What Is Income From Discontinued Operations The income statement must detail revenue expenses pre tax profit or loss and related income tax effects of discontinued operations Notes in the financial statements should explain the nature of the discontinued operations reasons for disposal and any significant changes in the company s business strategy Calculation of Gains or Losses

Discontinued operations have certain income tax accounting implications that must be considered Such implications must be considered both in the year of the discontinued operation and potentially in periods afterward See TX 12 intraperiod tax allocation This separation allows stakeholders to better understand the ongoing performance of the company without the noise of the discontinued segment The income statement plays a pivotal role in this process Companies must present the results of discontinued operations as a separate line item distinct from the results of continuing operations

What Is Income From Discontinued Operations

What Is Income From Discontinued Operations

http://www.cpajournal.com/wp-content/uploads/2017/02/CPA.2017.87.2.052.t001.jpg

What Do You Need To Know About Income Tax Richard Anthony

https://www.richard-anthony.co.uk/wp-content/uploads/2023/05/What-do-you-need-to-know-about-Income-Tax-1.png

What Is Operating Income Operating Income Formula And EBITDA Vs

https://remote-tools-images.s3.amazonaws.com/Operatingincome.jpg

An income statement s discontinued operations section refers to the financial results of a business segment or operation that has been or will be permanently discontinued This section reports the income or loss related to the operation that is being or has been sold closed down or spun off from the rest of the company Reporting of discontinued operations is important in providing users of financial statements the information necessary to determine the effects of a disposal transaction on the ongoing operations of an entity This publication is designed to assist professionals in understanding the accounting for discontinued

Discontinued operations are listed distinctly from continuous undertakings on financial reports As a result a firm has to report multiple line items on its income statement so that investors or analysts easily distinguish the cashflows and profits from the ceased activity s continuing operations In addition it is useful for them to analyze how the company will earn in the future if they merge What are Discontinued Operations Discontinued operations is a term used in accounting to refer to parts of a company s business that have been terminated and are no longer operational In accounting discontinued operations are listed separately on financial statements from continuing operations

More picture related to What Is Income From Discontinued Operations

Solved 5 5 1 Prepare A Partial Income Statement For 2024

https://www.coursehero.com/qa/attachment/35736237/

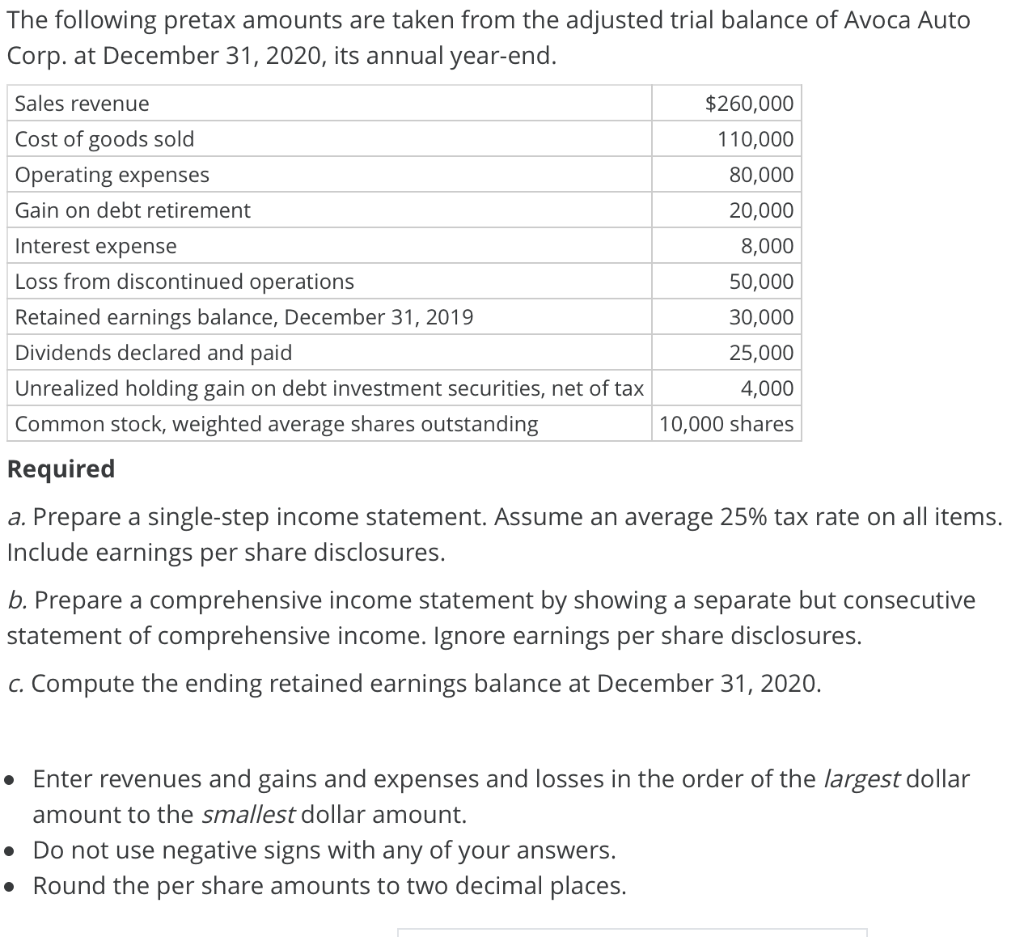

Solved The Following Pretax Amounts Are Taken From The Chegg

https://media.cheggcdn.com/media/b47/b471a1eb-0c47-46f9-b1f2-3c3fd2d4da02/phpEtEQbU.png

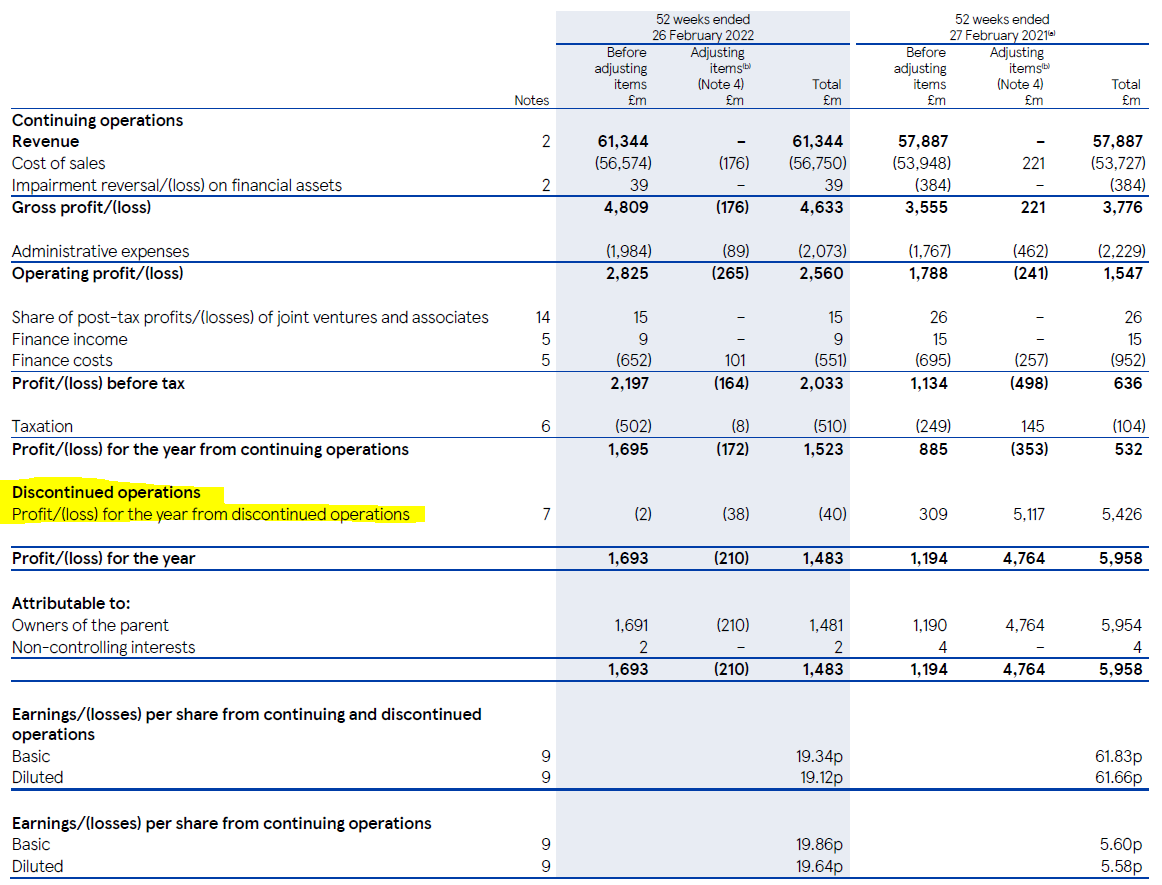

Discontinued Operations Comprehensive Income And Changes In Accounting

https://i.ytimg.com/vi/dVEd2ecYrwY/maxresdefault.jpg

A discontinued operation is a component of an entity that either has been disposed of or is classified as held for sale and a represents a separate major line of business or geographic area of operations b is part of a single coordinated plan to dispose of a separate major line of business or geographical area of operations or c is a The disclosure of discontinued operations in an income statement is significant for several reasons Transparency It provides stakeholders including investors creditors and analysts with a clear picture of what portions of the income and expenses are no longer going to be part of the entity s future operations This transparency helps in

[desc-10] [desc-11]

Discontinued Operations IFRS 5 IFRScommunity

https://ifrscommunity.com/wp-content/uploads/Tesco-discontinued-operations-income-statement.png

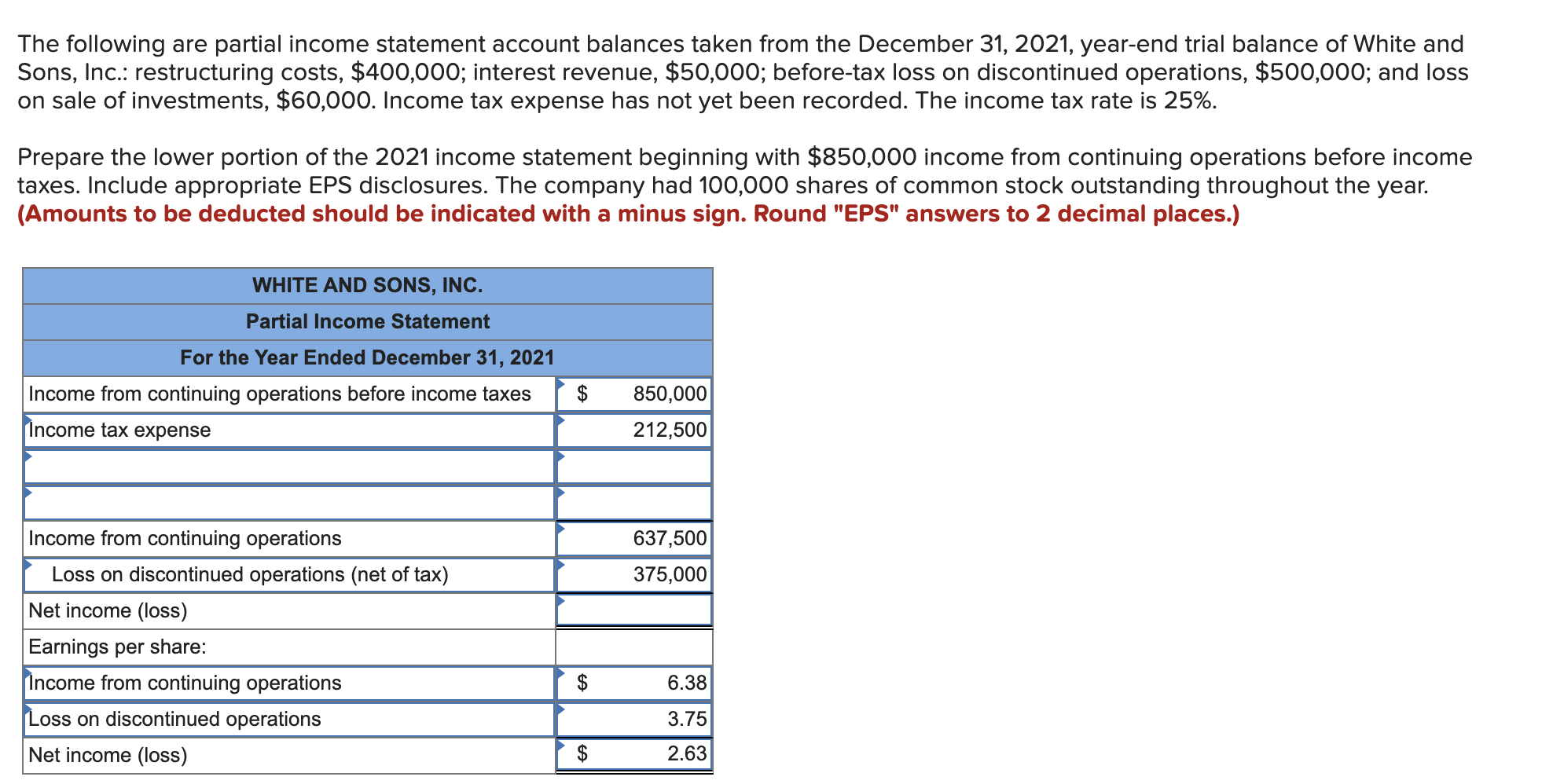

Solved The Following Are Partial Income Statement Account Chegg

https://media.cheggcdn.com/media/e6f/e6f9cf4f-bf1b-469b-91b8-611d14520e32/phpmllrS6.png

What Is Income From Discontinued Operations - An income statement s discontinued operations section refers to the financial results of a business segment or operation that has been or will be permanently discontinued This section reports the income or loss related to the operation that is being or has been sold closed down or spun off from the rest of the company