How Much Is 85000 After Taxes In California Verkko California Salary Calculation Single in 2024 Tax Year The table below provides an example of how the salary deductions look on a 85 000 00 salary in 2024 Each key

Verkko SmartAsset s California paycheck calculator shows your hourly and salary income after federal state and local taxes Enter your info to see your take home pay Verkko 1 tammik 2023 nbsp 0183 32 Find out how much you ll pay in California state income taxes given your annual income Customize using your filing status deductions exemptions and more

How Much Is 85000 After Taxes In California

How Much Is 85000 After Taxes In California

https://radicalfire.com/wp-content/uploads/2022/09/85000-A-Year-Is-How-Much-An-Hour-Maximize-Save-Your-Income.jpg

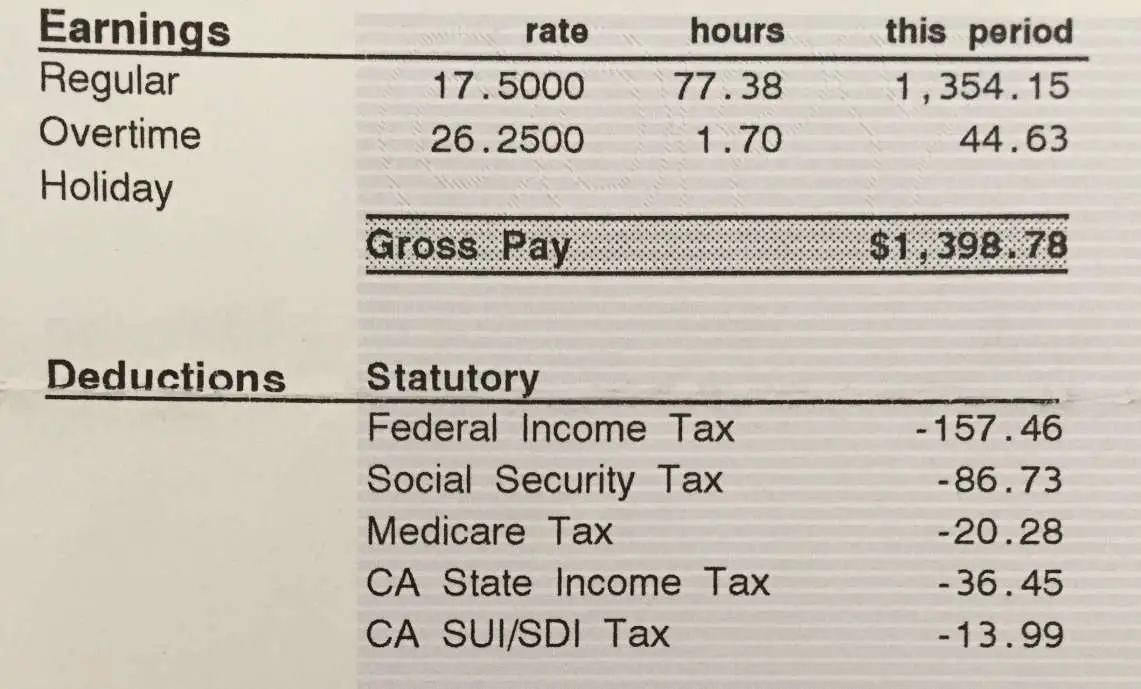

How To Calculate Payroll Taxes In California TaxesTalk

https://www.taxestalk.net/wp-content/uploads/how-to-calculate-paycheck-after-taxes-in-california-tax.jpeg

85 000 A Year Is How Much An Hour Before And After Taxes The Next

https://thenextgenbusiness.com/wp-content/uploads/2021/07/85000dollarsayear.webp

Verkko California Income Tax Calculator 2022 2023 Learn More On TurboTax s Website If you make 70 000 a year living in California you will be taxed 11 221 Your average tax rate is 11 67 Verkko Filing 85 000 00 of earnings will result in of your earnings being taxed as state tax calculation based on 2023 California State Tax Tables This results in roughly of

Verkko 85 000 After Tax CA On this page you ll find a detailed analysis of a 85 000 after tax annual salary for 2023 with calculations for monthly weekly daily and hourly rates as Verkko 29 tammik 2023 nbsp 0183 32 California Paycheck Calculator 2023 Investomatica Last reviewed on January 29 2023 Optional Criteria See values per Year Month Biweekly Week

More picture related to How Much Is 85000 After Taxes In California

How Much Is 85 000 A Year After Taxes filing Single 2023 Smart

https://smartpersonalfinance.info/wp-content/uploads/2022/08/after-tax-income-on-85000-dollars-sm-2-1024x768.png

2 1 Billion Rand Copyright Suit CARL SEIBERT SOLUTIONS

https://www.carlseibert.com/wp-content/uploads/2018/03/rand_banknotes_2048-e1520993949999-600x285.jpg

Making Tax Digital Delayed What You Need To Know Guidon Group

https://guidongroup.co.uk/wp-content/uploads/Making-Tax-Digital-Delayed-Guidon-Group-Accountants-Stockton.jpg

Verkko 27 kes 228 k 2023 nbsp 0183 32 Given you file as a single taxpayer 85 000 will net you 62 560 34 after federal and California state income taxes This means you pay 22 439 66 in Verkko Take Home Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be

Verkko 31 jouluk 2022 nbsp 0183 32 In this article we ll calculate estimates for a salary of 85 000 dollars a year for a taxpayer filing single We also have an article for 85 thousand dollars of Verkko 8 000 00 Salary Income Tax Calculation for California This tax calculation produced using the CAS Tax Calculator is for a single filer earning 8 000 00 per year The

What Is 85 000 After Tax In The US For 2023

https://mugshotbot.com/m?color=teal&hide_watermark=true&mode=dark&pattern=lines_in_motion&url=https://worldsalaries.com/us/salary-calculator/what-is-85000-after-tax/

85000 A Year Is How Much An Hour Savoteur

https://savoteur.com/wp-content/uploads/2022/06/cropped-85000ayearishowmuchanhour.jpg

How Much Is 85000 After Taxes In California - Verkko California Income Tax Calculator 2022 2023 Learn More On TurboTax s Website If you make 70 000 a year living in California you will be taxed 11 221 Your average tax rate is 11 67