Edward Jones Simple Ira Salary Reduction Agreement Form Salary Reduction Agreement Form PDF Schedule of Fees Read or print the latest version of this document Individual Retirement Account Schedule of Fees PDF Privacy Notice PDF Revenue Sharing Disclosure Read or print the latest version of this document Revenue Sharing Disclosure PDF 5304 SIMPLE IRA Plan PDF

A Salary Reduction Agreement is an arrangement between your business and your employees Your employees can elect to withhold and deposit a portion of their paychecks into your business s SIMPLE IRA plan This form also can be used to have employees elect not to defer in to the plan A SIMPLE IRA allows your employees to contribute to the plan through salary deferrals You re also responsible for making contributions to the plan Consider this plan if You re looking for a primarily employee funded plan with low required employer contributions

Edward Jones Simple Ira Salary Reduction Agreement Form

Edward Jones Simple Ira Salary Reduction Agreement Form

https://www.pdffiller.com/preview/652/892/652892464/large.png

Nandi Hills Bangalore Your Getaway Guide

http://blog.saffronstays.com/wp-content/uploads/2020/06/Nandi-Hills-Cover-images.jpg

Blank Salary Reduction Agreement sra By DKYoung Issuu

https://image.isu.pub/160908144429-063ffaf63c910c3294977270d4a5c660/jpg/page_1.jpg

A Salary Reduction Agreement is an arrangement between your business and your employees Your employees can elect to withhold and deposit a portion of their paychecks into your business s SIMPLE IRA plan This form also can be used to have employees elect not to defer in to the plan 4 Contributions The employer may determine annually either to make a matching or nonelective contribution to each eligible employee The matching contribution option requires the employer to make a matching contribution for each eligible employee s salary reduction contribution up to 3 of the employee s compensation

SIMPLE IRA Plan Savings Incentive Match Plan for Employees of Small Employers SIMPLE Individual Retirement Account IRA Plan is a tax favored retirement plan that certain small employers including self employed individuals can set up for the benefit of their employees 2 Employer Plan Eligibility Requirements Salary Reduction Agreement retained by client s payroll area Summary Plan Description and Employer Contribution Notice 5304 SIMPLE IRA Adoption Agreement Self directed SIMPLE Employer IRA Packet between Edward D Jones Co L P collectively Edward Jones

More picture related to Edward Jones Simple Ira Salary Reduction Agreement Form

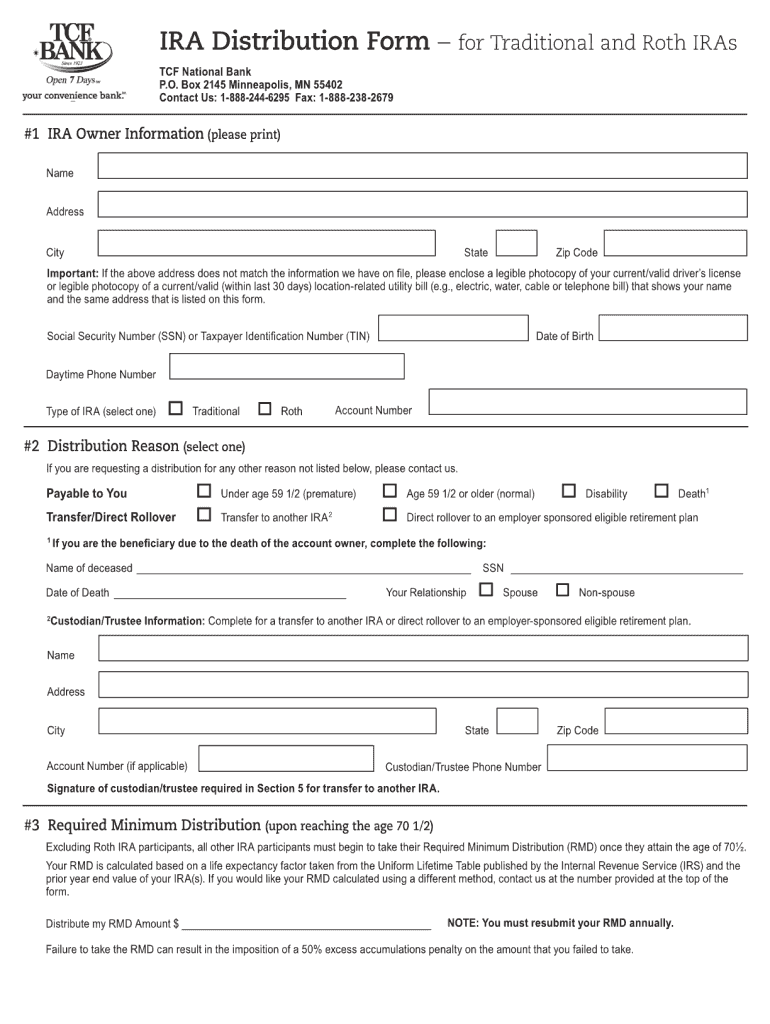

Principal Bank Ira Distribution Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/5/428/5428576/large.png

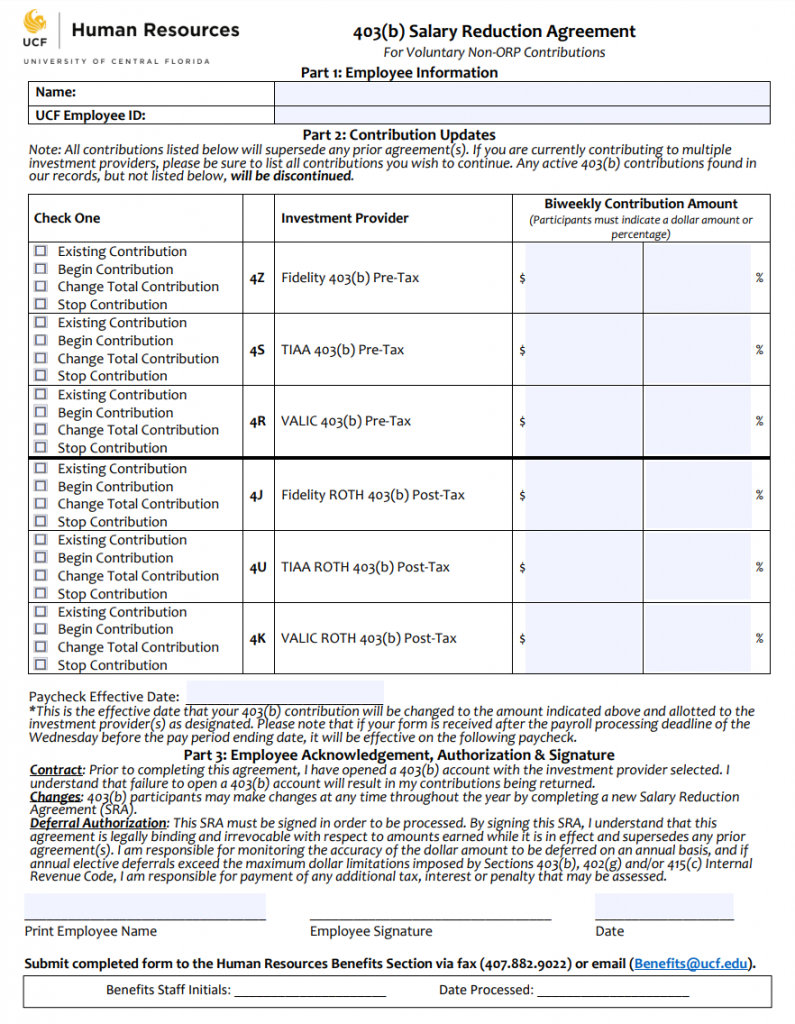

How To Enroll In A 401 k 403 b And Choose Investments University

http://tippyfi.com/wp-content/uploads/2018/09/UCF-403b-Salary-Reduction-Form-795x1024.png

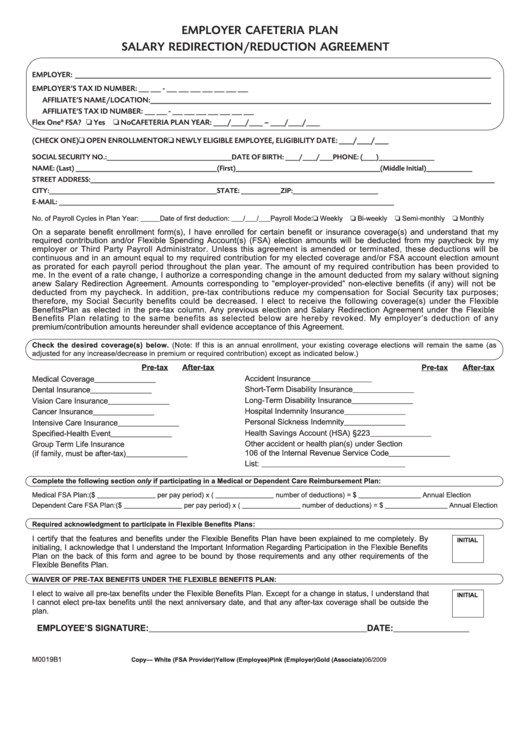

Sample Salary Redirection reduction Agreement Form Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/196/1968/196885/page_1_thumb_big.png

For each calendar year the Employer will contribute a matching contribution to each eligible employee s SIMPLE IRA equal to the employee s salary reduction contributions up to a limit of 3 of the employee s compensation for the calendar year ii The Employer may reduce the 3 limit for the calendar year in i only if 1 Employer is required to contribute each year either a Matching contribution up to 3 of compensation not limited by the annual compensation limit or 2 nonelective contribution for each eligible employee

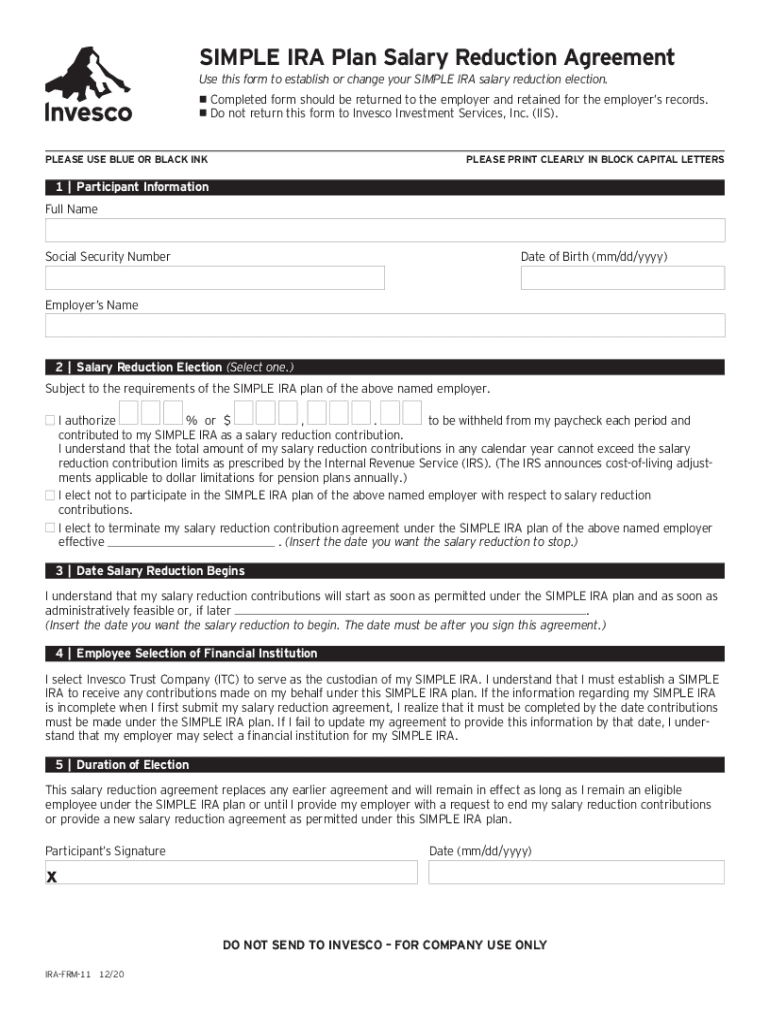

SIMPLE IRA Plan Salary Reduction Agreement Use this form to establish or change your SIMPLE IRA salary reduction election Completed form should be returned to the employer and retained for the employer s records Do not return this form to Invesco Investment Services Inc IIS PLEASE USE BLUE OR BLACK INK General Eligibility Requirements The Employer agrees to permit salary reduction contributions to be made in each calendar year to the SIMPLE IRA established by each employee who meets the following requirements select either 1a or 1b Full Eligibility All employees are eligible Limited Eligibility

Edward Jones Simple Ira Contribution Transmittal 2020 2023 Form Fill

https://www.signnow.com/preview/541/604/541604870/large.png

Fillable Online Dickinsonstate SALARY REDUCTION AGREEMENT Form Fill

https://www.signnow.com/preview/490/213/490213315/large.png

Edward Jones Simple Ira Salary Reduction Agreement Form - 4 Contributions The employer may determine annually either to make a matching or nonelective contribution to each eligible employee The matching contribution option requires the employer to make a matching contribution for each eligible employee s salary reduction contribution up to 3 of the employee s compensation