Effective Tax Rate Formula Excel Finding Your Effective Tax Rate Your marginal tax rate is the bracket percentage that applies to the top dollar of your income It would be 22 in our example the rate you d pay on your income

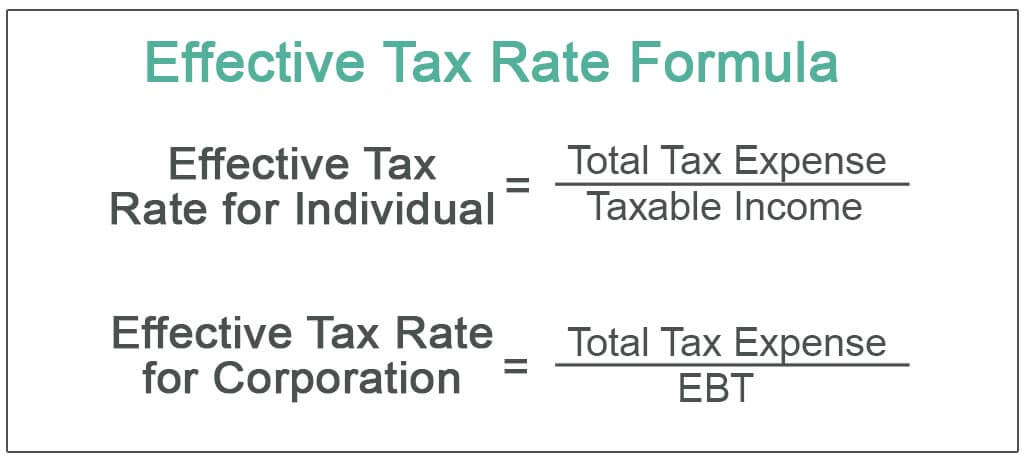

Marginal vs Effective Tax Rates When discussing income tax there are two rates you are likely to encounter the marginal tax rate and the effective tax rate The marginal tax is the tax rate applied to the last dollar earned For 100 000 of income the marginal tax rate is 24 since that s the rate applied to income in the fourth bracket Examples of Effective Tax Rate Formula With Excel Template Let s take an example to understand the calculation of the Effective Tax Rate in a better manner Effective Tax Rate Formula Example 1 In many countries an individual s income is divided into tax brackets Each taxed at a different rate

Effective Tax Rate Formula Excel

Effective Tax Rate Formula Excel

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/02/15150323/Effective-Tax-Rate-Formula-960x300.jpg

How To Calculate Tax On Salary Wholesale Deals Save 40 Jlcatj gob mx

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/02/15150753/Apple-Effective-Tax-Rate.jpg

Effective Tax Rate Formula AnnaliseRene

https://www.exceldemy.com/wp-content/uploads/2022/06/Reverse-Tax-Calculation-Formula-in-Excel-6.png

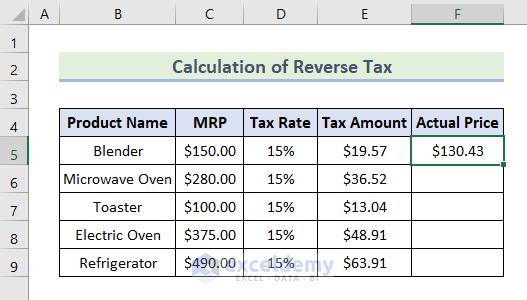

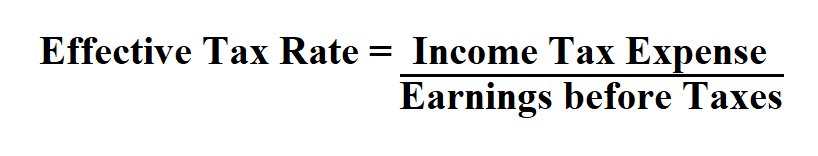

I want to devise a formula so that when i enter net rent payable it gives me gross amount and tax amount in two cells without using Goal Seek Example Rent 100 000 per month Tax As per Slab Annual Gross Rent Tax Slab Rates are Where the Gross amount of rent does not exceed Rs 200 000 Rate of tax Nil Rate of tax Nil Effective Tax Rate Excel Template xlsx Effective Tax Rate Formula Individual Total Tax expense Taxable Income For Corporations Effective Tax Rate Formula Corporation Total Tax Expense EBT Since EBT is effectively net income plus total tax expense and as such the above formula can be modified as

The 100 Excel Shortcuts You Need to Know for Windows and Mac Common Finance Interview Questions and Answers Therefore the effective and marginal tax rates are rarely equivalent as the effective tax rate formula uses pre tax income from the income statement a financial statement that abides by accrual accounting The US tax code uses has a graduated tax rate the tax rates on higher amounts of income are higher than on lower amounts As I calculated my tax payment I became curious as to my effective tax rate I am going to use Excel to duplicate a graph that I saw on the Wikipedia updated with 2018 tax rates My version of the graph is shown in Figure 1

More picture related to Effective Tax Rate Formula Excel

Effective Interest Rate Formula Excel Free Calculator Excel

https://i.pinimg.com/originals/e3/cc/20/e3cc20f519ba7a8e11b575d6db7e6f4e.jpg

Effective Interest Rate Formula Excel Free Calculator In 2022 Excel

https://i.pinimg.com/originals/30/fb/99/30fb99f0fb9f556b08ecf874f17c1110.jpg

OB APP

https://cdn.wallstreetmojo.com/wp-content/uploads/2021/05/Effective-Tax-Rate-Formula.jpg

In cell C1 enter the header Effective Tax Rate In cell C2 enter a formula that divides the tax amount by the income value and formats the result as a percentage For example you can enter the following formula in cell C2 B2 A2 Then click the Home tab on the ribbon and click the Percentage button to format the result as a The following tax rates would apply 10 for the first 25 000 20 for 25 001 to 50 000 30 for 50 001 to 75 000 and 40 for 75 001 to 80 000 Create a different cell for each income tax rate and multiply it by the amount of income you have in each bracket 25 000 times 10 for the first 5 000 times 40 for the last and so on

[desc-10] [desc-11]

Ponuka Pr ce Siln K Medit cii Personal Income Tax Calculator Revol cia

https://exceljet.net/sites/default/files/styles/original_with_watermark/public/images/formulas/income tax bracket calculation_0.png

How To Calculate Effective Tax Rate

https://www.learntocalculate.com/wp-content/uploads/2020/07/effective-ax-rate.png

Effective Tax Rate Formula Excel - I want to devise a formula so that when i enter net rent payable it gives me gross amount and tax amount in two cells without using Goal Seek Example Rent 100 000 per month Tax As per Slab Annual Gross Rent Tax Slab Rates are Where the Gross amount of rent does not exceed Rs 200 000 Rate of tax Nil Rate of tax Nil