How Much Is 85000 A Year After Taxes In Florida The FICA tax withholding from each of your paychecks is your way of paying into the Social Security and Medicare systems that you ll benefit from in your retirement years Every pay period your employer will withhold 6 2 of your earnings for Social Security taxes and 1 45 of your earnings for Medicare taxes

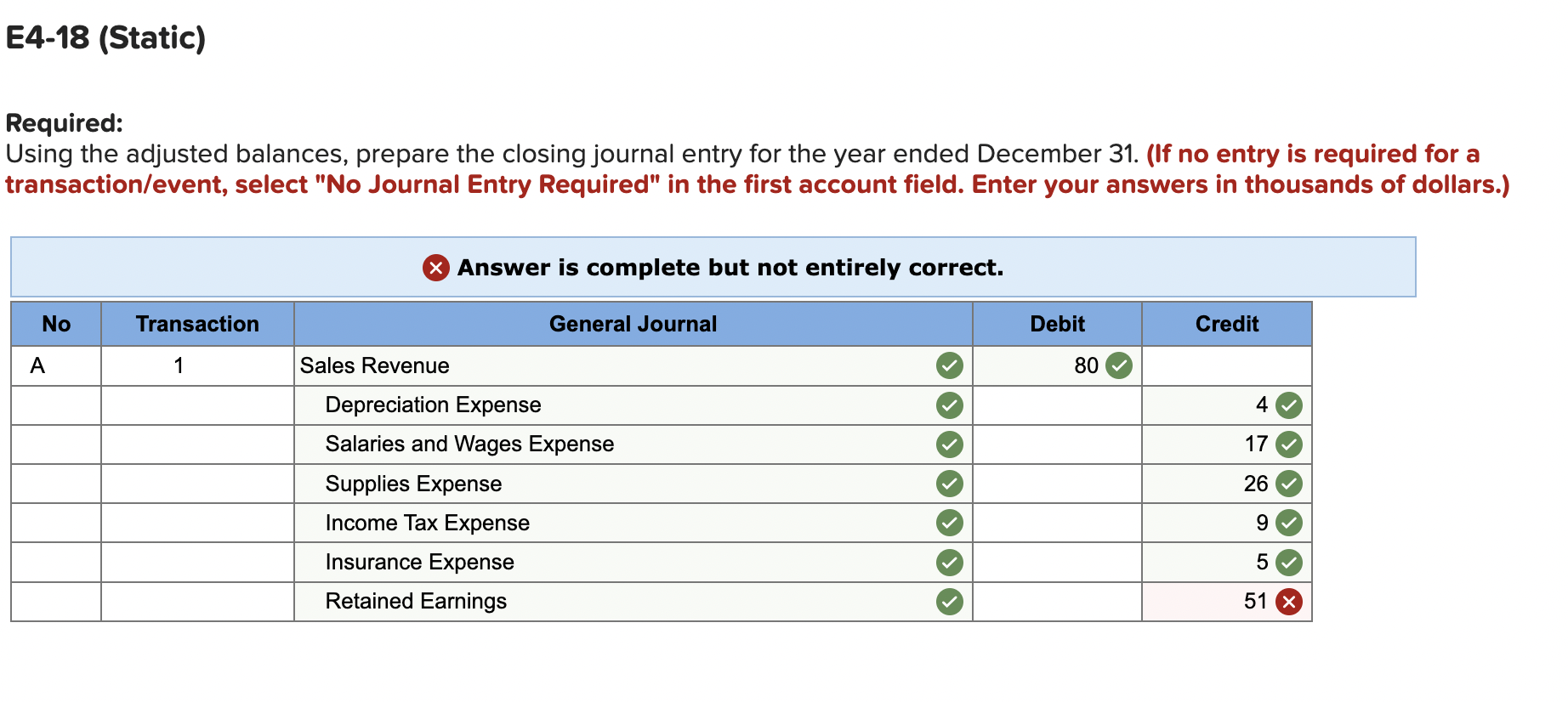

After entering it into the calculator it will perform the following calculations Federal Tax Filing 85 000 00 of earnings will result in 10 541 00 of that amount being taxed as federal tax FICA Social Security and Medicare Filing 85 000 00 of earnings will result in 6 502 50 being taxed for FICA purposes Florida State Tax Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

How Much Is 85000 A Year After Taxes In Florida

How Much Is 85000 A Year After Taxes In Florida

http://static1.squarespace.com/static/5b03437d620b854ca4b2af5f/t/5dbaebd05ce78b6271f24be2/1572531159145/GCMA+3D+Image+1A.png?format=1500w

2023 State Income Tax Rates And Brackets Tax Foundation

https://files.taxfoundation.org/20230217151820/2023-state-individual-income-tax-rates-2023-state-income-taxes-by-state.png

Solved Mint Cleaning Incorporated Prepared The Following Chegg

https://media.cheggcdn.com/media/b52/b522cfb3-b961-41aa-acfd-018be27d74e8/phpZFhSBR

Launch ADP s Florida Paycheck Calculator to estimate your or your employees net pay Free and simple Fast easy accurate payroll and tax so you can save time and money Payroll Overview Overview Small Business Payroll 1 49 Employees For over 70 years ADP has helped enterprise organizations with 1 000 employees make the The tax calculation below shows exactly how much Florida State Tax Federal Tax and Medicare you will pay when earning 85 000 00 per annum when living and paying your taxes in Florida The 85 000 00 Florida tax example uses standard assumptions for the tax calculation This tax example is therefore a flat example of your tax bill in Florida for

85k Salary After Tax in Florida 2024 This Florida salary after tax example is based on a 85 000 00 annual salary for the 2024 tax year in Florida using the State and Federal income tax rates published in the Florida tax tables The 85k salary example provides a breakdown of the amounts earned and illustrates the typical amounts paid each month week day and hour Use this Florida State Tax Calculator to determine your federal tax amounts state tax amounts along with your Medicare and Social Security tax allowances Florida Salary Tax Calculator for the Tax Year 2024 25 85 000 00 Salary Calculation with Graph 90 000 00 Salary Calculation with Graph

More picture related to How Much Is 85000 A Year After Taxes In Florida

85 000 A Year Is How Much An Hour Before And After Taxes The Next

https://thenextgenbusiness.com/wp-content/uploads/2021/07/85000dollarsayear-1024x682.webp

How Much Did Jane Earn Before Taxes New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

85 000 A Year Is How Much An Hour Maximize Save Your Income

https://radicalfire.com/wp-content/uploads/2022/09/85000-A-Year-Is-How-Much-An-Hour-Maximize-Save-Your-Income.jpg

Florida Annual Salary After Tax Calculator 2024 The Annual Salary Calculator is updated with the latest income tax rates in Florida for 2024 and is a great calculator for working out your income tax and salary after tax based on a Annual income The calculator is designed to be used online with mobile desktop and tablet devices Federal income tax 10 to 37 Social Security 6 2 Medicare 1 45 to 2 35 Other non tax deductions also reduce your take home pay The combined tax percentage usually ranges from 15 to 30 Updated on Jul 06 2024 Free tool to calculate your hourly and salary income after federal state and local taxes in Florida

FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024 The current rates for these taxes are 6 2 for Social Security on wages up to 160 200 in 2023 and 1 45 for Medicare on all wages If you have a high income over a certain threshold you ll also see a 0 9 Medicare surtax as well

How Much Is 85 000 A Year After Taxes filing Single 2023 Smart

https://smartpersonalfinance.info/wp-content/uploads/2022/08/after-tax-income-on-85000-dollars-sm-2-1024x768.png

Practice Quiz A Tax Offset Is Subtracted After The Basic Income Tax

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/8354b2745481c32a3190c379b2347259/thumb_1200_1698.png

How Much Is 85000 A Year After Taxes In Florida - Taxes in Florida Florida State Tax Quick Facts Income tax None Sales tax 6 7 50 Property tax 0 86 average effective rate Gas tax 36 525 cents per gallon of regular gasoline and 20 20 cents per gallon of diesel Florida s official nickname is The Sunshine State but it may as well be The Low Tax State