26 An Hour After Taxes If you make 26 an hour you would take home 40 560 a year after taxes Your pre tax salary was 54 080 But after paying 25 in taxes your after tax salary would be 40 560 a year The amount you pay in taxes depends on many different factors But assuming a 25 to 30 tax rate is reasonable

To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left hand table above In the Weekly hours field enter the number of hours you do each week excluding any overtime If you do any overtime enter the number of hours you do each month and the rate you get Multiply the hourly wage by the number of hours worked per week Then multiply that number by the total number of weeks in a year 52 For example if an employee makes 25 per hour and works 40 hours per week the annual salary is 25 x 40 x 52 52 000 Important Note on the Hourly Paycheck Calculator The calculator on this page is

26 An Hour After Taxes

26 An Hour After Taxes

https://www.counterpunch.org/wp-content/uploads/2021/08/Screen-Shot-2021-08-19-at-11.42.12-AM-822x630.png

Juanita Makes 26 An Hour At Work She Has To Take Chegg

https://media.cheggcdn.com/media/81f/81fa25fa-cfff-4c50-ab78-d5aa4a9f4af8/image

Top 10 29 An Hour Is How Much A Year That Will Change Your Life Nh m

https://moneybliss.org/wp-content/uploads/2021/12/29-per-hour-is-how-much-per-year-683x1024.jpg

Step 3 enter an amount for dependents The old W4 used to ask for the number of dependents The new W4 asks for a dollar amount Here s how to calculate it If your total income will be 200k or less 400k if married multiply the number of children under 17 by 2 000 and other dependents by 500 Add up the total In the year 2024 in the United States 26 an hour gross salary after tax is 45 361 annual 3 434 monthly 789 8 weekly 157 96 daily and 19 75 hourly gross based on the information provided in the calculator above Check the table below for a breakdown of 26 an hour after tax in the United States If you re interested in discovering

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major Key Takeaways An hourly wage of 26 per hour equals a yearly salary of 54 080 before taxes assuming a 40 hour work week After accounting for an estimated 26 54 tax rate the yearly after tax salary is approximately 39 725 74 On a monthly basis before taxes 26 per hour equals 4 506 67 per month

More picture related to 26 An Hour After Taxes

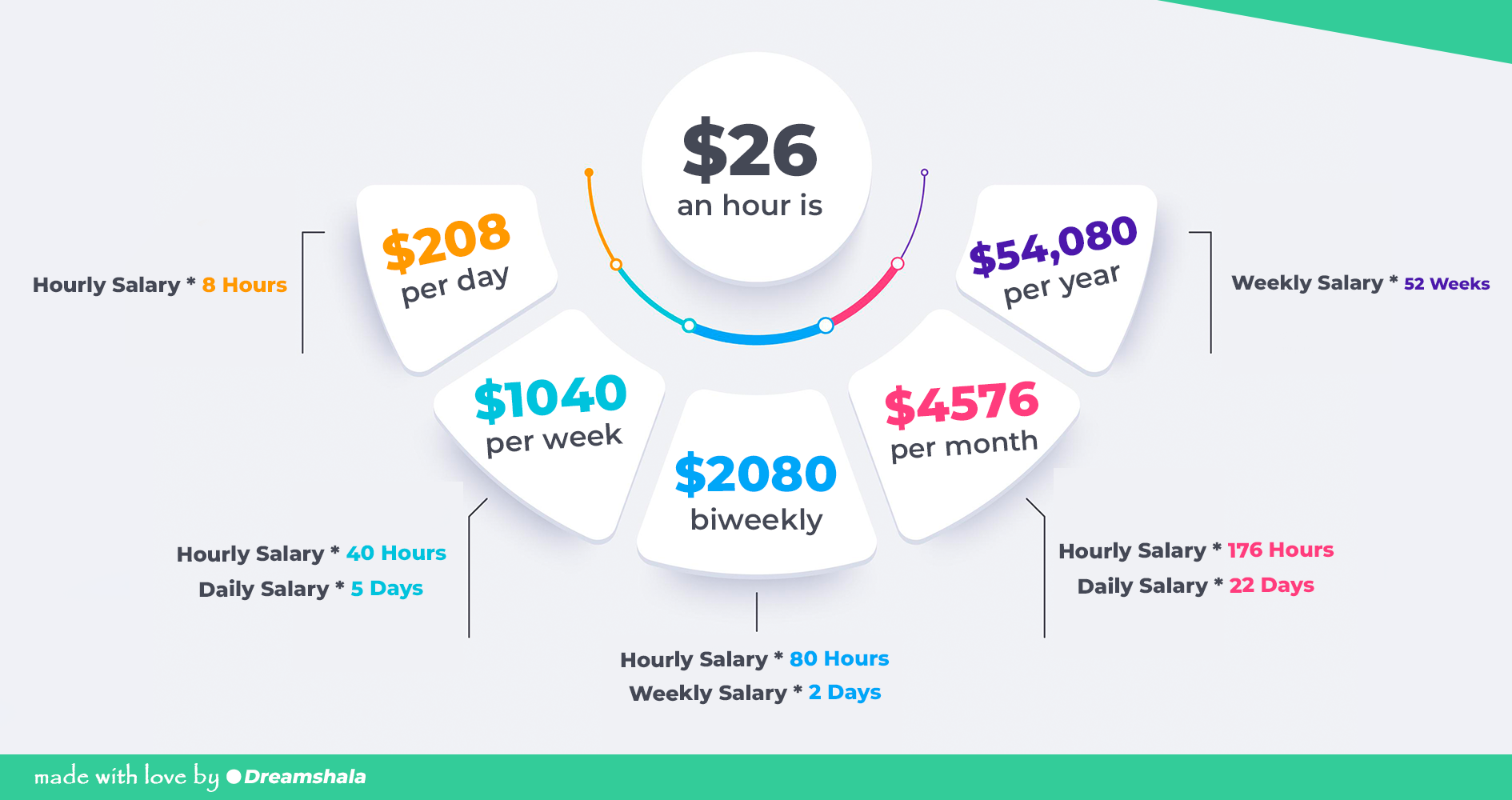

26 An Hour Is How Much A Year Gross Net Income

https://www.dreamshala.com/wp-content/uploads/2022/08/26-an-hour.png

Salary Vs Hourly The Difference How To Calculate Hourly Rate From

https://assets-global.website-files.com/5fa0baa5ea5c262586cf8fd0/61392d52372fbfda6e87bb22_Salary vs Hourly - Pros and Cons - Infographic - Wrapbook.jpg

Man Vs Leaf Vs Leaf Bag Vs Not Wanting To Spend Money Practically

https://practicallyhumans.files.wordpress.com/2022/11/pexels-photo-7785046.jpeg

How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 If you work 40 hours a week 50 weeks a year 26 per hour 52 000 per year 1 040 per week Click here for the opposite calculation

26 an Hour per Year after Taxes 41 290 This would be your net annual salary after taxes To turn that back into an hourly wage the assumption is working 2 080 hours 41 290 2 080 hours 19 85 per hour After estimated taxes and FICA you are netting 19 85 an hour That is 6 15 an hour less than what you thought you were paid Multiply By Number of Work Weeks Per Year The typical work year is approximately 52 weeks Multiply your weekly earnings by 52 1 040 per week 52 weeks 54 080 per year So if you make 26 an hour and work full time 40 hours per week your annual pre tax income would be approximately 54 080 per year

26 An Hour Is How Much A Year Smart Personal Finance

https://smartpersonalfinance.info/wp-content/uploads/2022/01/26-dollars-an-hour-is-how-much-a-year-1536x864.png

Should The Minimum Wage Really Be 26 An Hour Flipboard

https://ic-cdn.flipboard.com/cbsistatic.com/28b0831b8f3ad6b755017175fee6e5f0fa56a0a5/_xlarge.jpeg

26 An Hour After Taxes - Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major