How Much Is 26 An Hour After Taxes To calculate the yearly salary for an hourly wage of 26 simply multiply 26 by 40 the number of hours in a full time workweek and then by 52 the total weeks in a year Working full time at 26 per hour would result in a yearly income of 54 080

Lucy September 19 2023 Knowing how to convert an hourly wage into an annual salary is key for financial planning and determining your income potential In this article we ll break down the yearly earnings from 26 per hour based on standard full time and part time schedules How much is 26 an Hour After Tax in the United States In the year 2023 in the United States 26 an hour gross salary after tax is 45 361 annual 3 434 monthly 789 8 weekly 157 96 daily and 19 75 hourly gross based on the information provided in the calculator above

How Much Is 26 An Hour After Taxes

How Much Is 26 An Hour After Taxes

https://us-static.z-dn.net/files/db5/640baf321cfea588fce95603e784e432.png

26 An Hour Is How Much A Year Budget Billz

https://budgetandbillz.com/wp-content/uploads/2022/03/26-an-Hour-is-How-Much-a-Year-768x432.jpg

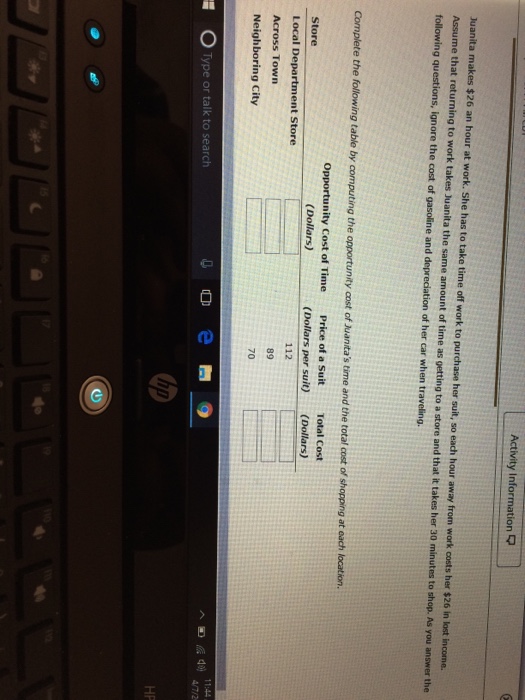

Juanita Makes 26 An Hour At Work She Has To Take Chegg

https://media.cheggcdn.com/media/81f/81fa25fa-cfff-4c50-ab78-d5aa4a9f4af8/image

US Hourly Wage Tax Calculator 2023 The Hourly Wage Tax Calculator uses tax information from the tax year 2023 to show you take home pay See where that hard earned money goes Federal Income Tax Social Security and other deductions More information about the calculations performed is available on the about page Hourly Wage 1 Pretax deductions withheld These are the deductions to be withheld from the employee s salary by their employer before the salary can be paid out including 401k the employee s share of the health insurance premium health savings account HSA deductions child support payments union and uniform dues etc 2 Deductions not withheld

Multiply the hourly wage by the number of hours worked per week Then multiply that number by the total number of weeks in a year 52 For example if an employee makes 25 per hour and works 40 hours per week the annual salary is 25 x 40 x 52 52 000 Important Note on the Hourly Paycheck Calculator The calculator on this page is Step 3 enter an amount for dependents The old W4 used to ask for the number of dependents The new W4 asks for a dollar amount Here s how to calculate it If your total income will be 200k or less 400k if married multiply the number of children under 17 by 2 000 and other dependents by 500 Add up the total

More picture related to How Much Is 26 An Hour After Taxes

The 26 An Hour Minimum Wage CounterPunch

https://www.counterpunch.org/wp-content/uploads/2021/08/Screen-Shot-2021-08-19-at-11.42.12-AM-822x630.png

How Much Of My Net Income Should Go To Mortgage MortgageInfoGuide

https://www.mortgageinfoguide.com/wp-content/uploads/heres-how-to-figure-out-how-much-home-you-can-afford.jpeg

30 Dollars An Hour Is How Much A Year And Can You Afford To Live On

https://www.pennypolly.com/wp-content/uploads/2022/05/30-Dollars-An-Hour-Is-How-Much-A-Year-Can-You-Live-Off-of-It-2.jpg

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator The latter has a wage base limit of 168 600 which means that after employees earn that much the tax is no longer deducted from their earnings for the rest of the year Those with high income may also be subject to Additional Medicare tax which is 0 9 paid for only by the employee not the employer State and local tax withholding

54 080 is the gross annual salary with a 26 per hour wage As of June 2023 the average hourly wage is 33 58 source Let s break down how that number is calculated Typically the average workweek is 40 hours and you can work 52 weeks a year Take 40 hours times 52 weeks and that equals 2 080 working hours How much can you really make annually when earning 26 per hour This is a common question for hourly employees as they try to map out their annual salary and budget accordingly If all you are interested in is the answer It is about 52 000 54 000 per year

26 Inches To Cm Definition Conversion Formula And More

https://www.getfettle.com/wp-content/uploads/2022/07/26-inches.jpg

26 An Hour Is How Much A Year Can I Live On It Money Bliss

https://moneybliss.org/wp-content/uploads/2021/08/26-per-hour-is-how-much-per-year.jpg

How Much Is 26 An Hour After Taxes - Step 3 enter an amount for dependents The old W4 used to ask for the number of dependents The new W4 asks for a dollar amount Here s how to calculate it If your total income will be 200k or less 400k if married multiply the number of children under 17 by 2 000 and other dependents by 500 Add up the total