Edward Jones Simple Ira Fees Edward Jones retains the right to charge the fee if the account balance is less than the amount of the fee Your account fee amount for 2023 is determined by the anniversary date of the opening of your account Please contact your financial advisor to determine your account s anniversary date

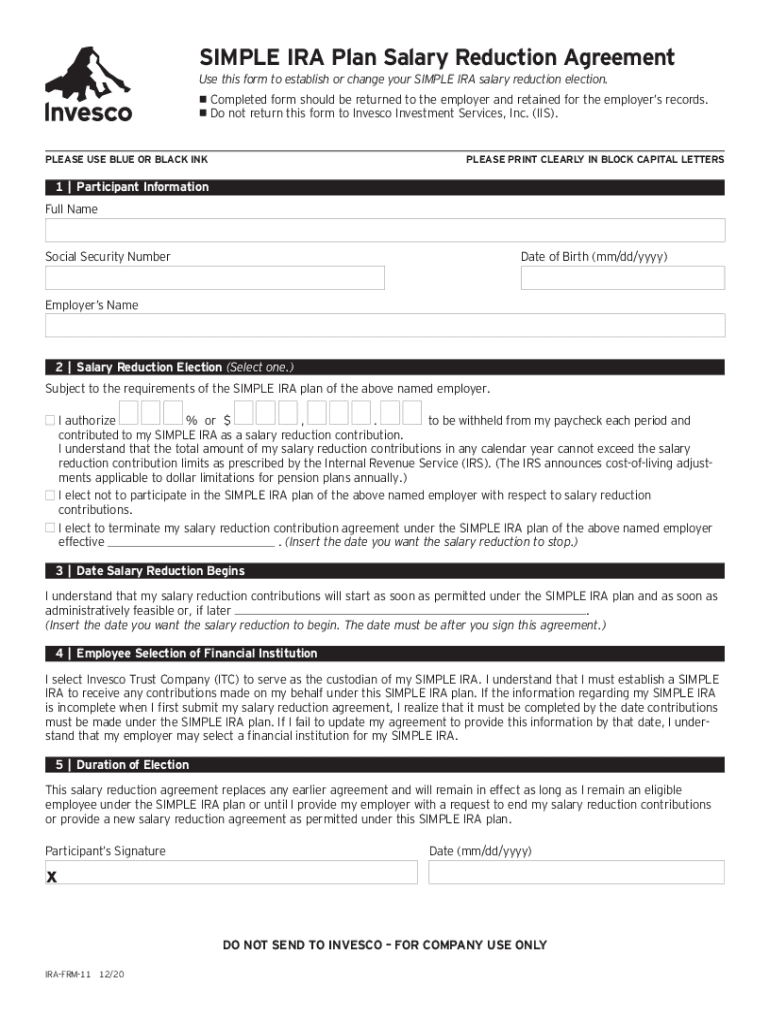

Edward Jones compensation and fees Mutual Fund Break Point disclosure Unit Investment Trust UIT compensation schedule Read or print the latest version of this document Unit Investment Trust UIT compensation schedule PDF Are you on track to meet your financial goals Match with Financial Advisors personalized for you Edward Jones SIMPLE IRAs opened before June 9 2017 View print or save the most recent version of the complete SIMPLE IRA Agreement SIMPLE IRA Agreement PDF Related disclosures we provide when you open a SIMPLE IRA Disclosure Statement PDF Disclosure Statement Appendix PDF Salary Reduction Agreement Form PDF

Edward Jones Simple Ira Fees

Edward Jones Simple Ira Fees

https://www.signnow.com/preview/541/604/541604870/large.png

AGIKgqML10DG2xAOEN6hfrQGc6RzSrSR7M MN2BSvOBeWdk s900 c k c0x00ffffff no rj

https://yt3.googleusercontent.com/ytc/AGIKgqML10DG2xAOEN6hfrQGc6RzSrSR7M_MN2BSvOBeWdk=s900-c-k-c0x00ffffff-no-rj

Edward Jones Culture LinkedIn

https://media-exp2.licdn.com/dms/image/C561BAQHmtSebV-r_mQ/company-background_10000/0/1519799150763?e=2147483647&v=beta&t=e2NVH0QTDxgCp4TUxWZR9NaBgkXt5tDZMLnAqXsyxf8

Account costs and fees Working with an Edward Jones financial advisor means you have a partner who deeply understands you and your goals Understanding your costs and fees is an integral part of that partnership We ve designed our account options so you can choose the approach that works for you Edward Jones IRA fees are listed separately on their website in PDF file Link to the file with Edward Jones IRA fees is located here SIMPLE Allows employees to make pre tax salary deferrals Plans must be established by the business between January 1 and October 1 The employer may not have more than 100 employees who have earned at

Benefits of a SIMPLE IRA include Simple administration that can lead to cost savings Low contributions requirements from the employer SIMPLE IRA contribution rules and features Participants may contribute on a pretax basis or Roth basis up to the annual limit of 15 500 for 2023 Edward Jones is a financial services firm that helps clients achieve their goals Learn more about the company s history values and community involvement in this media kit located here You can also find useful information on taxes investing and market insights on the website

More picture related to Edward Jones Simple Ira Fees

Trust Custodial Simple IRA Disclosures Edward Jones

https://www.edwardjones.com/sites/default/files/acquiadam/2022-07/ej-trust-co-logo-thumb.jpg

Edward Jones Ira Transfer Form Fill Online Printable Fillable

https://www.pdffiller.com/preview/100/278/100278868/large.png

AGIKgqOLHVutKGlcleoTfUaWAvjQSILFTGAGNgkkOkHgnQ s900 c k c0x00ffffff no rj

https://yt3.googleusercontent.com/ytc/AGIKgqOLHVutKGlcleoTfUaWAvjQSILFTGAGNgkkOkHgnQ=s900-c-k-c0x00ffffff-no-rj

Edward Jones self directed SIMPLE IRAs Edward Jones is also required to provide information to help with completing Article VI of the form As custodian of your SIMPLE IRA Plan Edward Jones does not need a copy of your completed Form 5304 SIMPLE Please retain a copy for your records 1 Total commission may vary for trades executed over multiple days and is added to a 4 95 transaction fee per trade 2 Principal amount calculated by multiplying the number of shares by the stock price 3 Minimum commission is 50 Free Investing Wealth management fees will definitely cost a huge amount over the years

Edward Jones offers a personal approach to personal finance in an industry trending toward robo advisors and self directed investing Is that approach right for your Traditional or Roth IRA Continue reading to find out Edward Jones Traditional and Roth IRA Fees Edward Jones Pros Personal Attention from an Advisor SIMPLE IRA vs 401 k Here are the need to know differences between SIMPLE IRAs and 401 k s Source IRS gov SIMPLE IRA vs 401 k How to decide Startup costs and ease of setup often

FUHp7QFo5DAIoWEbfON7Rzseqe8YVTHtFOdl63dPoV8U11VqJvSn9cM5LZqr3PekRsw2uP0

https://yt3.googleusercontent.com/fUHp7QFo5DAIoWEbfON7Rzseqe8YVTHtFOdl63dPoV8U11VqJvSn9cM5LZqr3PekRsw2uP09Hw=s900-c-k-c0x00ffffff-no-rj

Vanguard Roth IRA Explained For Beginners Tax Free Millionaire

https://i.ytimg.com/vi/BFNFcXefn88/maxresdefault.jpg

Edward Jones Simple Ira Fees - Edward Jones IRA fees are listed separately on their website in PDF file Link to the file with Edward Jones IRA fees is located here SIMPLE Allows employees to make pre tax salary deferrals Plans must be established by the business between January 1 and October 1 The employer may not have more than 100 employees who have earned at