What Is The Effective Tax Rate Formula Therefore the effective and marginal tax rates are rarely equivalent as the effective tax rate formula uses pre tax income from the income statement a financial statement that abides by accrual accounting Typically the effective tax rate is lower than the marginal tax rate as most companies are incentivized to defer paying the government

To calculate your effective tax rate you need two numbers the total amount you paid in taxes and your taxable income for that year You can access both numbers on your tax return Your total tax If you earned 60 000 in gross income you would pay 22 rate on only 18 225 of your income In both cases part of your income would be taxed at 22 but your effective tax rates would be different When your taxable income is 80 000 your effective tax rate is 13 23 while the rate is 10 31 when your taxable income is 60 000

What Is The Effective Tax Rate Formula

What Is The Effective Tax Rate Formula

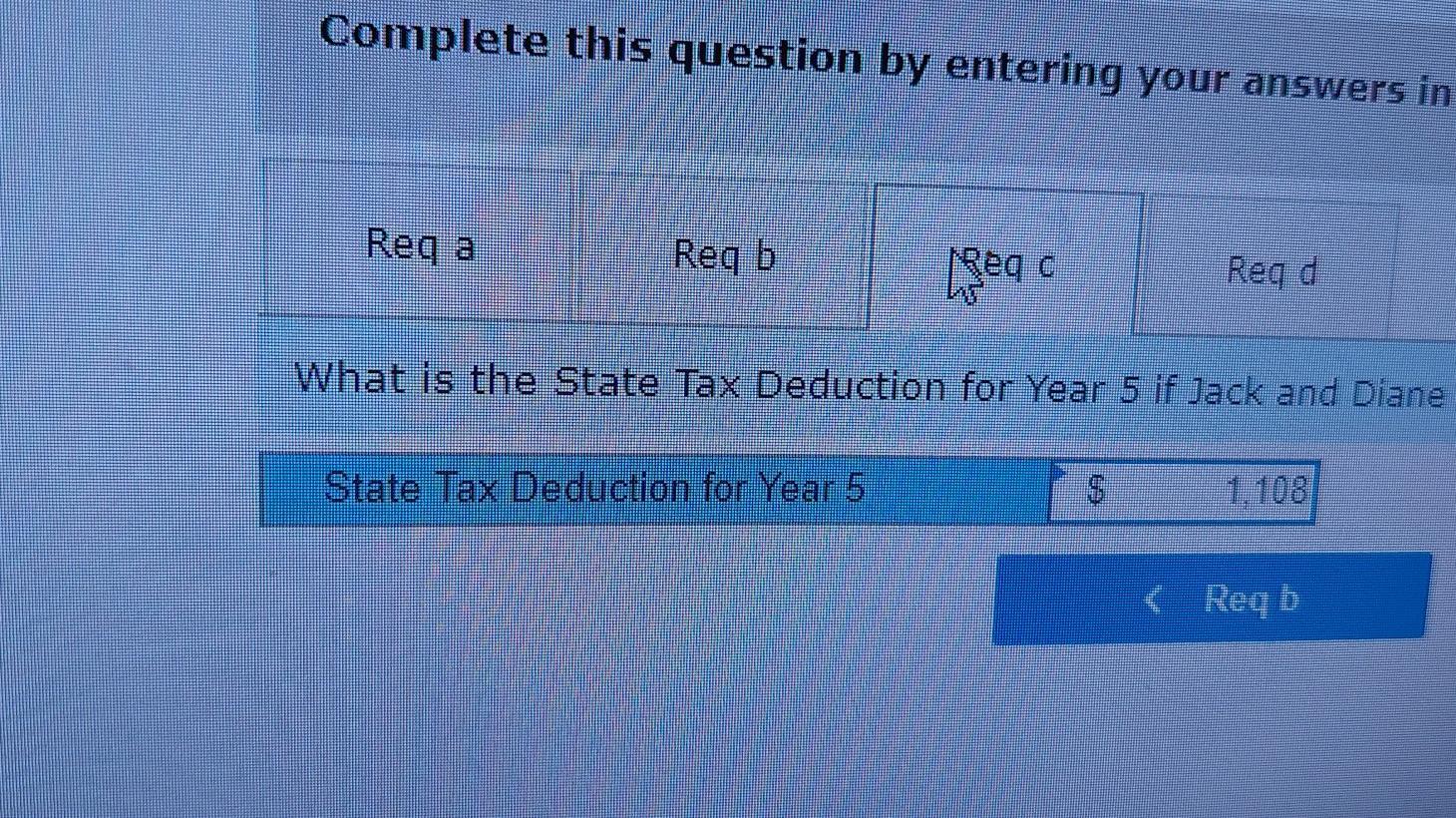

https://media.cheggcdn.com/study/b5d/b5da704b-cab2-4757-bc62-f7c73f4921d0/image

Effective Tax Rate Formula And Calculator Step by Step

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/02/15150323/Effective-Tax-Rate-Formula-960x300.jpg

How To Calculate Effective Tax Rate

https://cdn.educba.com/academy/wp-content/uploads/2019/10/Marginal-Tax-Rate-vs-Effective-Tax-Rate-info.jpg

Sample Computation Consider the following scenario Individual A reports a taxable income of 450 000 and Individual X s taxable income is 380 000 The individuals live in a country with a tax system where Income under 100 000 is taxed at 12 Income between 100 00 and 350 000 is taxed at 18 and Income over 350 000 is taxed at 28 Effective Tax Rate Total tax expense Taxable income 125 000 600 000 Tax Rate 20 83 Example 2 Let us take the example of John to understand the calculation for the effective tax rate John joined a bank recently where he earns a gross salary of 200 000 annually

How to Calculate Your Effective Tax Rate Your effective tax rate is your total tax divided by your taxable income In our example your tax bill is 11 017 and your taxable income is 70 000 Your effective tax rate would be 11 017 divided by 70 000 or 15 7 An individual can use a simple formula to calculate their effective tax rate Divide the amount of taxes due line 24 on IRS Form 1040 by the amount of taxable income line 15 on IRS Form 1040 Taxable income is the portion of gross income that s subject to taxes before deductions and other tax breaks

More picture related to What Is The Effective Tax Rate Formula

How To Calculate Tax On Salary Wholesale Deals Save 40 Jlcatj gob mx

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/02/15150753/Apple-Effective-Tax-Rate.jpg

Effective Tax Rate Formula AnnaliseRene

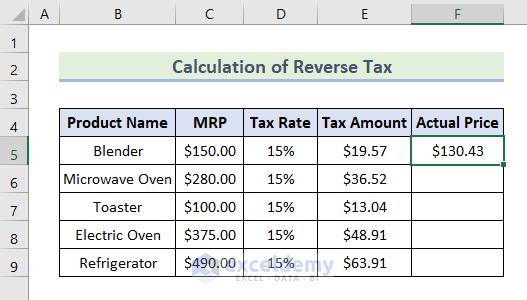

https://www.exceldemy.com/wp-content/uploads/2022/06/Reverse-Tax-Calculation-Formula-in-Excel-6.png

Effective Tax Rates In The United States The Ugly Budget

https://i0.wp.com/uglybudget.com/wp-content/uploads/2020/01/effective-tax-rates-1.png?fit=820%2C497&ssl=1

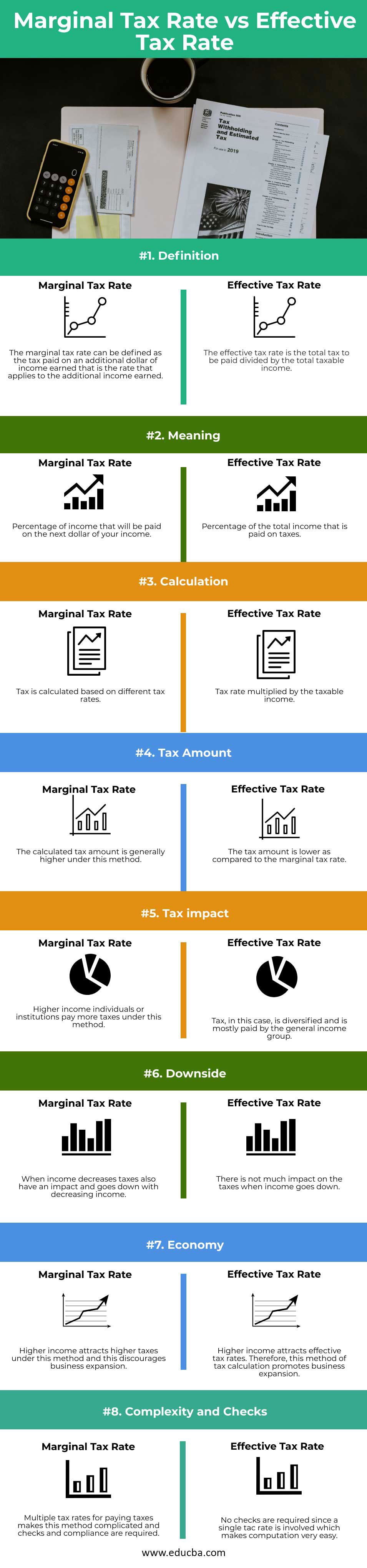

Marginal and effective tax rates help taxpayers understand how much they owe the IRS based on their annual income and tax bracket Effective tax rate This is a taxpayer s average tax rate or Effective Tax Rate Formula The formulas for effective tax rate are as follows Individual Total Tax Expense Taxable Income Corporation Total Tax Expense Earnings Before Taxes Effective tax rates simplify comparisons among companies or taxpayers This is especially true where a progressive or tiered tax system is in place

To calculate this rate take the sum of all your lost income and divide that number by your earned income In the above case the government has taken a total of 17 000 2 500 5 000 7 500 Example of Effective Tax Rate For example say that someone made 50 000 in 2022 Their income tax calculation for 2023 might look like this 0 10 275 at 10 10 275 of income taxed at 10

How To Calculate Effective Tax Rate Shared Economy Tax

https://sharedeconomycpa.com/wp-content/uploads/2020/03/thisisengineering-raeng-GzDrm7SYQ0g-unsplash-1024x683.jpg

Effective Tax Rate Formula Effective Federal Tax Rates You Can

https://lh6.googleusercontent.com/proxy/Y0_hk7zhsJJFv8YC_rUVHvvxESwYxSY_hZgDxImQjQWpk6QIGyKf0WPcWMRy4UtiSiQTqlq6FuCmwEZwRKCPUGhLf61bXRoyYwyT3wzNN5o5Ko_svNAwMvYKvlwBjKHM2FvC16hCDeIAt4UYOCQYuFKjyAE1d4gspSj9mndpkVe2aRqWFoODAPn6b7goBa9aqpW6RDU89gzXpyrlejlGOvw=w1200-h630-p-k-no-nu

What Is The Effective Tax Rate Formula - As your income goes up the tax rate on the next layer of income is higher When your income jumps to a higher tax bracket you don t pay the higher rate on your entire income You pay the higher rate only on the part that s in the new tax bracket 2023 tax rates for a single taxpayer For a single taxpayer the rates are