What Is Income From Continuing Operations The income from continued operations is calculated by subtracting all the operating expenses and tax on the operating income It shows the company s after tax operating income and most people confuse the income from continued operations with the operating income

Income from continuing operations is a critical metric in financial reporting offering insights into the ongoing profitability of a business Unlike one time gains or losses this figure reflects the earnings generated by core business activities over a specific period Investors and analysts closely monitor income from continuing operations to gauge a company s long term performance and Guide to what are Continuing Operations We explain the income from it its comparison with discontinued operations examples and benefits

What Is Income From Continuing Operations

What Is Income From Continuing Operations

https://d2vlcm61l7u1fs.cloudfront.net/media/c4a/c4ae4197-50ad-4658-b378-2aceec5ae8ae/phpNwrgA7.png

Solved Income From Continuing Operations Before Income Tax Chegg

https://d2vlcm61l7u1fs.cloudfront.net/media/eef/eef33d13-b0f0-4d30-8820-e6a2ee4114ba/phpXbBB7I.png

Solved How Can I Get Operating Income 5 800 Income From Chegg

http://d2vlcm61l7u1fs.cloudfront.net/media%2F9bf%2F9bfc04b6-27d1-446b-8a29-c3b721775349%2FphpbrLfKh.png

The net income from continuing operations is a crucial measure as it helps investors creditors and other stakeholders to understand how much income the company is likely to generate in the future from its regular operations Net income from continuing operations is a line item on the that notes the after tax earnings that a business has generated from its operational activities Since one time events and the results of discontinued operations are excluded this measure is considered to be a prime indicator of the financial health of a firm s core activities

Continuing operations are the day to day operations of a business Find more about continuing operations and how to calculate net income these business operations Income From Continuing Operations Income from continuing operations includes operating activities revenues cost of goods sold selling expenses and administrative expenses nonoperating activities other revenues and gains and other expenses and losses and income taxes Amounts in income from continuing operations are reported gross of tax and the income tax related to these amounts are

More picture related to What Is Income From Continuing Operations

Income From Continuing Operations Definition Finance Strategists

https://learn.financestrategists.com/wp-content/uploads/Income-From-Continuing-Operations-scaled.jpg

Income From Continuing Operations AwesomeFinTech Blog

https://www.awesomefintech.com/term/cards/continuingoperations/card.png

Mastering Income From Continuing Operations SimFin Financial Glossary

https://a.storyblok.com/f/177574/1000x666/23d6dfd9c3/income-continuing-operations.jpg

Conclusion Calculating income from continuing operations is a straightforward process that involves identifying and excluding non recurring items from a company s net income The income produced through a company s ongoing operations is what we call income from continuing operations or operating income Analysts creditors investors lenders and other stakeholders will regularly look at a company s income from operations to assess its financial health

[desc-10] [desc-11]

Continuing Operations What Are Continuing Operations Of A Business

https://www.freshbooks.com/wp-content/uploads/2022/02/Continuing-Operations.jpg

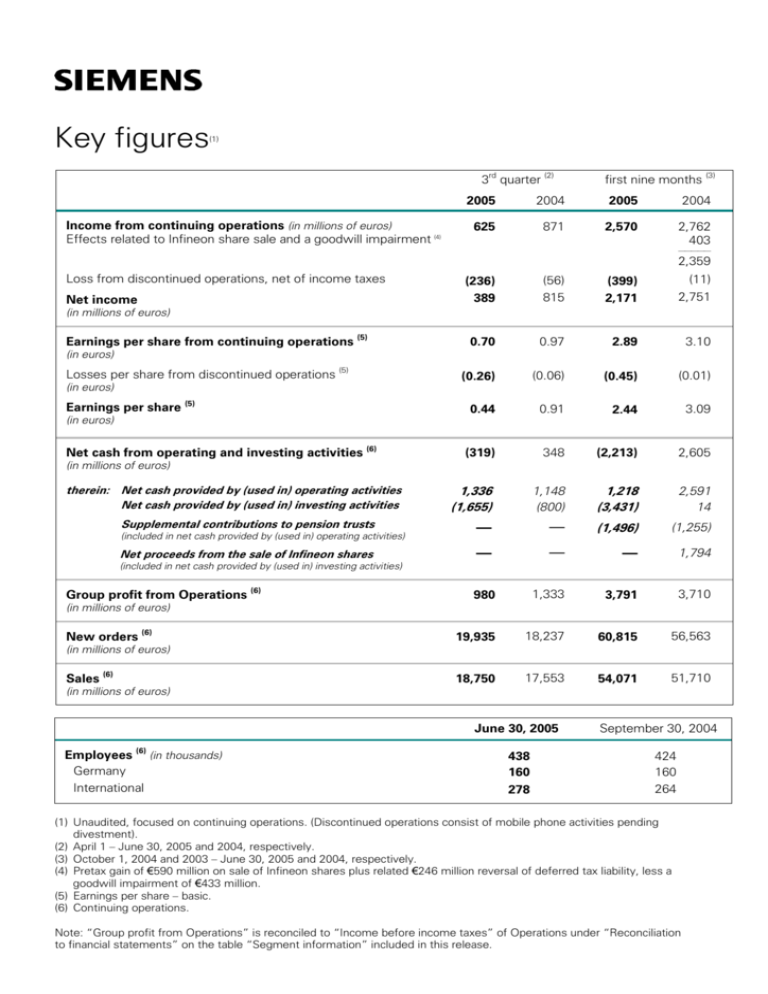

Income From Continuing Operations in Millions Of Euros

https://s3.studylib.net/store/data/008209543_1-8b0dc44521a13b0e2cb08fde5d31cca7-768x994.png

What Is Income From Continuing Operations - Income From Continuing Operations Income from continuing operations includes operating activities revenues cost of goods sold selling expenses and administrative expenses nonoperating activities other revenues and gains and other expenses and losses and income taxes Amounts in income from continuing operations are reported gross of tax and the income tax related to these amounts are