Maximum Salary Reduction For Simple Ira An employee can choose to make salary reduction contributions meaning a portion of their salary is put directly into their SIMPLE IRA up to the legal limit Employer contributions on

Any employer including self employed individuals tax exempt organizations and governmental entities that had no more than 100 employees with 5 000 or more in compensation during the preceding calendar year the 100 employee limitation can establish a SIMPLE IRA plan For 2024 the annual contribution limit for SIMPLE IRAs is 16 000 up from 15 500 in 2023 Workers age 50 or older can make additional catch up contributions of 3 500 for a total of

Maximum Salary Reduction For Simple Ira

Maximum Salary Reduction For Simple Ira

https://www.personalfinanceclub.com/wp-content/uploads/2021/11/2021-11-12-2022-Roth-IRA-Income-Limits-1536x1536.png

Simple Ira Contribution Rules Choosing Your Gold IRA

https://www.questtrustcompany.com/wp-content/uploads/2021/01/Charts-1024x791.png

Understanding The Inflation Reduction Act The Council Of State

https://www.csg.org/wp-content/uploads/sites/7/2022/08/MicrosoftTeams-image-7-1024x1007.jpg

A SIMPLE IRA is an excellent tool for small business owners to help their employees save for retirement This type of retirement account combines features of both the traditional IRA and the 401 k Like both of these plans the SIMPLE IRA is subject to annual contribution limits In 2024 employees can contribute up to 16 000 to a SIMPLE IRA account up from the 2023 limit of 15 500 Under age 50 16 000 Age 50 and older 19 500 These contribution limits are lower than those for a 401 k But people with a SIMPLE IRA may take part in another employer sponsored plan say

The most employees can contribute to SIMPLE IRAs in 2023 is 15 500 with an additional 3 500 catch up contribution for those age 50 and older In 2024 the SIMPLE IRA employee contribution limit increases to 16 000 with an additional 3 500 catch up contribution for those age 50 and older Employers may contribute either a flat 2 of your The annual employee contribution limit for a SIMPLE IRA is 15 500 in 2023 an increase from 14 000 in 2022 Employees 50 and older can make an extra 3 500 catch up contribution in 2023

More picture related to Maximum Salary Reduction For Simple Ira

Can Your Employer Reduce Your Salary Donovan Ho

https://dnh.com.my/wp-content/uploads/2018/04/Salary-Reduction-940x675.png

Understanding The Inflation Reduction Act The Council Of State

https://www.csg.org/wp-content/uploads/sites/7/2022/08/MicrosoftTeams-image-4-985x1024.jpg

Topic EunDuk IRA Backdoor Roth IRA WorkingUS

https://www.questtrustcompany.com/wp-content/uploads/2021/01/2021-Roth-IRA-Income-Limits.png

You may be eligible for a tax credit of up to 500 per year for the first 3 years for the cost of starting a SIMPLE IRA plan IRS Form 8881 Credit for Small Employer Pension Plan Startup Costs Administrative costs are low You are not required to file annual financial reports Establishing the Plan Starting a SIMPLE IRA plan is easy 7 000 8 000 if age 50 or over Maximum deduction 7 000 8 000 if age 50 or over for traditional IRA no deduction for Roth IRA contributions Deadline for adoption Due date of taxpayer s federal tax return not including extensions Last contribution date Due date of taxpayer s federal tax return not including extensions

A Salary Reduction Agreement is an arrangement between your business and your employees Your employees can elect to withhold and deposit a portion of their paychecks into your business s SIMPLE IRA plan This form also can be used to have employees elect not to defer in to the plan The amount contributed under the arrangement is called an The SIMPLE IRA is set up under a salary reduction agreement between the employer and the employees The maximum salary reduction contribution is adjusted for inflation SIMPLE IRA Contribution Dollar Limits Tax Year Base Contribution Catch Up Contribution 2024 16 000 3500 2023 15 500

Hsa 2023 Contribution Limit Irs Q2023F

https://i2.wp.com/www.wexinc.com/wp-content/uploads/2022/05/ContributionLimitsChart_Blog_SupplementalGraphic_2023-1-1024x768.jpg

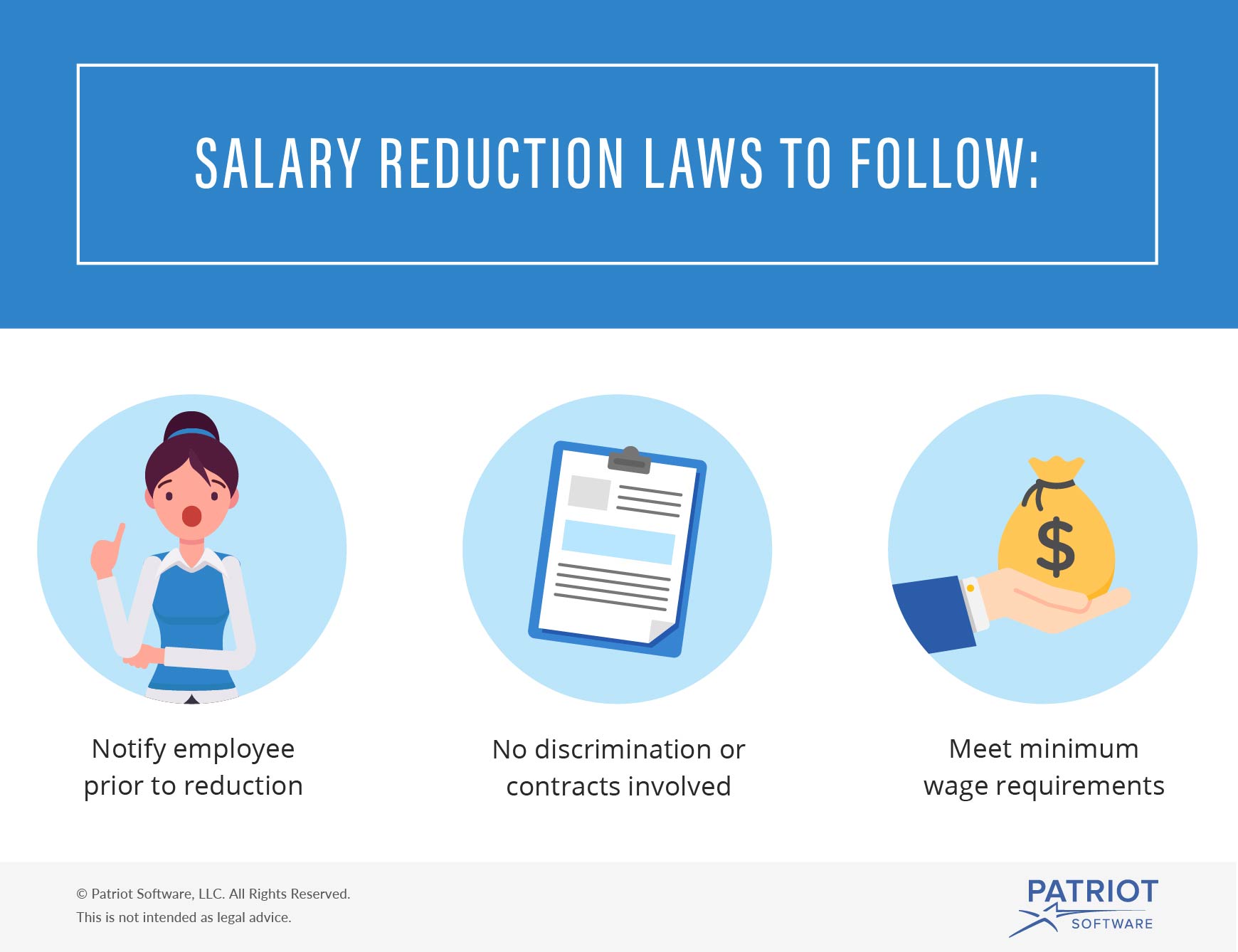

Handling Salary Reduction For Employees

https://www.patriotsoftware.com/wp-content/uploads/2019/12/salary_reduction_76034-01.jpg

Maximum Salary Reduction For Simple Ira - The most employees can contribute to SIMPLE IRAs in 2023 is 15 500 with an additional 3 500 catch up contribution for those age 50 and older In 2024 the SIMPLE IRA employee contribution limit increases to 16 000 with an additional 3 500 catch up contribution for those age 50 and older Employers may contribute either a flat 2 of your