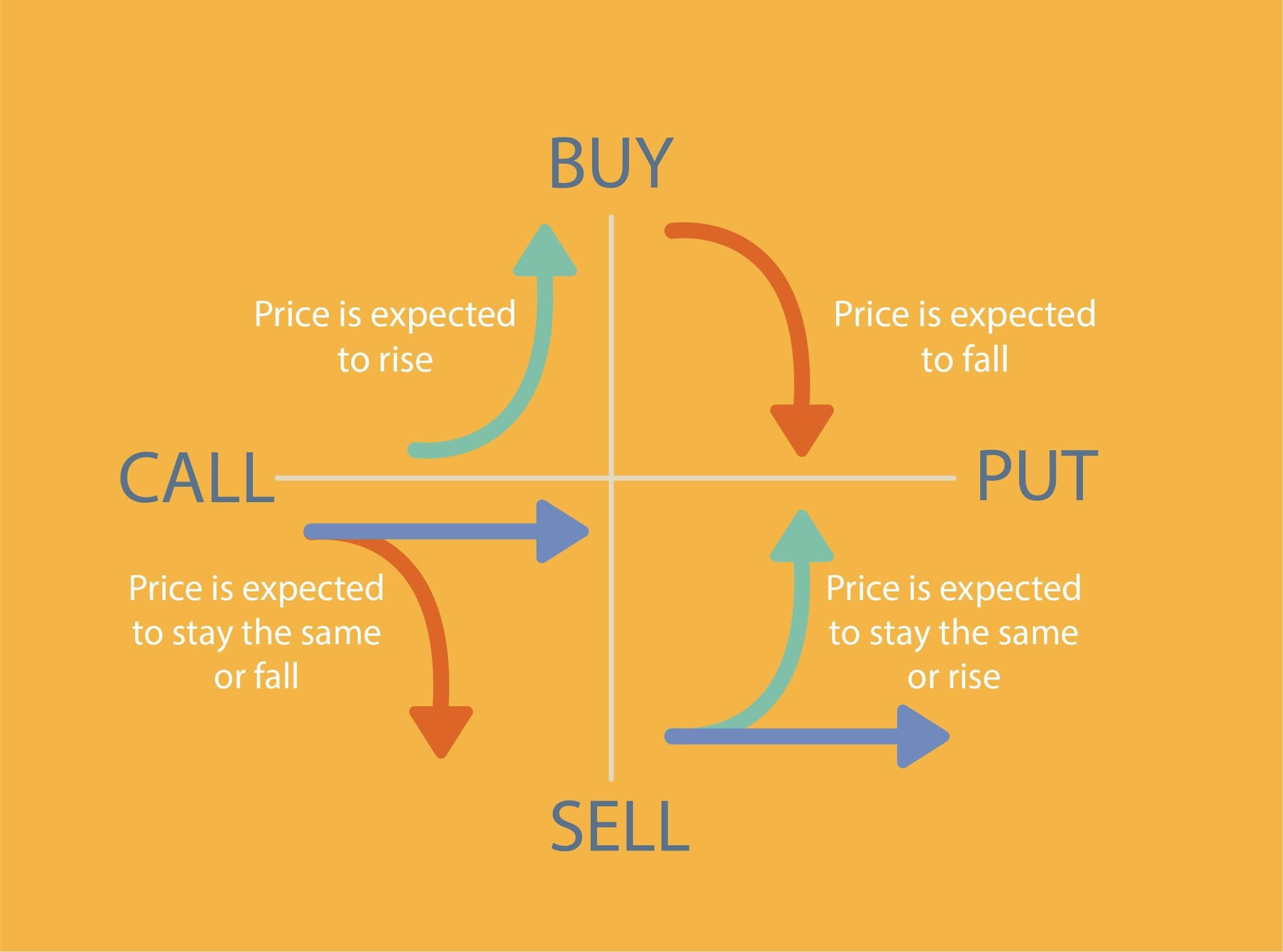

What Happens When Sell Put Option Expires What Happens When a Put Option Expires For Those Writing Selling Put Options Beginning a trade by selling a put option sell to open is a strategy used by those who are confident that the underlying stock will stay above the strike price of the put option If that prediction is accurate selling a put option generates profits through

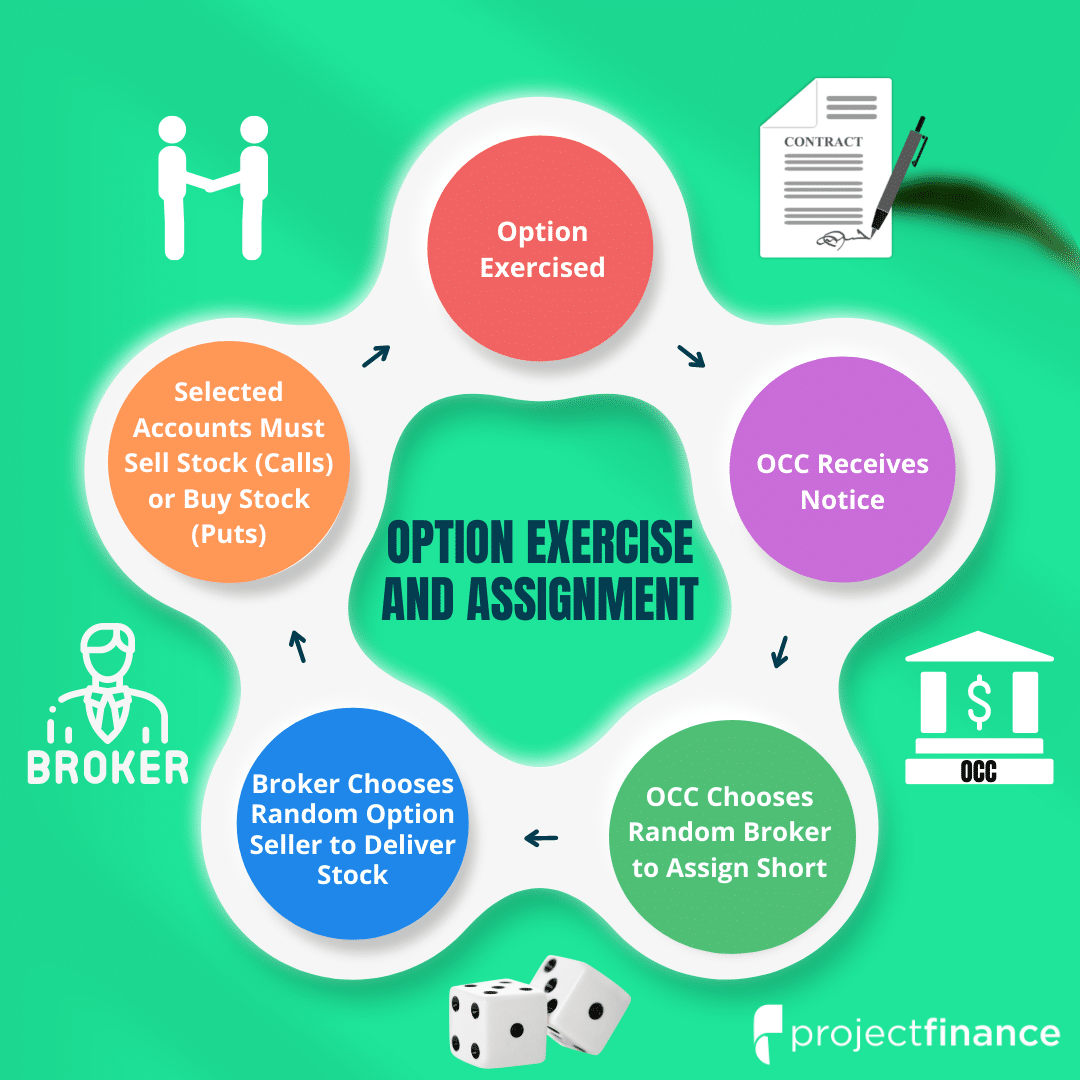

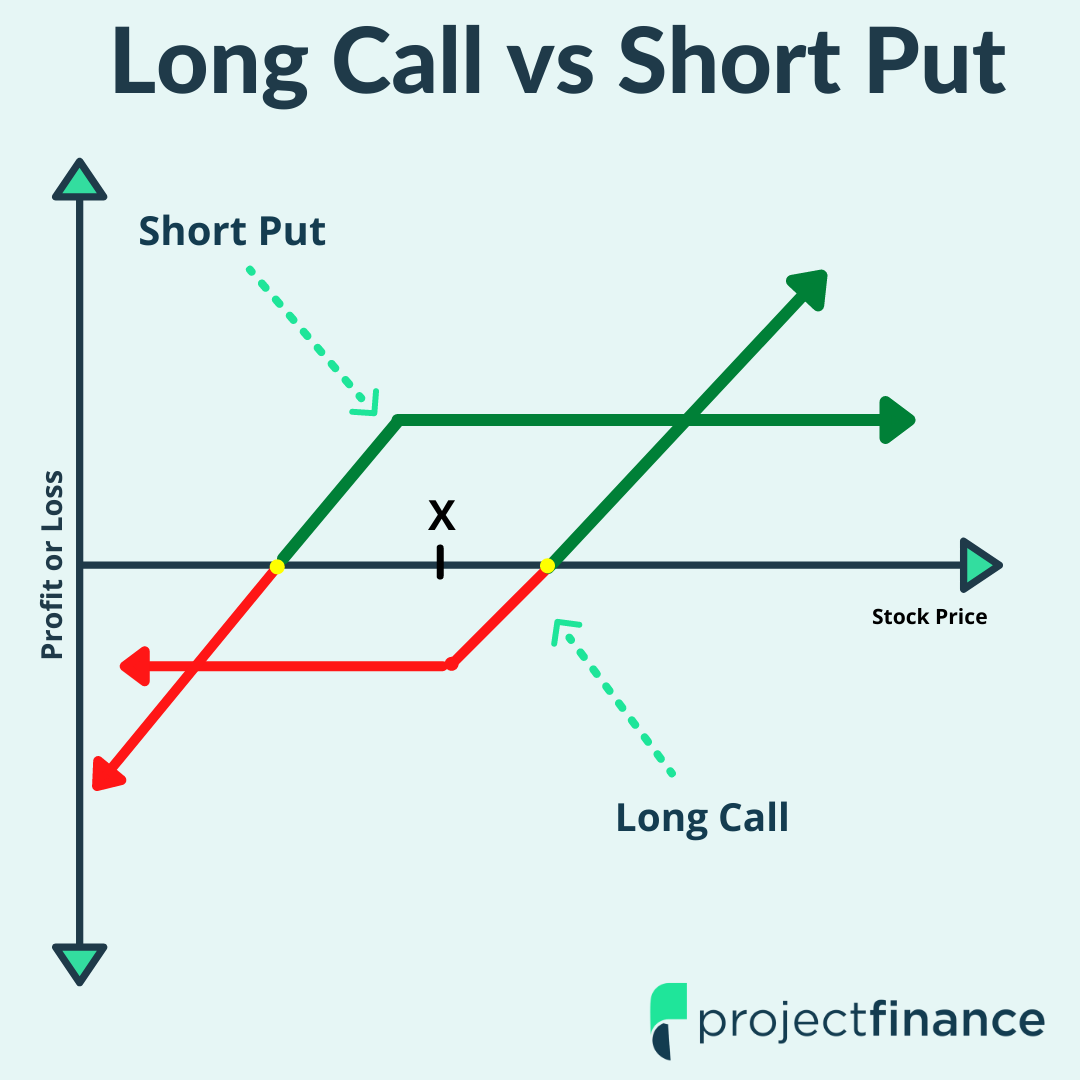

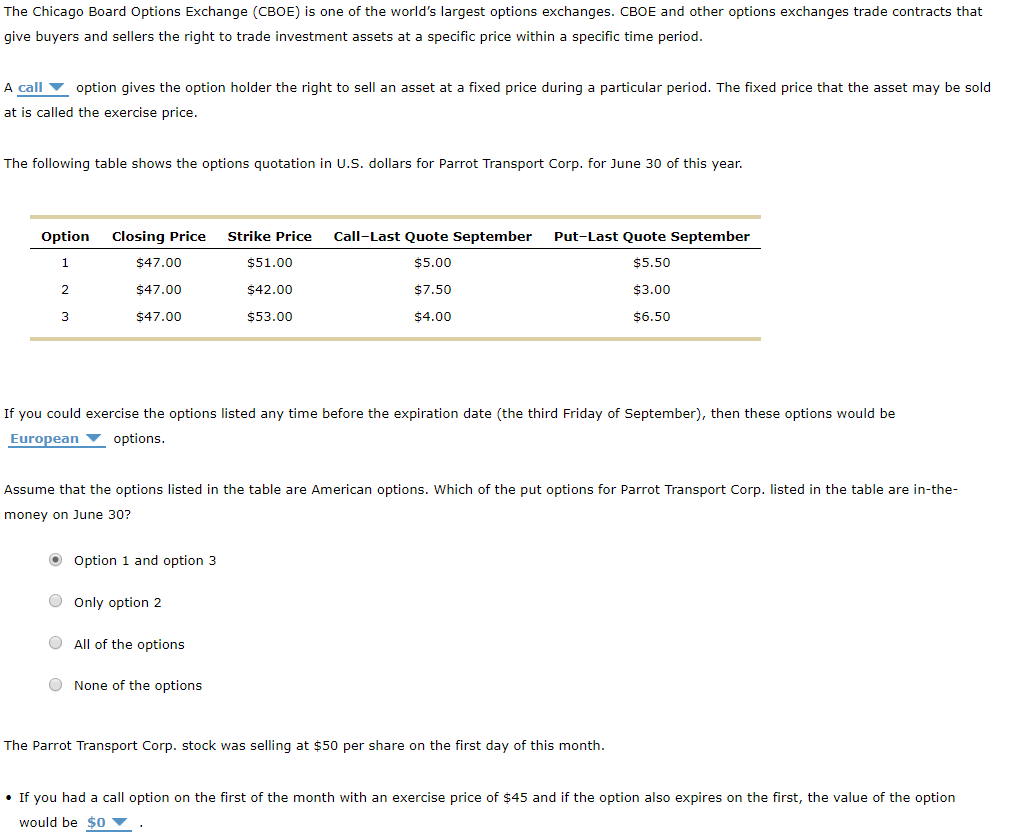

The buyer owner of an option has the right but not the obligation to exercise the option on or before expiration A call option 5 gives the owner the right to buy the underlying security a put option 6 gives the owner the right to sell the underlying security Conversely when you sell an option you may be assigned at any time regardless of the ITM amount if the option owner The Role of Theta in Options Expiration Theta also known as time decay plays a significant role in what happens when options expire As an option gets closer to its expiration date theta generally increases which means the option s value decreases This is because as time runs out there s less chance the option will become ITM if it

What Happens When Sell Put Option Expires

What Happens When Sell Put Option Expires

https://www.projectfinance.com/wp-content/uploads/2022/03/In-The-Money-Option-at-Expiration.png

Put Options Explained Buying And Selling Cheddar Flow

https://www.cheddarflow.com/wp-content/uploads/2022/10/Group-2779.jpg

What Happens When An Option Expires In The Money

https://financhill.com/blog/wp-content/uploads/2021/09/Untitled-design-94.jpg

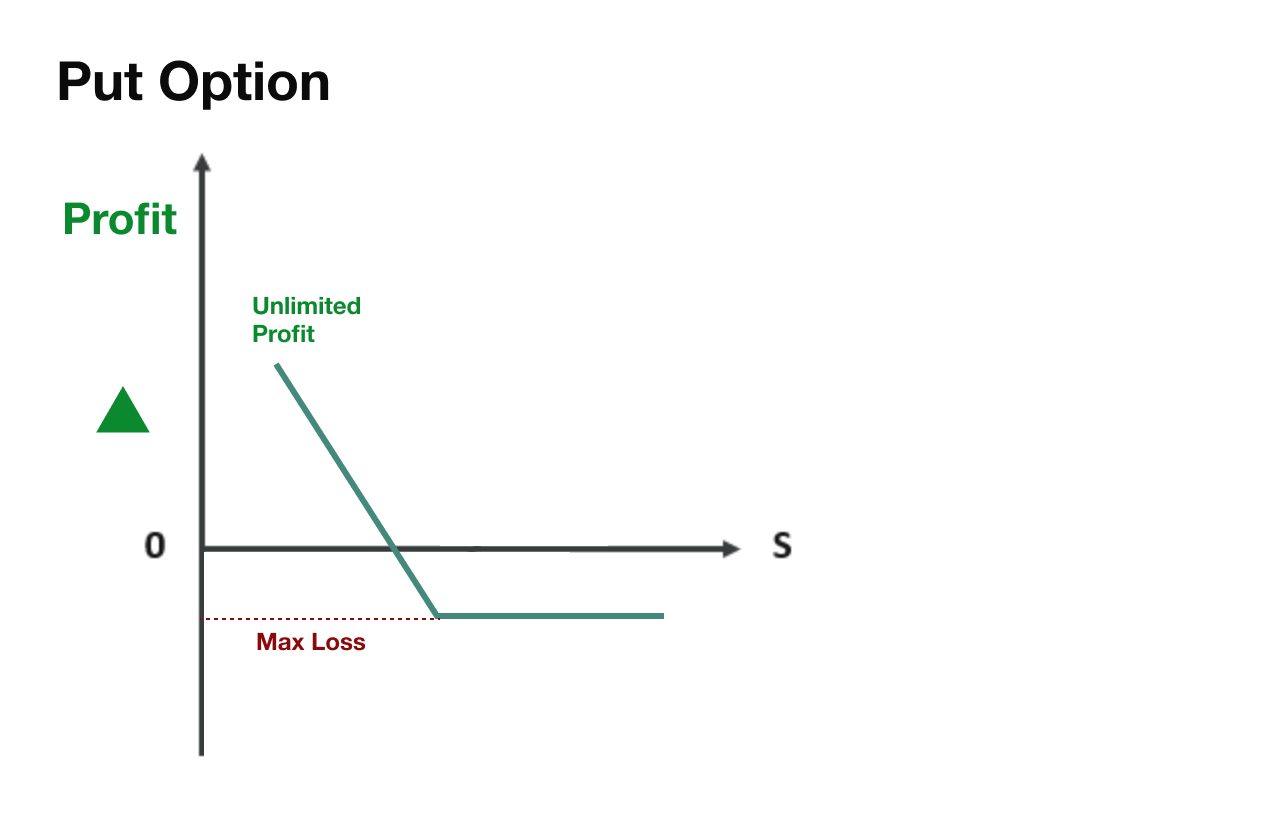

A put option is a contract that gives its holder the right to sell a set number of equity shares at a set price called the strike price before a certain expiration date If the option is A put option put is a contract that gives the owner the right to sell an underlying security at a set price strike price before a certain date expiration

Selling puts is an oft overlooked option trade that can pair well with long term investing strategies under certain circumstances if the option expires worthless while your maximum loss is For example if an option is trading for 1 40 the price of one contract excluding fees is 140 or 1 40 x 100 multiplier 140 Expiration Each option has an expiration date which is when the contract expires and ceases to exist Strike price Each option also has a strike price and if the contract is exercised the underlying

More picture related to What Happens When Sell Put Option Expires

Long Call Vs Short Put Comparing Strategies W Visuals Projectfinance

https://www.projectfinance.com/wp-content/uploads/2022/02/Long-Call-vs-Short-Put.png

Options Pt 3 Time Decay And Its Impact On Options Trading Market

https://www.markettradersdaily.com/wp-content/uploads/2020/06/Options-Trading-101-Pt.-2-Buying-And-Selling-Calls-And-Puts22.jpg

Solved If The Call Option Expires In Six Months The Value Chegg

https://media.cheggcdn.com/media/d9c/d9c19153-9020-4368-a2e0-0c4d0fddab02/phpAaD7cU.png

Assessment If TQE stayed at 54 75 the 55 call options or the short side of the spread will not be in the money This means that if TQE was above 50 but below 55 at expiration there would be a purchase of 5 000 shares and there would not be an offsetting sell of 5 000 shares of TQE The buying power to cover the purchase of TQE would Put Option A put option is an option contract giving the owner the right but not the obligation to sell a specified amount of an underlying security at a specified price within a specified time

Put options are a type of option that increases in value as a stock falls A put allows the owner to lock in a predetermined price to sell a specific stock while put sellers agree to buy the Each option contract has a set expiration date This date significantly impacts the value of the option contract because it limits the time you can buy sell or exercise the option contract Once an option contract expires it will stop trading and either be exercised or expire worthless

Options Expiration Definitions A Checklist More Charles Schwab

https://www.schwab.com/sites/g/files/eyrktu1071/files/Custom_Options_Expiration_3x2.jpg

Learn How To Trade Options A Step By Step Guide To Get Started

https://media.realvision.com/wp/20210910160929/Put-vs-Call-Chart.jpg

What Happens When Sell Put Option Expires - Her option will expire worthless you ll keep your 143 premium and your 3 000 in secured cash will be freed up for selling another option Here s the rate of return calculation if the option expires 143 2 857 0 05 5 You made a 5 rate of return on your initial cash in about 3 5 months