How Is Effective Tax Rate Calculated This is because marginal tax rates only apply to income that falls within that specific bracket Based on these rates this hypothetical 50 000 earner owes 6 307 50 which is an effective tax rate of about 12 7 Tax Withholding Estimator Calculating Taxable Income Using Exemptions and Deductions Federal tax rates apply only to taxable income

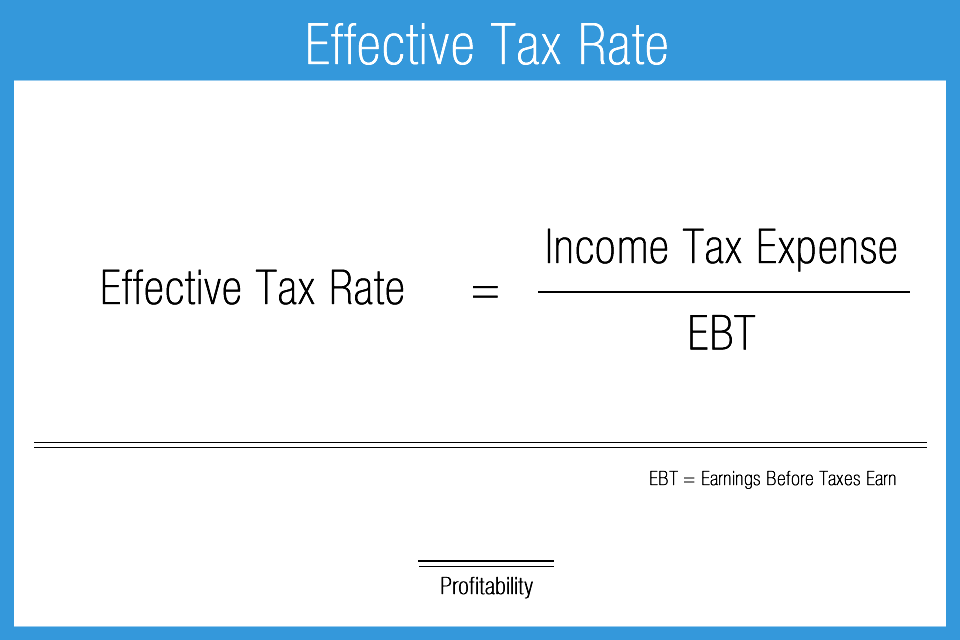

To calculate your effective tax rate you need two numbers the total amount you paid in taxes and your taxable income for that year You can access both numbers on your tax return Your total tax The effective tax rate can be calculated for historical periods by dividing the taxes paid by the pre tax income or earnings before tax EBT The formula used to calculate the effective tax rate is the ratio between the taxes paid and pre tax income EBT

How Is Effective Tax Rate Calculated

How Is Effective Tax Rate Calculated

https://cdn.educba.com/academy/wp-content/uploads/2019/04/Effective-Tax-Rate-Formula-Example-1-9.jpg

Profitability Ratios Accounting Play

https://accountingplay.com/wp-content/uploads/2015/08/Effective_Tax_Rate.png

How To Calculate Your Effective Tax Rate

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1aojY9.img?w=1600&h=1067&m=4&q=84

If you earned 60 000 in gross income you would pay 22 rate on only 18 225 of your income In both cases part of your income would be taxed at 22 but your effective tax rates would be different When your taxable income is 80 000 your effective tax rate is 13 23 while the rate is 10 31 when your taxable income is 60 000 Once you ve calculated your total taxable income check the IRS s tax brackets to find your marginal tax rate Based on the 2022 tax brackets shown above you would pay 10 on your first

Use Bankrate s free calculator to estimate your average tax rate for 2022 2023 your 2022 2023 tax bracket and your marginal tax rate for the 2022 2023 tax year Taxes Marginal vs effective Sample Computation Consider the following scenario Individual A reports a taxable income of 450 000 and Individual X s taxable income is 380 000 The individuals live in a country with a tax system where Income under 100 000 is taxed at 12 Income between 100 00 and 350 000 is taxed at 18 and Income over 350 000 is taxed at 28

More picture related to How Is Effective Tax Rate Calculated

A Few Issues With U S Corporate Tax Policy Between The Balance Sheets

http://betweenthebalancesheets.files.wordpress.com/2011/10/effective-corporate-tax-rate.png

What Is Your Effective Tax Rate Tally

https://images.ctfassets.net/csd0v5p1fzif/3hrteRTgZZcVFOhbYyGNzJ/4514e293c4a4b298b43585063af7fb21/pexels-thirdman-5060982.jpg

What Is Effective Tax Rate Explained All You Need To Know

https://lawyer.zone/wp-content/uploads/2022/08/Effective-Tax-Rate.png

You can solve for the effective tax rate by taking the amount paid in taxes 25 000 and divide it by the annual income before taxes 100 000 The answer 0 25 or 25 percent Estimate your effective tax rate Tax savings calculators Tax Deferral Benefits of Variable Annuities The power of tax deferral Compare taxable tax deferred and tax free investment growth Learn more about how taxes and inflation impact returns Estimate your effective tax rate

Calculate your potential tax liability or refund with our free tax calculator The calculator will estimate your 2023 2024 federal income taxes based on your income deductions and credits The calculator will show that the marginal tax rate for a single person with 50 000 in taxable income is 22 Because the U S tax system is progressive not all of your income will be

How To Calculate Tax On Salary Wholesale Deals Save 40 Jlcatj gob mx

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/02/15150753/Apple-Effective-Tax-Rate.jpg

What Does Effective Tax Rate Mean Credit Karma

https://creditkarma-cms.imgix.net/wp-content/uploads/2019/07/what-is-effective-tax-rate_991174378.jpg

How Is Effective Tax Rate Calculated - If you earned 60 000 in gross income you would pay 22 rate on only 18 225 of your income In both cases part of your income would be taxed at 22 but your effective tax rates would be different When your taxable income is 80 000 your effective tax rate is 13 23 while the rate is 10 31 when your taxable income is 60 000