26 An Hour Is How Much A Year After Taxes Near New York Ny 2012 47 680 New York State s progressive income tax system is structured similarly to the federal income tax system There are nine tax brackets that vary based on income level and filing status Wealthier individuals pay higher tax rates than lower income individuals New York s income tax rates range from 4 to 10 9

State income tax 4 to 10 9 local income tax Social Security 6 2 Medicare 1 45 to 2 35 State Disability Insurance 0 5 Paid Family and Medical Leave 0 455 Updated on Jul 06 2024 Free tool to calculate your hourly and salary income after federal state and local taxes in New York New York paycheck calculator Use ADP s New York Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees Just enter the wages tax withholdings and other information required below and our tool will take care of the rest

26 An Hour Is How Much A Year After Taxes Near New York Ny

26 An Hour Is How Much A Year After Taxes Near New York Ny

https://michaelryanmoney.com/wp-content/uploads/2022/11/28-An-Hour-is-How-Much-a-Year.jpg

60 000 A Year Is How Much An Hour Young The Invested

https://youngandtheinvested.com/wp-content/uploads/40000-a-year-is-how-much-an-hour.webp

33 An Hour Is How Much A Year

https://savvybudgetboss.com/wp-content/uploads/2021/12/20-dollars-an-hour-is-how-much-a-year-1-1280x720.jpg

Step 3 enter an amount for dependents The old W4 used to ask for the number of dependents The new W4 asks for a dollar amount Here s how to calculate it If your total income will be 200k or less 400k if married multiply the number of children under 17 by 2 000 and other dependents by 500 Add up the total Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

It depends on how many hours you work but assuming a 40 hour work week and working 50 weeks a year then a 26 hourly wage is about 52 000 per year or 4 333 a month Is 26 an hour good pay It s above average For each payroll federal income tax is calculated based on the answers provided on the W 4 and year to date income which is then referenced to the tax tables in IRS Publication 15 T For 2024 rates are 0 10 12 22 24 32 35 or 37

More picture related to 26 An Hour Is How Much A Year After Taxes Near New York Ny

20 An Hour Is How Much A Year Monthly Budget Guide For 2023

https://www.moneyforthemamas.com/wp-content/uploads/2022/05/20-an-hour-is-how-much-a-year-683x1024.jpg

17 50 An Hour Is How Much A Year Complete Salary Guide

https://www.fiscalflamingo.com/wp-content/uploads/2020/08/17.50-an-hour-is-how-much-a-year_.png

28 An Hour Is How Much A Year SpendMeNot

https://spendmenot.com/wp-content/uploads/2022/09/27-an-Hour-Is-How-Much-a-Year.jpg

Like the state the federal government also has an unemployment tax called FUTA which is paid by employers FUTA is an annual tax an employer pays on the first 7 000 of each employee s wages The FUTA rate for 2023 is 6 0 but many employers are able to pay less for instance up to 5 4 each year due to tax credits 26 an hour is how much a month If you make 26 an hour your monthly salary would be 4 506 67 Assuming that you work 40 hours per week we calculated this number by taking into consideration your hourly rate 26 an hour the number of hours you work per week 40 hours the number of weeks per year 52 weeks and the number of months per year 12 months

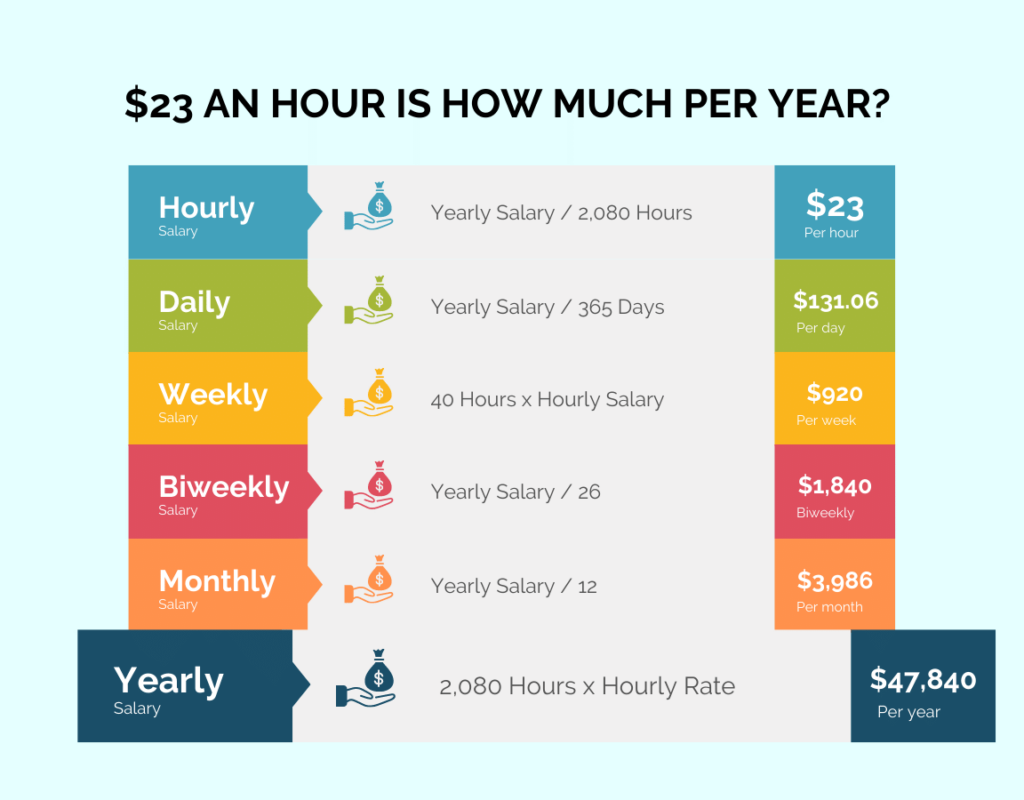

The formula of calculating annual salary and hourly wage is as follow Annual Salary Hourly Wage Hours per workweek 52 weeks Quarterly Salary Annual Salary 4 Monthly Salary Annual Salary 12 Semi Monthly Salary Annual Salary 24 Biweekly Salary Annual Salary 26 To effectively use the New York Paycheck Calculator follow these steps Enter your gross pay for the pay period Choose your pay frequency e g weekly bi weekly monthly Input your filing status and the number of allowances you claim Add any additional withholdings or deductions such as retirement contributions or health insurance

26 An Hour Is How Much A Year Can I Live On It Money Bliss

https://moneybliss.org/wp-content/uploads/2021/08/26-per-hour-is-how-much-per-year.jpg

Hourly Rate Equivalent To Yearly Salary DominicTeresa

https://www.howtofire.com/wp-content/uploads/23-dollars-an-hour-1024x800.png

26 An Hour Is How Much A Year After Taxes Near New York Ny - Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major