per Kilo Of Saffron 3160

https://saffronred.com/wp-content/uploads/2022/07/saffron-online-store-in-USA.jpg

How Much Does An Engagement Ring Setting Cost Cheapest Buying Save 62

https://i.shgcdn.com/afc56d34-755b-492c-bb95-9070617915bb/-/format/auto/-/preview/3000x3000/-/quality/lighter/

85 000 A Year Is How Much An Hour Maximize Save Your Income

https://radicalfire.com/wp-content/uploads/2022/09/85000-A-Year-Is-How-Much-An-Hour-Maximize-Save-Your-Income.jpg

This salary calculator assumes the hourly and daily salary inputs to be unadjusted values All other pay frequency inputs are assumed to be holidays and vacation days adjusted values This calculator also assumes 52 working weeks or 260 weekdays per year in its calculations The unadjusted results ignore the holidays and paid vacation days Summary If you make 85 000 a year living in the region of Florida USA you will be taxed 17 971 That means that your net pay will be 67 030 per year or 5 586 per month Your average tax rate is 21 1 and your marginal tax rate is 29 7 This marginal tax rate means that your immediate additional income will be taxed at this rate

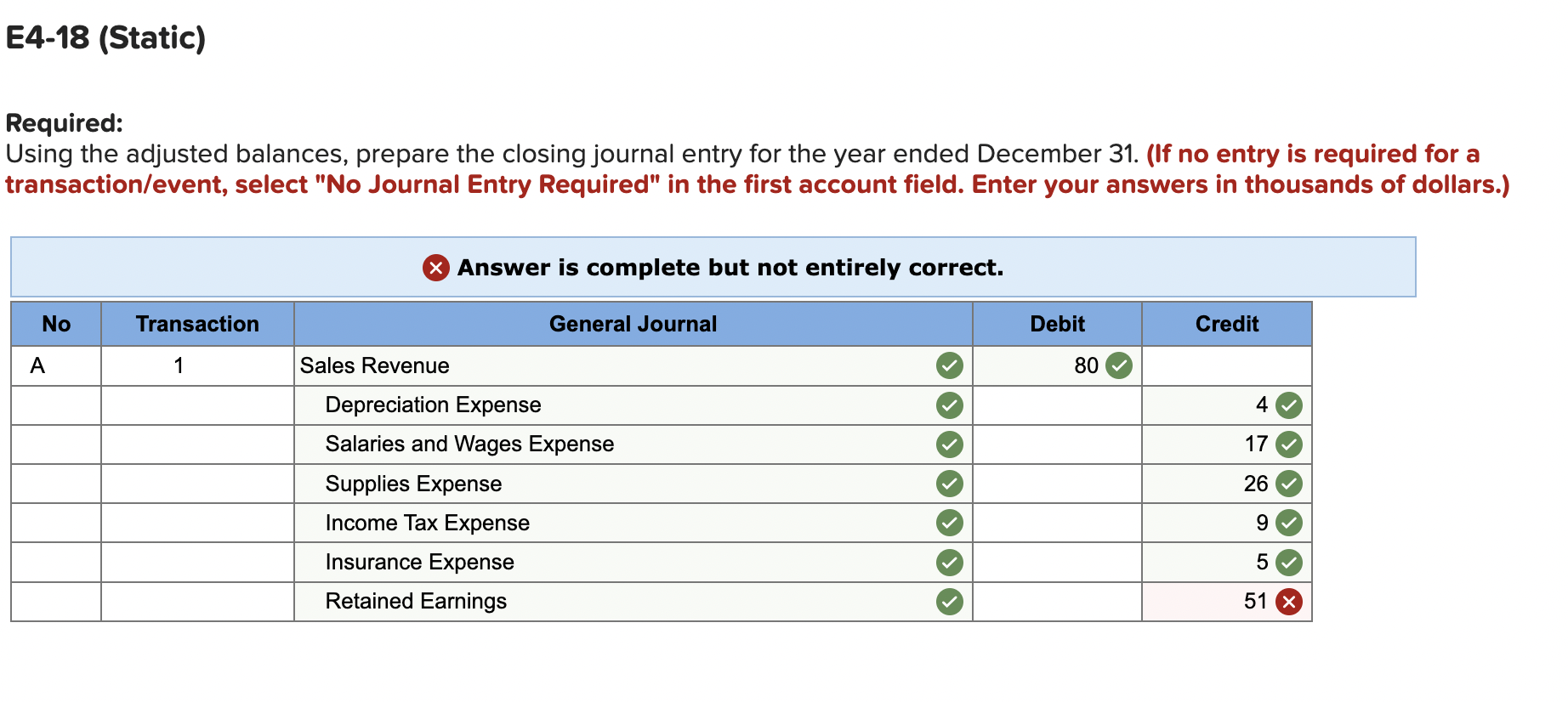

85 000 00 After Tax This income tax calculation for an individual earning a 85 000 00 salary per year The calculations illustrate the standard Federal Tax State Tax Social Security and Medicare paid during the year assuming no changes to salary or circumstance Month 2024 days in month Income Tax Deferred Student loan interest 66 300 annual income after tax 12 months 5 525 So at a yearly salary of 85 000 your monthly income after taxes would be approximately 5 525 While this is a decent estimate your monthly after tax income can be different depending on a variety of factors Factors that Determine Your After Tax Income

Solved Mint Cleaning Incorporated Prepared The Following Chegg

https://media.cheggcdn.com/media/b52/b522cfb3-b961-41aa-acfd-018be27d74e8/phpZFhSBR

You Need 85 000 In 10 Years If You Can Earn 78 Percent Per Month

https://img.homeworklib.com/questions/146013f0-2e28-11ea-b678-690be0bbd67e.png?x-oss-process=image/resize,w_560

How Much Is 85000 Per Month After Taxes - The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336